How do some merchants appear to all the time discover themselves on the fitting facet of the market?

Can they actually anticipate main worth strikes earlier than they occur?

Though it might appear like they’re utilizing a secret method, don’t fear… it’s not rocket science!

Merchants with quite a lot of expertise typically use tried-and-true strategies to assist them perceive how the market works and make higher selections.

One such technique is the Wyckoff idea, which this information is all about!

At first look, Wyckoff’s concepts might sound arduous to know and even outdated.

But when you understand how to make use of Wyckoff’s concepts appropriately, they can provide you a giant edge in your buying and selling technique.

By specializing in these key points, you’ll see how highly effective these methods may be in your buying and selling:

- What’s Wyckoff?

- The Three Legal guidelines of Wyckoff

- Wyckoff’s Composite Man

- The Market Phases: Accumulation, Mark Up, Distribution, Markdown

- The Limitations of Wyckoff in Fashionable Markets

Able to take your market information to the following stage?

Then let’s get began!

What’s The Wyckoff Principle?

The Wyckoff Methodology is a buying and selling technique created by Richard D. Wyckoff within the early 1900s.

By taking a look at worth modifications, buying and selling quantity, and general market tendencies, it tries to assist merchants work out how the market works.

His strategy was groundbreaking as a result of it gave merchants a transparent method to analyze markets, by specializing in how provide and demand have an effect on costs.

Wyckoff believed that markets transfer in predictable cycles and that by finding out these cycles, merchants might attempt to predict the place costs may go subsequent.

The Wyckoff Methodology was first made for buying and selling shares, however it may be utilized in different markets as nicely.

Wyckoff’s technique is constructed on three most important concepts:

- The Regulation of Provide and Demand: Costs go up when extra individuals need to purchase than promote and go down when extra individuals need to promote than purchase.

- The Regulation of Trigger and Impact: An enormous buildup of shopping for or promoting (the trigger) results in a big transfer in worth (the impact).

- The Regulation of Effort versus Consequence: By evaluating how a lot buying and selling exercise (effort) there’s to how a lot the value strikes (consequence), merchants can get a way of how sturdy or weak a market transfer is perhaps.

Altogether, this technique offers you a method to learn market alerts and use them to make extra knowledgeable selections about when to purchase or promote!

The Three Legal guidelines of The Wyckoff Principle

Wyckoff Principle Regulation #1: Provide and Demand

Most significantly, Wyckoff’s buying and selling idea is predicated on the Regulation of Provide and Demand.

It’s fairly easy: costs go up when extra individuals need to purchase than promote (demand is larger than provide), and costs go down when extra individuals need to promote than purchase (provide is larger than demand).

This concept is straight out of primary economics and helps clarify why costs in monetary markets transfer the way in which they do.

However how do merchants use this virtually with Wyckoff?…

…nicely, merely take a look at worth and quantity information to see if provide or demand is in management!

For instance, if the value is rising and lots of shares are being traded (excessive quantity), it exhibits sturdy demand, that means the value may maintain going up.

On the flip facet, if the value is dropping with excessive quantity, it exhibits sturdy provide, and costs may proceed to fall…

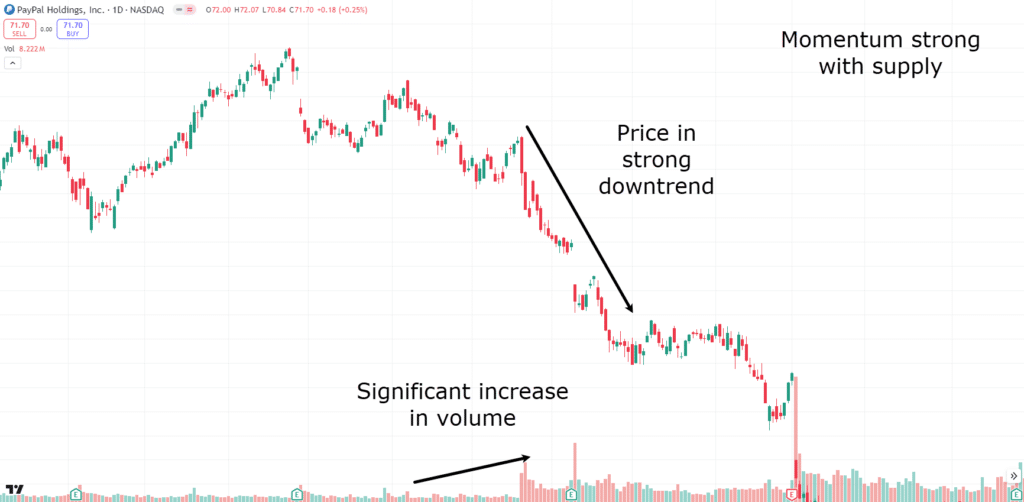

PayPal Day by day Chart Robust Downtrend With Enhance Quantity:

That is particularly necessary through the accumulation (shopping for) and distribution (promoting) phases…

Throughout accumulation, good merchants are quietly shopping for, slowly growing demand with out pushing costs up an excessive amount of.

Because the accessible provide will get smaller, costs begin to rise, resulting in an uptrend!

