Do you ever surprise how merchants appear to know when a chart is about to begin trending?

Is there some darkish magic in play…?

Under no circumstances!

Skilled merchants usually use indicators to assist them predict what may occur.

Two of an important for tendencies are the Golden Cross and the Dying Cross.

Now, despite the fact that these names may sound mystical at first, don’t fear!

I’ve designed this information to clarify these essential indicators to you as merely as doable.

You’ll quickly get the grasp of them… and uncover how useful they are often.

On this article, you’ll delve into key features like:

- What the Golden Cross and the Dying Cross are

- Why utilizing the 50 and 200 shifting averages is important

- Utilizing complementary indicators

- Actual buying and selling setups and examples

- Recognizing the restrictions of the Golden Cross and Dying Cross

Prepared to boost your buying and selling technique?

Let’s dive in!

What’s a Golden Cross vs. a Dying Cross?

First, there are some variations between the Golden Cross and the Dying Cross.

A Golden Cross happens when a short-term shifting common crosses above a long-term shifting common, signaling a possible bullish market development.

As a result of it’s usually discovered on the backside of a downtrend, this crossover suggests the market’s short-term momentum is outpacing its longer-term momentum…

…indicating the start of an upward development!

Usually, merchants search for the 50-day shifting common to cross above the 200-day shifting common as a powerful bullish sign.

So, what does this seem like?…

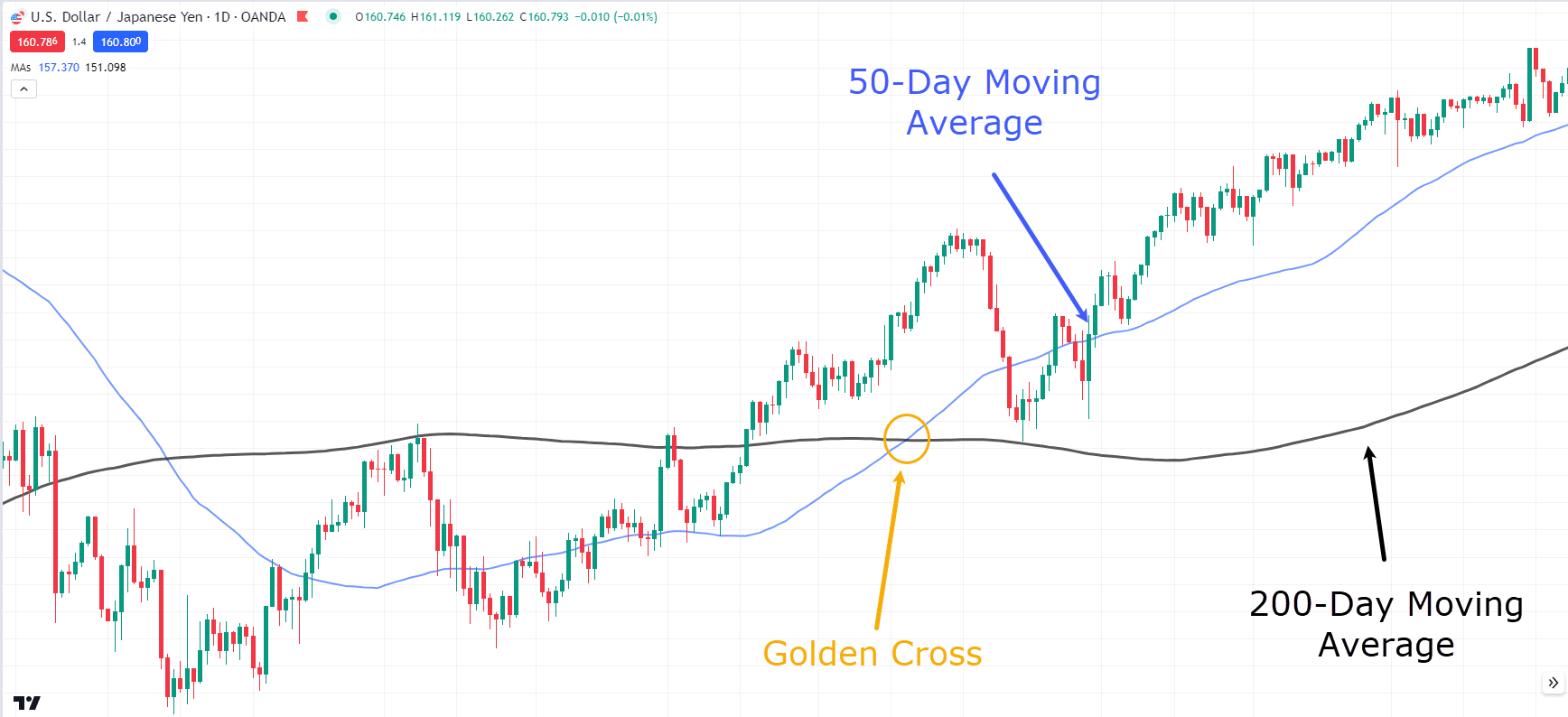

USD/JPY Each day Chart Golden Cross:

On this chart, are you able to see how the short-term every day common crossed above the longer 200-day shifting common?

It is a basic instance of a Golden Cross.

Look what occurred afterwards; the worth continued its momentum, signaling the beginning of a brand new uptrend.

So… what concerning the Dying Cross?

Even the title sounds daunting, proper?

However all it’s saying is that an uptrend could also be coming to an finish.

In distinction to the Golden Cross, the Dying Cross seems on the high of an uptrend.

It occurs when a short-term shifting common crosses beneath a long-term shifting common, signaling a possible bearish development.

This crossover means that the market’s short-term momentum is weaker than its longer-term momentum…

…indicating {that a} downtrend could also be imminent!

Have a look…

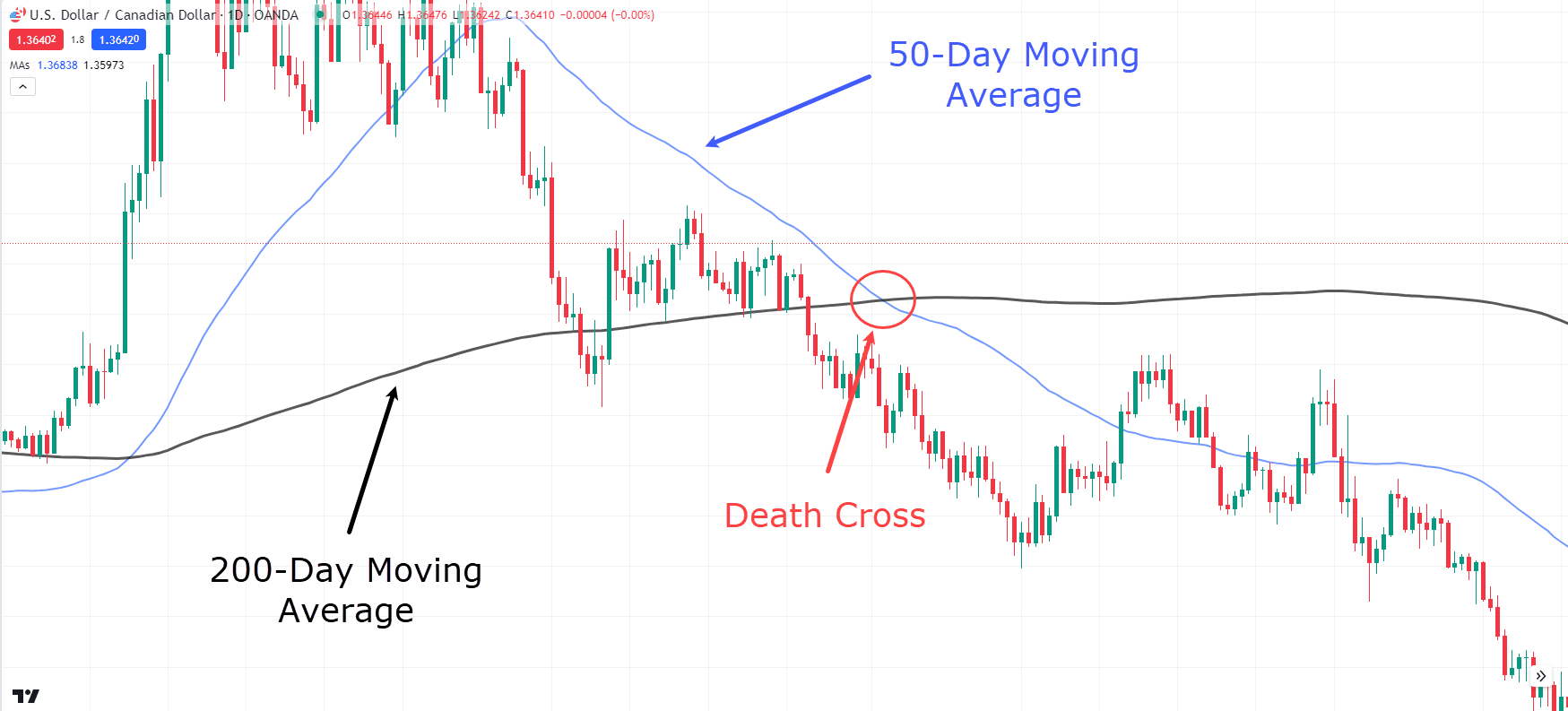

USD/CAD Each day Chart Dying Cross:

As with the Golden Cross, the 50-day and 200-day shifting averages are used to seek out the Dying Cross.

Each patterns are broadly used as a result of they create clear indicators, and supply a broader view of the market.

They’re an easy-to-understand option to inform whether or not the market is in an uptrend or downtrend.

Make sense?

Nice!

Let’s transfer on!

What about completely different Transferring Averages?

50-Day and 200-Day Transferring Averages

One of many largest questions I usually get is:

“Why use solely the 50-day and 200-day shifting averages?”

“Why not use the 20 and 100, or the 5 and 20?”

Properly, the reason being that the 50- and 200-day seize short-term and long-term momentum rather well!

Another mixture leads to a shifting common crossover, which may’t reside as much as the Golden and Dying Crosses.

It’s all about discovering a stability between sensitivity and reliability.

Utilizing the 50-day and 200-day shifting averages creates loads of buying and selling alternatives whereas having the ability to monitor market momentum shifts that favor your commerce.

Now, your subsequent query could be:

“What if I don’t commerce the every day timeframe?”

Learn on to seek out out!

Transferring Averages on completely different timeframes

The excellent news is that these shifting averages could be adjusted for any timeframe.

For instance, should you’re utilizing the 1-hour timeframe, using the 50- and 200-day shifting averages will generate extra frequent buying and selling alternatives.

Nonetheless, all the time do not forget that extra frequent buying and selling alternatives don’t essentially imply higher high quality trades!

Decrease timeframe setups usually carry much less weight and worth in comparison with these on greater timeframes.

Preserve this in thoughts when contemplating buying and selling the Golden and Dying Cross on completely different timeframes.

Now, these indicators don’t need to work alone.

Let’s have a look at some that may complement the Golden and Dying crosses…

Utilizing Complementary Indicators

Relative Power Index (RSI)

The Relative Power Index (RSI) is a momentum oscillator that measures the velocity and alter of value actions.

It ranges from 0 to 100 and is usually used to establish overbought or oversold situations available in the market.

An RSI above 70 means a safety could also be overbought, whereas an RSI beneath 30 suggests it could be oversold.

When used alongside Golden and Dying crosses, the RSI might help verify the power of a development.

So, what may this seem like when utilizing it with a Golden Cross?

Let’s have a look…

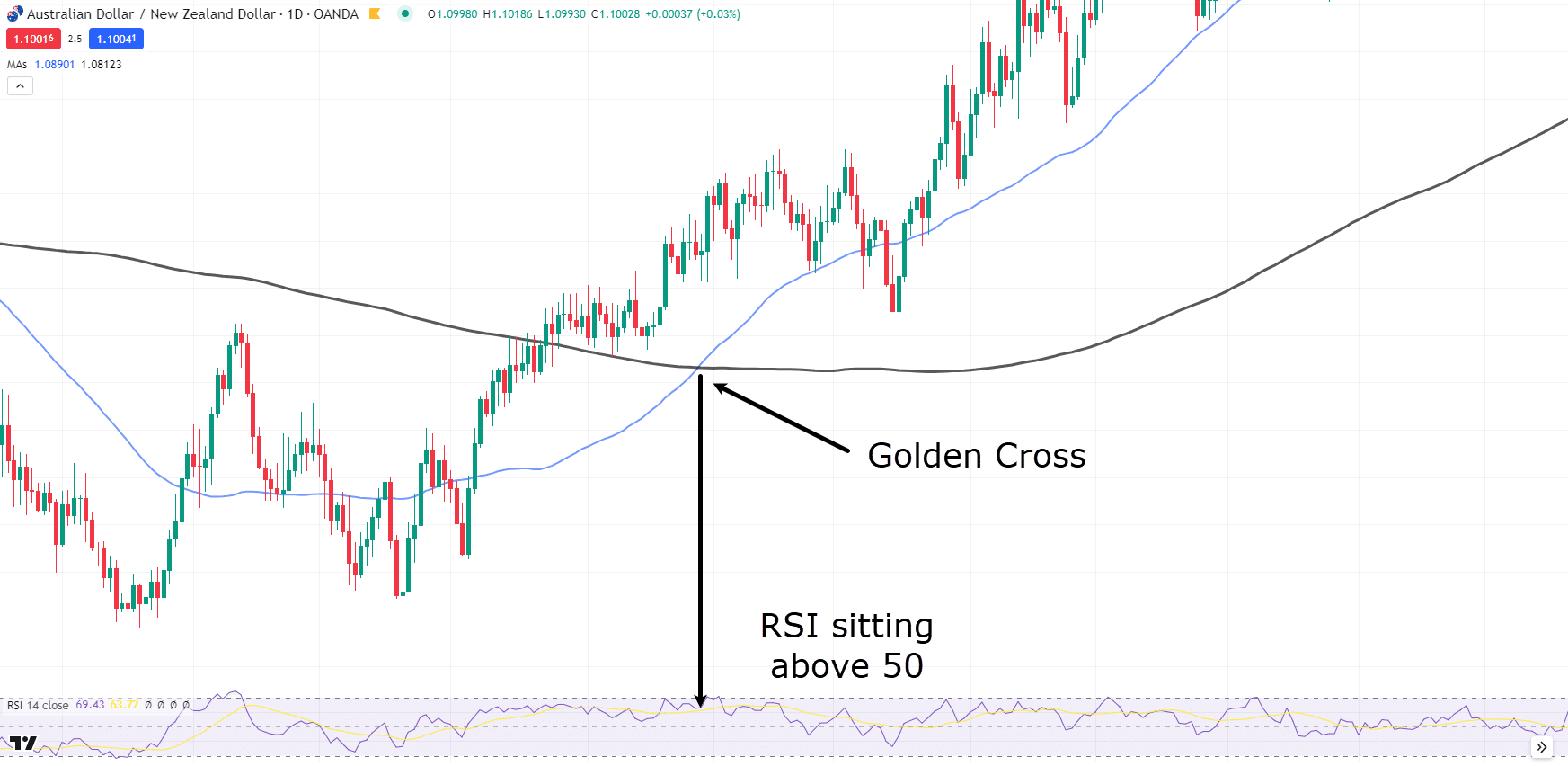

AUD/NZD Each day Chart RSI Instance:

Within the chart above, the shifting averages have crossed over, representing a Golden Cross.

