By Arthur Tzianabos, CEO of Lifordi Immunotherapeutics, as a part of the From The Trenches function of LifeSciVC

It’s simple to leap on the ‘damaging bandwagon’ as of late when information in our world and business is targeted on doom & gloom. In biotech, headlines and each day conversations lean closely towards firm layoffs, shutdowns, pipeline pare-backs, regulatory setbacks, depressed valuations, and what appears like unattainable conditions. Whether or not it’s inside firms, boardrooms, analysis establishments, healthcare organizations, funding companies, banks, actual property workplaces, manufacturing hubs or convention panels and hallways, the beat down is palpable and contagious.

At the moment’s uncertainty, together with financial coverage shifts, monetary challenges, and perceived regulatory hurdles, will be scary. It seems that many people are permitting or perpetuating negativity. That is completely regular since we’re human and are cautious of job safety or the lack to lift cash to fund our firms. Nonetheless, I worry that if we proceed to embrace a pessimistic view, we danger making a self-fulfilling prophecy. This is not going to serve us or our sufferers properly.

Understandably, fast, and up to date adjustments in authorities coverage and personnel create uncertainty, however this isn’t new. Anxiousness in 2017 over NIH and FDA appointments preceded a number of the strongest years of approvals, income, and funding. Furthermore, we all know and plan for improvement timelines that span a number of administrations, which implies we should proceed to deal with good science and prudent enterprise operations.

Though the stakes appear greater at present, the basics of the biotech business and the important thing components for fulfillment haven’t modified. The biotech recipe nonetheless requires a wholesome mixture of:

1) Credible science/promising drug candidate(s)

2) Skilled administration

3) Excessive unmet medical wants/industrial alternative

4) Entry to capital

We’ve got skilled intervals up to now when a number of of those important components have been tough to obtain and keep. Even then, biotech firms launched new medicines, essential scientific discoveries superior to the clinic, therapies obtained regulatory approval and sufferers, buyers and society benefited.

At the moment, we are able to nonetheless examine these bins…..

Scientific discoveries are flowing

New mechanisms of motion (MOAs), new targets, modalities and approaches abound and are serving to many extra sufferers at present

- Biologics and focused therapies embrace new cytokine targets and bispecific antibodies. We welcome modern CAR-Ts, GLP-1 receptor agonists, PD-1 inhibitors and others which have been authorized, are in improvement or ready to be found.

Good knowledge is being rewarded

- Optimistic Part 2 medical knowledge in head and neck most cancers reported by Merus N.V. resulted in an increase in inventory value from ~$40 to $62+ over the previous a number of weeks

- Sizzling off the press is Kymera Therapeutics’ Part 1 wholesome volunteer knowledge for its first-in-class oral STAT6 degrader which resulted in a powerful ~45+% leap in inventory value on the information

- And this simply in: Lyra Therapeutics’ optimistic Part 3 ends in the therapy of Continual Rhinosinusitis (CRS), which drove the top off ~400% on the announcement

Pipelines/applications based on novel science which have needed to be shelved for now doesn’t essentially imply that they’ll not see the sunshine of day. Opportunistic pharma and savvy buyers should still seize the day and provides a few of these promising breakthroughs a brand new house when the time is true.

Administration groups have gained precious expertise

Trade leaders have weathered quite a few storms now, a few of which have been extra extreme and lasted longer than others. Nimble, open-minded, and skilled administration groups have taken essential classes ahead. They’ve develop into more proficient at constructing and contracting, protecting their choices open, and pivoting when vital. The very best ones have additionally discovered how and when to ask for assist, leveraging the robust relationships that our biotech neighborhood is based upon.

That’s not to say that there aren’t alternatives to discover ways to function extra effectively. Assessing outsourcing methods, notably early on and in occasions of financial strain, has develop into an artwork to efficiently advancing the science. Realizing what key features will be served from afar and people who have to be built-in inside is usually firm and time dependent. Skilled groups will lean towards staying lean whereas producing knowledge as rapidly as attainable as a result of money is king.

Unmet medical wants stay excessive

One indicator of excessive unmet want is the variety of medical trials listed and at the moment underway. In line with ClinicalTrials.gov, there are over 500,000 registered research together with interventional and observational research. Not all of those research are lively or at the moment recruiting, however over the previous 5 years, greater than 35,000 research have been registered yearly. In 2024, BioSpace reported that the U.S. had 20,465 ongoing medical trials, and worldwide there have been 65,474 trials recruiting topics. Unmet wants stay excessive and medicines that display clear advantages for sufferers will proceed to draw pharma companions, strategic investments, and patrons.

