It’s a truth that the majority merchants begin craving the decrease timeframes.

At first, it looks like a simple solution to make a fast buck…

…to begin raking in these massive wins…

…and fulfil your dream of constructing buying and selling your fundamental supply of earnings!

However then, what often follows?

Dropping streaks start…

…accounts are doubtlessly blown up…

…you develop into fully mentally drained!

Ultimately, you begin to “outgrow” in search of decrease timeframe income and begin transferring into larger timeframes.

However what when you determined to provide decrease timeframe buying and selling yet one more shot?…

…to essentially grasp the strategies wanted to commerce on the 1 hour timeframe?…

Do you assume it may very well be value it?

I actually do!

That’s why in at the moment’s information, I’ll present you precisely how you can commerce worth motion within the 1 hour timeframe.

Particularly, you’ll study…

- What particular worth motion setups you have to be searching for on the 1 hour timeframe

- What it’s good to look out for on the every day timeframe earlier than buying and selling the 1 hour timeframe

- A step-by-step course of on how you can commerce worth motion within the 1 hour timeframe

- The “unheard” buying and selling tricks to succeeding buying and selling the decrease timeframes

Prepared?

Then let’s get began.

Tips on how to commerce worth motion within the 1 hour timeframe: What worth motion setups must you be searching for?

I’m positive you have got quite a lot of burning questions proper now…

“What setups will we commerce?”

“How lengthy ought to a commerce final?”

“Do I would like to look at the charts each single hour?”

Don’t fear, my good friend.

As a result of I’ll reply all of these within the following sections.

For now, let’s begin with the fundamentals after which work out the small print.

It’s essential to know the context and the “why” of every idea till ultimately, all of it comes collectively.

Sound good?

So, at this level…

There are a ton of movies and guides on how you can commerce worth motion, equivalent to these:

The Worth Motion Buying and selling Technique Information

And I agree, worth motion is known as a broad matter to cowl!

That’s why on this information, as an alternative of feeding you the fundamentals of worth motion like a child…

I’ll share the important three setups it’s good to achieve buying and selling on the 1 hour timeframe.