In case you comply with the Golden Cross level all the way down to the RSI, you’ll discover that the RSI is above the 50-level.

This offers further affirmation that momentum is within the consumers’ favor, alongside the Golden Cross sign.

It’s not the one indicator that may assist, both!

Let’s check out the MACD subsequent…

Transferring Common Convergence Divergence (MACD)

The Transferring Common Convergence Divergence (MACD) is one other in style momentum indicator that exhibits the connection between two shifting averages of a safety’s value.

Bear in mind, the MACD is calculated by subtracting the 26-period EMA from the 12-period EMA.

The results of this calculation is known as the MACD line.

A nine-day EMA of the MACD, referred to as the “sign line,” is then plotted on high of the MACD line, which generally is a set off for purchase and promote indicators.

Merchants usually search for crossovers of the MACD line and the sign line and divergences from the worth motion to substantiate tendencies they discover by Golden and Dying crosses.

Lets have a look a have a look at one other Golden Cross instance…

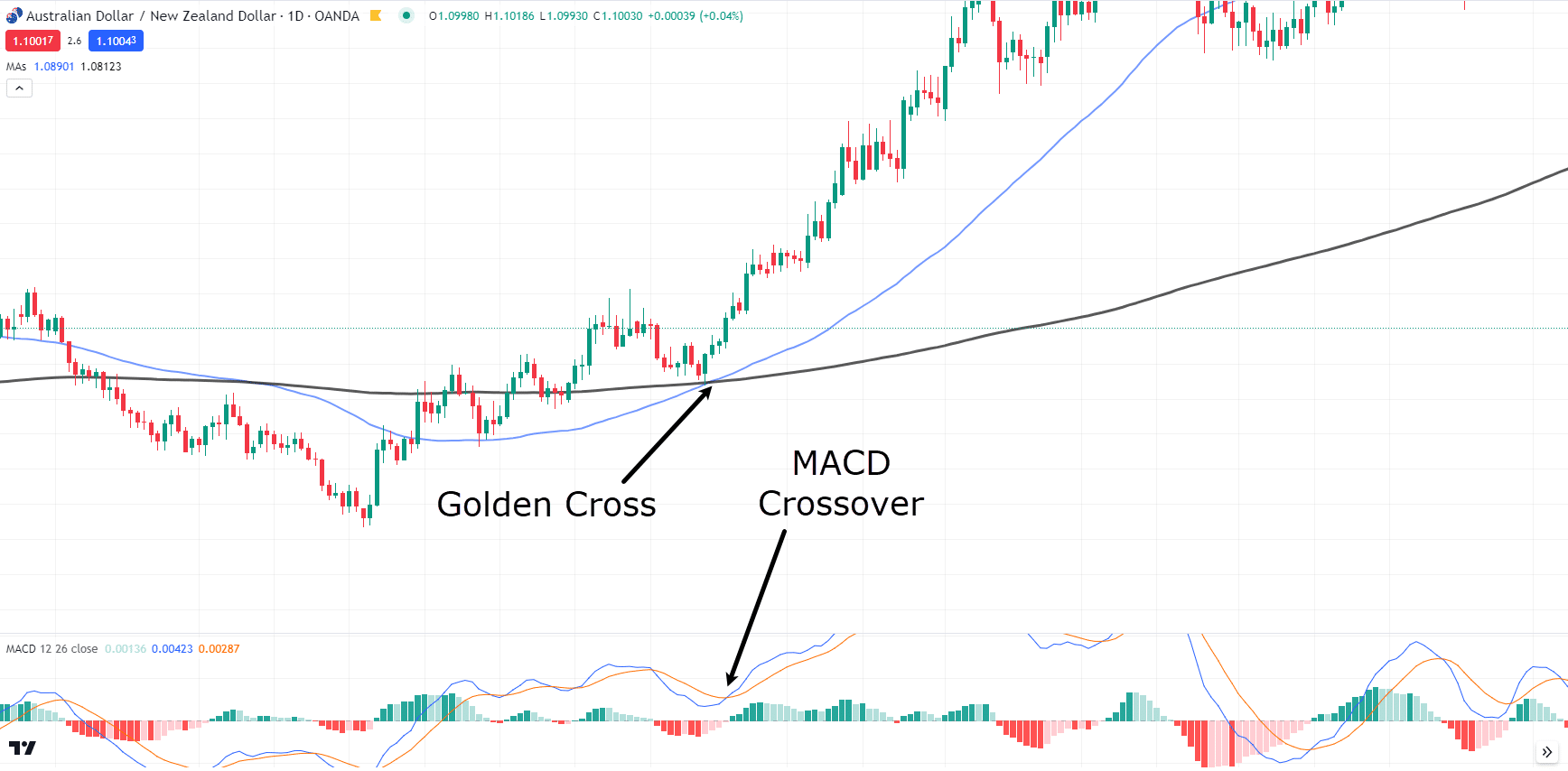

AUD/NZD Each day Chart MACD Crossover:

Within the chart above, are you able to see how a number of bars after the Golden Cross, the MACD additionally crosses over?

This implies momentum is clearly within the bulls’ favor.

OK, so, you’ve seen so much about figuring out Golden and Dying Crosses, however what about taking earnings and managing trades after entry?

Let’s have a look at some actual buying and selling examples!

Dying Cross Examples

First, let’s have a look at the Dying Cross…

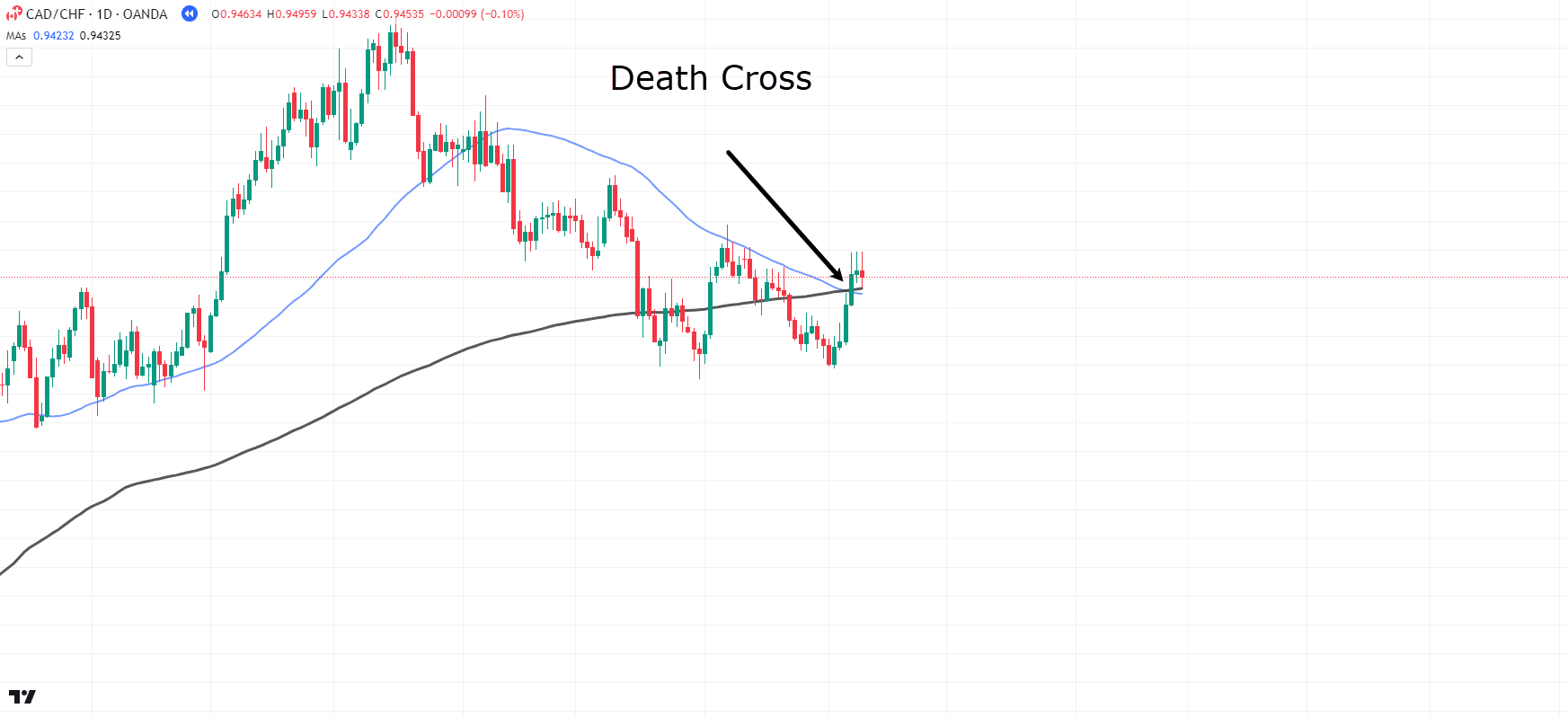

CAD/CHF Each day Chart Dying Cross:

On this CAD/CHF every day chart, the worth has began forming decrease highs and decrease lows.

The shifting averages have additionally crossed to create the Dying Cross!

Nonetheless, despite the fact that the Dying Cross has occurred, it’s all the time really helpful to attend for the worth to reject the present stage and present some type of bearish candlestick.

Let’s search for a candle that signifies bearish rejection…

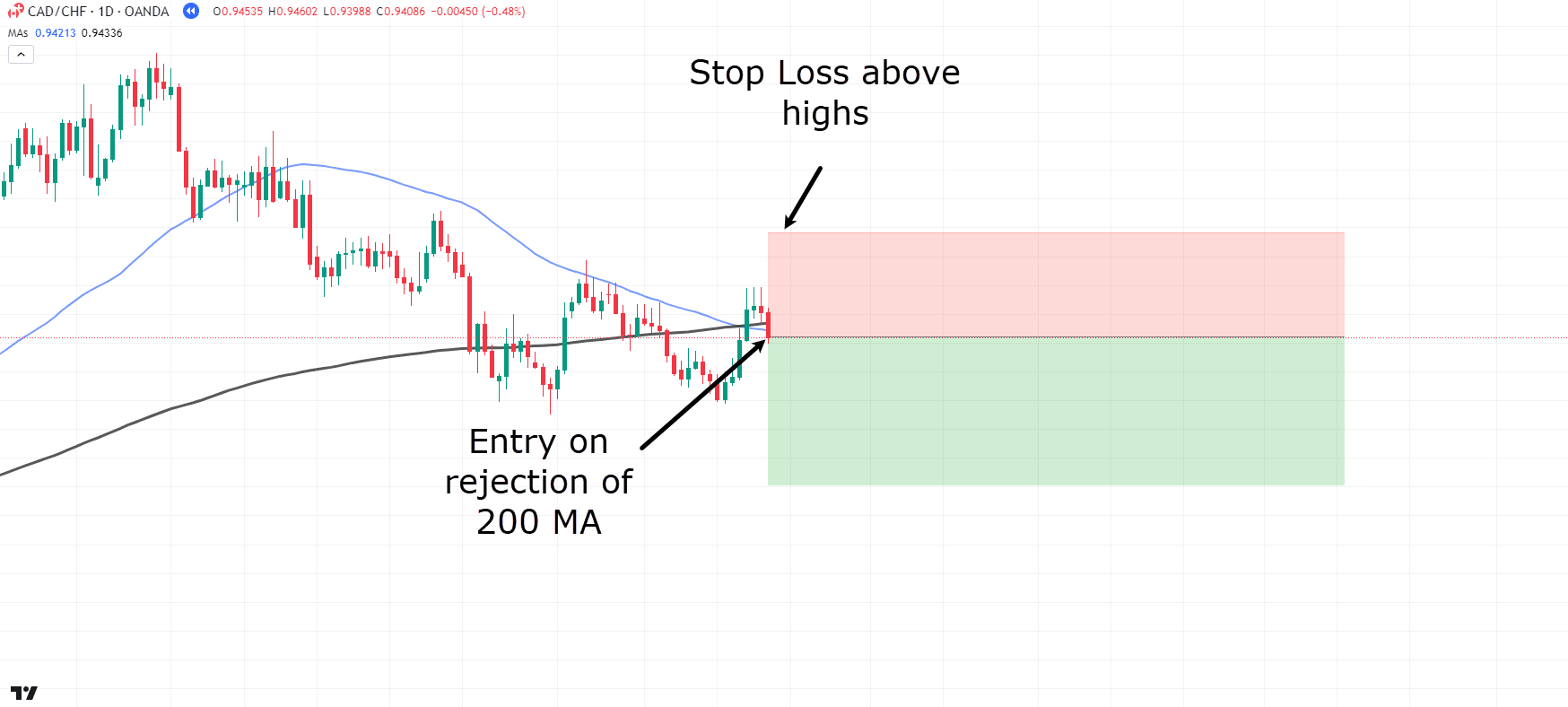

CAD/CHF Each day Chart Dying Cross Entry:

Nice! Discover how the worth has fallen beneath the shifting averages and appears to have shaped a excessive of the decrease excessive?