In the course of the distribution part, these merchants begin promoting, growing provide and resulting in falling costs.

Understanding this circulate might help you determine when the market may change route and how you can plan your trades.

Now, the following legislation is the legislation of trigger and impact.

Wyckoff Principle Regulation #2: Trigger and Impact

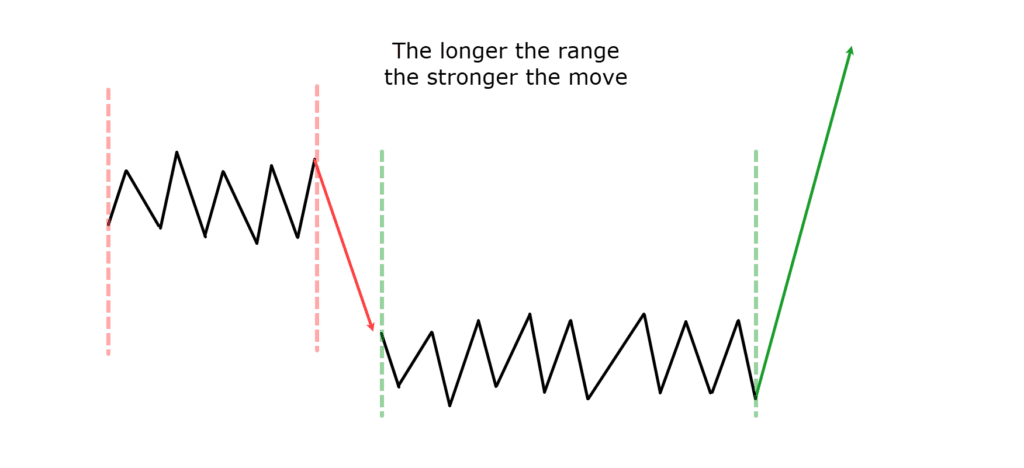

One other necessary concept in Wyckoff’s buying and selling technique is the Regulation of Trigger and Impact.

It states that each vital worth transfer occurs for a motive.

To place it merely, the quantity of shopping for or promoting that occurred earlier than a worth change (the impact) determines how huge that change is.

It’s one more legislation serving to you higher estimate how far costs may rise or fall after a interval of shopping for (accumulation) or promoting (distribution).

For instance, throughout accumulation, the “trigger” is the good merchants slowly and quietly shopping for shares.

The longer and extra intense this shopping for part, the bigger the value soar (the “impact”) might be through the begin of the brand new uptrend!.

Instance Trigger and Impact:

By taking this into consideration, merchants can set practical worth targets and have extra endurance, understanding that giant worth actions typically take time to materialize.

Recognizing the “trigger” out there permits merchants to place themselves for the “impact,” serving to them benefit from vital worth shifts.

Wyckoff Principle Regulation #3: Effort Vs Consequence

Yet one more necessary concept within the Wyckoff Methodology is the Regulation of Effort versus Consequence.

It says that the quantity of effort (measured by buying and selling quantity) ought to match the consequence (worth motion).

A sign of a powerful development is when effort and consequence match up.

But when they don’t match, it might imply the development is weakening or might reverse.

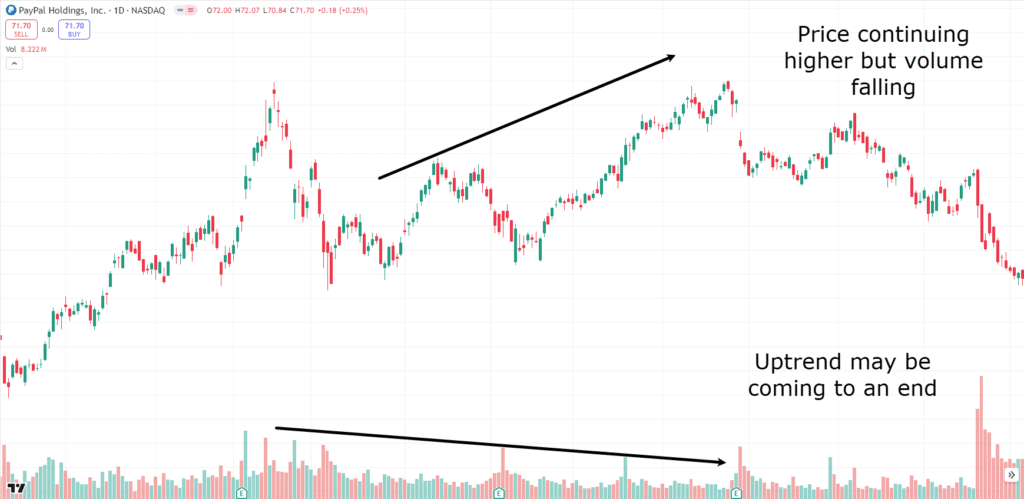

To confirm a powerful uptrend, for instance, you’d search for each rising costs and buying and selling quantity.

But when costs maintain rising whereas quantity drops… nicely, you is perhaps taking a look at a weaker development that would quickly reverse...

PayPal Day by day Chart Development Weakening:

For downward tendencies, if costs are falling and quantity is excessive, it signifies stronger promoting stress and a continued decline.