Let’s start with the primary one…

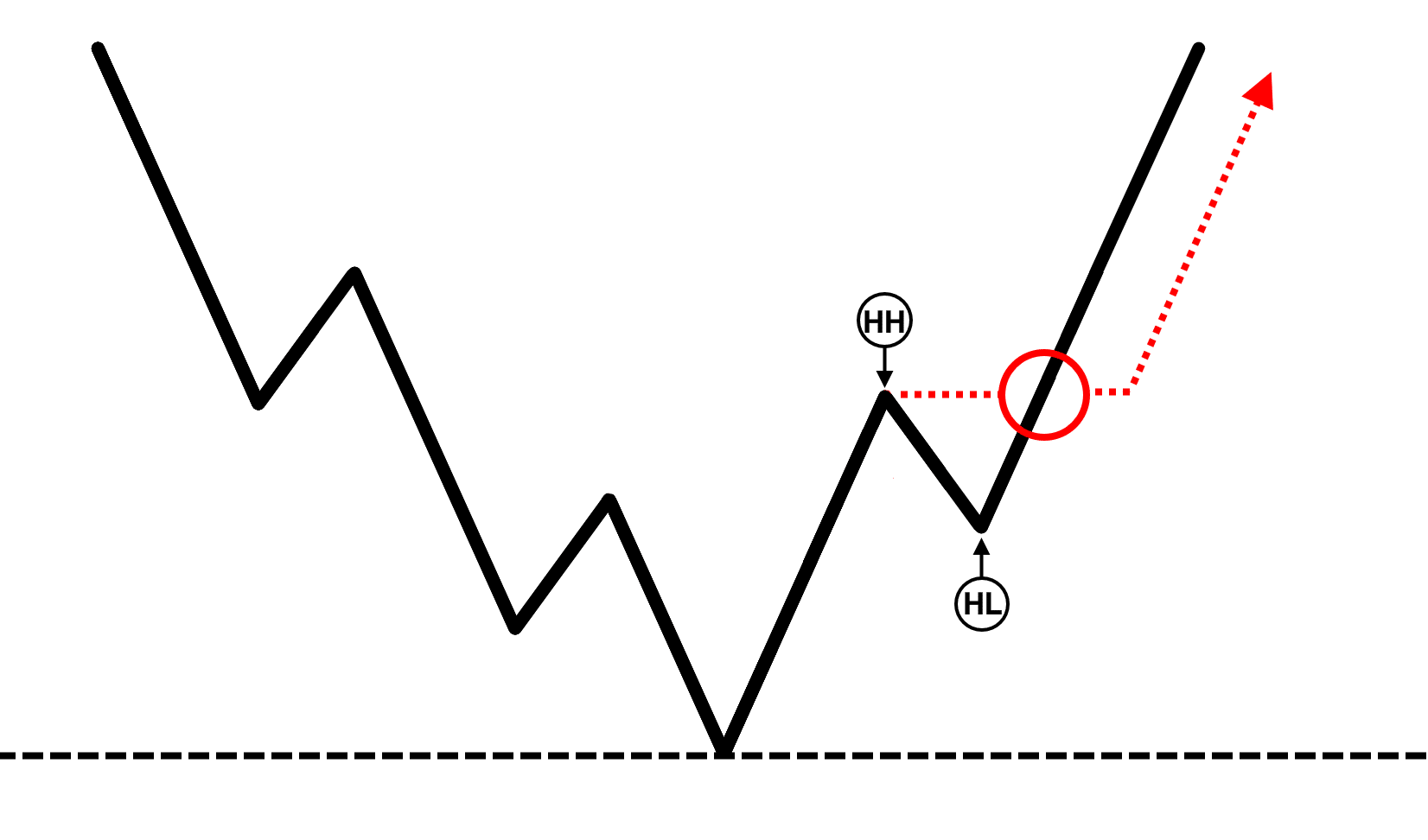

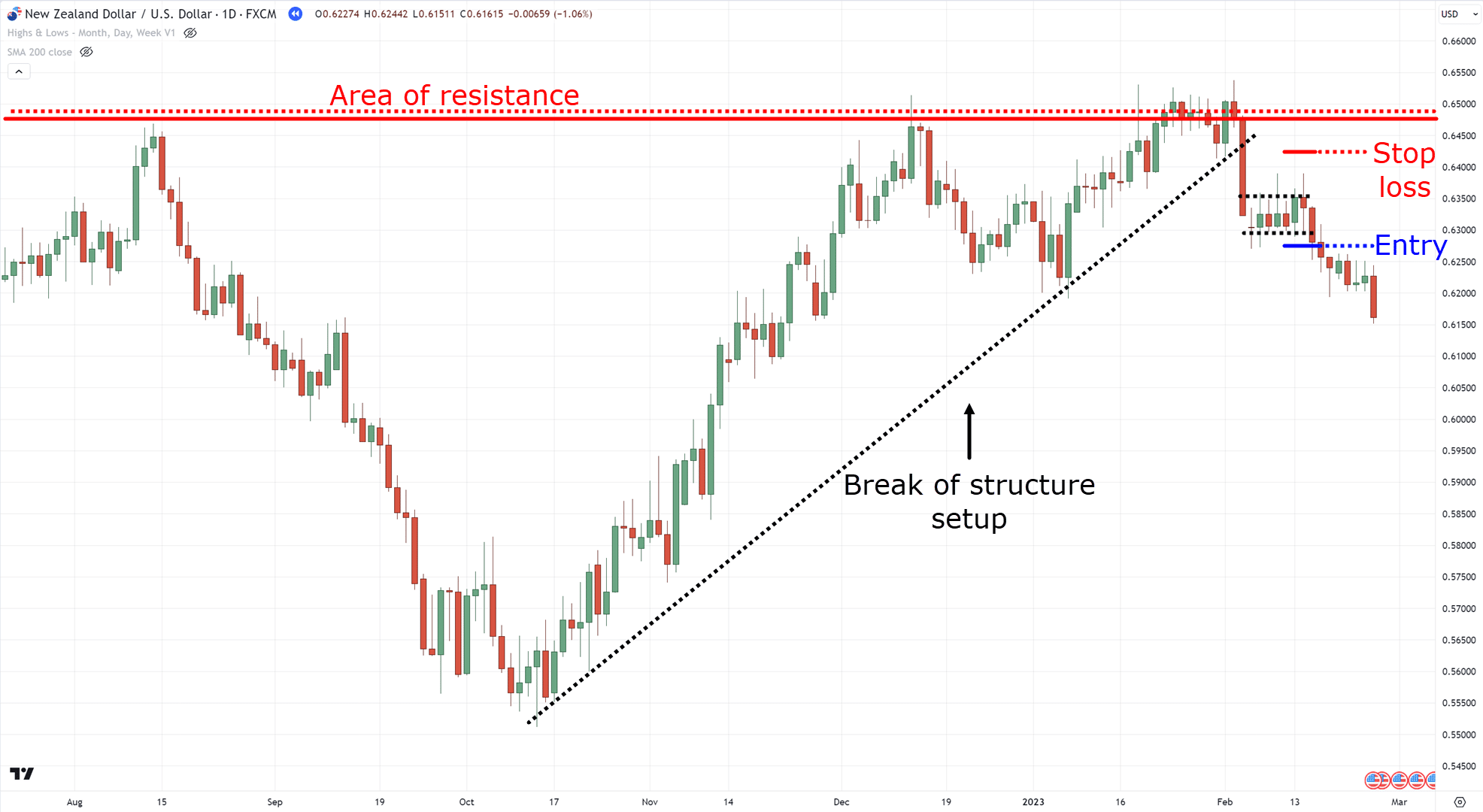

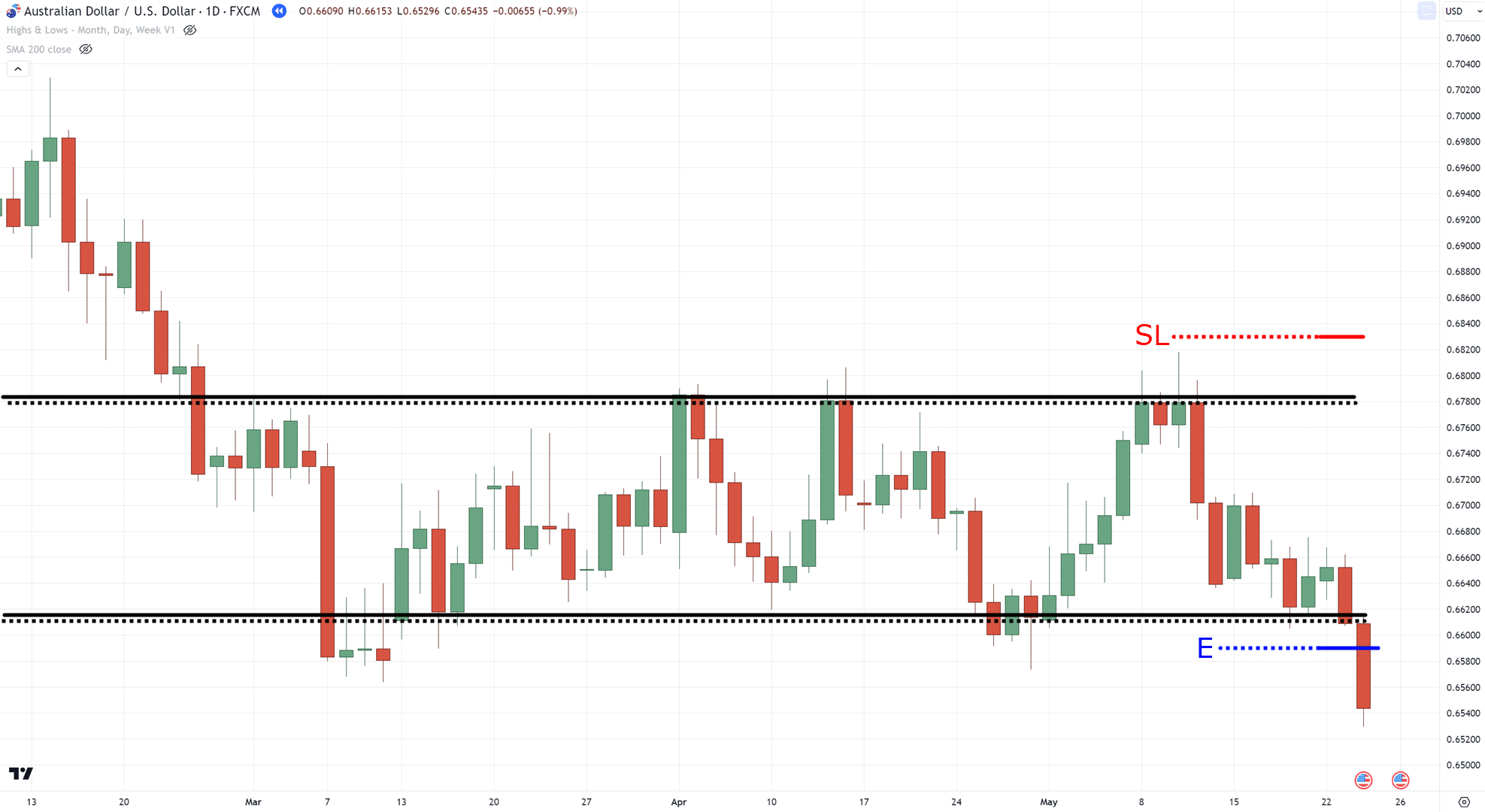

Break of construction

Simply because the illustration exhibits you…

This setup is a 3-step course of.

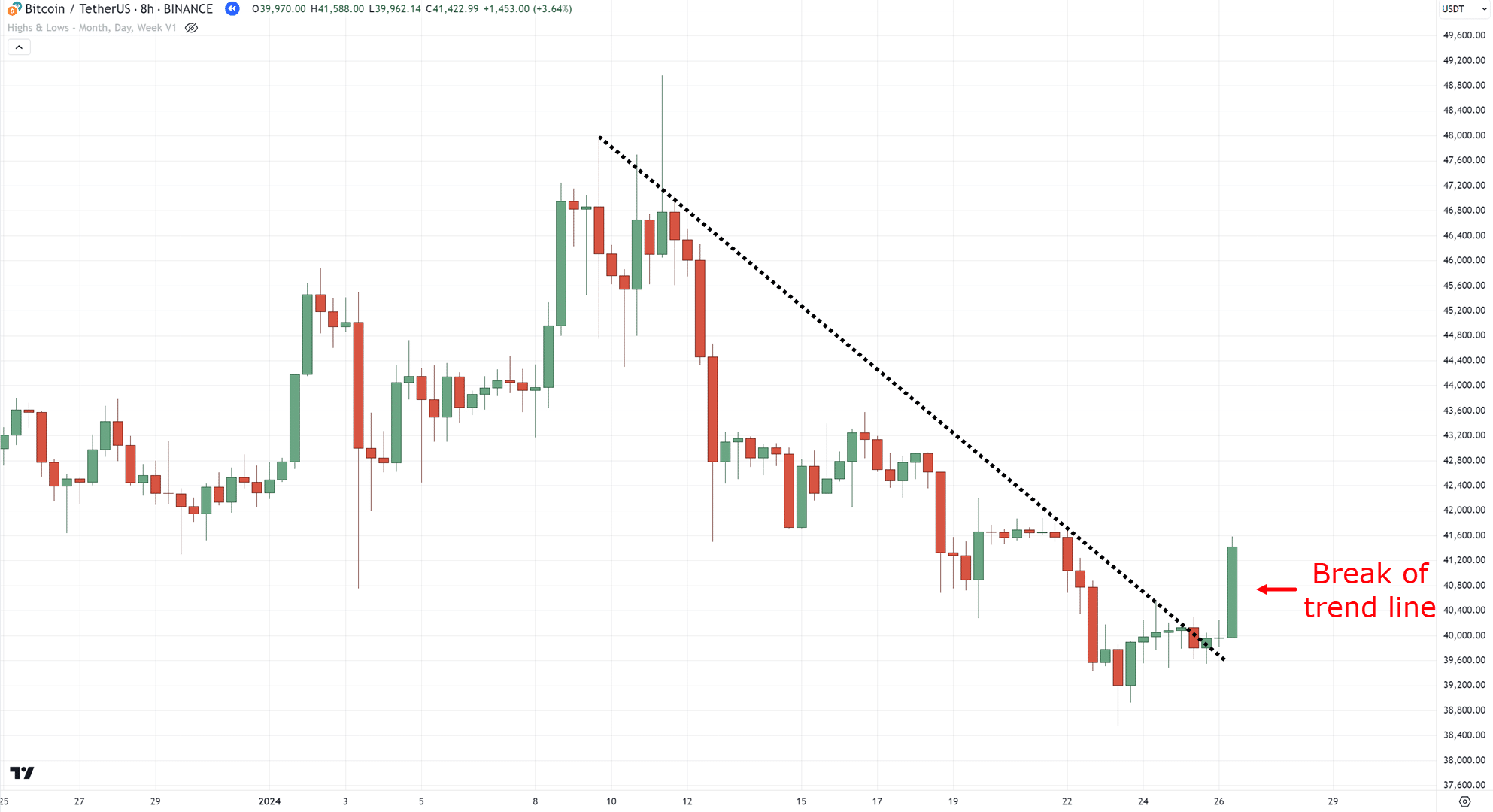

First, the value should break above a development line space of worth…

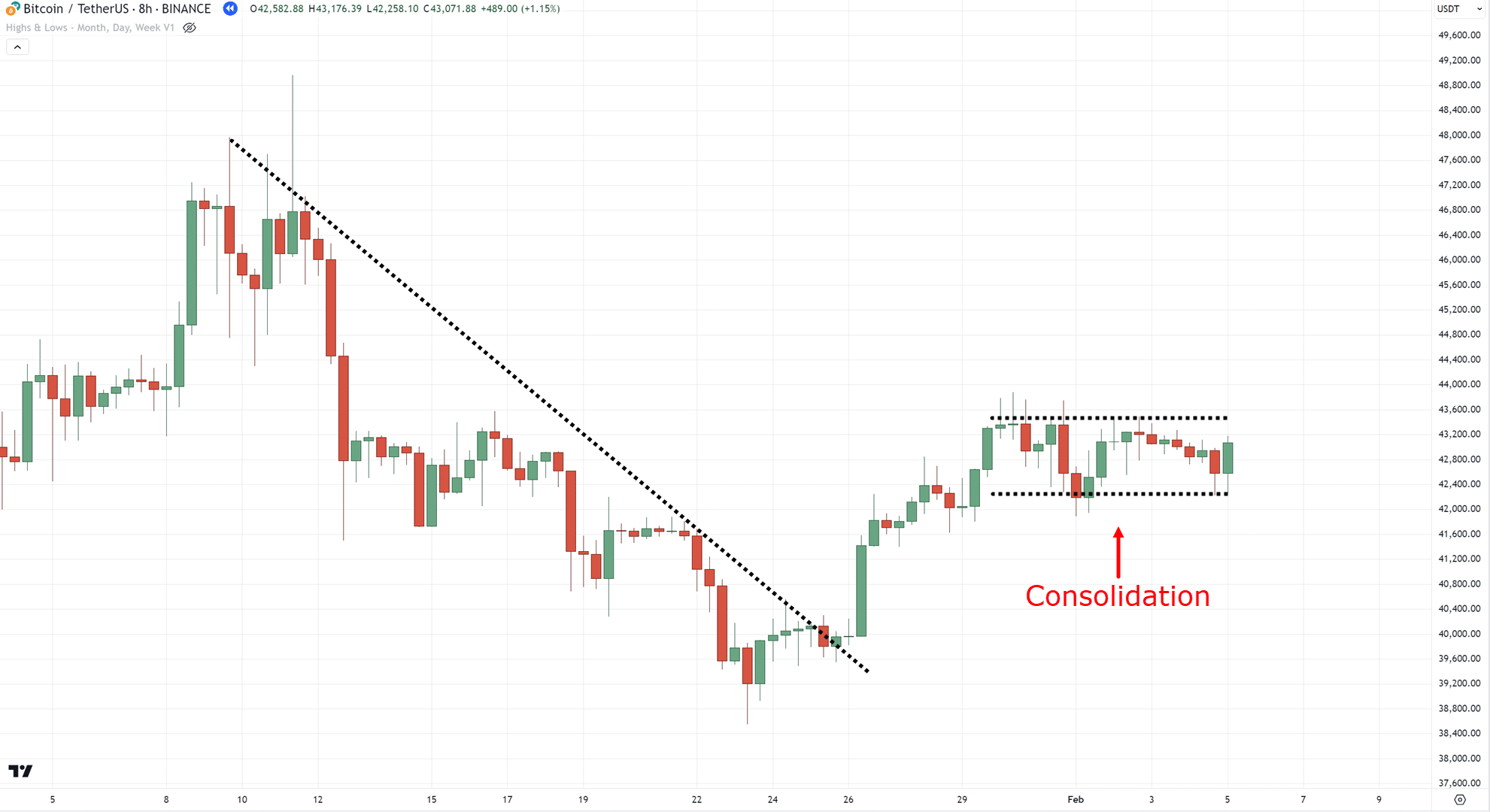

Second, the value should make a flag sample or a consolidation…

(Be sure you all the time keep in mind that the second step is essentially the most essential to this setup!)