Your stop-loss placement relies on your danger tolerance, however for this instance, let’s place it safely above the earlier highs…

On this situation, intention to exit the commerce if the shifting averages cross again over, signaling the potential finish of the downtrend…

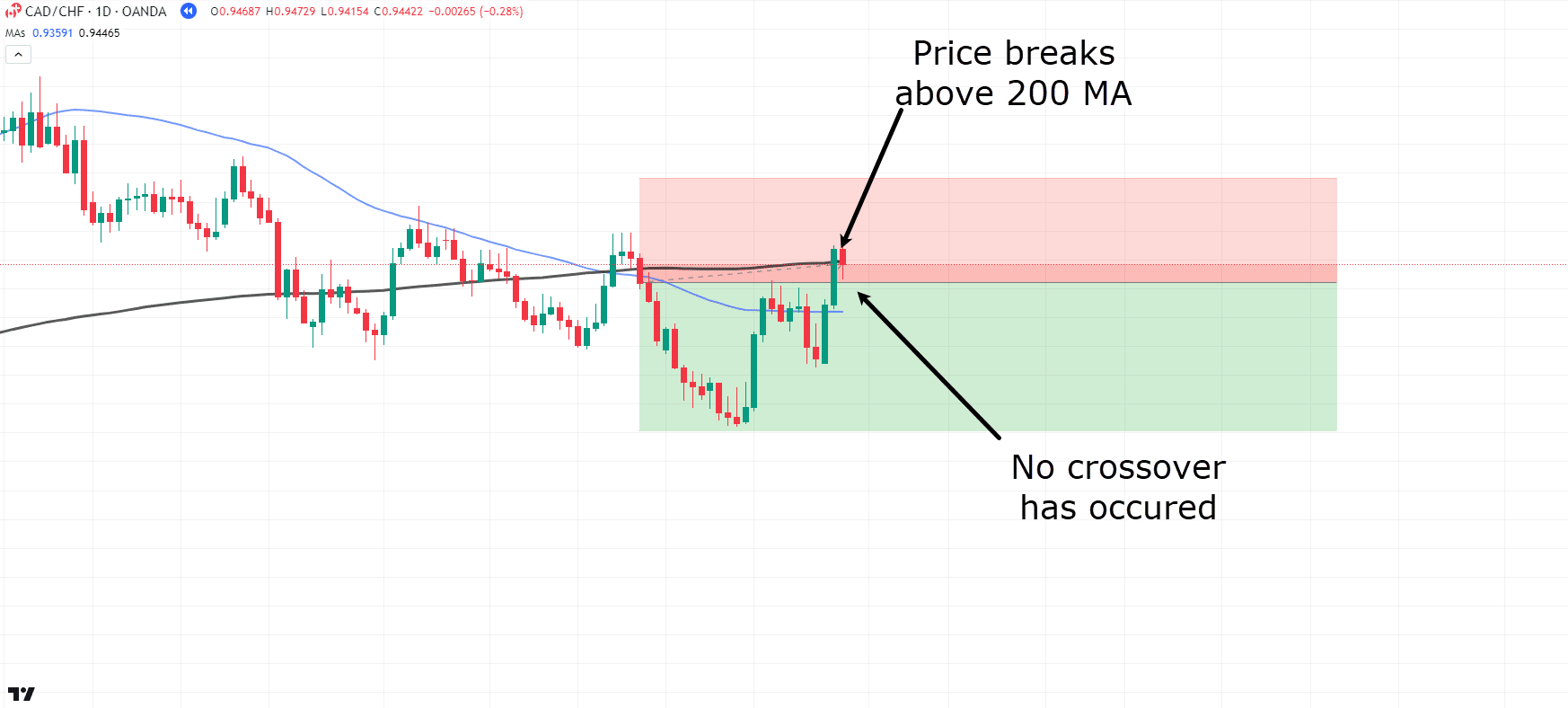

CAD/CHF Each day Chart Dying Cross Commerce Administration:

Oh no! Worth has shaped what seems to be like the next low and is now breaching the highs.

Nonetheless, have you ever observed that the crossover hasn’t occurred but?

So, let’s persist with the commerce and see what occurs…

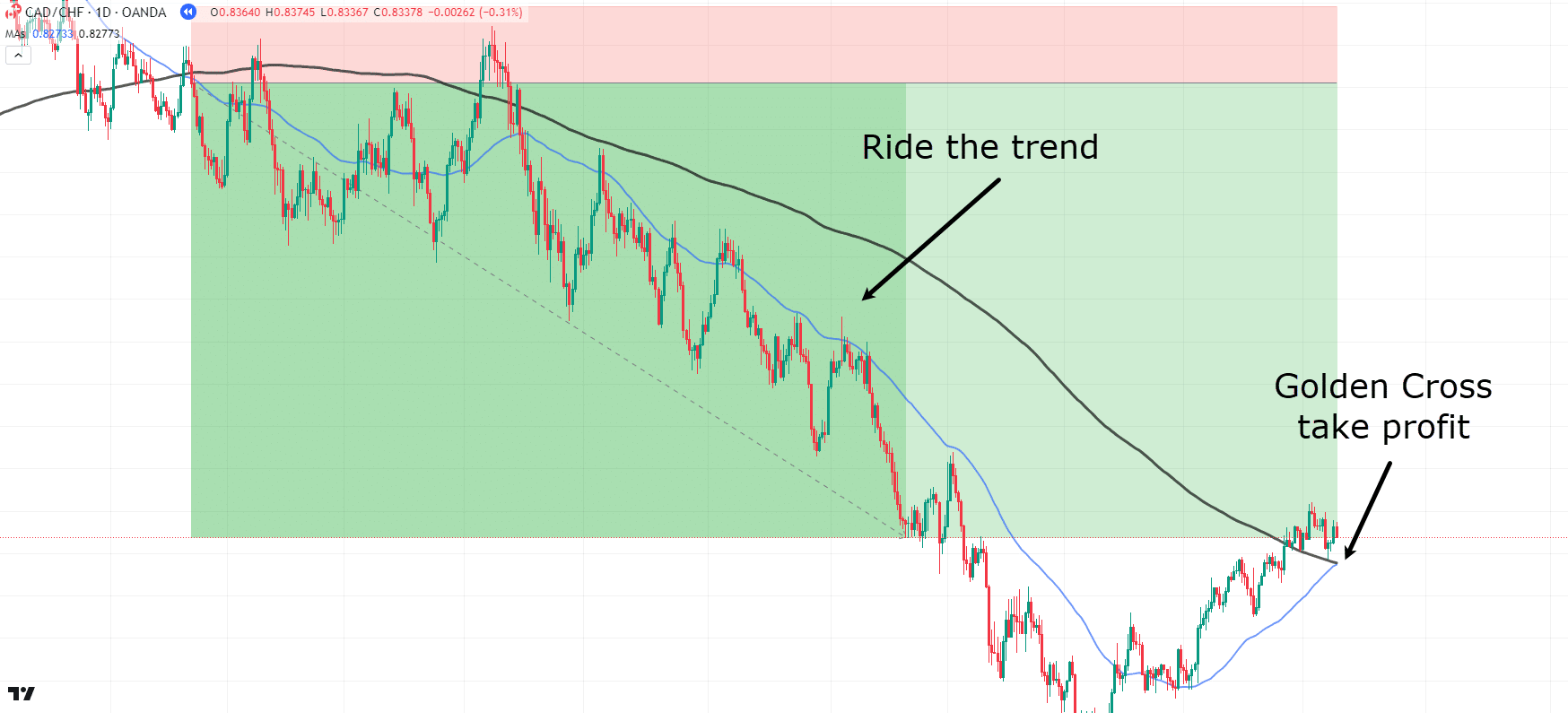

CAD/CHF Each day Chart Dying Cross Take Revenue:

Wow!

Have a look at that!

Worth continued to respect the Dying Cross downtrend, and also you secured some severe earnings after the crossover occurred once more.

See how there have been a number of alternatives to overcomplicate the commerce and exit too early?

It’s essential to have a transparent understanding of what is going to set off an early exit or what situations you wish to see for taking revenue.

Let’s check out one other instance!…

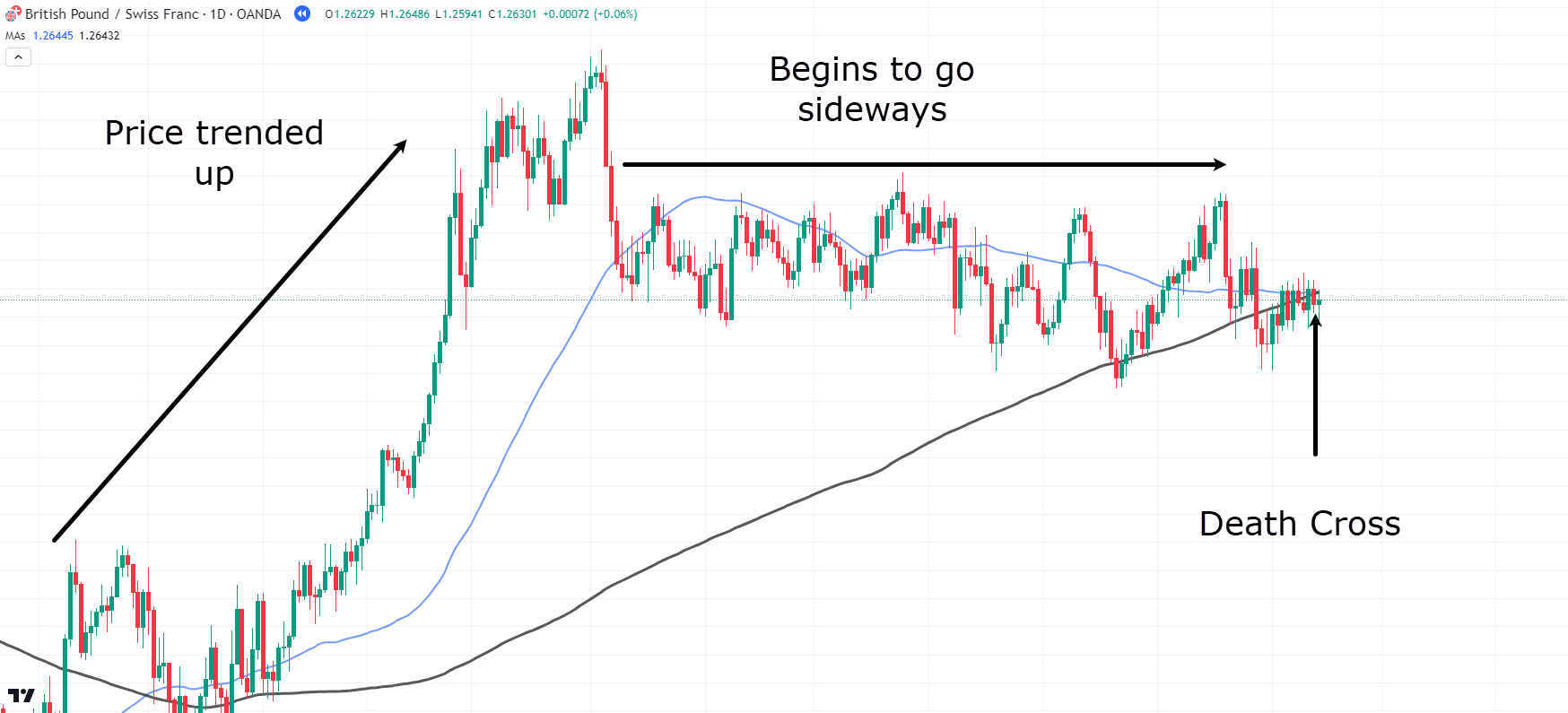

GBP/CHF Each day Chart Dying Cross:

Right here is one other instance of the Dying Cross taking part in out…

Worth is trending up however then begins to maneuver sideways, shedding its bullish momentum.

It’s an important indication that the worth could also be shifting from an uptrend to a downtrend…

So, let’s take the commerce, proper?

However wait – not so quick!

Bear in mind to attend for a transparent rejection of the realm…

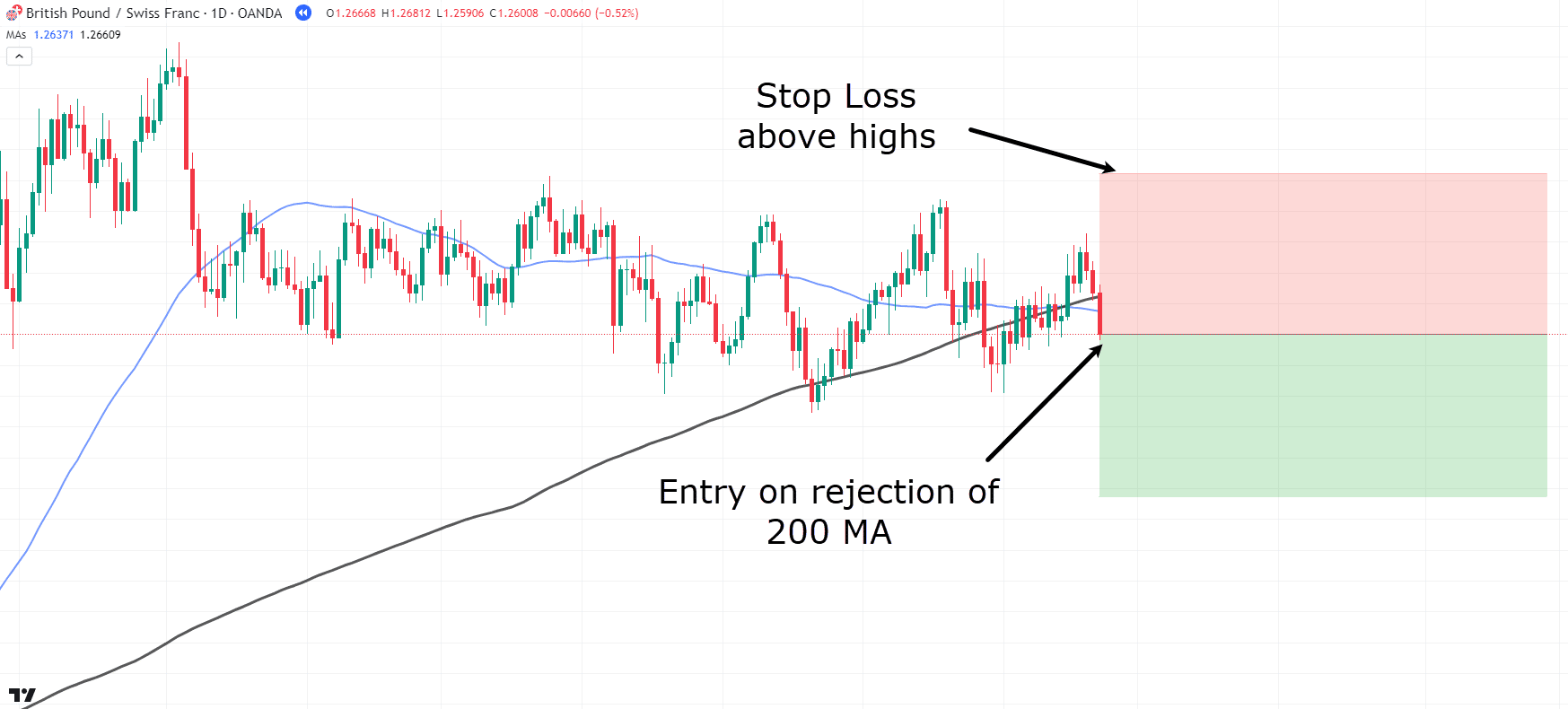

GBP/CHF Each day Chart Dying Cross Entry:

Alright!