Capital is accessible

There’s vital capital that’s but to be invested. In line with knowledge from Cambridge Associates and Pitchbook, non-public fairness and enterprise capital funds are sitting on round $1.7 trillion of dedicated, however not but invested capital. This consists of practically $140 billion raised in 2019 or 2020 and a further $200 million from 2021, a few of which may additionally hit the tip of its funding interval this calendar yr. Protecting in thoughts that the majority funds have 5 years to construct their portfolios, crucial allocation selections will must be made within the close to time period.

Traders have extra cash to deploy

By mid-Might, Life Sciences issuers raised roughly $8 billion in equity-based offers (together with IPOs, CMPOs, Comply with-Ons, Purchased Offers, Convertible Word choices, PIPEs and RDs and this doesn’t embrace Most well-liked Choices and ATMs). Personal financings from 2025 additionally point out that offers are getting achieved.

Choose non-public financings from 2025

On this surroundings, buyers will proceed to be conservative and disciplined concerning the businesses they spend money on. Administration groups will must be much more results-driven and environment friendly with their {dollars}. This can be a good factor. Corporations with the correct components that additionally take a conservative and disciplined method can succeed. Low valuations received’t final perpetually and whereas right here, they provide alternatives for sensible, discerning, and affected person buyers to reap doubtlessly higher ROI.

“Because the biotech sector rebounds from the funding downturn, capital is now being extra selectively allotted to high-quality, data-driven applications.” – 3rd Annual BioConnect Convention, H.C. Wainwright & Co., Investor Panel