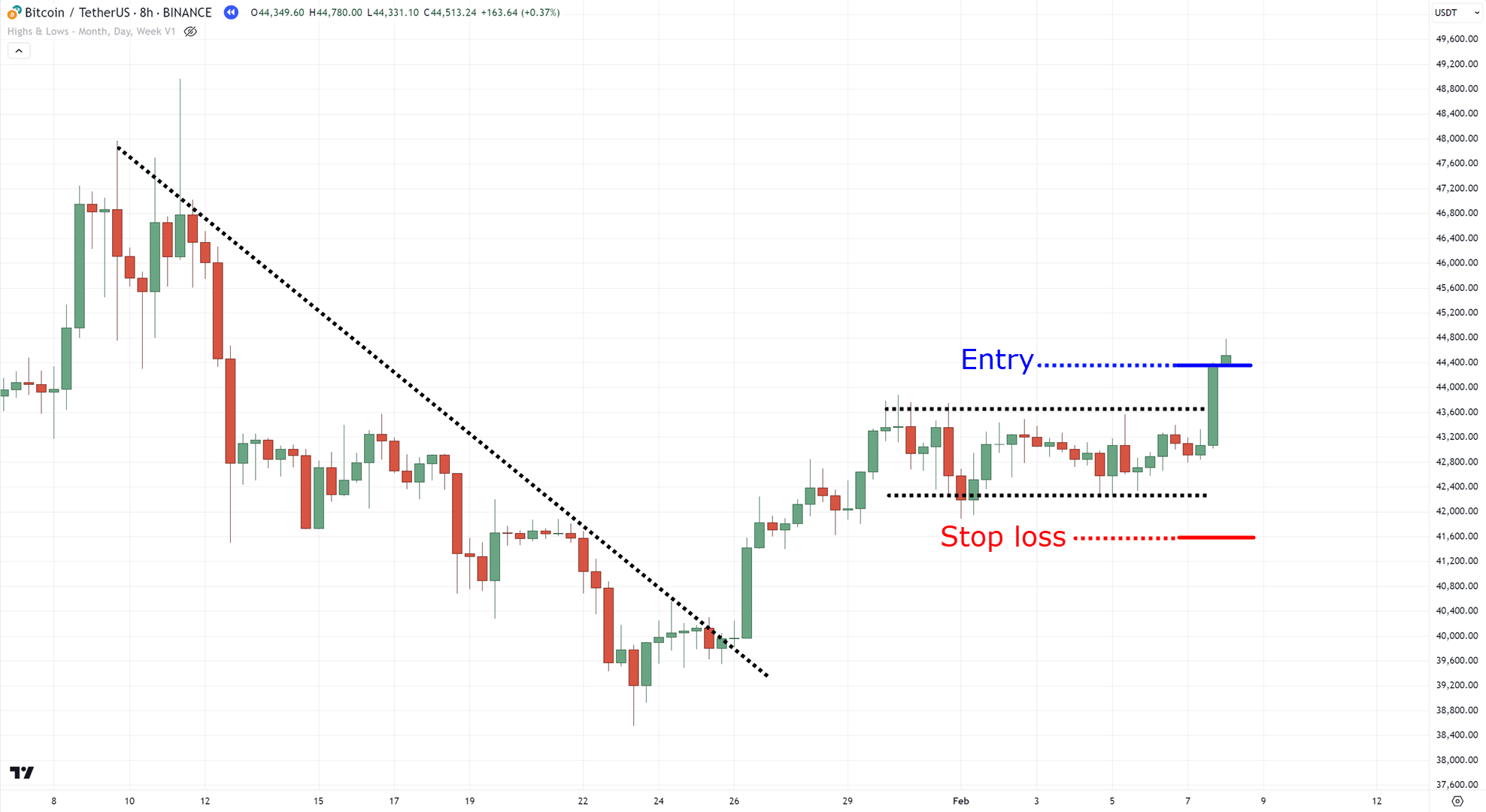

Third, the value should escape from that flag sample…

It’s right here that our entries lie, as you need to await the candle to shut past the flag sample earlier than getting into the commerce.

Now, you is perhaps pondering…

“Why this setup?”

Good query!

And the reply is extra easy than you’d assume.

This setup not solely detects market reversals but additionally offers you the chance to trip that reversal with out “chasing” the market.