Now that you’ve got a transparent rejection within the space of worth, it’s time to take that commerce.

This time, place the cease loss above the highs.

“However what’s the plan for exiting the market on this commerce?” I hear you ask…

Properly, you can too use the shifting averages as indicators of whether or not or to not maintain the commerce.

For a special strategy, let’s set off the take revenue on a detailed above the 200 Transferring Common (black line)…

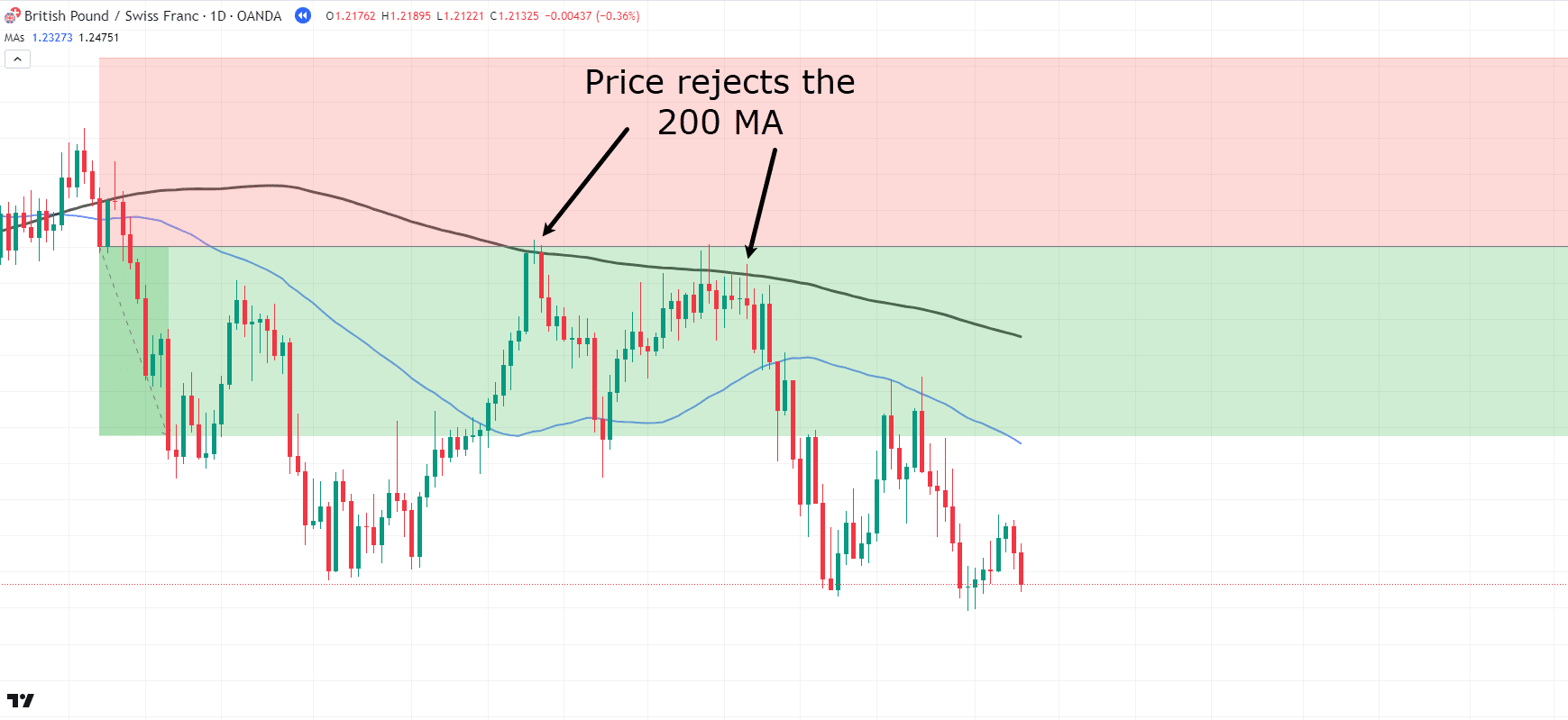

GBP/CHF Each day Chart Dying Cross Commerce Administration:

See how the worth has began its downtrend and by no means closed above the 200 MA?

As an alternative, it looks like the worth is utilizing the 200 MA as a resistance stage and persistently rejecting it.

Let’s proceed with this commerce and see what occurs…

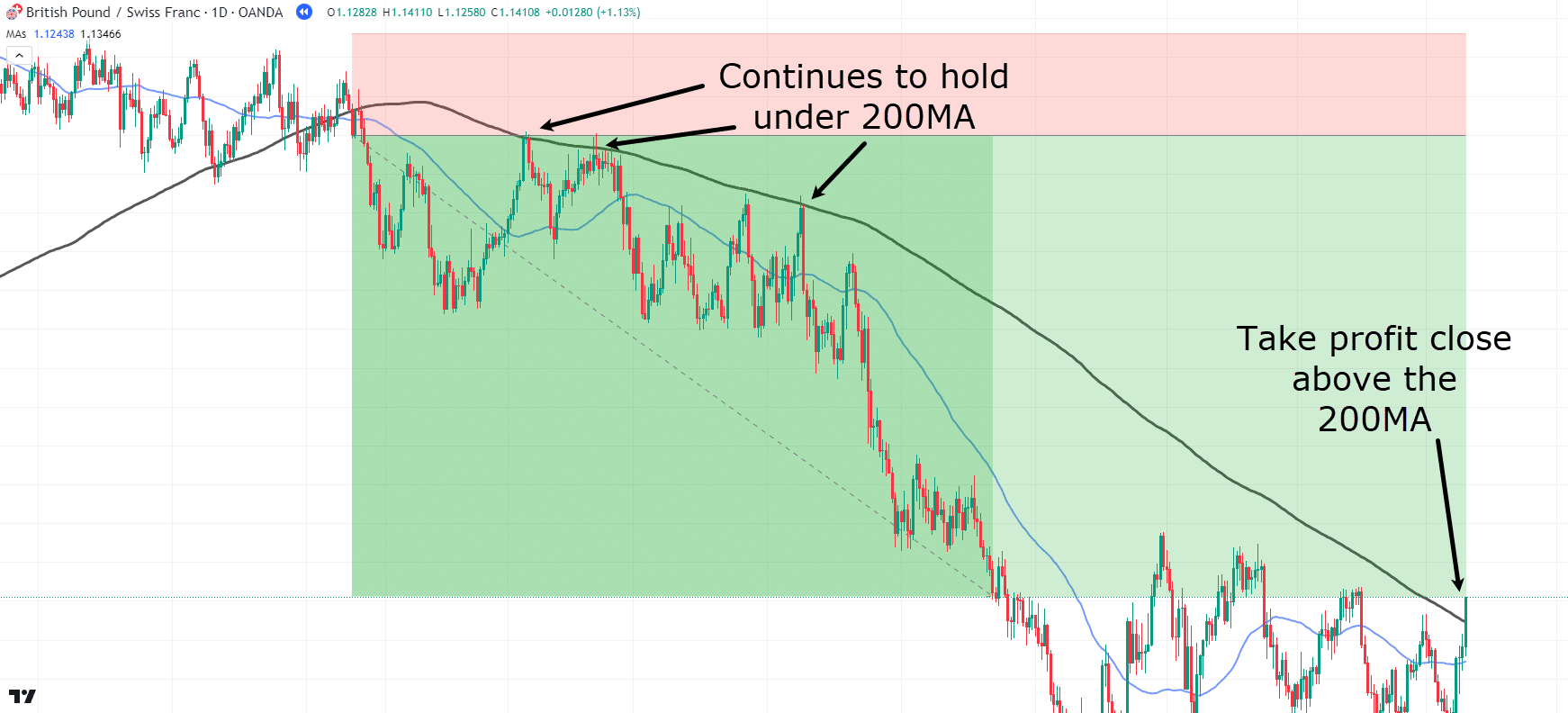

GBP/CHF Each day Chart Dying Cross Take Revenue:

Wow! Congratulations on one other profitable commerce!

This strategy demonstrates how you need to use the shifting common as a resistance indicator for potential profit-taking.

Alright, one final instance!…

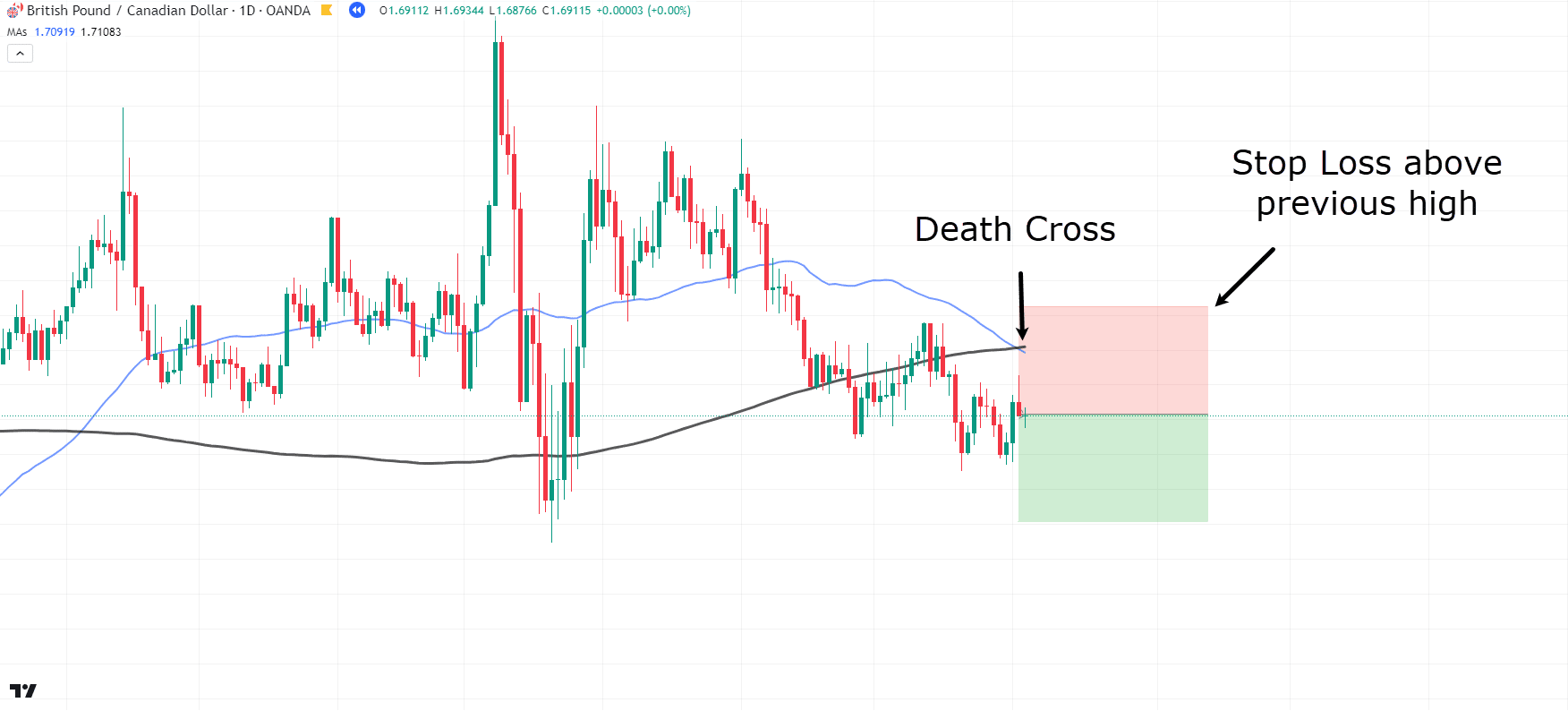

GBP/CAD Each day Chart Dying Cross:

Right here, you’ll be able to see one other Dying Cross occurring…

On this instance, let’s place the cease loss above the earlier highs.

Now, I do know what you’re anticipating: value to proceed into revenue like our earlier examples, proper?