Pharma has cash to spend

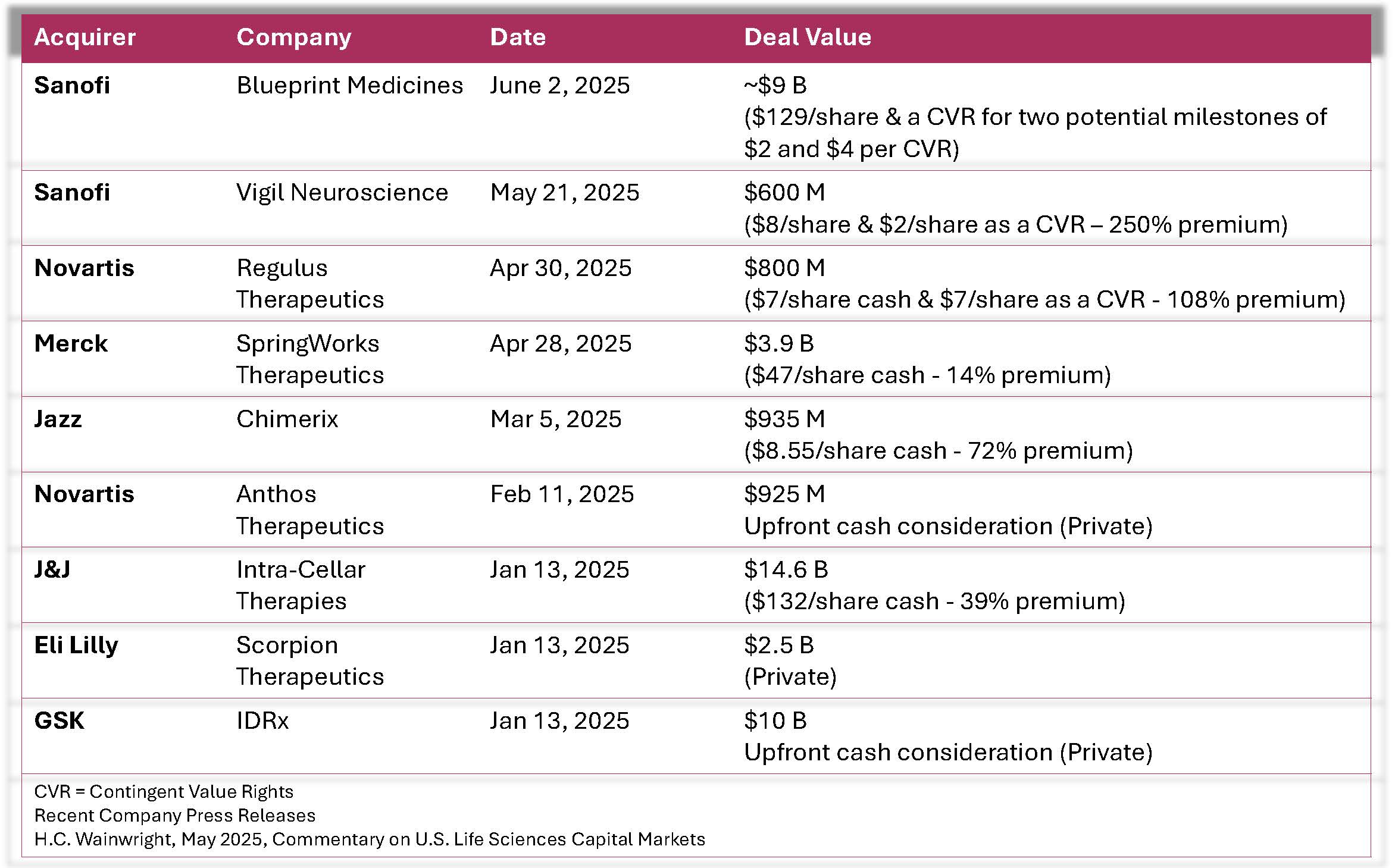

The arrival of COVID vaccines contributed to report world drug revenues, and the brand new weight problems medication seem like following swimsuit. With trillions of {dollars} in revenues, R&D reductions, pipelines in want of enlargement, and a bevy of patent expirations which are drawing even nearer, Pharma must be lively. As of mid-Might 2025, Life Sciences M&A transactions represented ~$30 billion of introduced worth. SMID-cap M&A exercise is anticipated to speed up in 2025 presuming a positive regulatory surroundings because the pharmaceutical sector hunts for brand spanking new pipeline property. 4 public and three non-public M&A offers with consideration higher than $500 million had been introduced.

With trillions of {dollars} in revenues, R&D reductions, pipelines in want of enlargement, and a bevy of patent expirations which are drawing even nearer, Pharma must be lively. As of mid-Might 2025, Life Sciences M&A transactions represented ~$30 billion of introduced worth. SMID-cap M&A exercise is anticipated to speed up in 2025 presuming a positive regulatory surroundings because the pharmaceutical sector hunts for brand spanking new pipeline property. 4 public and three non-public M&A offers with consideration higher than $500 million had been introduced.

Biotech clearly has property that present worth to pharma’s pipelines, and one may count on to see a bolus of M&A offers over the subsequent 3-6+ months. As competitors for probably the most promising property and firms intensifies, biotechs who’ve demonstrated significant progress and generated compelling knowledge ought to command higher economics.