Nevertheless, if costs are falling however quantity is lowering, it might imply promoting stress is easing, and a reversal is perhaps coming.

This primary legislation might help you notice potential modifications just by taking a look at how intently quantity and worth motion match up.

It’s additionally one other instance of how analyzing quantity typically offers clues about upcoming worth modifications.

Now, you is perhaps asking, who’s behind these huge strikes?

Properly, let’s see what Wyckoffs idea has to say…

Wyckoff Principle’s Composite Man

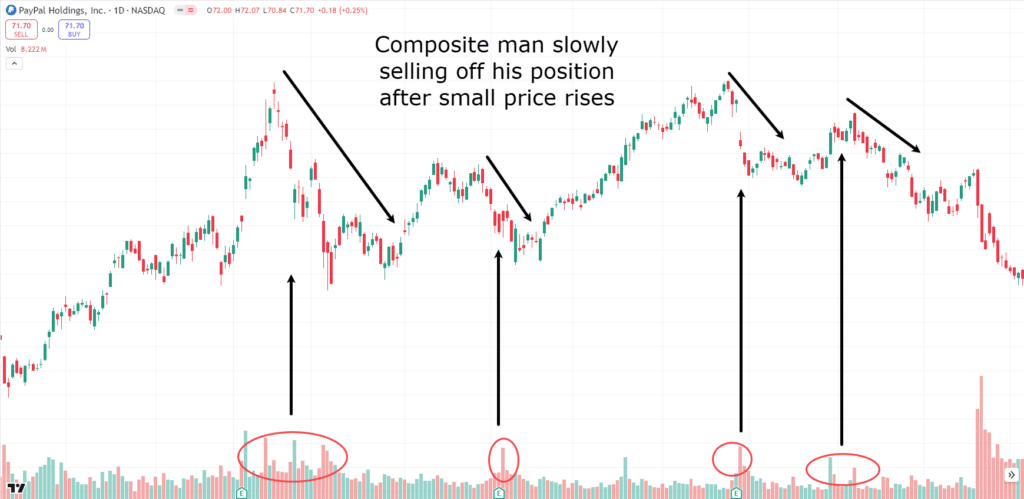

Wyckoff’s idea is most attention-grabbing in terms of the thought of the “Composite Man.”

He imagined the market is influenced by a fictional character referred to as the “Composite Man.”

This character represents the actions of the largest and strongest market movers—typically referred to as “good cash” or “huge cash.”

These are the massive institutional buyers, hedge funds, and different main gamers with the cash and affect to have an effect on markets.

Wyckoff believed that the Composite Man’s objective is to purchase (accumulate) numerous shares when costs are low and promote (distribute) them when costs are excessive.

However the catch is that the Composite Man does this in a approach that hides his true intentions.

Throughout accumulation, he quietly buys with out pushing costs up an excessive amount of.

Throughout distribution, he sells right into a rising market, typically utilizing information and market sentiment to his benefit to verify he will get the very best worth…

Composite Man Principle:

For merchants utilizing the Wyckoff Methodology, understanding what the Composite Man is doing is important.

It helps them spot the completely different phases of the market, like when huge gamers are shopping for up shares (accumulation), after they’re promoting them off (distribution), and the ensuing strikes up (markup) or down (markdown) in worth.

Your objective is to align your trades with the actions of the Composite Man.

Purchase when he’s shopping for…

Promote when he’s promoting…

…so that you may be on the fitting facet of the market!

Fairly attention-grabbing idea, proper?