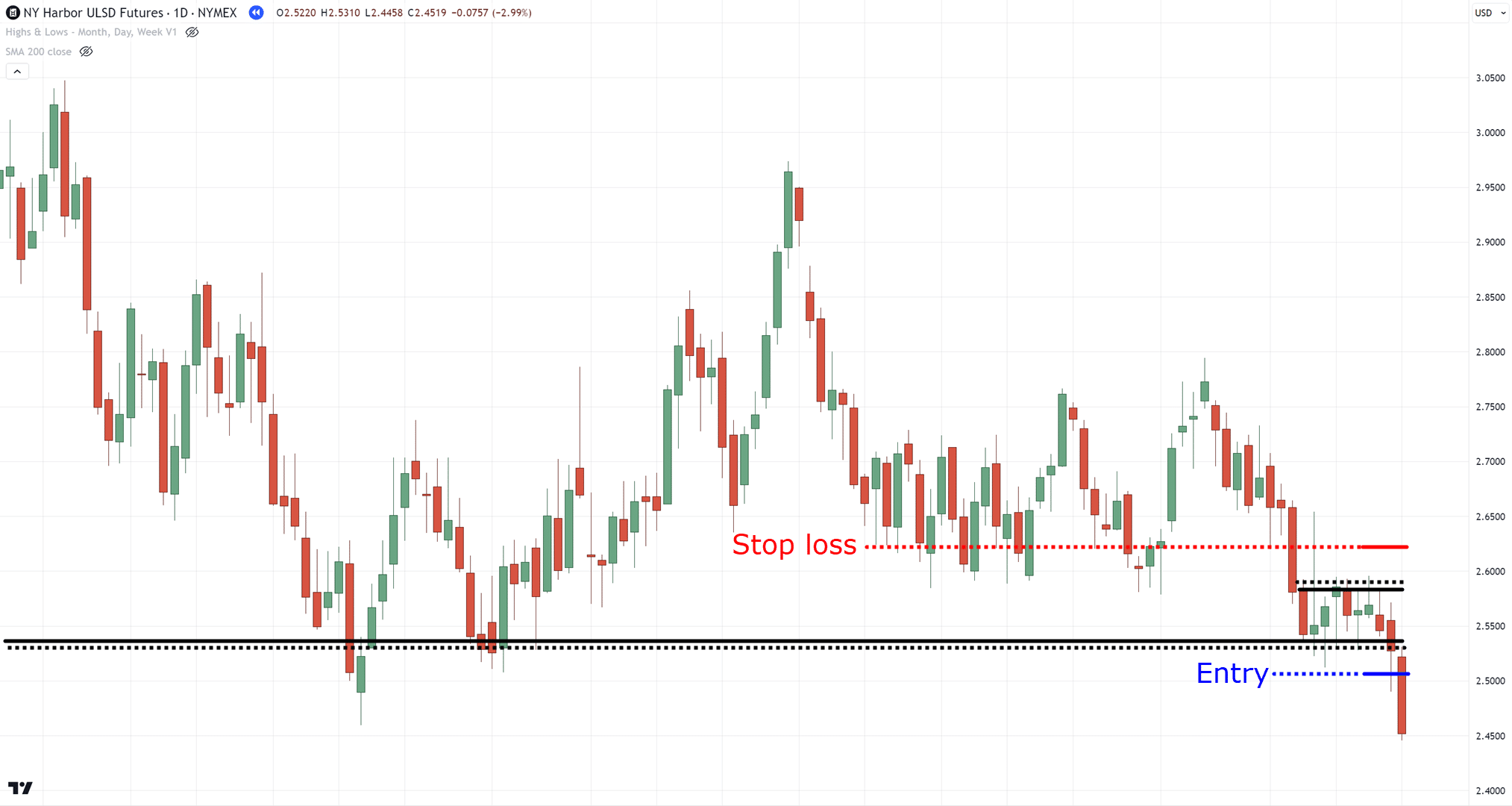

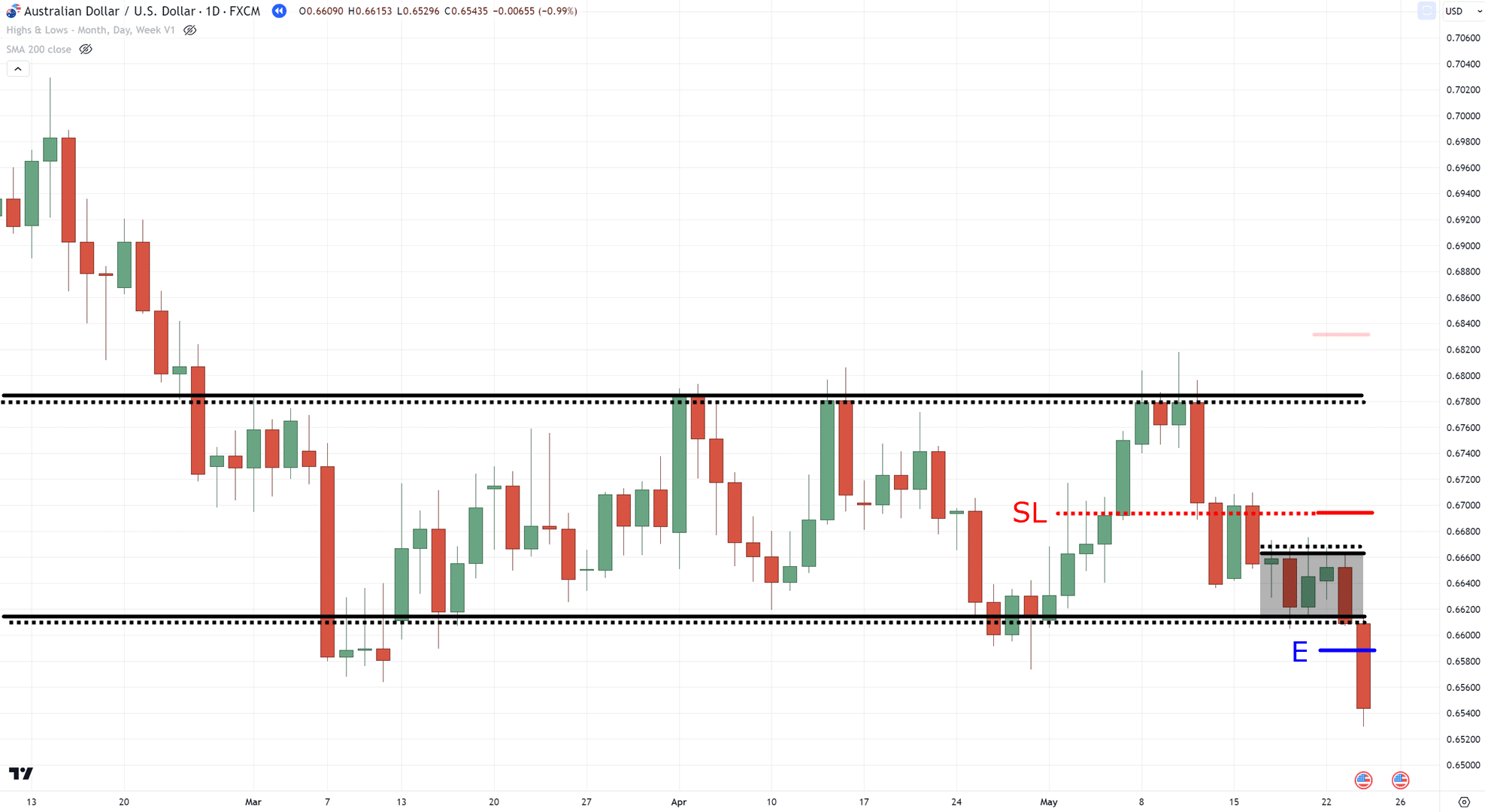

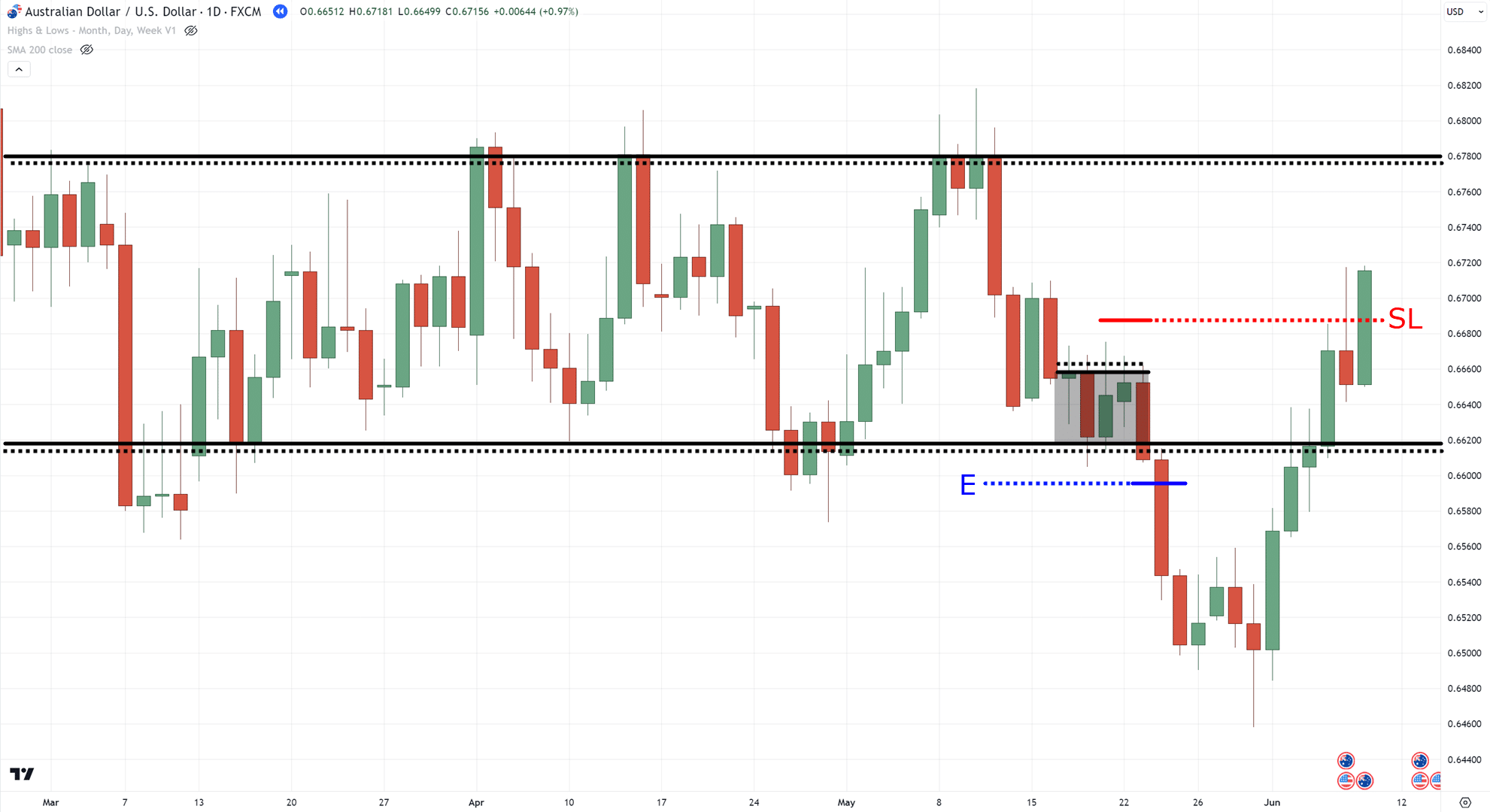

Take a look at this instance of the value approaching a significant space of resistance…

Are you able to see it?

Now, the second setup is one thing you would possibly already be aware of…

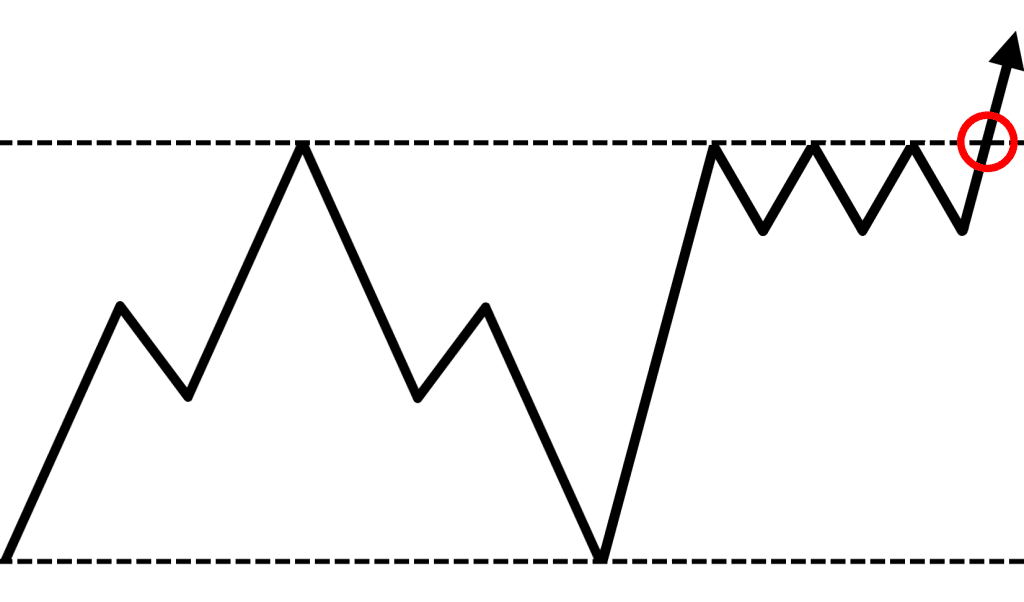

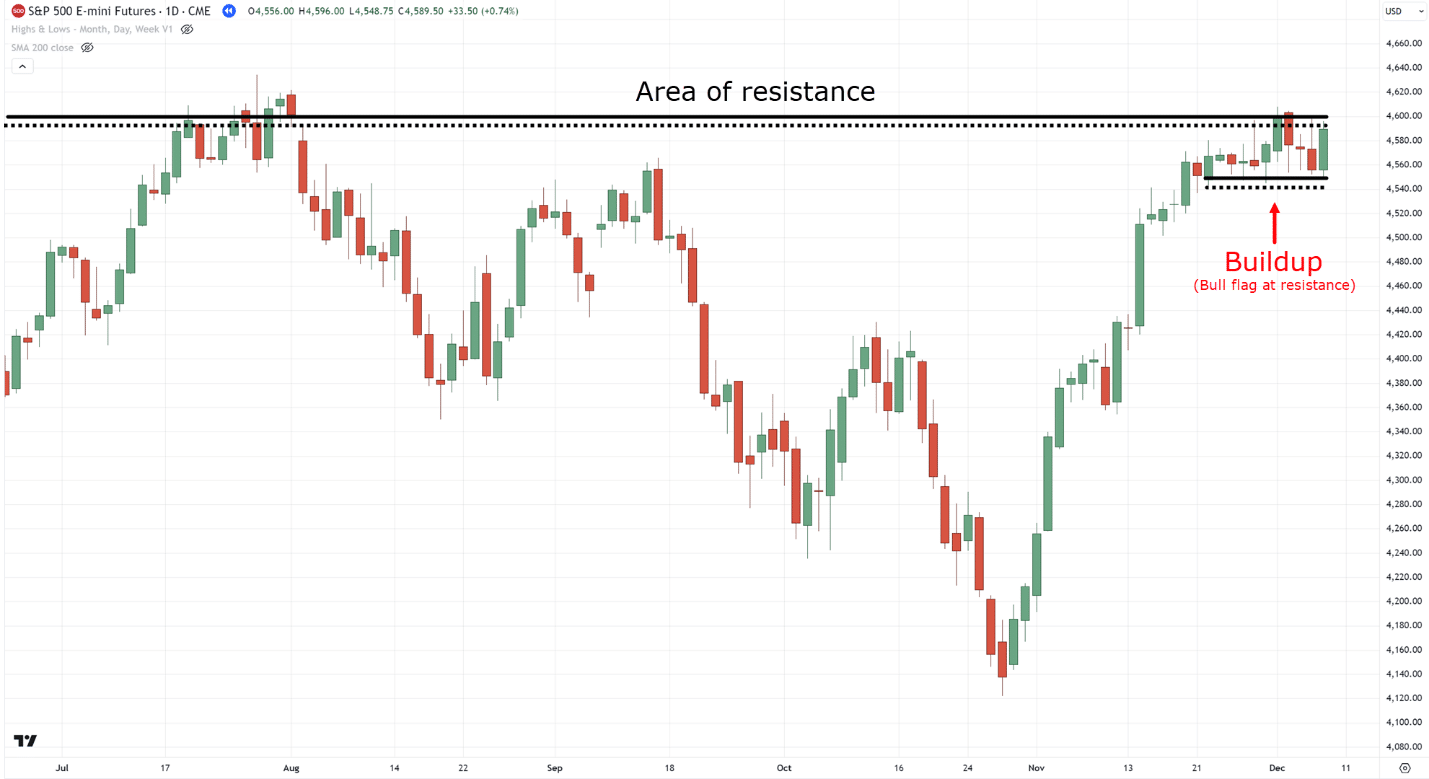

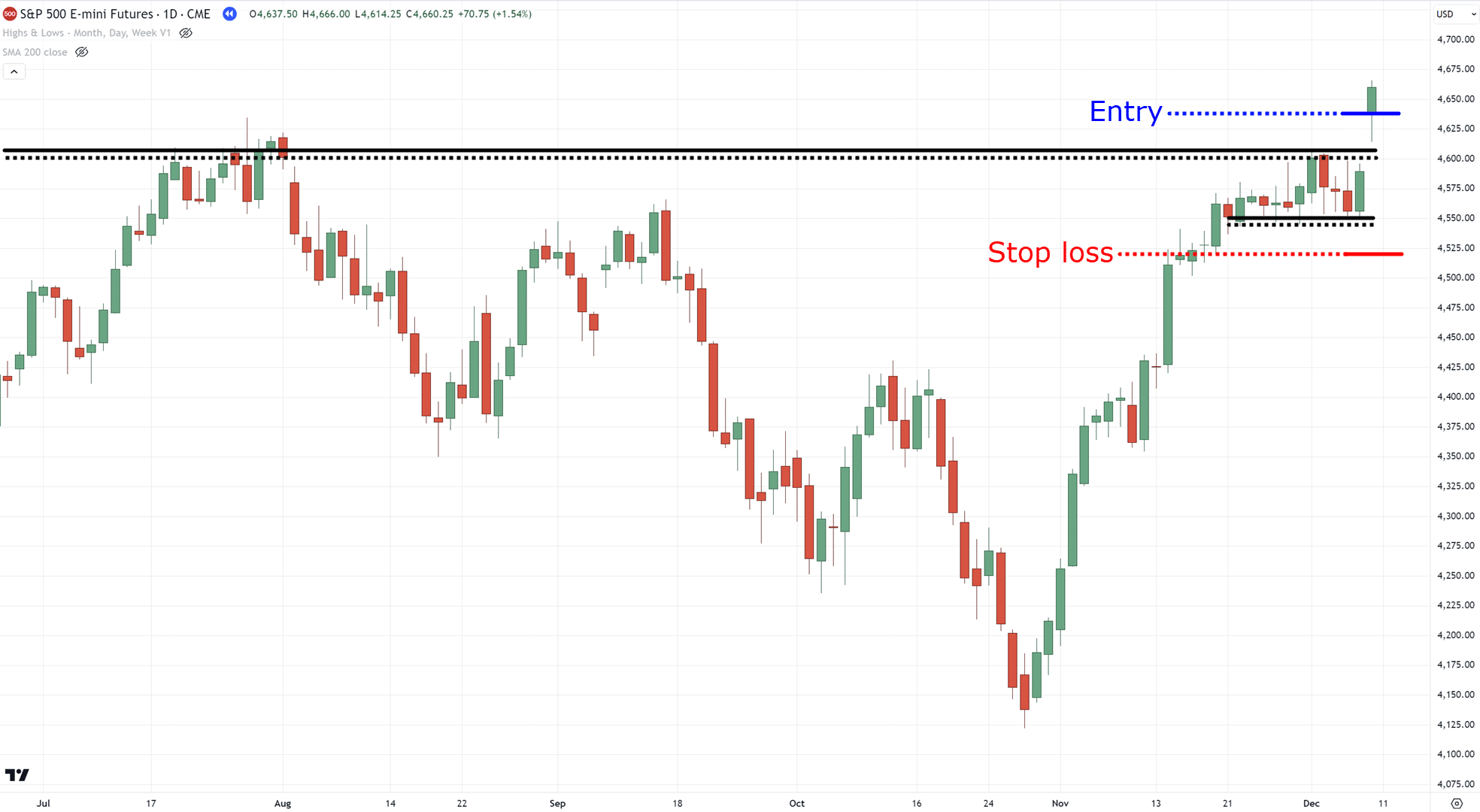

Buildups

What does this imply?