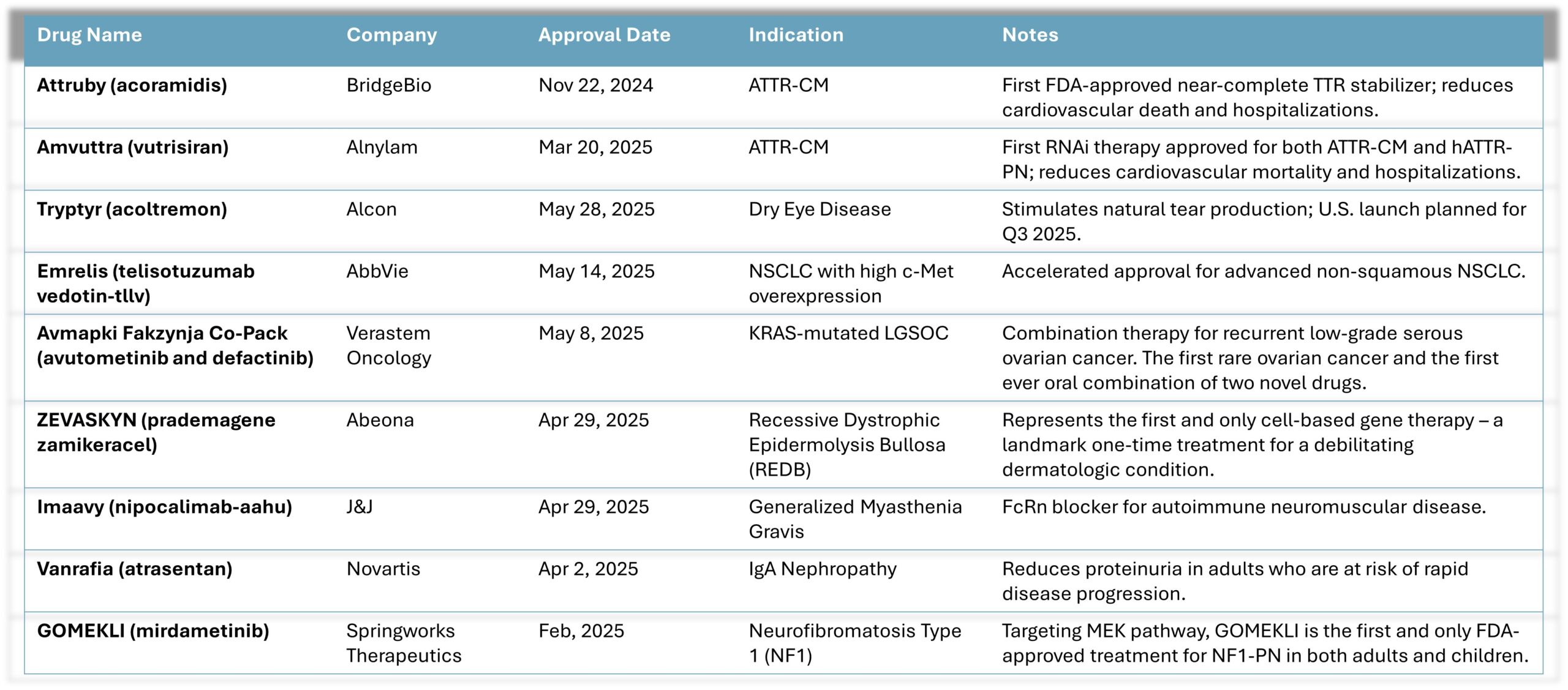

FDA continues to approve therapies, and the business is experiencing success in industrial launches with extra to return. Current drug approvals embrace:

It’s price noting that Verastem’s approval is the primary for a uncommon ovarian most cancers and the first-ever oral mixture of two novel medication in oncology. Abeona’s approval represents the primary and solely cell-based gene remedy for a debilitating derm situation –and with a single therapy. These are vital milestones for each sufferers and for the biotech business.

