I not too long ago watched a documentary about Invoice Gates on Netflix and the factor that caught with me essentially the most from it was that he didn’t develop into one of many wealthiest folks on this planet via luck or inheriting enormous sums of cash. He actually reads like 8 books whereas touring, he can learn 150 pages an hour, and he ENJOYS studying. One among his shut associates mentioned “Invoice all the time is aware of extra about any topic than the individual he’s speaking to about it”. What does this must do with buying and selling? Every thing…

The important thing to buying and selling success is creating your self right into a worthwhile dealer by studying to commerce correctly and being persistently disciplined to observe an efficient buying and selling routine till it turns into a behavior.

Right here’s what it’s essential to learn about buying and selling routines: Buying and selling routines are the actual key to success available in the market. There’s no magic indicator or algorithmic buying and selling robotic that’s going to simply make you a worthwhile dealer. Similar to Invoice Gate’s routine every and on a regular basis over the course of years, led him to insane monetary success, so can your buying and selling routine. Nevertheless, when you have no routine or the fallacious routine, you’ll by no means develop into a profitable dealer. May Invoice Gates have laid round watching T.V. consuming Cheetos all day as a substitute of studying every thing he may get his palms on about enterprise and programming? Positive. And you’ll by no means know who Invoice Gates was if he had completed that.

There’s a “fireplace” inside Invoice Gates; a want to be taught, to develop, to be extra, that gave the impression to be half innate and half developed via his childhood. I can’t present this for you, it’s essential to develop it for those who don’t have it. However, I CAN provide the framework, the “keys” to the “kingdom” so to talk, however it’s important to be within the correct buying and selling mindset to have the ability to ‘flip’ the important thing. So, for those who’re prepared, learn on and be taught in regards to the every day buying and selling routine that has labored for me for the final 10+ years available in the market….

The Fundamental Substances of My Every day Buying and selling Routine

- My buying and selling routine entails interacting with the market FAR lower than many different merchants. This works for me and I firmly imagine that it’s going to give you the results you want for the next causes: Much less stress, Much less time to mess up your trades by over-involvement, low commerce frequency, instills self-discipline, you management solely your self and don’t attempt to management the market.

- My total method is to concentrate on end-of-day knowledge, which implies I concentrate on the every day chart time frames and I’ll sometimes wait till the market closes every day to essentially sit down and take a detailed have a look at the markets in my watch checklist. That is what I name a half time buying and selling routine and never solely does it have the benefit of much less screen-time (so you are able to do different issues) however the actual fact that you just’re spending much less time in entrance of the charts really will enhance your buying and selling efficiency over the long-term.

- I take a weekly view first: I try the weekly chart time frames, attract the important thing ranges, get a really feel for the near-term and long-term traits and make a remark of any apparent / massive value motion reversal indicators.

- Subsequent, we’re trying on the every day chart time-frame. We’re primarily on the lookout for key ranges of assist and resistance, the present and up to date market situations: Trending or sideways? And final however not least, we’re trying on the PRICE ACTION; any indicators which will have shaped close to the important thing ranges? Any indicators shaped after a pull again to a degree? Be aware: Ranges may be horizontal ranges of assist or resistance or EMA – exponential shifting averages and even 50% retrace ranges.

- Now, since that is only a weblog publish, I’ve to “gloss” over a number of the extra detailed subjects like cash administration, buying and selling psychology, cease loss placement, and so forth, however you may observe the hyperlinks I simply offered to be taught a bit extra and naturally these subjects are mentioned far more totally in my skilled buying and selling course.

- What’s the GLUE of all of this? Of my whole buying and selling course of? Easy. It’s routine – self-discipline – behavior or RDH. Let me clarify this to you (it’s crucial) – Bear in mind my point out of Invoice Gates earlier? Invoice Gates in all probability has higher habits than you (or me to be trustworthy), Warren Buffet too. The elite of the world, these women and men who’ve amassed massive fortunes or in any other case succeed at their craft, obtained to that time via Routines that took Self-discipline which became Habits. The dedication is unreal, however actually, that’s what it takes. Invoice Gates doesn’t learn so many books as a result of he hates it, he does it as a result of he genuinely loves it! So, you actually should love buying and selling and it’s essential to love the routine and self-discipline for those who hope to show them into correct buying and selling habits. Correct buying and selling habits are what deliver you wealth within the markets, there isn’t any simple means or short-cut apart from TRULY loving the method. And bear in mind, I can present you my course of, the one which has labored for me, but it surely’s as much as you to LOVE it, to be passionate sufficient in regards to the course of to make it work!

My Every day Buying and selling Course of: Chart Evaluation and Commerce Execution

The primary main chart side of my buying and selling routine is taking a “chook’s eye” view of the markets on my watch checklist. That normally means beginning with the weekly chart time-frame and giving it a very good once-over. I’m primarily on the lookout for key ranges available in the market, main turning factors, traits and areas of consolidation to make be aware of. I all the time mark the important thing ranges on the weekly chart first, right here’s an instance:

Subsequent, I’ll drop all the way down to a every day chart time-frame and start analyzing it in a really related means. The important thing ranges from the weekly might have to be adjusted a bit on the every day, relying on the value motion or you could want to attract in extra ranges:

Now, I’m analyzing the near-term market situations to resolve which route is one of the best to commerce in and what close by ranges / areas are crucial to observe. I’ll typically use a shifting common right here, just like the 21 EMA or related, to assist see the near-term pattern and momentum. Additionally, you will wish to be taught to determine durations of Larger Highs / Larger Lows and Decrease Highs / Decrease Lows, which you’ll be able to be taught extra about it in my article on learn how to determine trending markets.