Now, let’s look another time on the phases of the strategy…

The 4 Phases of The Wyckoff Principle Defined

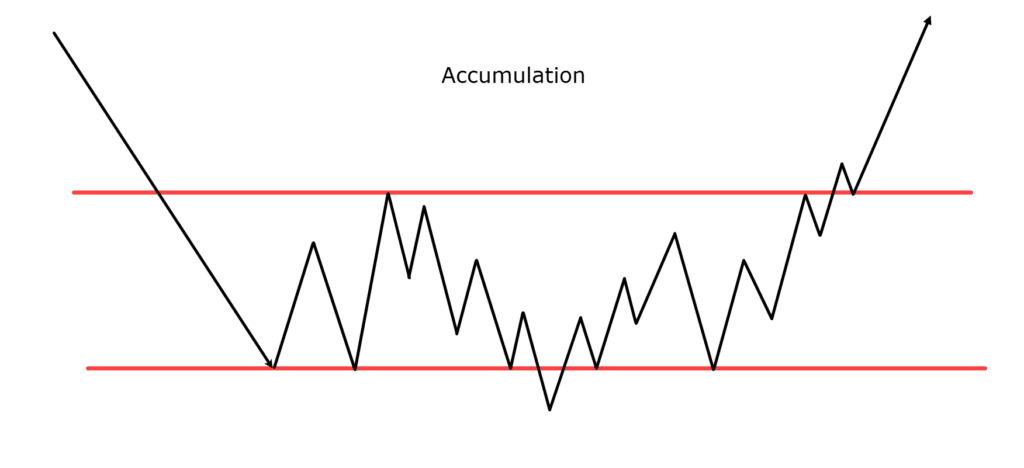

Accumulation

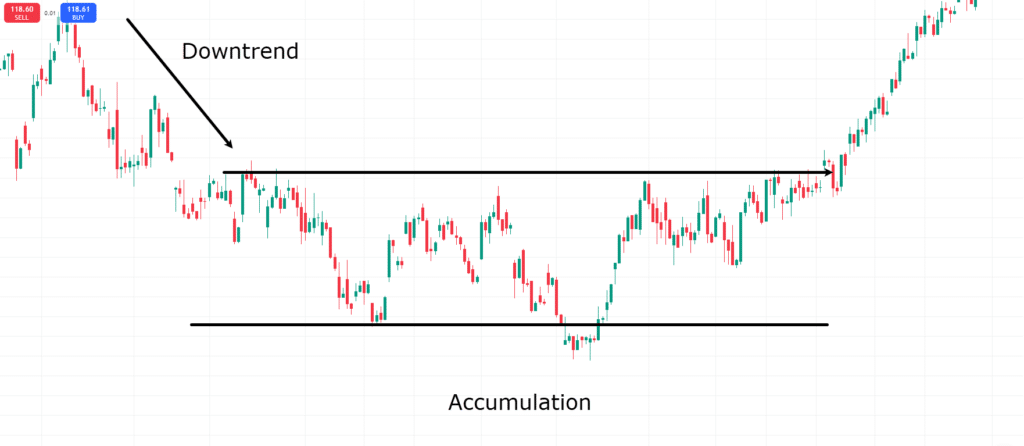

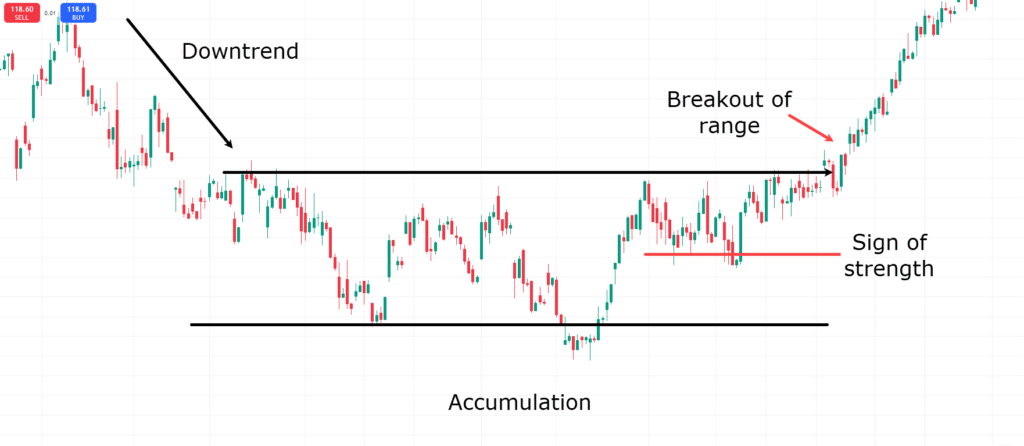

Accumulation Diagram:

As you’ll be able to see within the diagram above, the accumulation part is when the market stops falling and begins to stage out.

After costs have been dropping for some time, they start to maneuver sideways inside a decent vary.

Throughout this era, there’s no clear route out there—costs go up and down barely as consumers and sellers are evenly matched.

So, why does this occur?

This part happens as a result of huge, savvy buyers—typically referred to as “good cash”—begin shopping for the asset at these low costs, believing it to be deal.

They purchase slowly and quietly to keep away from inflicting a sudden worth enhance that might tip off different buyers about their actions.

The buildup part alerts that the downward development is perhaps coming to an finish, and the market may very well be on the brink of climb once more.

As soon as there’s sufficient shopping for stress to outweigh the promoting, costs will begin to rise.

Recognizing this accumulation stage is essential as a result of it means that you can enter the market earlier than it transitions into the following stage, referred to as the markup part, the place costs start to extend considerably.