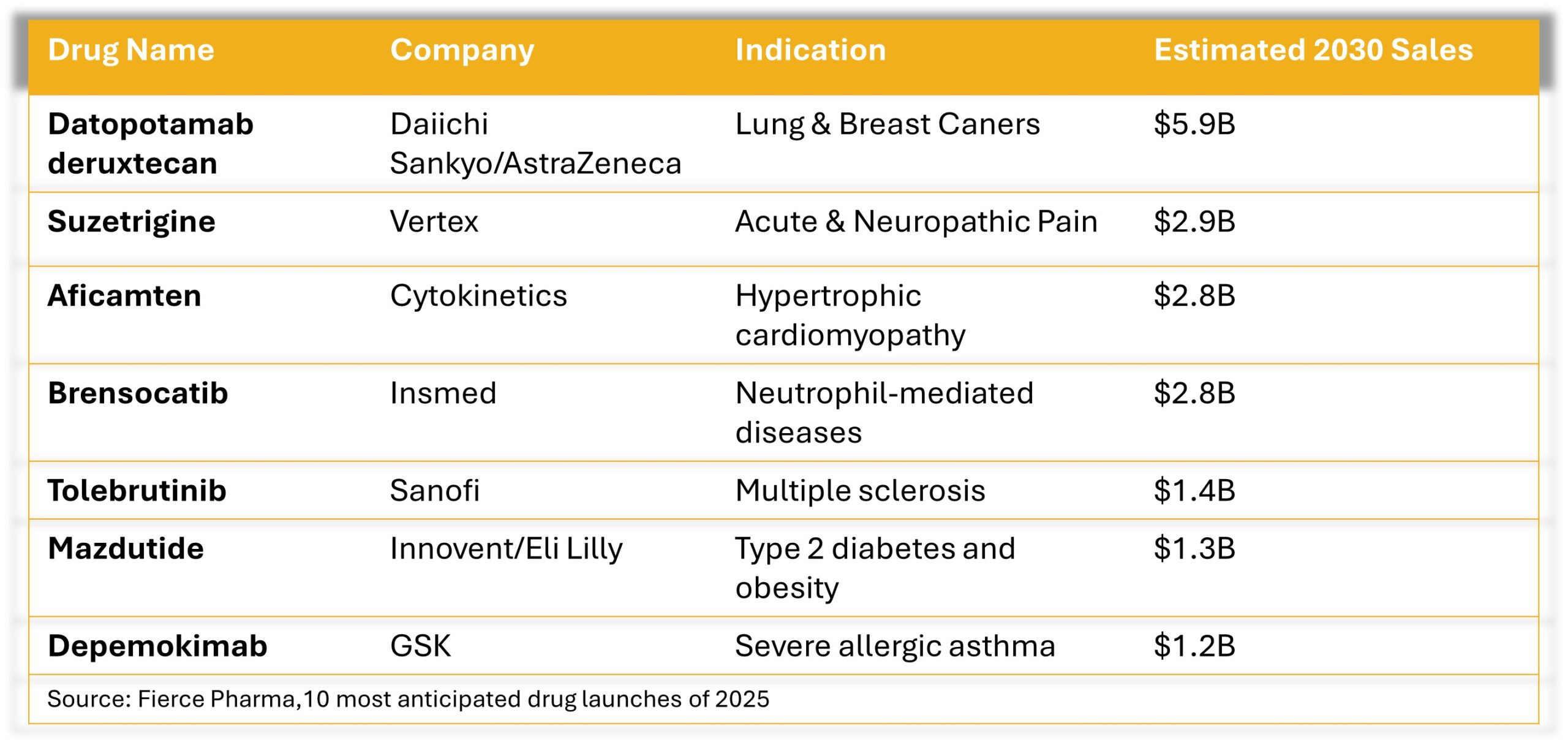

Eli Lilly’s Zepbound, a drug authorized for persistent weight administration in adults, generated over $2 billion in income for 1Q 2025, which represented a rise of $517.4 million over the identical interval final yr. Medicine nonetheless anticipated to launch in 2025 embrace:

So, with all this excellent news, why do biotech surveys, analyst and business studies, and normal, commerce and social media preserve harping on the damaging?

Maybe they’ve forgotten that over the previous 5-10 years an unprecedented variety of biotech firms have launched, and a substantial variety of these additionally accomplished preliminary public choices (IPOs) at a lot earlier levels of their improvement (preclinical levels). These biotechs should report their progress, in addition to any setbacks, on a frequent foundation. Consequently, they’re unveiling preliminary knowledge and having it play out within the public markets vs. in a non-public firm setting. How usually does a small, early medical knowledge set knock it out of the park in security and efficacy? Very not often. Relying on the PK/PD of a drug and the indication, early knowledge readouts will be significant. As a rule, the info are combined, open to interpretation and needing extra sufferers to display medical proof of idea and a pretty security and efficacy profile.

It’s no marvel that persistence is carrying skinny. Through the pandemic, COVID vaccines had been authorized in report time and with Emergency Use Authorizations (EUAs) got here the concept future therapies may additionally attain sufferers ahead of ever earlier than. Breakthrough Designations, Quick Tracks, RMATs and Accelerated Approvals have been main developments, however creating new medication and acquiring approval remains to be an extended, winding, and costly street.

As a substitute of fueling the fireplace, this is a chance for us to reassess what we’re doing, how we’re doing it, and why we’re doing it.

We’re creating modern therapies as rapidly and effectively as attainable to assist sufferers who want new therapy choices.

It’s time to get off the damaging bandwagon and preserve our deal with what we do properly, what we may do higher and what we consider is feasible. With the BIO Worldwide Conference simply across the nook, let’s regroup, reset, and hop on board a optimistic bandwagon. To encourage this view, I share some latest quotes from buyers and business veterans that I consider deserve extra of the highlight:

“…now we should always deal with rebuilding, not dwelling on issues we can not management however studying from them.” –Paul Hastings from the Endpoints 100 Biotech Survey

“If we give into the damaging sentiment, it’s like giving up… and that’s not what we do, it’s not how we’re constructed, and it’s why we survive.” –Longtime CEO and VC

And I assumed this one summed it up properly:

“That is probably the best second in biotech when you can see by the present headwinds. Valuations are engaging for environment friendly biotechs with good drug candidates, sensible administration groups, and supportive buyers. Concentrate on areas of unmet want…and develop it cheaply and rapidly. It CAN be achieved. Dare.” –Investor at BioConnect Convention, H.C. Wainwright

Hopefully, I’ve made a case for why we have to shift our collective mindset to a optimistic mode. We’ve got numerous nice science being found day by day and the data and expertise to translate it into impactful medication for ailments the place sufferers have few, if any, therapies obtainable.

WE GOT THIS……LFG!