However take a better look!…

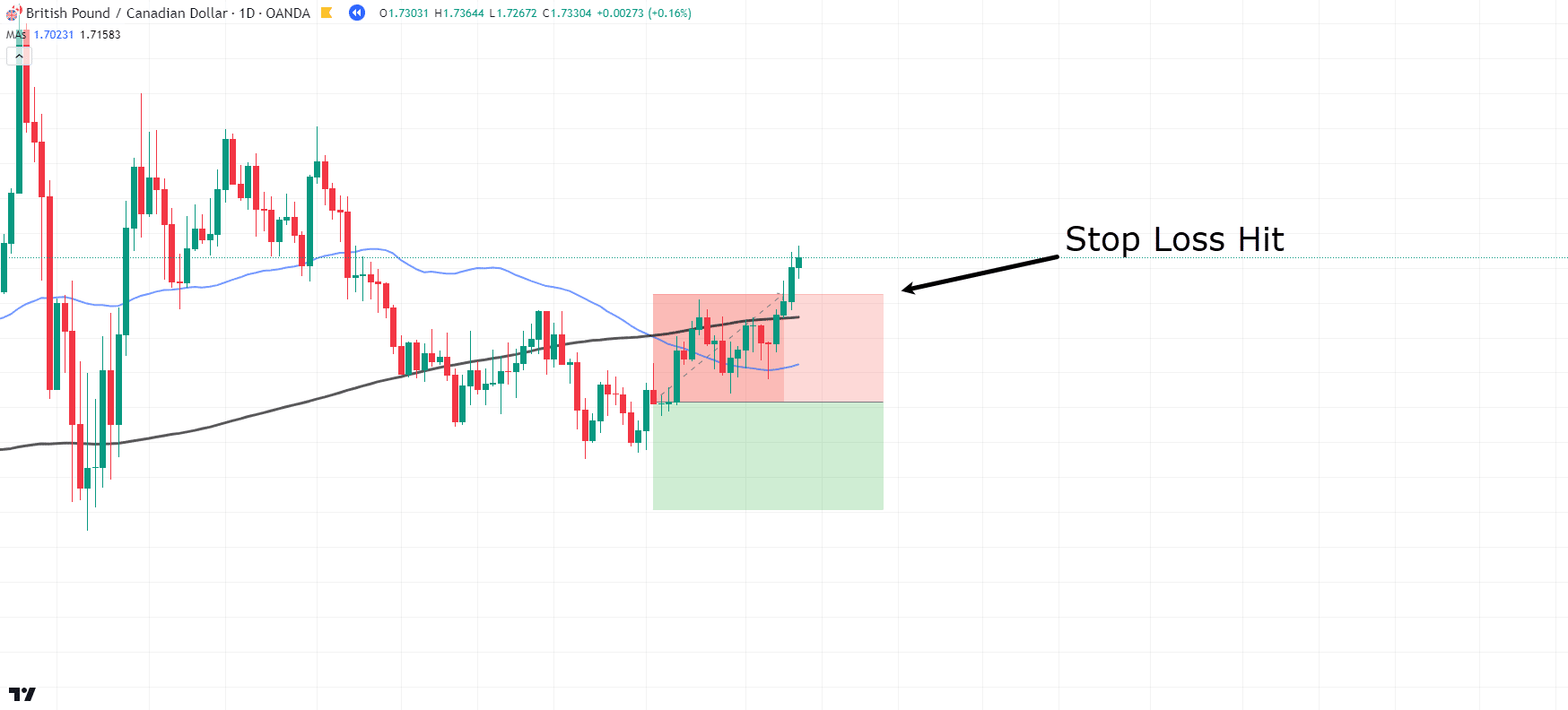

GBP/CAD Each day Chart Dying Cross Cease Loss Hit:

Cease loss hit??

That wasn’t presupposed to occur!

What’s the lesson right here?

Properly, the Dying Cross doesn’t all the time play out as anticipated.

However there’s some excellent news!

There have been early indicators indicating that this commerce won’t unfold the way in which initially anticipated…

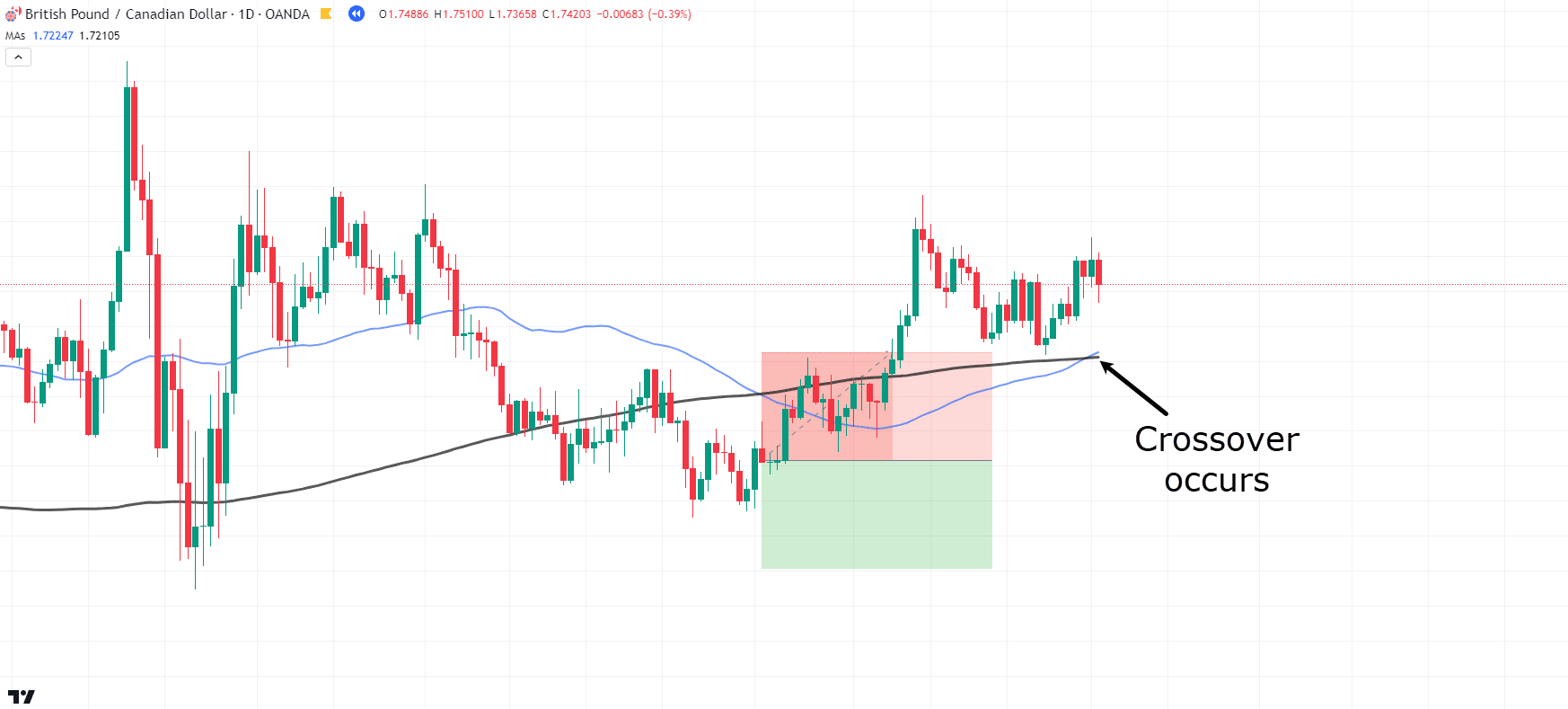

GBP/CAD Each day Chart Crossover:

See how the worth rapidly crossed again over after the cease loss was hit?

Let’s study the earlier value information earlier than the commerce was taken and ask: Is that this a great commerce to make?…

GBP/CAD Each day Chart Vary:

See how this market has been in a large vary for an prolonged interval?

The newest Dying Cross is just like the numerous Golden Crosses and Dying Crosses that occurred earlier than it.

So – this can be a cautious reminder to take a look at the context of the general market.

A ranging market just isn’t ultimate for executing the Dying Cross technique.

That is completely different from value briefly shifting sideways after an uptrend.

I imply, the instance exhibits value in a sustained massive vary for a few yr!

Alright, now it’s time to take a look at some Golden Cross examples!…

Golden Cross Examples

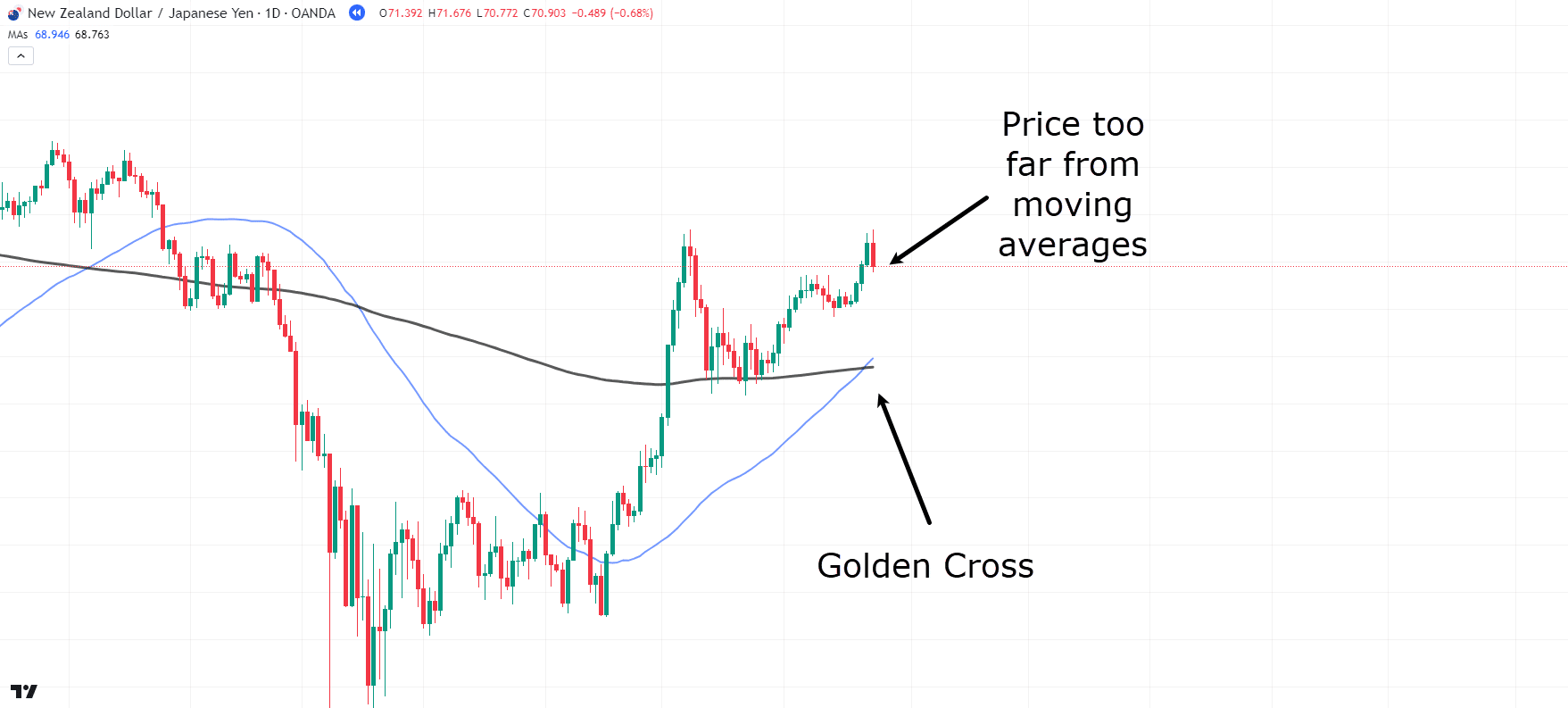

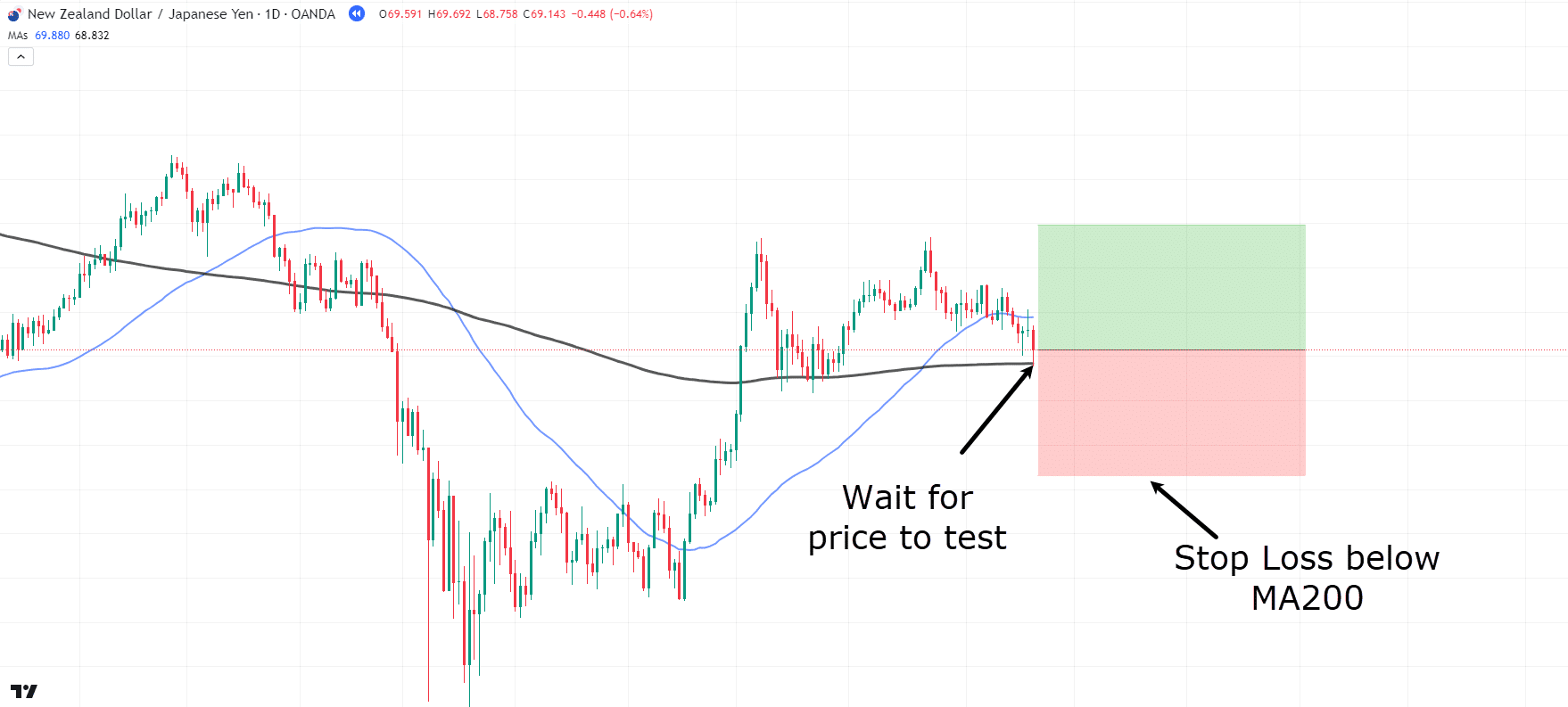

NZD/JPY Each day Chart Golden Cross:

Right here, now we have a stable every day Golden Cross, however there’s an issue…

In case you have been to enter at this crossover, your cease loss would must be positioned fairly removed from the entry, making it difficult to safe an honest revenue.