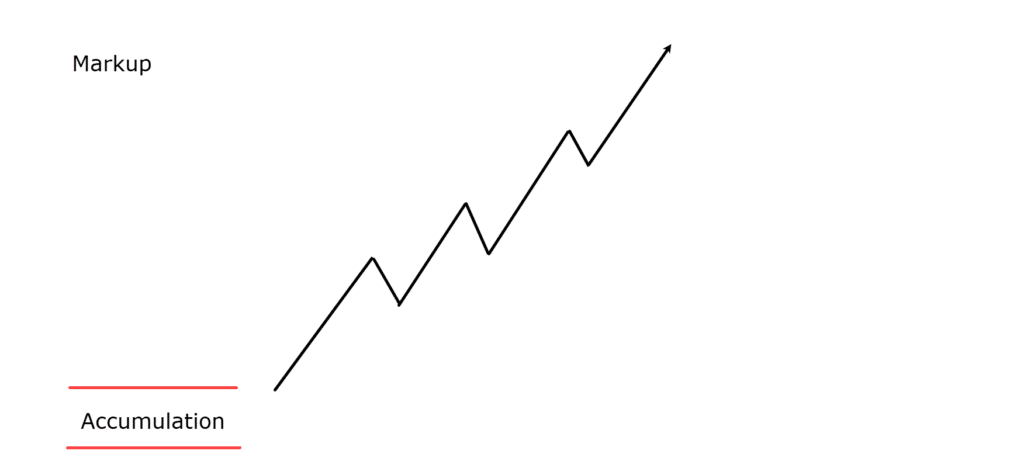

Markup Part

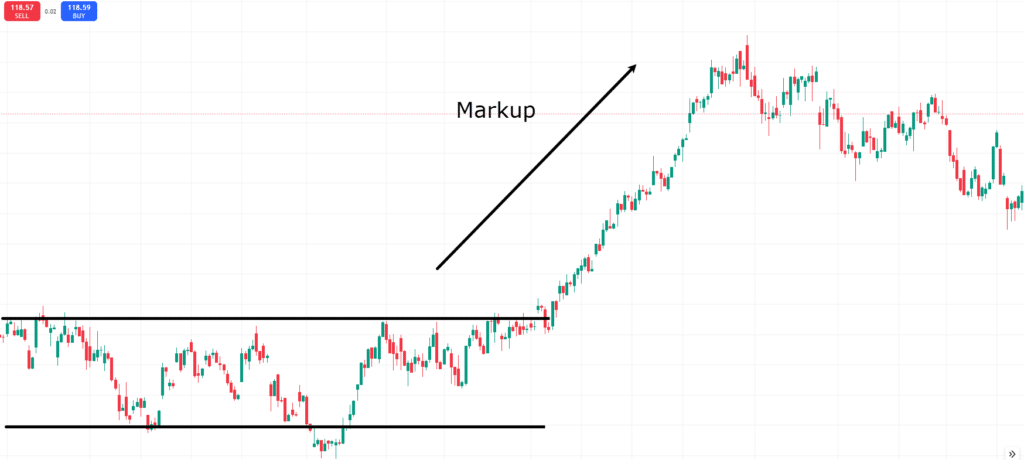

Markup Part Diagram:

The markup part is when costs begin to rise steadily, breaking out of the sideways sample seen throughout accumulation.

The market strikes into an uptrend, with costs forming larger highs and better lows.

That is often essentially the most worthwhile time for merchants who purchased in through the accumulation stage.

The markup part happens as a result of the massive buyers (“good cash”) have already purchased up quite a lot of the accessible provide, decreasing what’s left for others.

As extra buyers discover the upward momentum, they begin shopping for too, which pushes costs even larger.

Optimistic information or sturdy financial information typically provides gas to this part, drawing in much more consumers.

The markup part signifies a powerful uptrend and is often accompanied by rising demand and growing confidence amongst buyers.

At this level, extra individuals—together with on a regular basis retail merchants—begin to be part of the development.

Are you able to see the significance of shopping for through the accumulation part?

For those who miss out, you may find yourself getting into the market later through the markup part, when costs are already larger.

Now, how are you aware when it’s time to promote?