Effectively, it’s about ready for a flag sample at an space of worth.

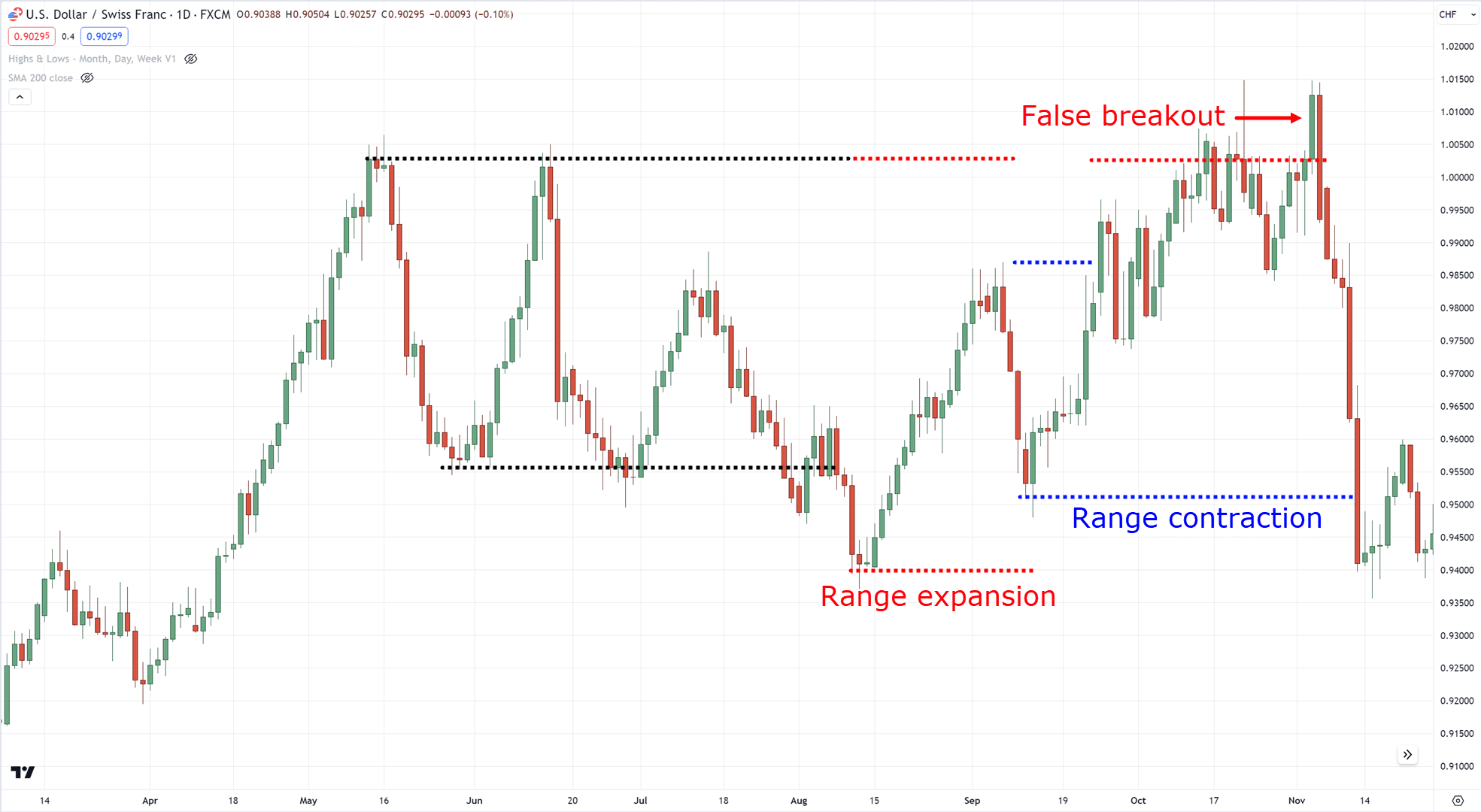

Are you able to see a flag sample hovering at resistance?…

Good, as a result of it exhibits that the consumers are already on the gates – about to interrupt them open!…

A really bullish setup!

It’s truly the identical as ready for a “buildup” on the space of help, simply in the wrong way…

Make sense?

Alright, then why this setup?

The primary purpose is that by ready for a buildup, you keep away from being “prey” to false breakouts more often than not, as you let the market play its hand first by exhibiting a buildup!

Bought it?

Lastly, we now have…

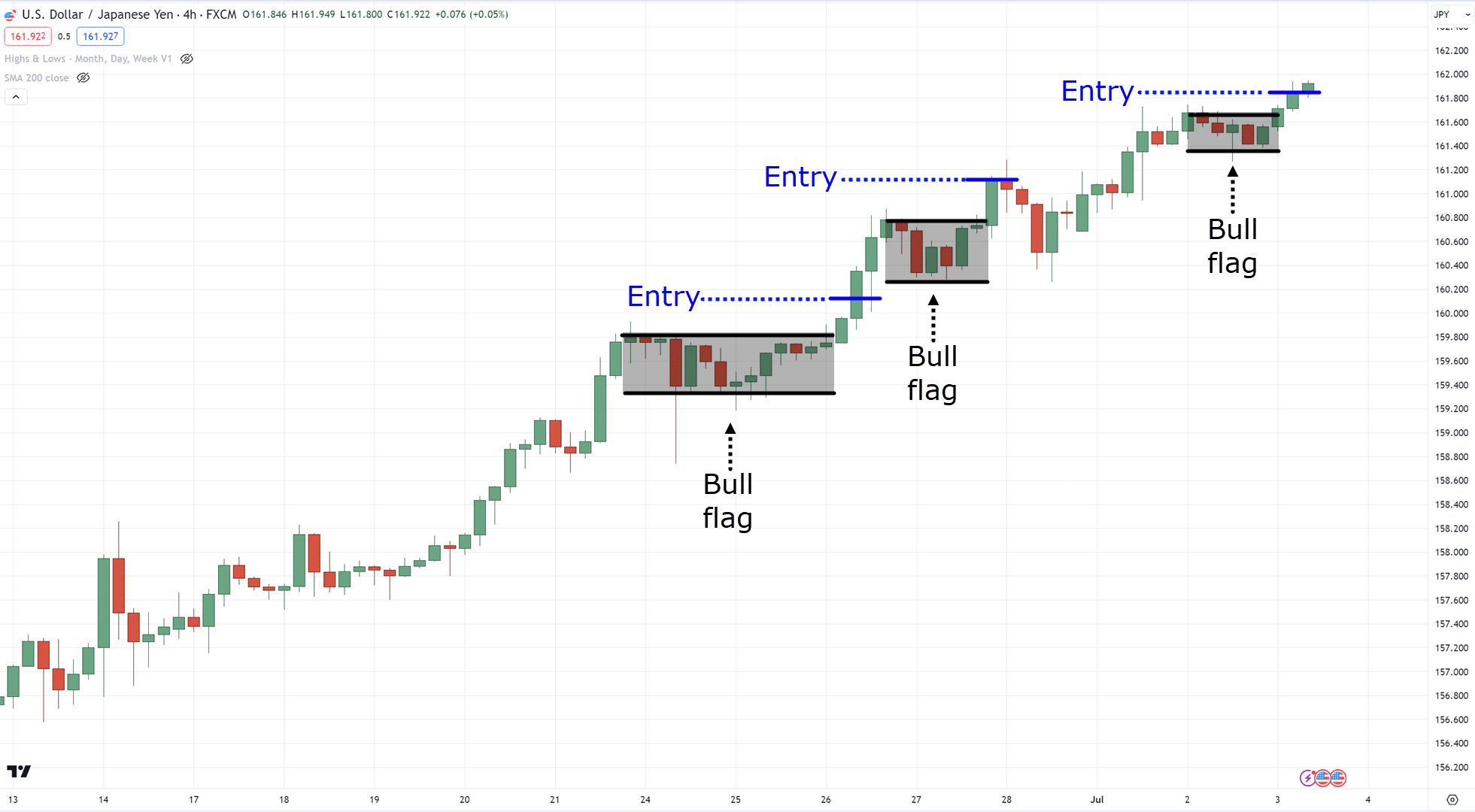

Development Continuation

Each time there’s a bear market or a uneven market, buying and selling the markets turns into tough, proper?

Tons of false indicators!

Numerous “market manipulation!”…

However as soon as there’s a development in play?…

All the things appears so easy!

It’s these market circumstances which might be essentially the most ideally suited to commerce.

Nonetheless, irrespective of how far the development goes, you all the time should enter objectively, equivalent to by ready for a flag sample…

Easy development, easy setups!

At this level, I’m positive you notice that we’re buying and selling a bunch of flag patterns.

And also you’re right!

So simple as they’re, flag patterns give you essentially the most goal solution to enter the markets.

However most of all, they will let you have a greater risk-to-reward ratio.

As an alternative of putting your stops above resistance on breakout…

Ready for a flag sample would provide you with a greater reference level on the place to put a tighter cease loss…

Fairly highly effective stuff, proper?

The flag sample permits you to have a greater risk-to-reward ratio, however on the identical time, it additionally rapidly alerts you in case your buying and selling thought has been invalidated…

One factor, although.

It’s value remembering that “there’s no such factor as a assure” undoubtedly applies right here!

The flag sample can fail as properly, identical to all setups on the market.

However now that you’ve got a setup that may commerce developments, reversals, and breakouts…

I’ll share with you why integrating the every day timeframe into your 1 hour buying and selling is necessary (and what you have to be searching for)

Why it’s good to take a look at the every day timeframe for how you can commerce worth motion within the 1 hour timeframe

One phrase…

Market choice.

At occasions, you would possibly hear merchants ask:

“Out of all of the hundreds of shares on the market, how do you select which of them to commerce?”

A inventory filter, after all!

“How do you select which foreign exchange pairs to commerce?”

On this case, a forex power meter!

“How about crypto?”

You possibly can select to commerce crypto primarily based on market capitalization!

There may be some ways to pick out markets to commerce, however the principle takeaway is that this:

You possibly can’t simply select which markets to commerce primarily based on different folks’s opinions or evaluation.

It’s essential to have a market choice rule…

…a constant solution to choose markets to commerce!

So, how do you select which markets to commerce on the 1 hour timeframe?

Take a look at the every day timeframe

The decrease the timeframe, the extra essential it’s to hunt affirmation in the next timeframe!