So in these conditions, it’s greatest observe to attend for a pullback.

Let’s see what occurs…

NZD/JPY Each day Chart Golden Cross Entry:

Excellent! Worth has now retested the shifting averages, and our cease loss and entry factors make far more sense.

Let’s see how this commerce unfolds!…

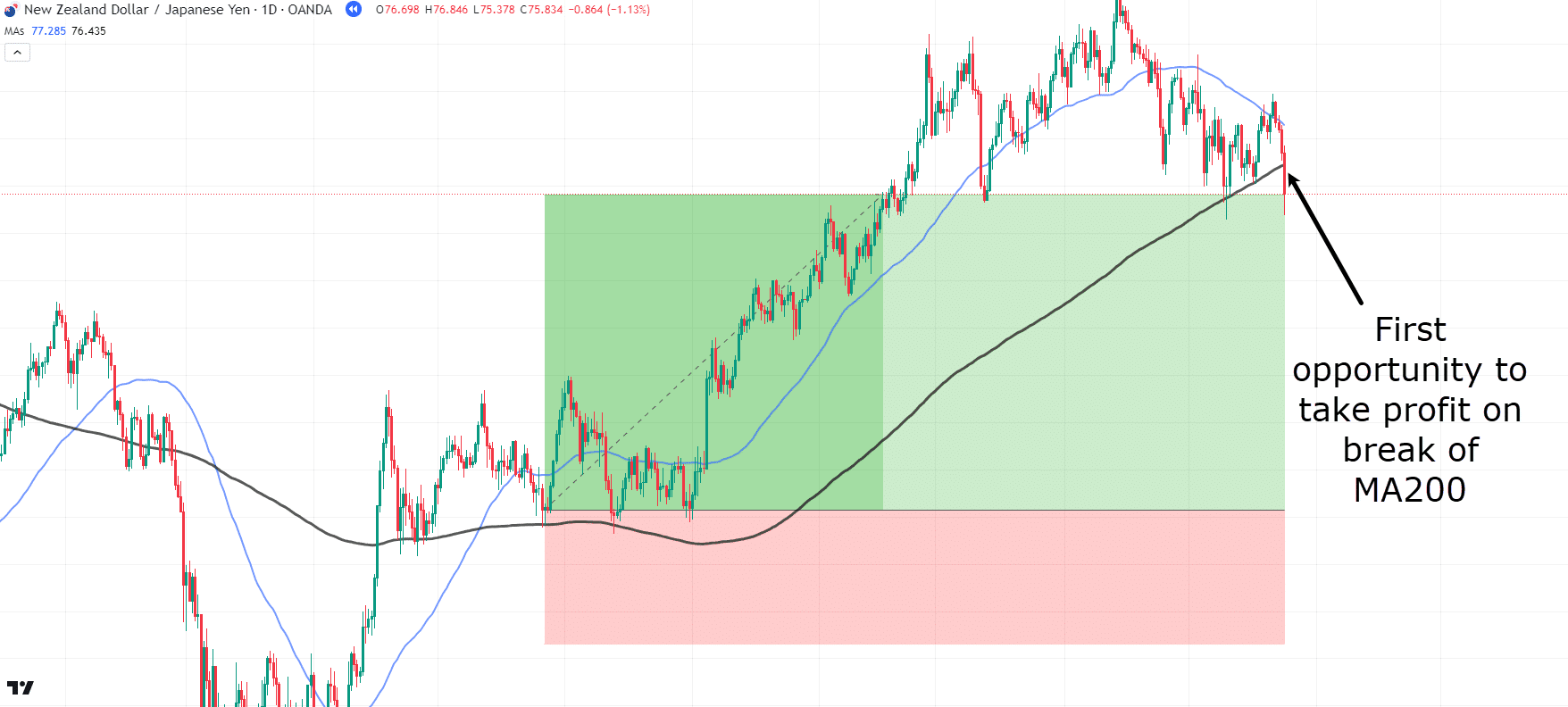

NZD/JPY Each day Chart Golden Cross Potential Exit:

Wow, what a pleasant transfer!

However right here’s the query: do you have to exit on the break of the 200 MA, or do you have to await the crossover to sign the top of the uptrend?

The reality is, there’s no proper or mistaken reply!

Check out every situation…

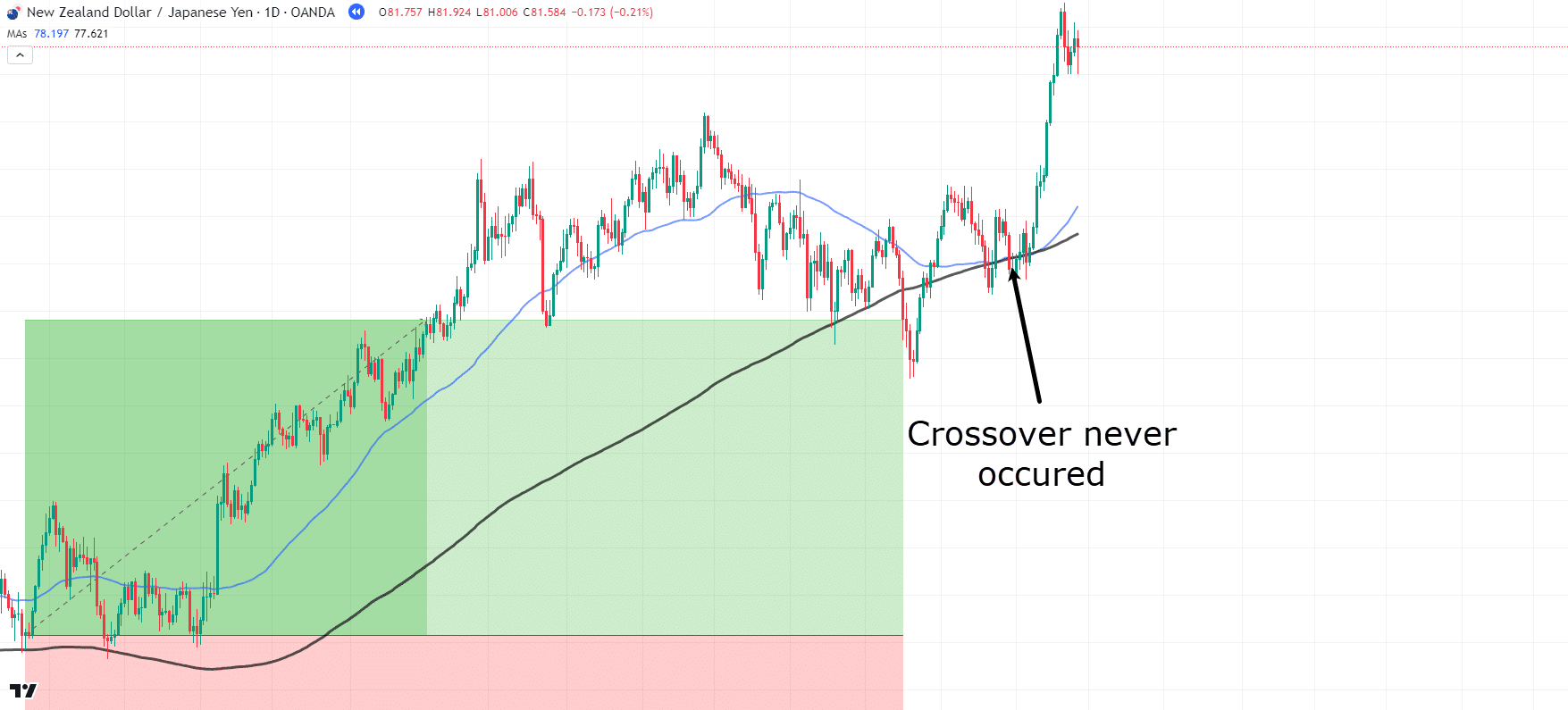

NZD/JPY Each day Chart Golden Cross Commerce Administration:

As value continues, the shifting averages get very near crossing over; nevertheless, the crossover by no means truly happens, so let’s proceed with this commerce…

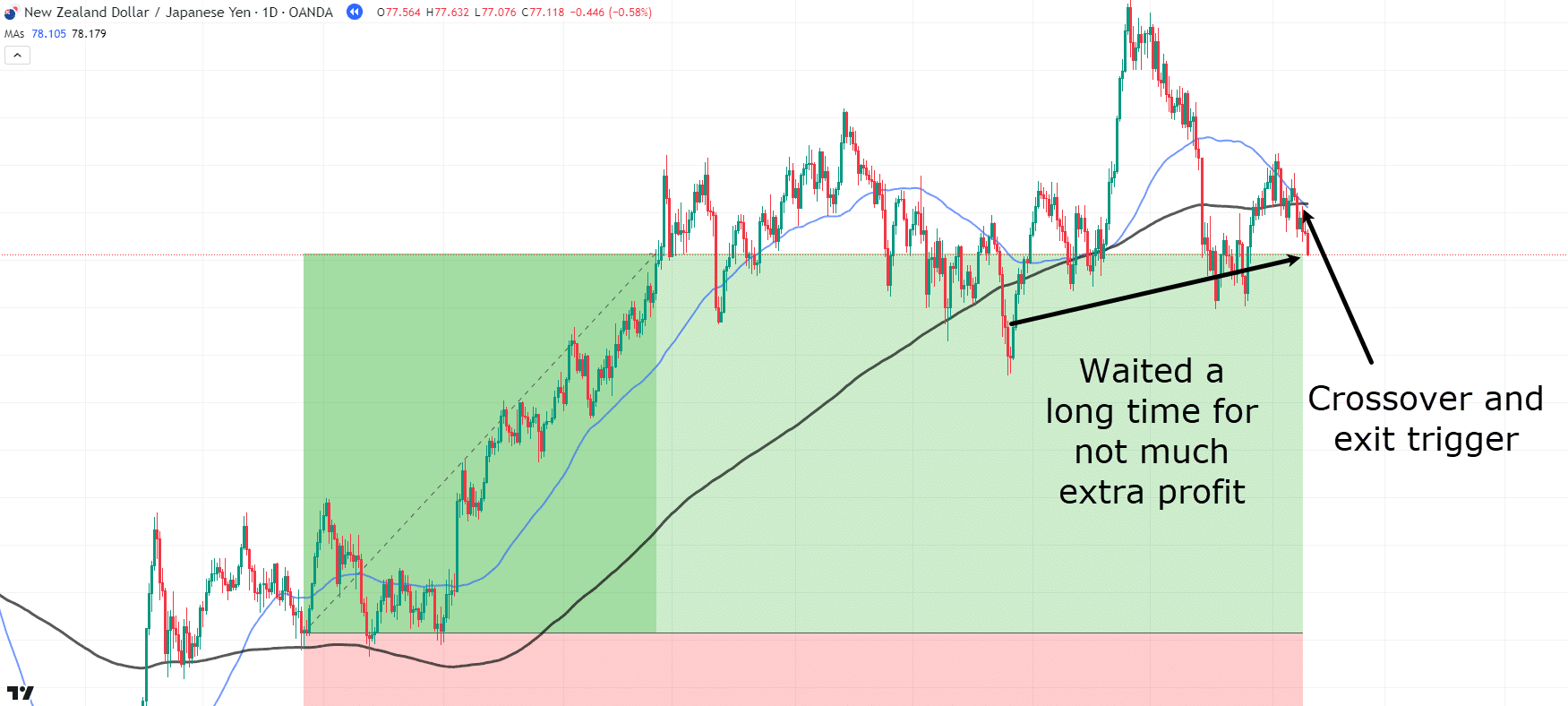

NZD/JPY Each day Chart Golden Cross Exit:

Lastly, the shifting averages crossed again over.

You may assume it was price ready for the crossover moderately than exiting earlier.

Nonetheless, as proven above, the gap between the 2 potential exits and the quantity of revenue generated was low.

It is best to take into account whether or not taking earnings sooner moderately than later could be a greater strategy.

As mentioned earlier, neither choice is true nor mistaken, however the way you handle the commerce will rely in your private danger tolerance and which shifting averages or areas on the charts you imagine the worth is respecting.

Now, as for whether or not the Golden Cross and Dying Cross can be utilized on decrease timeframes…

…the reply is, Sure it may be!