That’s the place the distribution part is available in…

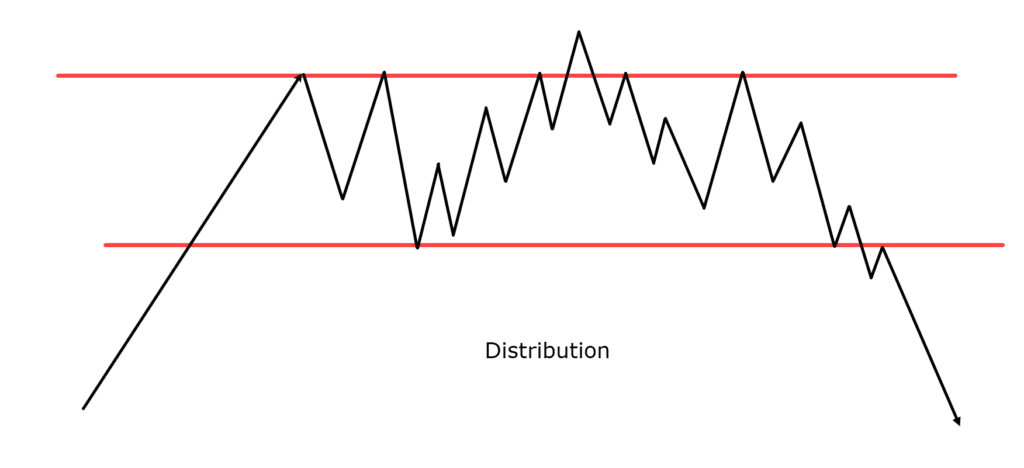

Distribution Part

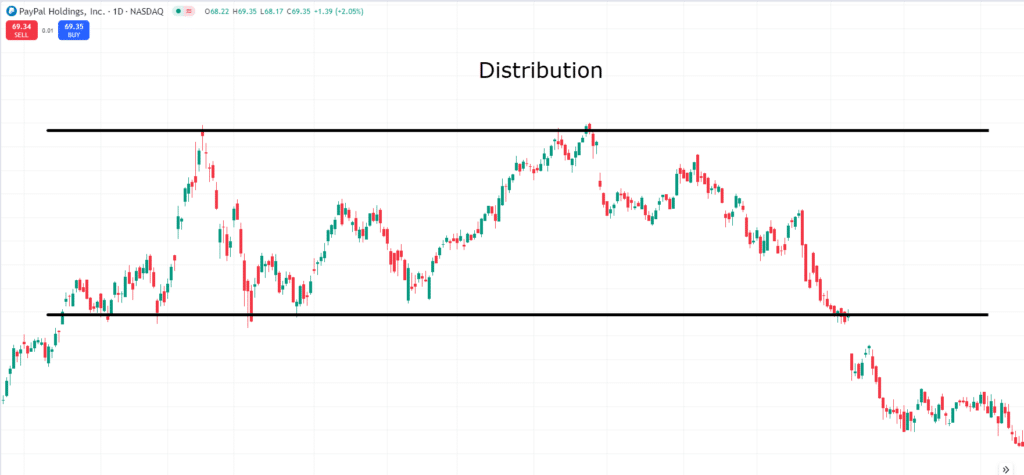

Distribution Part Diagram:

The distribution part is when the market’s uptrend begins to lose steam, and costs begin transferring sideways once more.

Not like the buildup part, which occurs after a downtrend, distribution happens after a big uptrend.

Throughout this time, costs fluctuate inside a spread, and the sturdy upward momentum begins to fade.

Why does this occur?

Within the distribution part, the “good cash” that purchased in through the accumulation part begins to dump their positions to lock in income.

They offload their holdings to the broader market, typically promoting to retail buyers who entered the market late, drawn by the earlier uptrend.

Distribution alerts that the uptrend is weakening, and a reversal is perhaps on the way in which.

As extra promoting stress builds, the market struggles to maneuver larger, setting the stage for the following part: the markdown part…

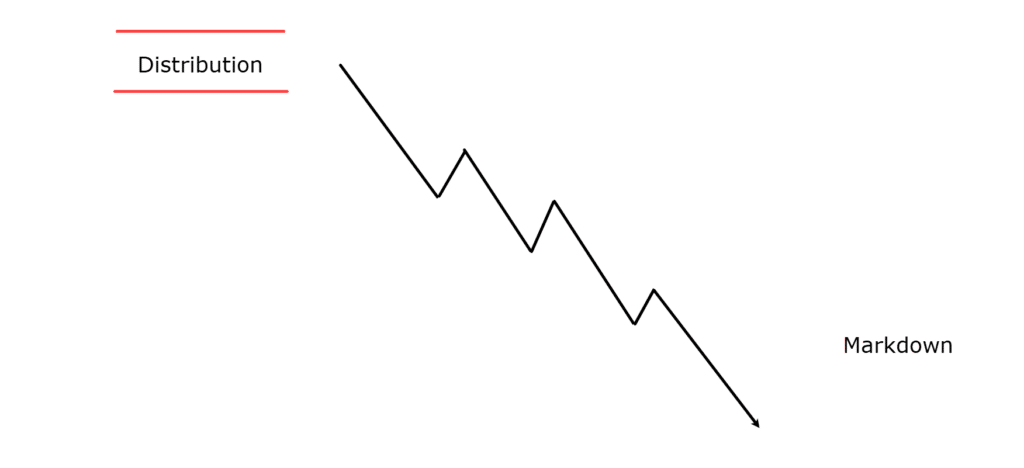

Markdown Part

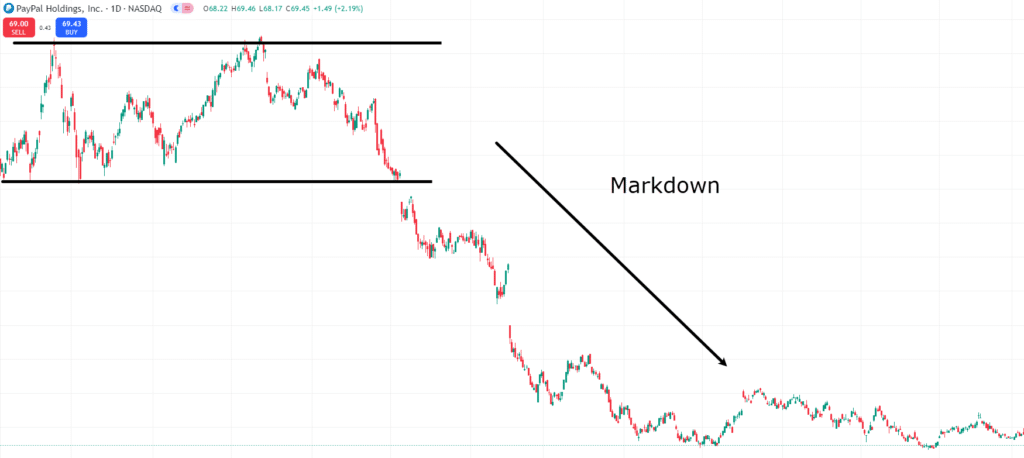

Markdown Part Diagram:

The markdown part is when costs begin to fall persistently, signaling the start of a brand new downtrend.