Final, however definitely not least, I’m on the lookout for value motion indicators / potential trades. I’m particularly on the lookout for “clear and apparent” indicators that line-up with ranges on the chart, in different phrases, which have confluence.

- What you noticed above within the charts is a short overview of my weekly / every day chart evaluation routine that I do for all of the markets in my watchlist. In the event you don’t have a watch checklist, it is best to learn my article on creating market watch lists for extra.

- Markets undergo phases. Research the markets you want essentially the most in your watch lists and you’re going to get to know them, get intimate with them. In the event you see some or most of them are in unhealthy buying and selling phases, or sideways consolidation that’s uneven, simply look at them and stroll away or don’t even verify them for a number of days. The perfect buying and selling phases or situations are trending or when markets are buying and selling in very outlined and bigger buying and selling ranges.

- I can’t pound this into your head sufficient: MOST TRADERS LOSE BECAUSE THEY LOOK AT THE CHARTS TOO DAMN MUCH! The market just isn’t meant to be a on line casino so don’t deal with it as one. Don’t get hooked on it! View and deal with the market as a means so that you can present how deliberate, expert and disciplined you may be and you’re going to get rewarded handsomely for doing so.

How I Discover a Commerce, Set it Up and Execute It

Now, upon getting completed the above steps, let’s say you see a possible commerce. Right here is how I’ll set it up with the entry, cease loss and revenue goal placement…

- Discover the “value motion sign” within the chart beneath, this was technically a bearish tailed bar, adopted by a pin bar sign that was additionally an inside bar inside that bearish tailed bar. Value consolidated for a number of days earlier than in the end breaking decrease with the present downtrend.

- Value had pulled again to resistance on the 21 EMA (blue line) and the 1.1250 horizontal degree, so we had a number of factors of confluence: degree and pattern.

- Merchants may have netted 2R revenue from this commerce had they held on to it for 3-4 weeks after entry. Because of this I all the time preach set and neglect buying and selling!

- This instance reveals a transparent pin bar promote sign that shaped at resistance (each horizontal and ema) and inside a downtrend. This was a really clear and apparent commerce for a savvy value motion dealer. Cease loss was simply above the pin bar excessive and a 2-3R revenue was simply achieved for those who held the commerce for a few weeks.

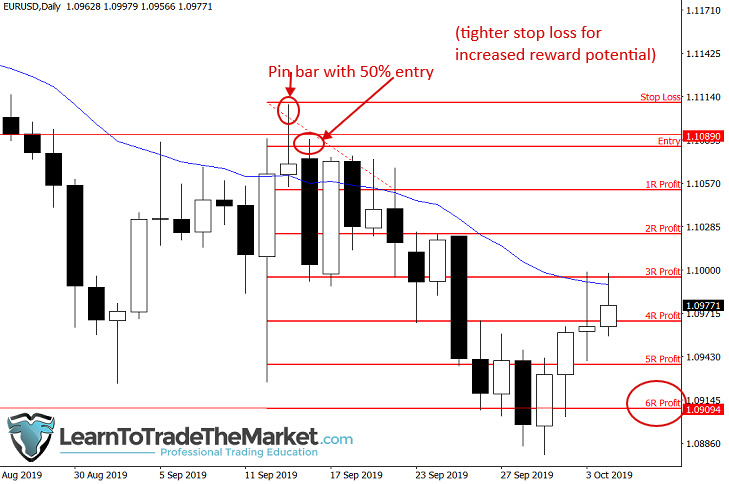

- An fascinating “twist” on the final commerce above is seen beneath. Discover the entry was made as a 50% retrace entry of the pin bar’s tail.

- This entry permits for both a tighter cease loss and therefore elevated potential threat / reward OR with a traditional width cease you can give the commerce extra respiratory room. On this case, we’re exhibiting a tighter cease with elevated threat reward, 6R was attainable right here!

Conclusion

In as we speak’s lesson, I’ve proven you the way I personally analyze the charts every week and day and gave you a ‘peek’ into my very own private buying and selling habits. Hopefully, after studying as we speak’s lesson (and re-reading it) you now have a greater understanding of WHY you want a every day buying and selling routine and HOW to develop one.

The above every day buying and selling routine is the core basis that every one of my trades are constructed on, and it’s my opinion that every one aspiring merchants want such a basis to construct their buying and selling profession on in the event that they wish to have a critical probability at making constant cash within the markets.

A lot of I publish a every day market commentary every day shortly after the every day Foreign exchange market shut. Nevertheless, what you could not know is that doing these every day commentaries (much like above charts) can also be a part of my every day chart evaluation and buying and selling routine. I really began writing down my ideas in regards to the markets every day nicely earlier than I began this web site, and it’s one thing I’ve completed repeatedly each buying and selling day for in regards to the final decade. It’s actually a ordinary a part of my every day life…if I miss a day of commentary for some odd motive, like journey or a vacation, I actually really feel ‘unusual’, and like one thing is ‘lacking’. It’s good to get to that time too.

For on-going assist and help with studying to commerce, analyzing the markets, recognizing trades and constructing your individual private buying and selling plan, my every day commentary and members’ evaluation is a good instance of how I carry out my rolling (ongoing) evaluation of the market in real-time situations. That is one thing which you could be taught from me and mimic in your charts. I encourage you to “watch over my shoulder” every day as I analyze the charts and plan my trades within the members every day chart evaluation space and my commerce concepts publication.

Please Depart A Remark Beneath With Your Ideas On This Lesson…

If You Have Any Questions, Please Contact Me Right here.