In fact, some would argue which you could simply stick to at least one timeframe.

Nonetheless…

Trying on the every day timeframe not solely offers you a constant solution to commerce worth motion within the 1 hour timeframe, but additionally will increase the chance of profitable trades.

And also you is perhaps pondering…

“Alright, what precisely will we search for on the every day timeframe?”

Right here’s the deal:

I gives you two strategies which have labored for me in addition to for a lot of college students and coaches.

However earlier than buying and selling it dwell on the markets…

It’s essential to do your individual again testing first, as you must by no means take every thing at face worth.

With that agreed, let’s get began!

Earlier day highs and lows

Of the 2 strategies I’ll share with you, this one is the simplest.

That’s as a result of you’ll be able to execute it even with out an indicator (although having one will assist).

The idea is easy – simply take the highs and lows of the every day timeframe…

After which merely go down the 1 hour timeframe…

Mainly, the earlier every day highs and lows act as an space of worth in your chart…

Take be aware that we don’t contemplate the “present” every day highs and lows as you’d wish to reference the earlier every day highs and lows!

So, how you can commerce worth motion within the 1 hour timeframe utilizing this methodology?

Effectively – await reversals through break of construction!…

That is notably helpful, as you don’t essentially want to have a look at the every day timeframe.

Nonetheless, the indicator (which is known as the Highs & Lows by UnknownUnicorn on TradingView) exhibits the info from the every day timeframe.

However there’s one caveat to this methodology…

Throughout trending markets, the value will have a tendency to interrupt its earlier day’s excessive or low.

On this case, you employ the buildup setup across the earlier every day highs…

Mainly, await a bull flag sample forming round the day before today’s excessive or a bear flag sample on the day before today’s low.

Bought it?

For taking income, you’ll be able to all the time contemplate putting your targets earlier than the earlier every day excessive (if lengthy)…

However for trending markets, contemplate trailing your cease loss utilizing a short-term transferring common such because the 20 MA…

Excessive MACD ranges

I’ve to confess.

I discovered this methodology from Darek Dargo which you’ll take a look at in his interview with Rayner right here:

The Foreign exchange Dealer With 86% Profitable Charge (With Darek Dargo)

So, it’s solely honest to provide him credit score for this methodology!

However mainly…

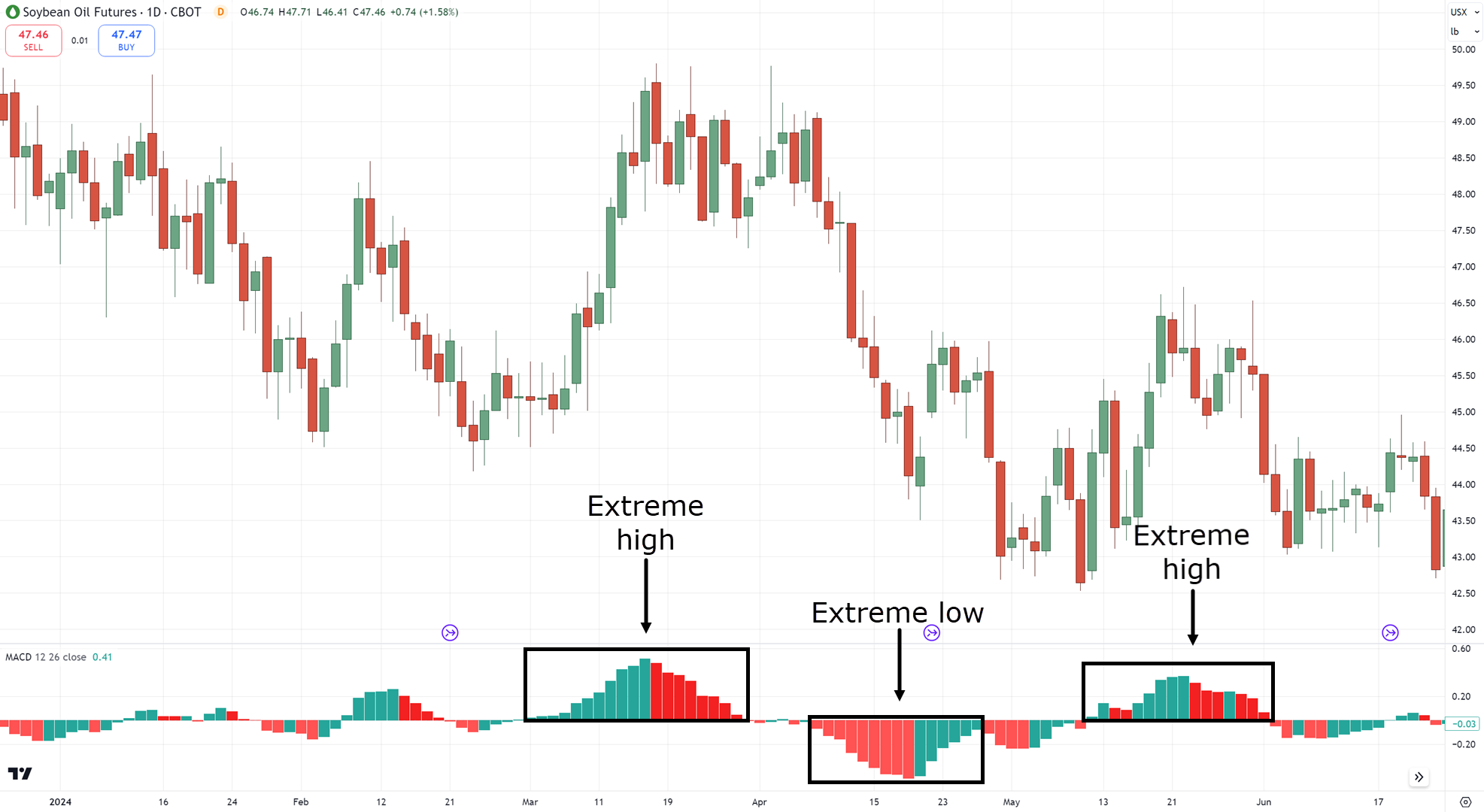

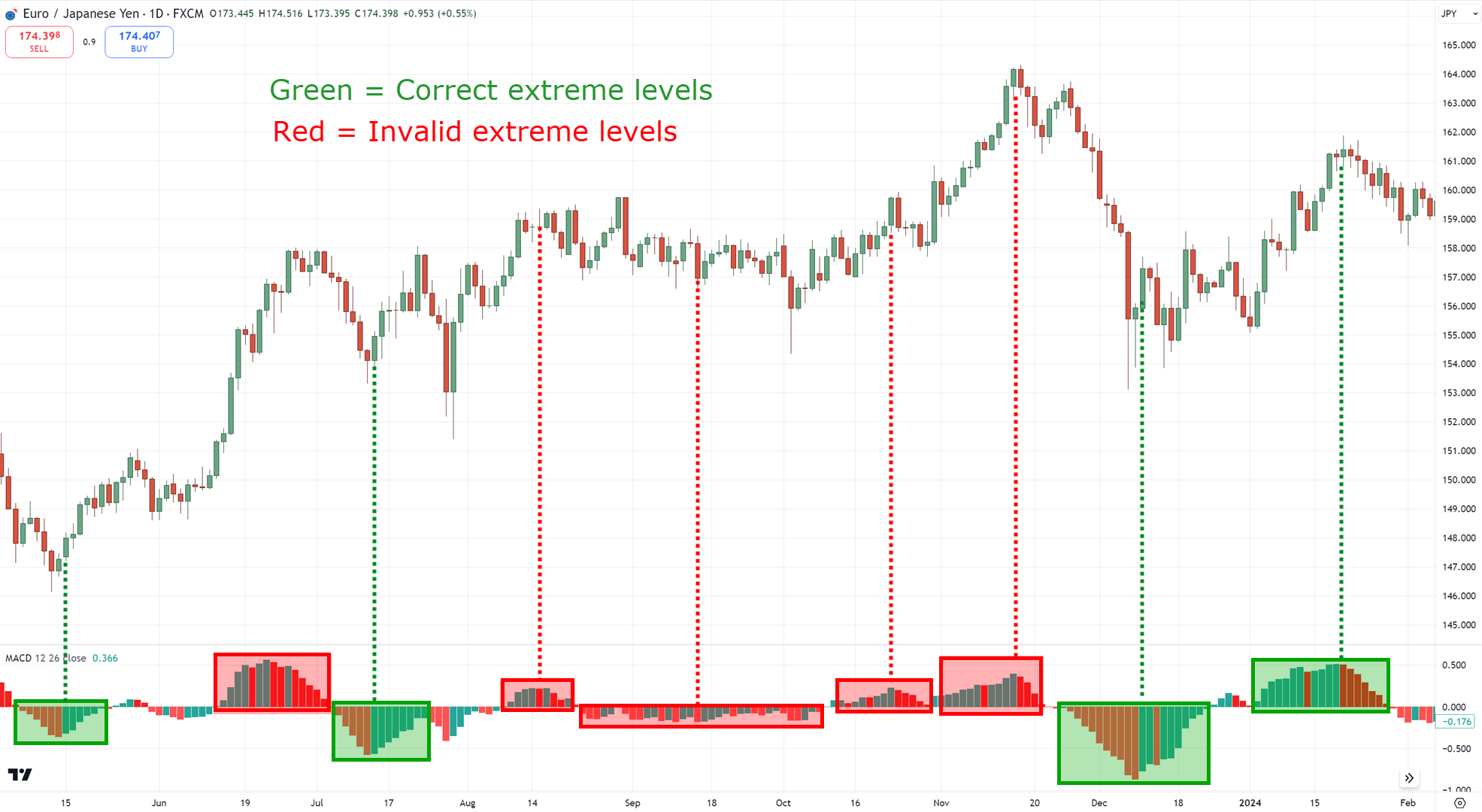

You wish to take a look at the “extremes” on the MACD histogram (default values) on the every day timeframe…

Recognizing these extremes on the every day timeframe will take follow!

That you must study what’s an excessive degree and what isn’t…

However as soon as you notice one…

It’s solely a matter of time earlier than the market snaps again, like an overstretched rubber band!