The market shifts to decrease highs and decrease lows as promoting stress turns into stronger than shopping for curiosity.

This part can generally set off panic promoting, inflicting costs to drop even quicker.

Markdown happens as a result of the market acknowledges that the earlier uptrend is over.

Those that purchased through the late levels of the uptrend start promoting their positions to chop losses or shield income.

As costs proceed to fall, extra buyers panic and promote, which drives costs down additional.

This markdown part signifies a bearish market, the place the development is clearly downward.

Buyers who didn’t catch the indicators of the shift through the distribution part may face vital losses, whereas those that offered earlier keep away from a lot of the decline.

So, are you able to see how understanding Wyckoff’s market phases might help you determine the place you might be out there cycle?

It’s a priceless device for gauging the place the market is perhaps headed subsequent and making extra knowledgeable buying and selling selections.

Let’s check out some actual chart examples so you’ll be able to see how they give the impression of being in precise markets…

Wyckoff Principle: Buying and selling Examples

Earlier than we discuss markup and markdown, allow us to take a look at some inventory examples of how accumulation and distribution play out.

Additionally, it’s necessary to keep in mind that the buildup and distribution diagrams are subjective.

It requires apply and expertise to have the ability to choose them up in actual time, so don’t beat your self up if issues don’t go completely at first.

With that stated, take a look at the distinction in how worth is transferring at these key areas on the chart…

XOM 4-Hour Chart Accumulation:

Are you able to see how the value was in a gradual downtrend, persistently making decrease lows and decrease highs?

However then one thing modifications within the worth motion.

As an alternative of continuous this sample, the value makes a decrease low however then begins to kind even highs and even lows, signaling a possible shift in market conduct.

As the value continues to maneuver, it experiences a spring—a second the place it drops beneath the vary’s low however then rapidly rebounds all the way in which to the vary’s excessive.

This fast restoration signifies that consumers are stepping in, and will imply that the market is gearing up for a markup part…

XOM 4-Hour Chart Accumulation Breakout:

At this level, worth holds near the vary excessive and types a brand new minor assist stage, often known as a Signal Of Power…

XOM 4-Hour Chart Markup:

After this level, the vary lastly breaks out to the upside, signaling the start of the markup stage.

Acquired it?

Subsequent, check out a distribution instance…

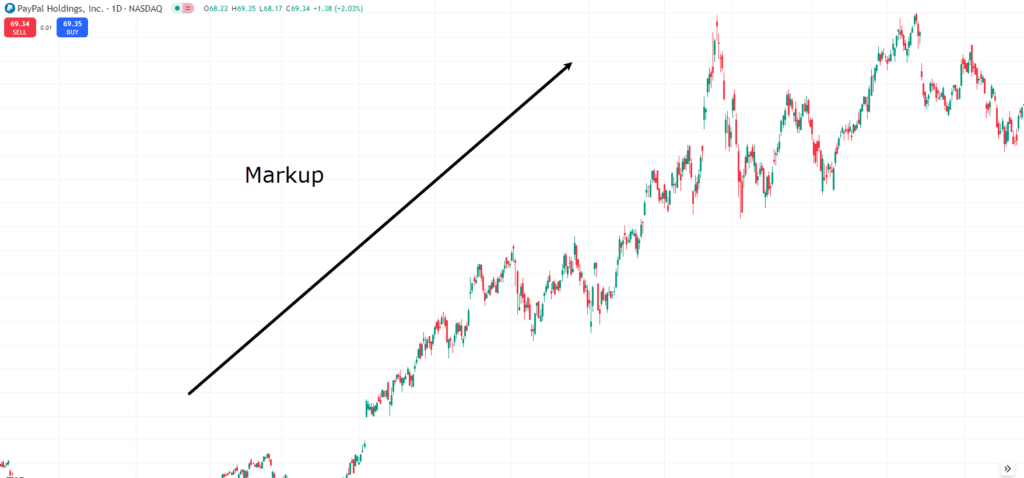

Paypal Day by day Chart Markup:

As you’ll be able to see in PayPal’s day by day chart, the value was initially in a gradual uptrend, persistently making larger highs and better lows…

Paypal Day by day Chart Distribution:

Nevertheless, on the prime of this development, the value begins to kind a spread, repeatedly struggling to interrupt previous the earlier highs.

That is the primary signal {that a} potential reversal is perhaps coming.

When the value breaks beneath the vary low and fails to carry it as assist, it turns into clear that this was the distribution part of the market cycle.

Check out what occurs subsequent…

Paypal Day by day Chart Markdown:

You’ll be able to see the value continues to development decrease within the markdown part.

So, discover how necessary it’s to concentrate as to whether markets are struggling?

It’s these equal highs in distribution and equal lows in accumulation that may tip you off as to what might occur subsequent!

Fastidiously following worth motion by means of these phases can provide clues about future strikes.

After all, it might not all the time be apparent, as market phases can differ in form or dimension…

However by asking your self, “What part of the market am I in?” you’ll be able to achieve perception into whether or not you’re shopping for on the proper worth.

For instance, let’s say you discover the value is in markup and begins to vary…

Properly, doesn’t it recommend that the market may very well be in a distribution vary? That the uptrend might have run its course?