Let’s have a look at one other Golden Cross instance, however this time on a decrease timeframe, and see if it interprets as effectively…

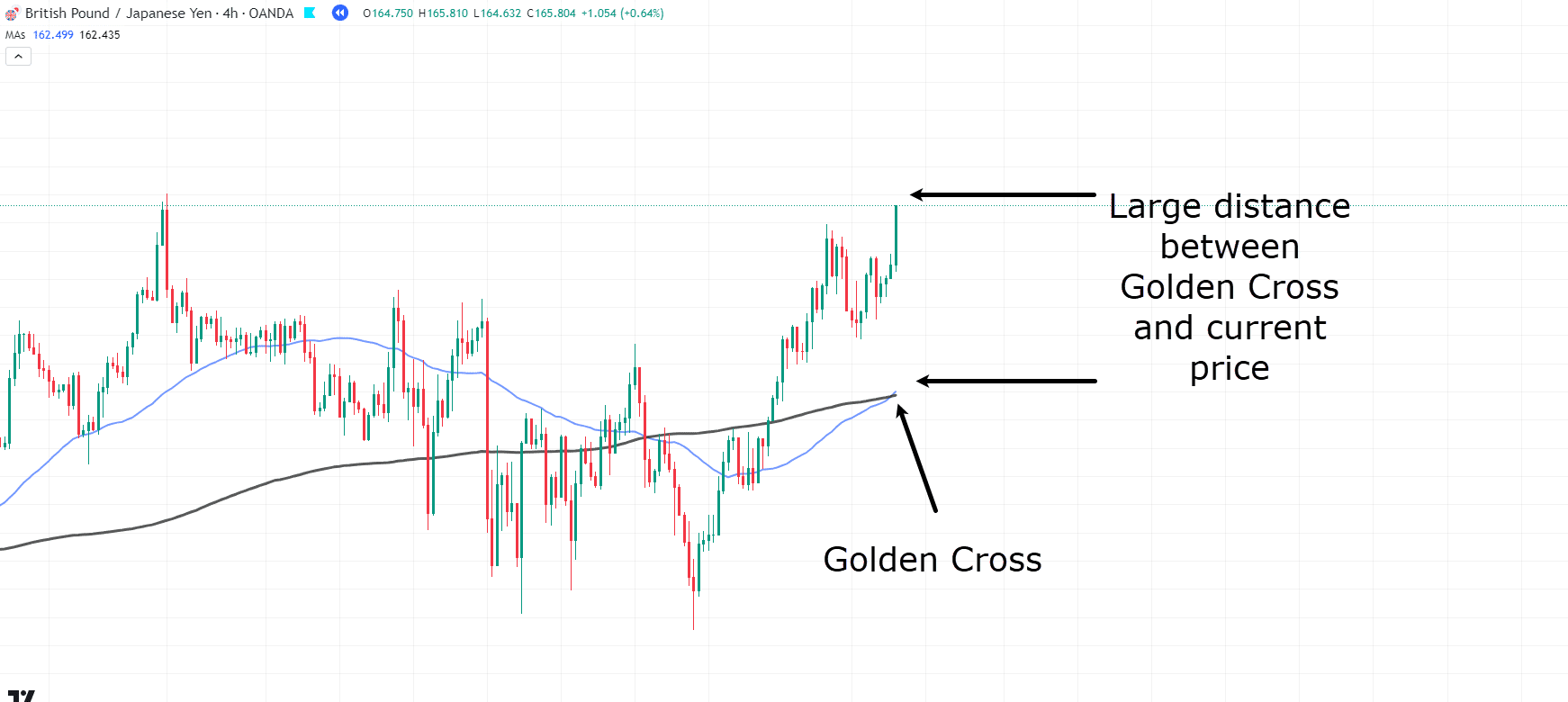

GBP/JPY 4-Hour Chart Golden Cross:

Identical to within the earlier instance, a Golden Cross has occurred.

Nonetheless, the worth is a big distance from any acceptable entry.

In these situations, you don’t have any selection however to attend for a pullback.

Let’s be affected person and wait…

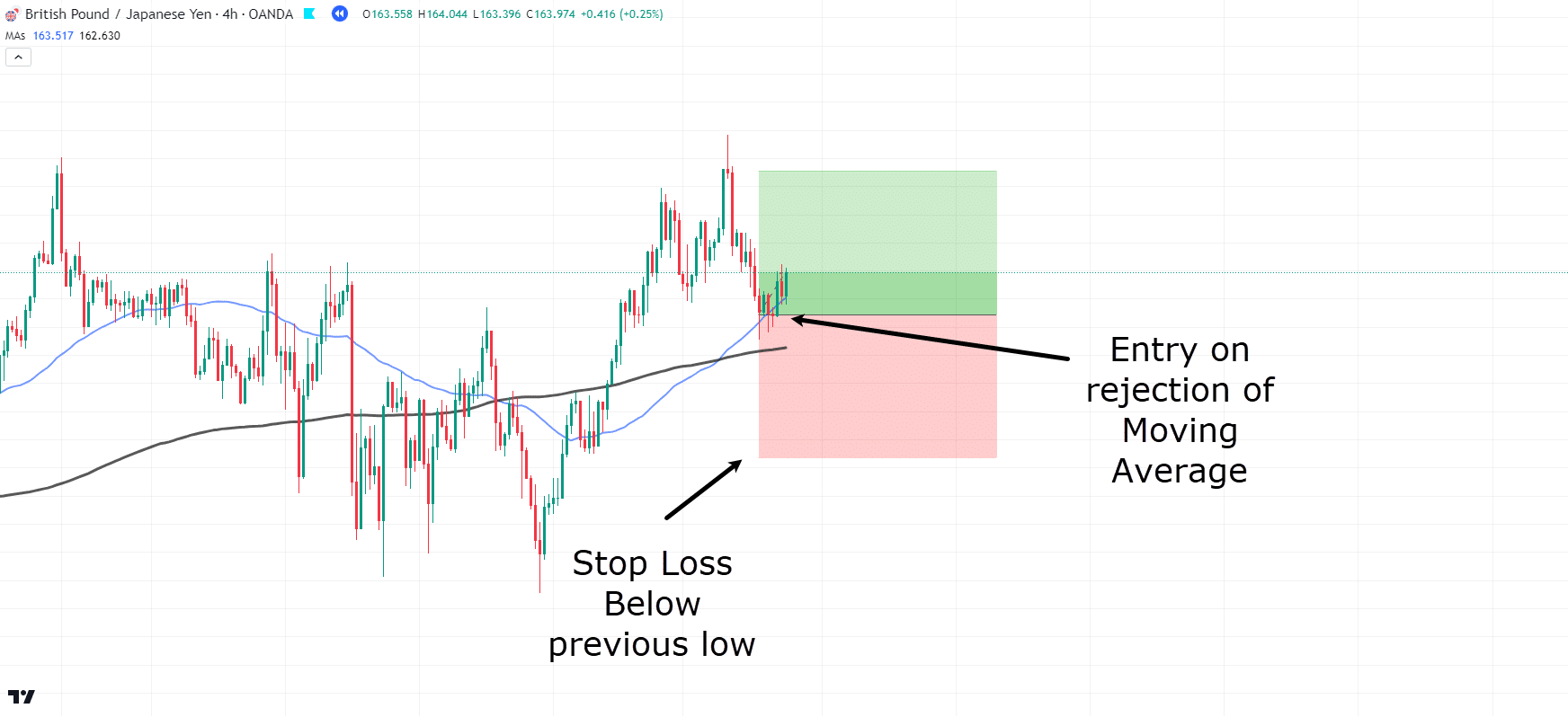

GBP/JPY 4-Hour Chart Golden Cross Entry:

Nice! Worth has come again all the way down to the shifting averages and began to indicate indicators of rejection.

So let’s take the commerce, inserting our cease loss beneath the earlier low.

For this instance, merely await the crossover to happen once more…

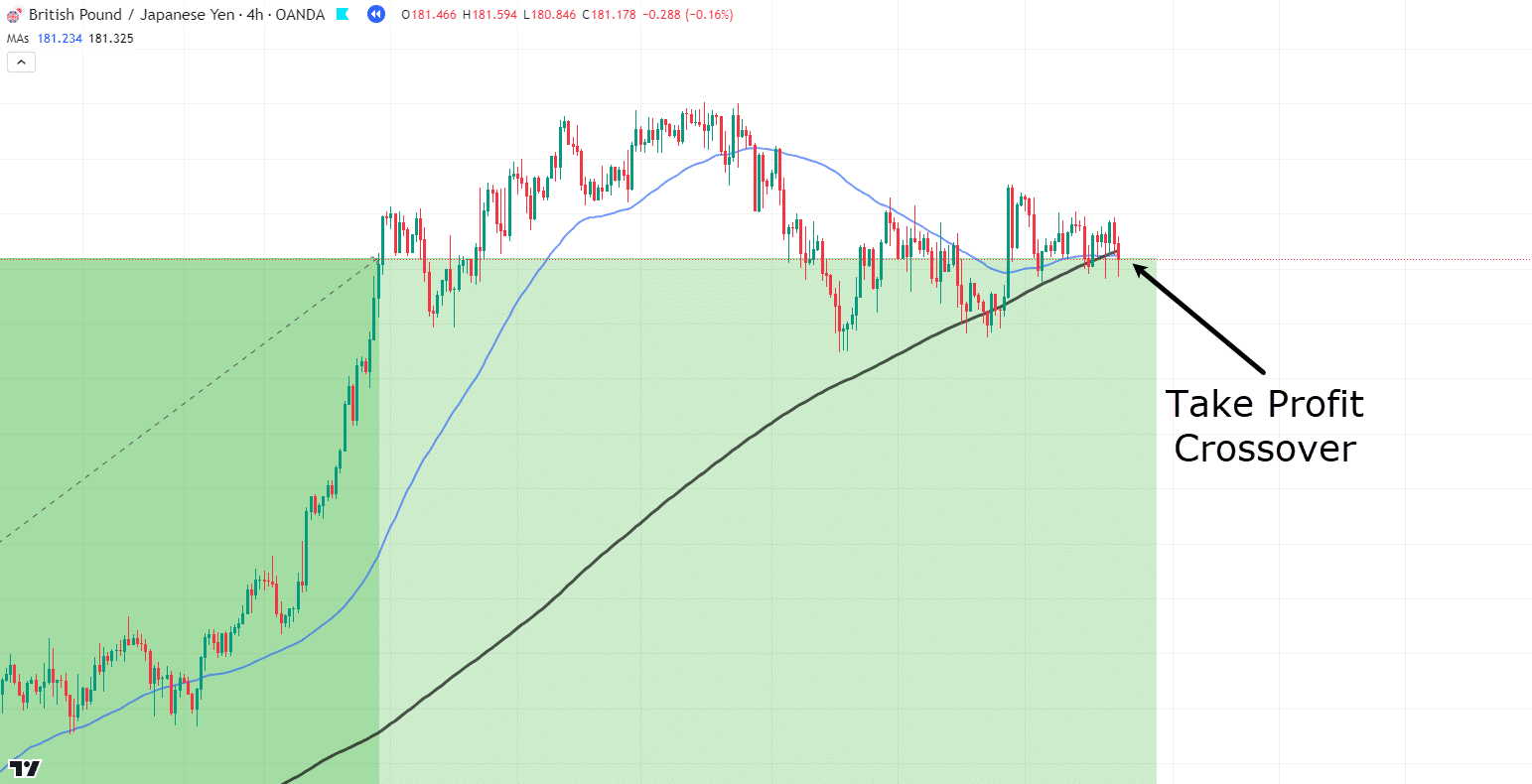

GBP/JPY 4-Hour Chart Golden Cross Take Revenue:

Wow! That’s a major transfer!

This exhibits how the rules work out persistently, even on decrease timeframes…

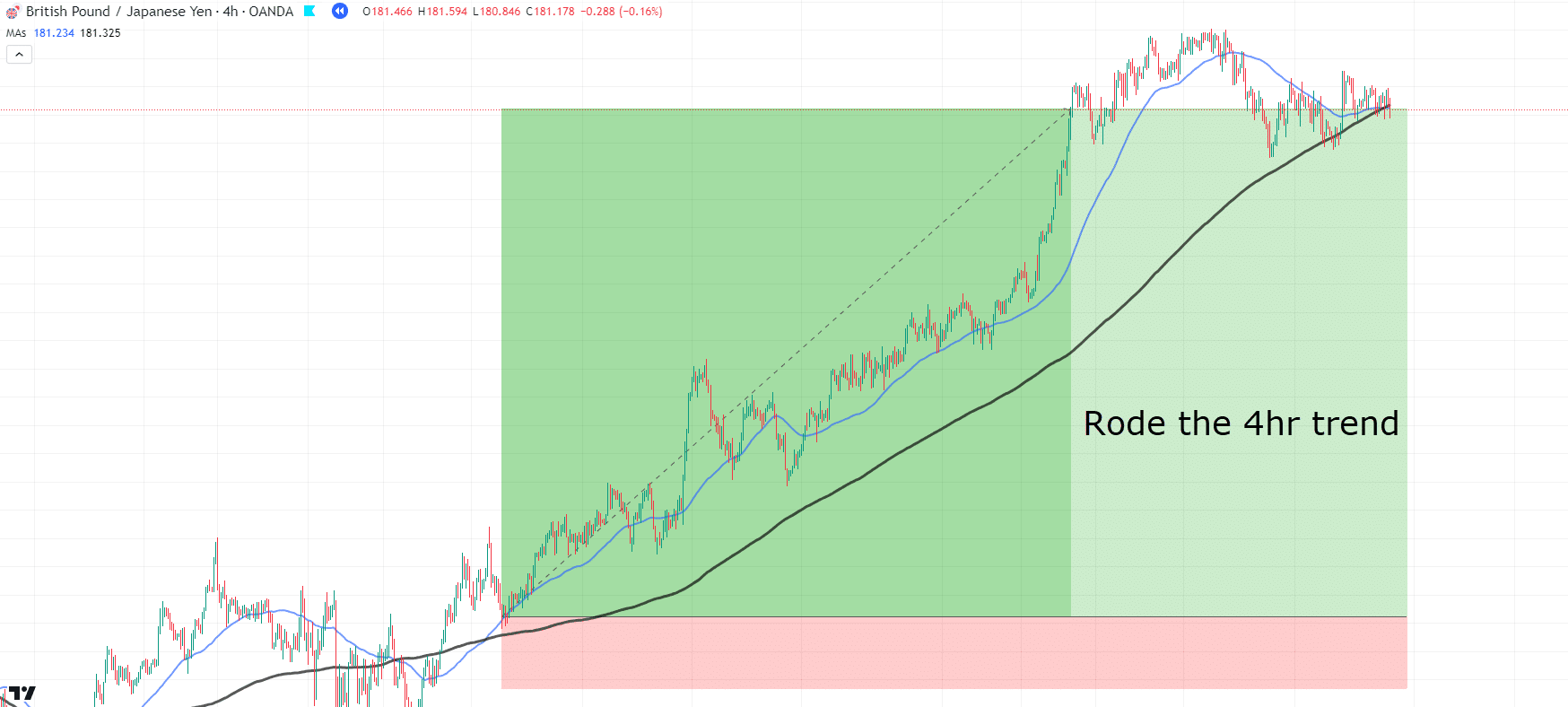

GBP/JPY 4-Hour Chart Golden Cross Commerce Overview:

The 4-hour timeframe permits for a tighter cease loss whereas producing bigger earnings.

Nonetheless, there’s all the time a trade-off between danger and reward…

Decrease timeframe charts can usually result in false indicators.

Bear in mind, when utilizing Golden and Dying Crosses throughout completely different timeframes, the decrease the timeframe, the much less weight these indicators carry within the general market context!