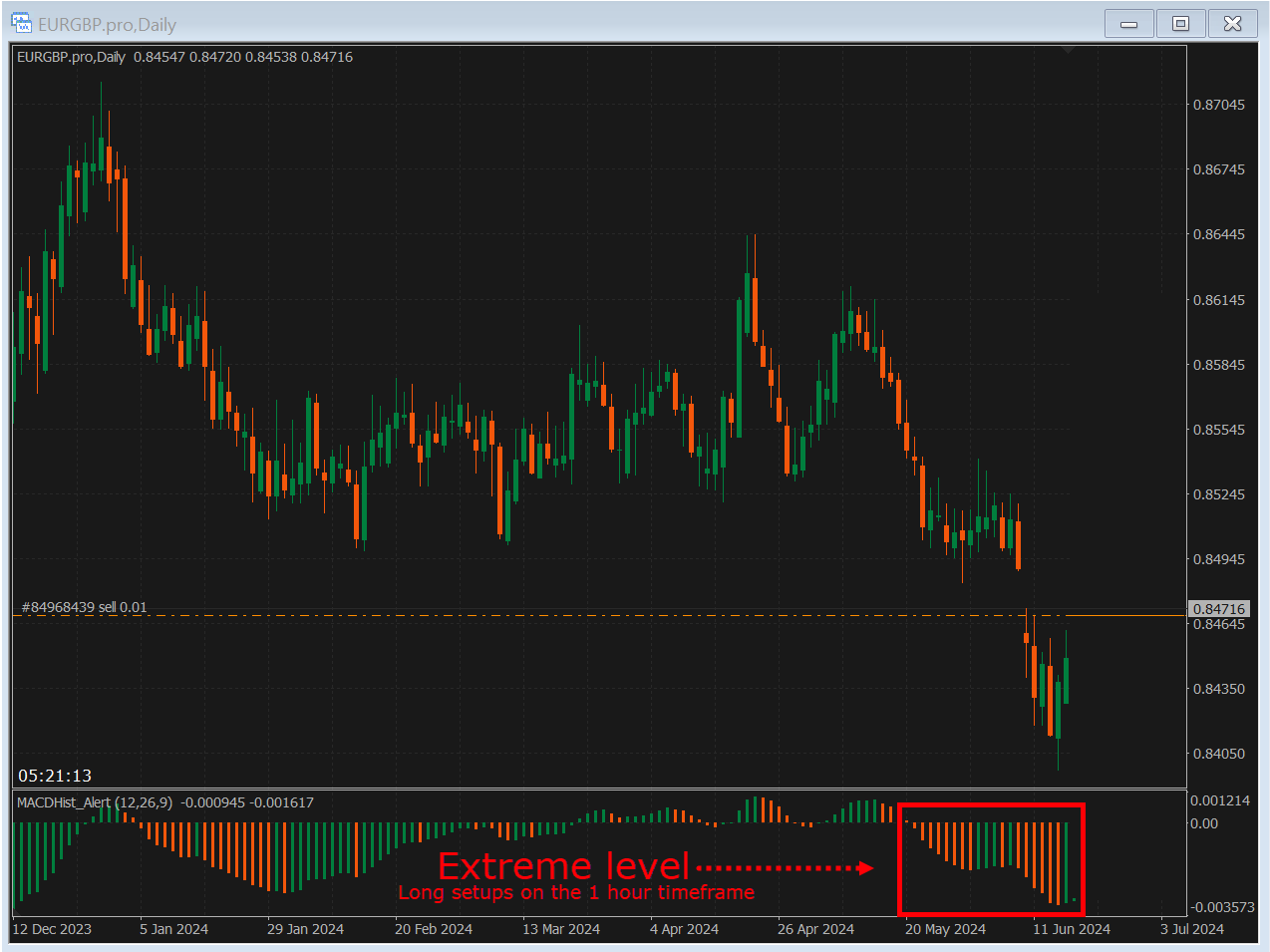

Now, how will you use this to commerce the 1 hour timeframe?

First, spot an excessive degree on the MACD histogram on the every day timeframe that’s beginning to reverse…

When you see it, go right down to the decrease timeframe and commerce worth motion within the course of the potential reversal…

This methodology is especially helpful because it doesn’t simply allow you to simply spot potential reversals out there and helps you notice setups in your watchlist, which I’ll share with you later.

Now, as for taking income…

Darek typically makes use of a 1:1 risk-to-reward ratio to maintain this win price excessive…

However you’re additionally free to compromise by having a partial take revenue after which taking full income on the nearest space of worth…

Make sense?

Nice!

At this level, you’ve discovered a number of worth motion setups to commerce on the 1 hour timeframe.

Not solely that!

You’ve additionally discovered how you can choose markets to commerce.

Nonetheless, there’s one particular matter that merchants don’t typically speak about, if in any respect…

And that’s the buying and selling routine.

Let me share extra with you within the subsequent part…

Tips on how to commerce worth motion within the 1 hour timeframe: When must you verify your charts?

This matter is commonly essentially the most neglected but a very powerful.

Why?

Since you wish to deal with buying and selling as a enterprise as an alternative of a pastime!

You want a constant buying and selling routine on when and when to not verify your charts.

As a result of let’s face it…

On markets equivalent to foreign exchange and crypto, you’ll be able to’t be awake on a regular basis!

So, going again to the query – when must you verify your charts?

Effectively, a buying and selling routine throughout a day may be segregated into three components:

- Watchlist constructing (early morning)

- Execution (interval checking in the course of the day)

- Journaling (each weekend)

Let me clarify…

Watchlist constructing (early morning)

That is the place you’re taking a detailed take a look at your watchlist to see potential trades for the remainder of the day.

I recommend you do that within the morning.

When you’ve analyzed each market in your watchlist…

You’ll hone it to some markets that you’ll monitor or execute throughout the day.

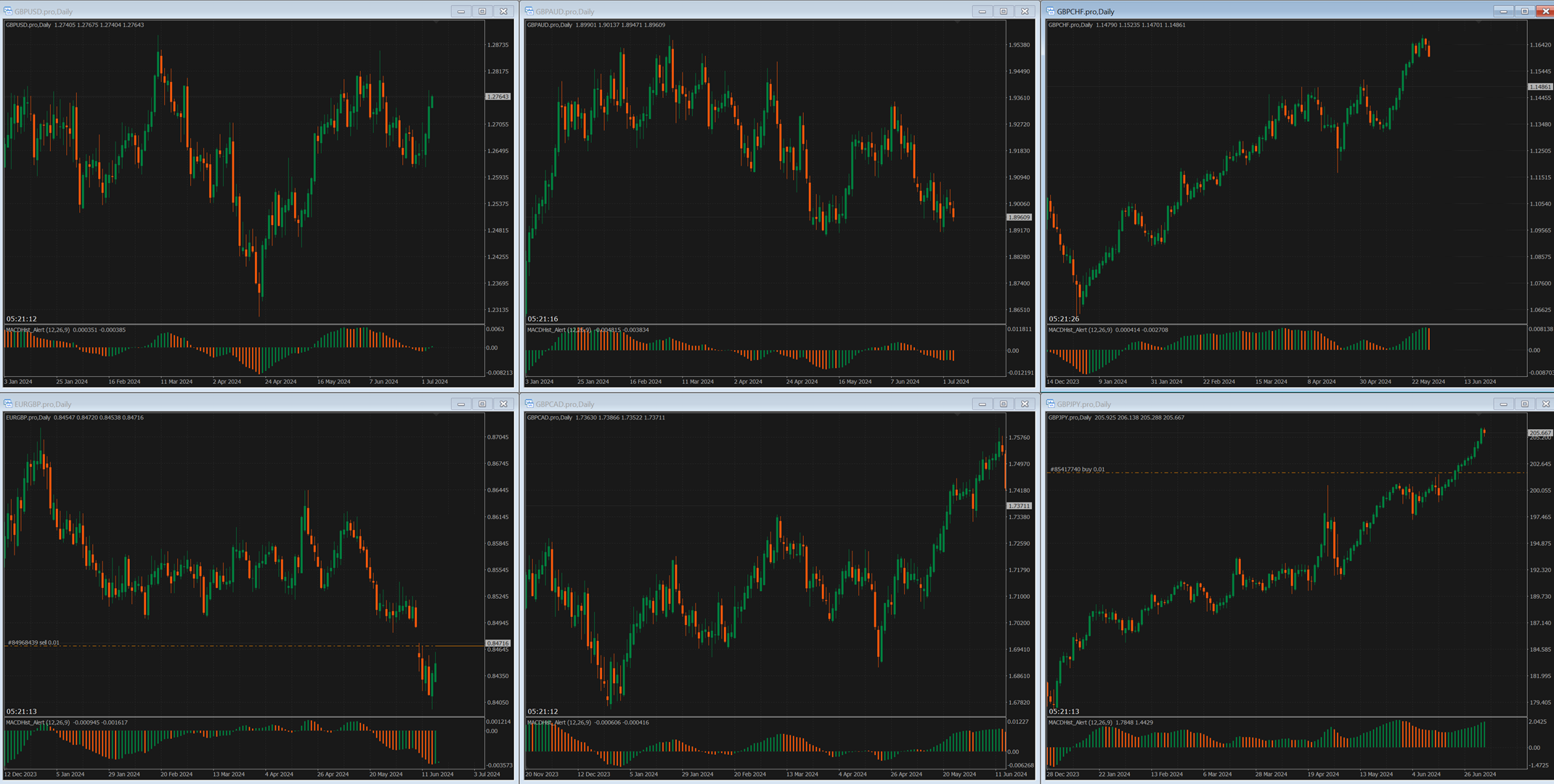

Let’s take foreign exchange for instance.

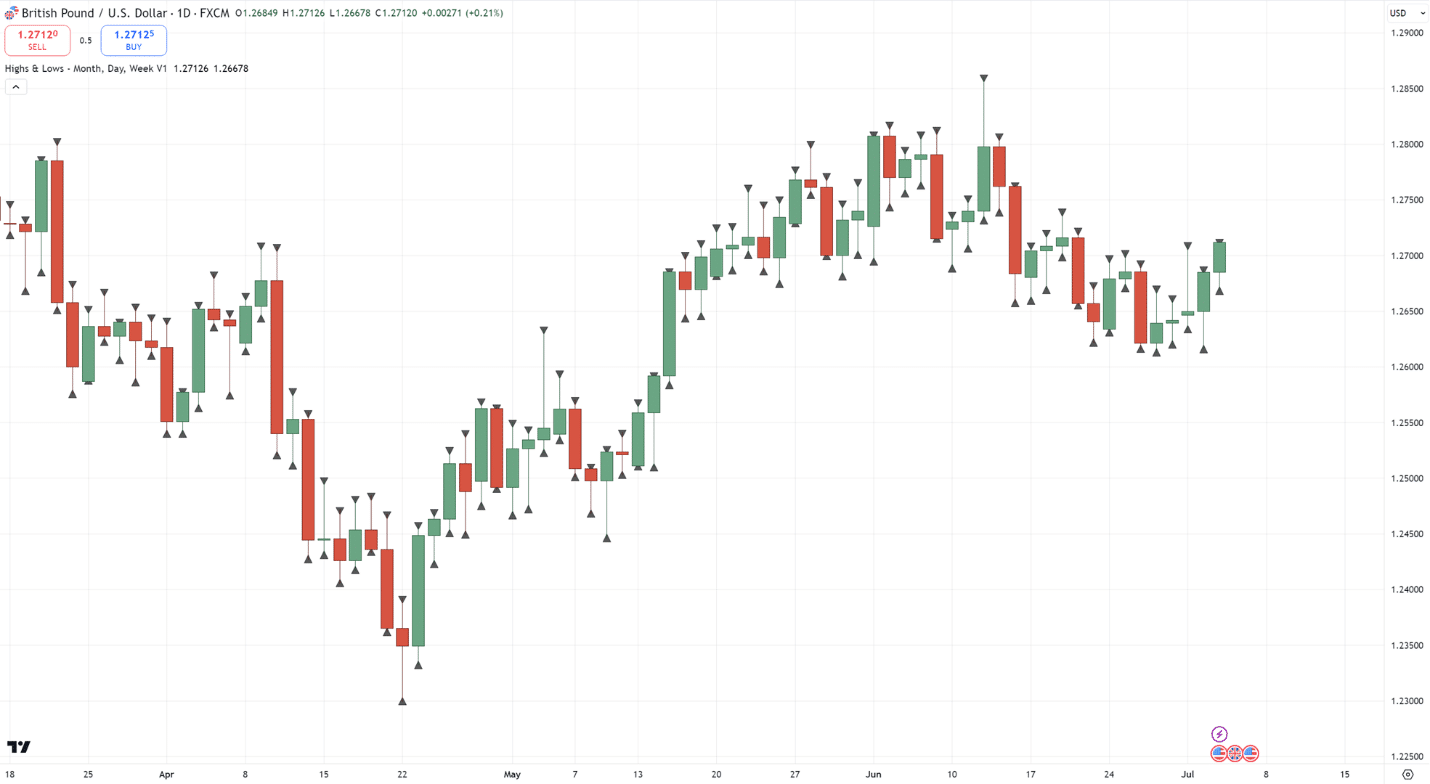

As you’ll be able to see beneath, that is my watchlist for the GBP crosses…

If we take Darek’s excessive MACD methodology for instance…

Which of the markets are presently at their extremes?