Whereas many retail merchants might need to soar in, you need to use Wyckoff to rise above, and perceive that the value is extra prone to enter the markdown stage quickly.

Getting the thought?

Nice!

With that stated, let’s discover some limitations of Wyckoff…

Limitations

Wyckoff Quantity evaluation may be deceptive

These days, quantity information isn’t as straightforward to know because it was, which may make utilizing the Wyckoff Methodology tougher.

When Richard Wyckoff developed his strategy within the early twentieth century, quantity was a dependable indicator of market exercise.

Nevertheless, trendy buying and selling has modified rather a lot since then!

At present, with the rise of algorithmic buying and selling, high-frequency buying and selling (HFT), and darkish swimming pools (personal exchanges the place huge trades occur), quantity can generally give deceptive alerts.

Algorithmic buying and selling can generate large numbers of trades that don’t truly replicate actual shopping for or promoting curiosity however are simply computer systems exploiting small worth modifications.

Equally, darkish swimming pools can disguise massive trades from the general public, making it tougher to see the actual quantity exercise…

Due to these modifications, Wyckoff’s conventional strategy to quantity might not all the time work in addition to it as soon as did.

In truth, merchants at this time may want to regulate their methods or use further instruments to take care of these trendy market circumstances.

Greatest for Positional Buying and selling, Not Day Buying and selling

The Wyckoff Methodology is commonly seen as much less efficient for day buying and selling due to how a lot markets have modified.

At present, massive establishments, market makers, and even teams of retail merchants may cause fast, unpredictable worth swings, making it tougher to depend on Wyckoff’s rules for intraday buying and selling.

For instance, stop-hunting is frequent in day buying and selling, the place huge gamers push costs to hit the stop-loss orders of smaller merchants, inflicting momentary volatility.

This makes it tough to exactly place your orders and cease losses with out them being probably worn out.

That’s why Wyckoff tends to work higher for positional buying and selling, the place you maintain a commerce for days, weeks, and even months.

In these longer time frames, the market noise from day-to-day actions settles down, making it simpler to see the larger image and apply Wyckoff’s methods.

When you can nonetheless use Wyckoff for day buying and selling, you simply have to be very conscious of which part of the market cycle you’re in and commerce accordingly.

If you achieve extra information and apply, you’ll start to see the place appropriate stop-loss positions must be and the way you need to use Wyckoff to your benefit on the decrease timeframes.

Suited to shares greater than foreign exchange

On the subject of shares, the Wyckoff Methodology works finest as a result of the cycles of accumulation, distribution, and quantity evaluation are simpler to see.

Shares typically comply with extra predictable patterns, with huge establishments quietly shopping for shares (accumulation), then driving up costs (markup), and finally promoting to the general public (distribution).

This performs out properly with Wyckoff’s phases and makes it simpler for merchants to acknowledge the availability and demand.

Nevertheless, the foreign exchange market is a special beast.

As foreign exchange operates 24/7, worth actions are pushed by a variety of things like financial information, politics, and central financial institution actions.

These elements may cause sharp and unpredictable strikes, making it tougher to suit foreign exchange worth conduct into Wyckoff’s phases.

Moreover, as a result of foreign exchange doesn’t have a central trade, quantity information is much less dependable in comparison with the inventory market.

Foreign exchange additionally tends to vary greater than development, particularly on larger timeframes, which doesn’t all the time align with Wyckoff’s trending market strategy.

For higher outcomes, it’s possible you’ll want to vary the way in which you utilize Wyckoff or mix it with different instruments if you wish to use it in foreign exchange.

Conclusion

It’s clear that the Wyckoff buying and selling idea might help you higher perceive how markets are working, and higher time your trades in consequence.

Through the use of Wyckoff’s concepts in your buying and selling, you’ll be able to study necessary issues about market phases, the plans of good cash, and the way provide and demand actually work.

And when utilized in mixture with different technical instruments, the Wyckoff Methodology can present a big edge in predicting market tendencies and figuring out key turning factors.

To summarize, on this article, you’ve:

- Realized what Wyckoff buying and selling idea is and the place it comes from

- Explored the idea of Wyckoff’s Composite Man and the position of good cash

- Understood the three basic legal guidelines of Wyckoff: Provide and Demand, Trigger and Impact, and Effort vs. Consequence

- Examined intimately the 4 market phases: Accumulation, Mark Up, Distribution, and Markdown

- Reviewed the constraints of making use of Wyckoff’s strategies in trendy markets, together with challenges with quantity and day buying and selling

Wyckoff evaluation goes far past what I’ve lined on this article, however by mastering these primary Wyckoff rules and integrating them along with your different evaluation methods, you’re nicely in your method to changing into a extra insightful and strategic dealer.

For those who appreciated what you noticed right here, it is best to positively discover additional on the subject!

Now, I’m very fascinated by listening to your ideas on the Wyckoff buying and selling idea…

Do you at the moment use Wyckoff’s rules in your buying and selling?

Are you able to see why it stays a essential part of technical evaluation?

How has it impacted your buying and selling success?

Share your ideas and experiences within the feedback beneath!