Let’s check out one final instance to essentially get the concept…

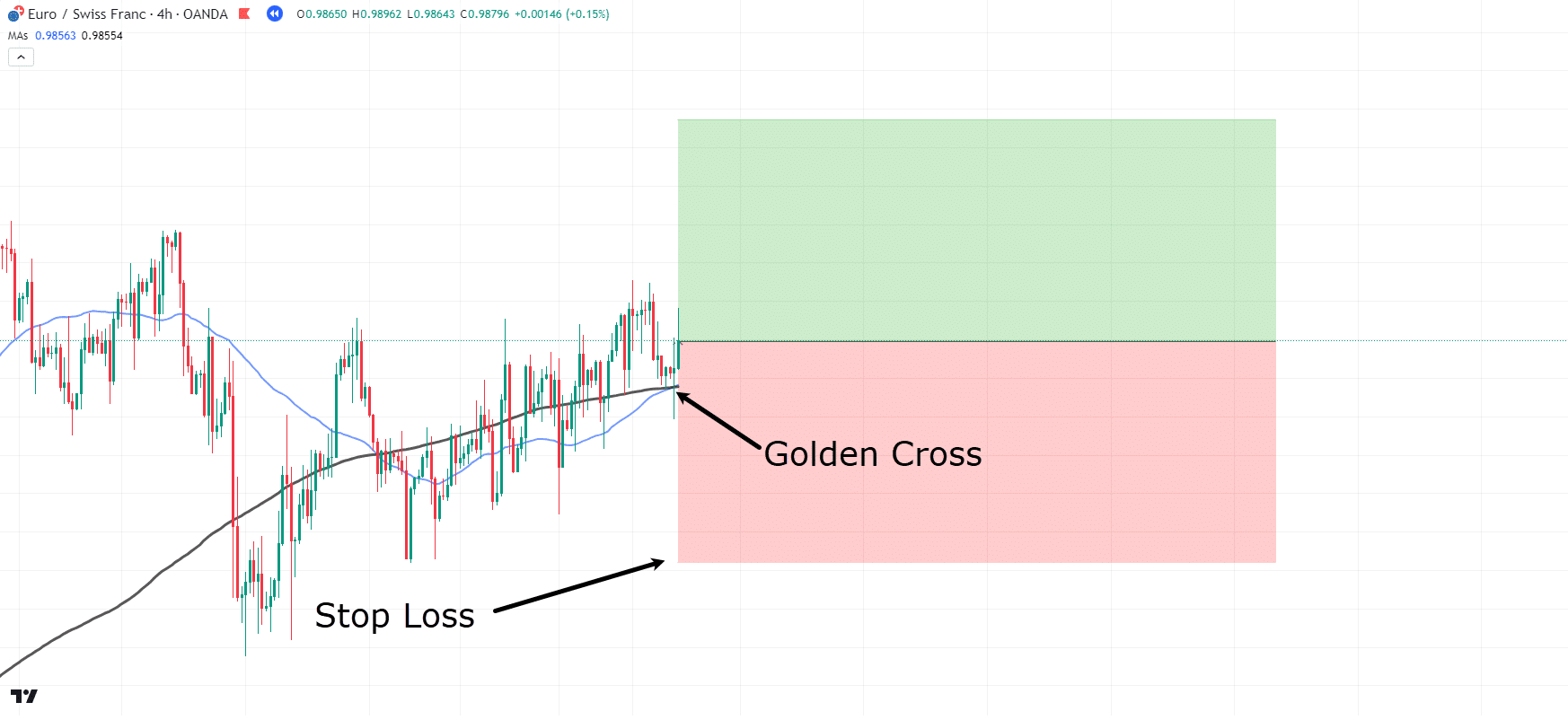

EUR/CHF 4-Hour Chart Golden Cross Entry:

Just like the earlier instance, the shifting averages have shaped a Golden Cross on the 4-hour timeframe!

Worth is on the crossover space and is exhibiting indicators of rejection…

Let’s take the commerce and place the cease loss effectively beneath the earlier lows and the shifting averages…

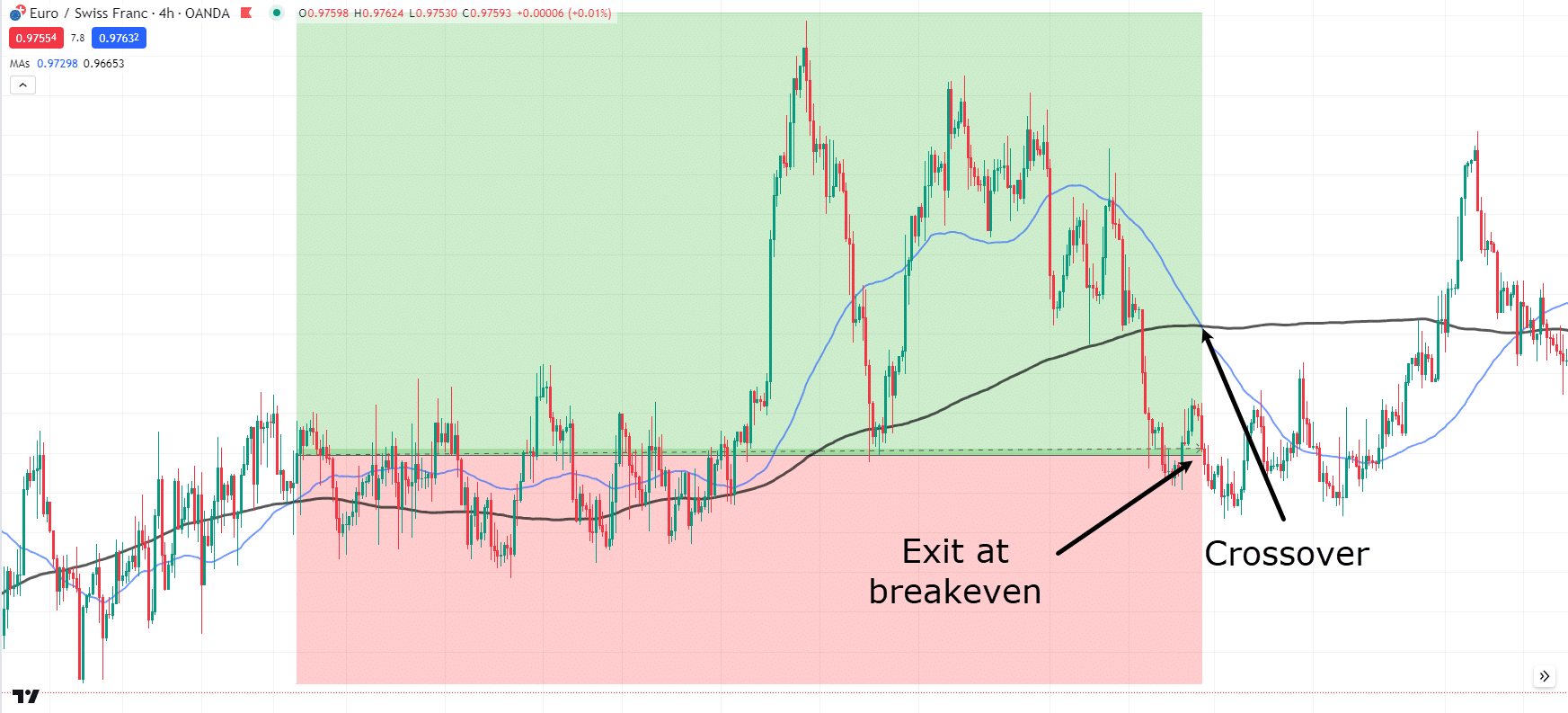

EUR/CHF 4-Hour Chart Golden Cross Commerce Overview:

OK, so what occurred?

Whereas value did transfer in your favor, by the point the crossover returned, it had reached a breakeven stage.

I do know this may be irritating – particularly when the worth initially went into revenue!

However bear in mind, it’s merely a part of buying and selling.

Now, the way you handle trades and seize earnings is completely as much as you.

I encourage you to experiment with completely different take-profit strategies.

There isn’t any proper or mistaken reply relating to profit-taking.

And bear in mind, even when the commerce didn’t yield a revenue, breaking even generally is a win in itself!

Limitations of Golden Cross and Dying Cross

Lagging Indicators

Each the Golden Cross and the Dying Cross are lagging indicators.

They’re based mostly on historic value information and should sign a development change after the brand new development has truly begun.

This lag may end up in merchants coming into positions later than optimum, probably lacking a good portion of the development.

For instance, by the point a Golden Cross is recognized, a lot of the upward transfer could have already occurred.

Equally, a Dying Cross could sign a bearish development after a considerable decline has already taken place.

This precept additionally applies for taking revenue.

As proven in a few of the examples, because of the crossover being a lagging indicator, a few of your earnings could have already got been eaten by the point the exit crossover exhibits itself.

Because of this I like to recommend taking part in round with some take revenue guidelines that assist you to try to seize the most effective earnings alongside the way in which.

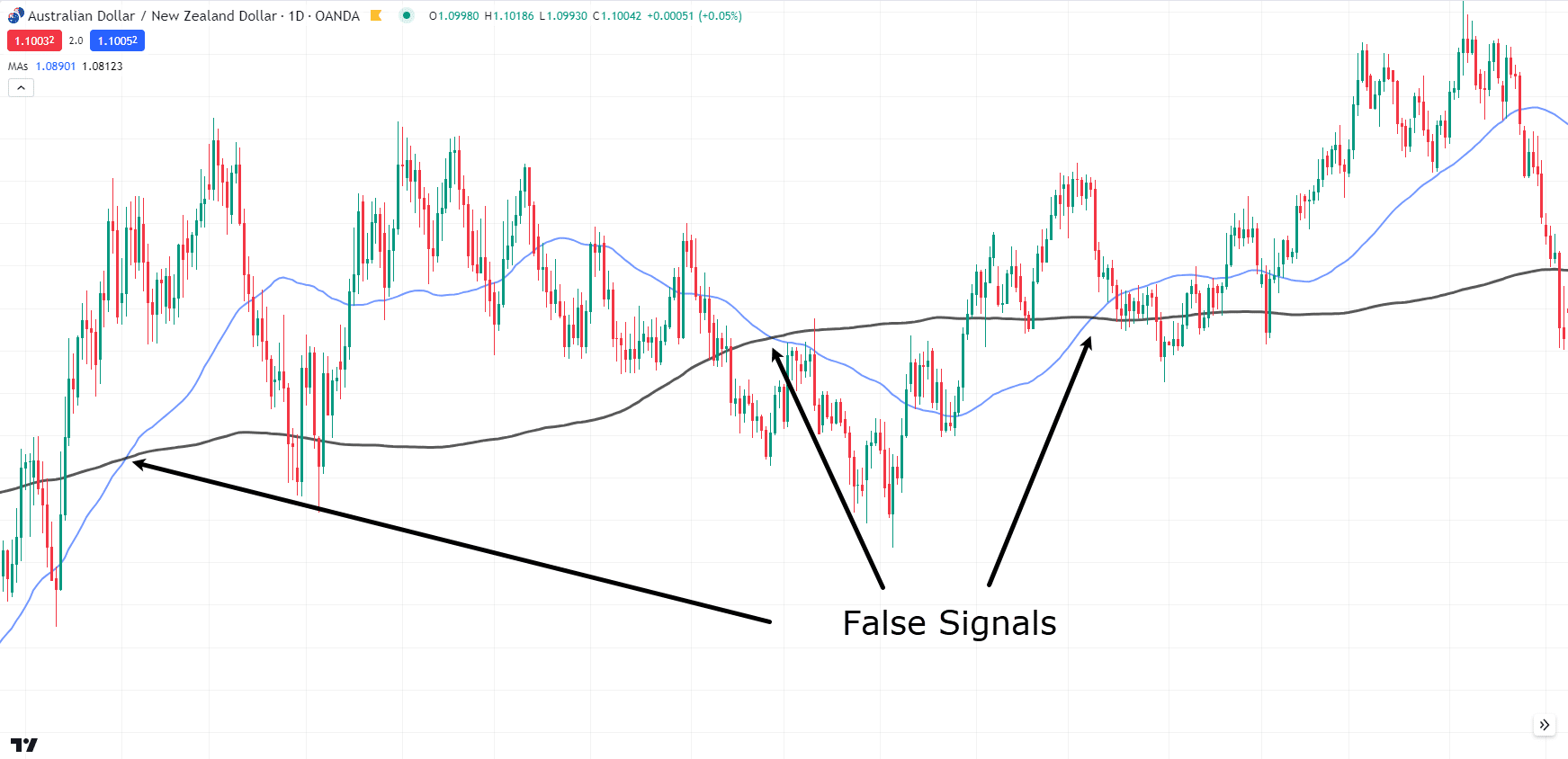

False Alerts

One other limitation of those indicators is their danger of false indicators, particularly in unstable or ranging markets.

A false sign happens when a Golden or Dying Cross exhibits a development change that… by no means exhibits up!

This could occur when short-term value fluctuations trigger the shifting averages to cross however don’t lead to a sustained development.

In such circumstances, merchants could enter positions based mostly on these indicators and incur losses when the market reverses or stays range-bound.

Let me present you an instance…

AUD/NZD Each day Chart False Alerts:

As value begins to vary, you’ll be able to see a number of crossovers…

…however it turns into very unclear when the Dying Cross or Golden Cross will carry by!

Utilizing indicators can help with this flaw, however it’s vital to do not forget that false indicators will occur every now and then.

Conclusion

In conclusion, understanding the Golden Cross and Dying Cross is important for locating new market tendencies and making knowledgeable buying and selling selections.

These crossovers, which depend on the 50 and 200 shifting averages, supply clear indicators for potential upward or downward tendencies, serving to you confidently navigate the market.

To recap what you’ve realized:

- The variations between the Dying Cross and a Golden Cross

- The particular shifting averages to make use of

- How complementary indicators can enhance your buying and selling methods

- Actual buying and selling examples showcasing numerous take-profit approaches

- The constraints of utilizing lagging indicators just like the Golden and Dying Cross

Nice!

Now that you’ve got a deeper understanding of those highly effective indicators, it’s time to place them into observe!

Do you have got any questions or private experiences with the Golden Cross and Dying Cross?

What timeframe do you assume you wish to use the Crossovers on?

Share your ideas within the feedback beneath!