That’s proper! You could have EURGBP and GBPCHF…

Now, what this implies is that for the remainder of the day, you’ll intently take a look at these pairs solely and discover setups within the 1 hour timeframe!

This leads me to the following step…

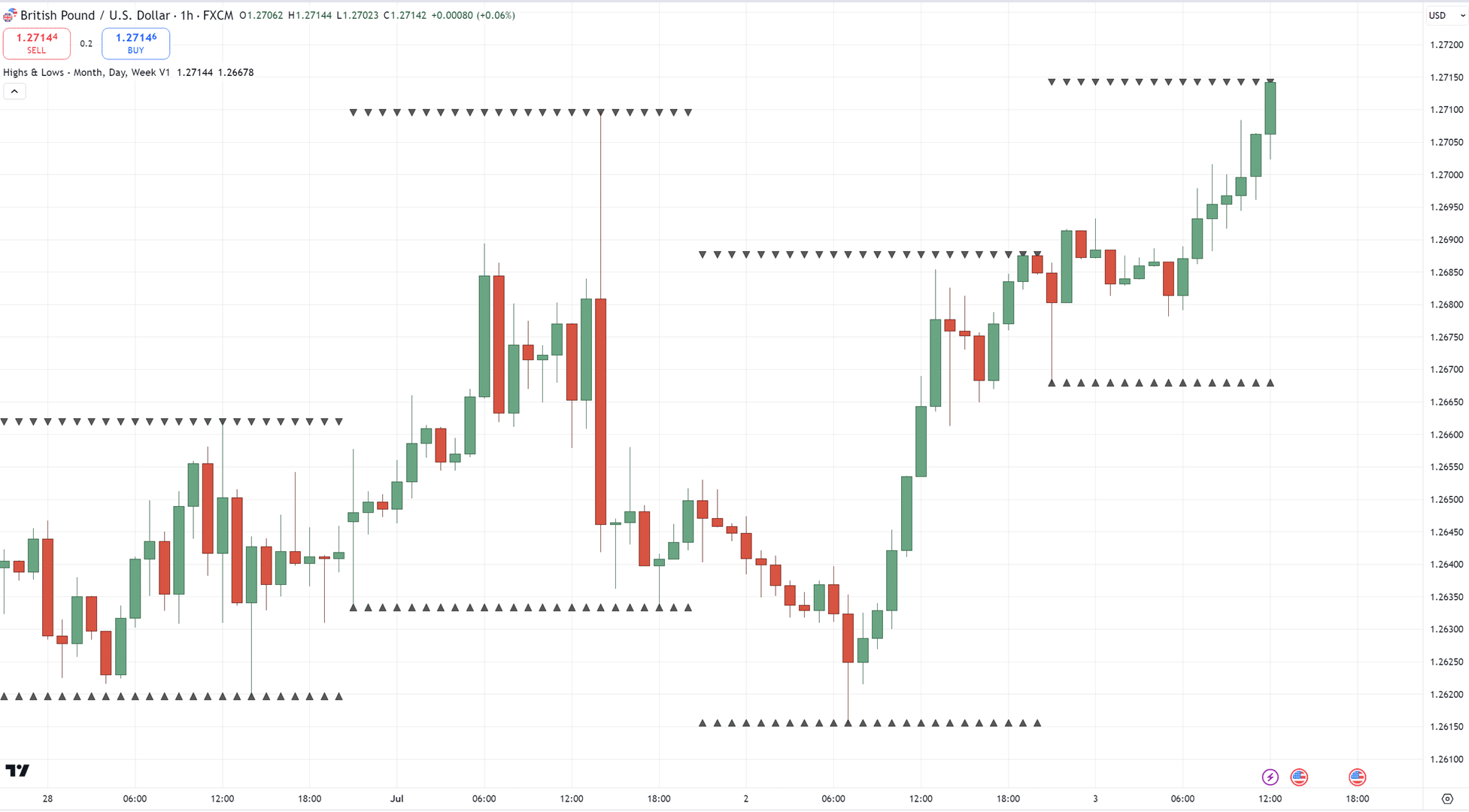

Execution (interval checking in the course of the day)

In contrast to day buying and selling or scalping timeframes such because the 5-minute or 15-minute timeframes…

…the 1 hour timeframe is much less delicate to risky market classes.

This implies if you wish to scalp the markets, you wish to focus buying and selling solely on market classes that provide essentially the most volatility.

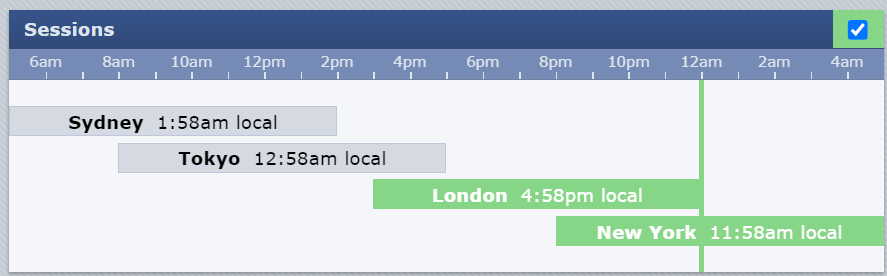

Such because the London and New York session overlap for Foreign exchange…

Supply: ForexFactory

However because you’re buying and selling the 1 hour timeframe, you’ll be able to commerce all market classes.

Notice once more that you just shouldn’t be checking each single hour!

Why?

As a result of the value motion of the market takes time to develop.

Because of this I recommend checking your narrowed-down watchlist as soon as each 4-hours.

For example…

- 8 am – watchlist constructing for the day

- 12 pm – execute trades or monitor honed watchlist

- 4 pm – execute trades or monitor honed watchlist

- 8 pm – execute trades or monitor honed watchlist

After 8 pm, you put together for mattress or spend time together with your youngsters and household.

No charts throughout that point!

It’s necessary to stability buying and selling and way of life

In fact, you’re free to switch this schedule relying on the markets you commerce, however you get the concept.

Journaling (each weekend)

Fortunately, there are some detailed guides on how one can journal your trades right here:

A Full Information To Creating And Utilizing A Foreign exchange Buying and selling Journal

However the principle takeaway is that this…

Don’t overcomplicate it

You wish to journal your trades in a method that’s easy sufficient so that you can repeat the method again and again.

If you need to enter 20 particulars on every commerce, are you able to realistically preserve it for the following 1,000 trades?

Very tedious, proper?

So, preserve it easy by:

- Taking an image of your commerce as you enter it

- Taking an image of your commerce when you’ve exited it

That’s it!

In order for you extra superior metrics, then let automated buying and selling journals report them for you, equivalent to Myfxbook or Fxblue.

Lastly, it’s good to learn to use your buying and selling journal!

Because of this each weekend you wish to accumulate information of no less than 10 completed trades and ask these questions…

- Out of all of your trades, for what share of them did you observe your guidelines?

- For those who broke your guidelines on most of your trades, how will you enhance your buying and selling routine, or is your psychological well being okay? Do you have to take a break?

- For those who didn’t break your guidelines however the week turned out adverse, how will you enhance out of your losses? Tighter stops? Fastened targets?

From there, you’ll wish to make adjustments to your buying and selling plan for the approaching week.

Once more, slight adjustments solely – you are attempting to optimize your buying and selling plan as an alternative of rewriting it!

One other factor to pay attention to is to solely do that over the weekend when the markets are closed.

A closed market retains your thoughts targeted in your buying and selling journal as an alternative of being hooked up to your open trades.

Necessary stuff, proper?

So, as you’ll be able to see, having the precise buying and selling routine is about attempting to attain a stability…

…between sustaining your way of life and having a buying and selling enterprise…

…in a method that they don’t intervene with one another!

You might be free to switch these processes to your liking, simply be sure to have the three phases of a buying and selling routine in thoughts.

Within the subsequent part, issues are going above and past as you take a look at the enterprise side of buying and selling!

Tips on how to commerce worth motion within the 1 hour timeframe: How must you handle your danger and when must you add capital?

Right here’s one factor to bear in mind…

The decrease the timeframe, the decrease your danger per commerce ought to be.

Why?

As a result of decrease timeframe buying and selling signifies that you’ll have larger frequency buying and selling exercise…

…which in flip signifies that you’ll have fixed suggestions in your trades.

It’s precisely this type of suggestions that may have an effect on your feelings essentially the most simply.

So, to counter this, you wish to danger 0.5% per commerce or decrease.

The reason being easy!

The decrease your danger per commerce is, the much less risky your buying and selling portfolio shall be general…

…as you improve the frequency of your trades in comparison with buying and selling solely on the 4-hour or every day timeframe.

And you probably have an enormous account or are managing funds, then chances are you’ll even wish to contemplate risking 0.25% per commerce.

Talking of buying and selling accounts…

When must you add capital?

Ideally, you wish to begin small.

Whether or not that’s $50, $500 or $1,000 to you, that doesn’t matter!

By beginning small, there’s much less emotional impression.

Now, when you discover you’ve been constant in your actions for no less than 2 months…

…then it is perhaps time to think about including extra funds to your account!

Mainly…

You don’t wish to commerce on an enormous account with out confidence.

So as an alternative, construct your confidence on a small account.

As soon as your buying and selling confidence arises, it can develop into simpler mentally to deal with a bigger account.

Make sense?

Good, as a result of that’s all there may be to it!

I’ve laid down every thing I do know that can assist you not solely construct your buying and selling account within the 1 hour timeframe however to additionally enable you to maintain it.

So, with that stated…

Let’s have a recap of what you’ve discovered at the moment!

Conclusion

Don’t get me fallacious.

It’s completely okay to solely commerce the upper timeframes if you want!

However when you’ve reached this far, it signifies that you’re properly in your solution to buying and selling the 1 hour timeframe.

This information is designed to be sure you obtain consistency.

Right here’s what you’ve discovered at the moment:

- Buying and selling the 1 hour timeframe may be so simple as having three worth motion setups: break of construction, buildups, and development continuation

- On the every day timeframe, you’ll be able to both select to have a look at the earlier every day highs or lows or search for the acute MACD ranges as a solution to choose and filter markets to commerce in the course of the day

- A buying and selling routine consists of constructing your watchlist each morning, executing or monitoring your charts as soon as each 4 hours, and journaling your trades

- On the decrease timeframes, contemplate risking lower than 0.50% per commerce, in addition to beginning with a small account, after which including extra funds as you construct confidence and consistency in buying and selling

So there you go!

A whole information on how you can get began in 1 hour timeframe!

Now right here’s what I wish to know…

Do you already commerce the 1 hour timeframe?

In that case, have you ever discovered one thing new right here at the moment?

Or maybe you’re feeling the 1 hour timeframe simply isn’t for you?

At any price, share your ideas within the feedback beneath!