Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business consultants and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

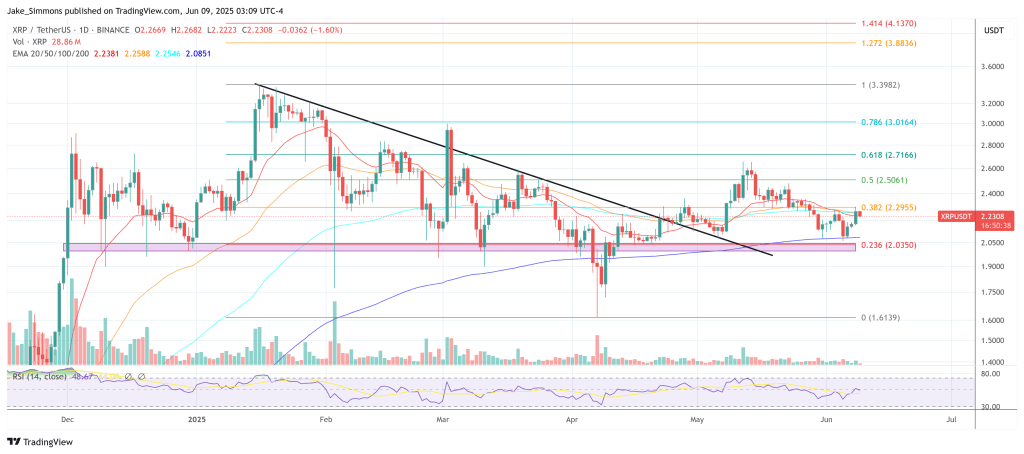

Pseudonymous analyst CryptoInsightUK has warned that the subsequent main transfer for XRP may very well be a entice. In a video printed on June 8, the analyst outlined a state of affairs the place XRP surges towards $2.30–$2.40 within the quick time period—solely to reverse violently into a pointy liquidity flush earlier than any sustainable breakout happens.

XRP Bull Entice Looming?

“I feel XRP goes to sub-$2.0. I actually do,” he stated, including: “It may come and sweep the highs right here… may come as much as like what, $2.30, after which push us down. That might be extra ache for everybody, ‘trigger everybody’s going to suppose we’re going to the upside.”

The setup he describes relies on market construction and liquidity dynamics, notably the buildup of resting orders beneath XRP’s present vary. “This here’s a concern, an actual concern for me,” he stated, referring to the rising pool of liquidity beneath present costs. In keeping with his inside fashions, such liquidity zones are statistically touched “80% of the time.”

Associated Studying

“Somebody’s making an attempt to trick somebody right here,” he warned. “I’m cautious.” Regardless of his near-total XRP allocation—he states he’s “95%+, in all probability extra like 98%” positioned in XRP—CryptoInsightUK emphasised that he’s not rooting for a correction. “I don’t need it to come back down,” he stated. “I’m simply exhibiting you what I see.”

The analyst proposed a number of structural paths: one by which XRP instantly breaks out, and one other the place it briefly rallies to brush native highs earlier than flushing downward to type a bullish divergence. “We’re in a spread proper now,” he stated. “Will we come up, sweep the highs, then take the lows and go?”

He elaborated on the bullish divergence sample he’s watching, the place value kinds a decrease low whereas the RSI (Relative Power Index) prints a better low—a setup he makes use of to establish bottoming buildings. “That’s what I want to see,” he defined.

Broader Macro Circumstances Nonetheless Supportive

Regardless of the bearish tactical setup, the video struck an upbeat macro tone. Will cited 4 near-term catalysts: the Genius Act on stablecoin oversight, the imminent submitting deadline within the SEC’s cures section in opposition to Ripple, the July choice window for a spot-XRP ETF proposal, and a renewed expectation of accommodative fiscal coverage sparked by final week’s televised Trump-Musk dialogue.

“What this actually tells us is there’s going to be cash printing,” he argued. “Property throughout are going to blow up to the upside and, for the opposite particular causes, XRP in all probability does even higher.”

Turning to Bitcoin, the analyst noticed an ongoing decline in buying and selling quantity, suggesting indecision or exhaustion. “There’s been no quantity. There’s been nothing,” he stated of current BTC value motion.

Associated Studying

He highlighted a CME futures hole round $92,000–$93,000 and added that fastened vary quantity evaluation factors to a attainable pullback zone at $96,000–$97,000. “It’s in all probability coming imminently, perhaps this week,” he stated of a possible correction, projecting a state of affairs the place BTC dips into this vary earlier than resuming its upward trajectory.

“Does this imply we squeeze to the upside or come down and take this low and put in that bullish divergence construction?” he requested, noting the same divergence setup at $75,000 earlier this 12 months.

XRP Spot Exercise Raises Purple Flags

Within the ultimate hour earlier than the video, XRP had “squeezed up with some quantity,” however the analyst urged warning. Whereas open curiosity had risen sharply, funding remained inexperienced—suggesting web lengthy positioning—and mixture premium had turned pink. “This means to me that though there are nonetheless some shorts coming in, extra longs than shorts have entered,” he stated.

He warned that this imbalance may trigger a pointy transfer decrease if the market fails to carry present ranges. “If we do now come down and lose this low, count on a extra aggressive, sooner transfer to the draw back,” he stated, pointing to the chance of liquidating leveraged positions.

XRP’s relative efficiency in opposition to ETH and BTC additionally got here beneath assessment. Whereas it had begun testing resistance zones, neither the XRP/ETH nor the XRP/BTC charts had decisively damaged out. “We may nonetheless be on this vary chopping about,” he cautioned. “May lose energy till we begin to see some confirmations to the upside.”

At press time, XRP traded at $2.23.

Featured picture created with DALL.E, chart from TradingView.com