Purpose to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

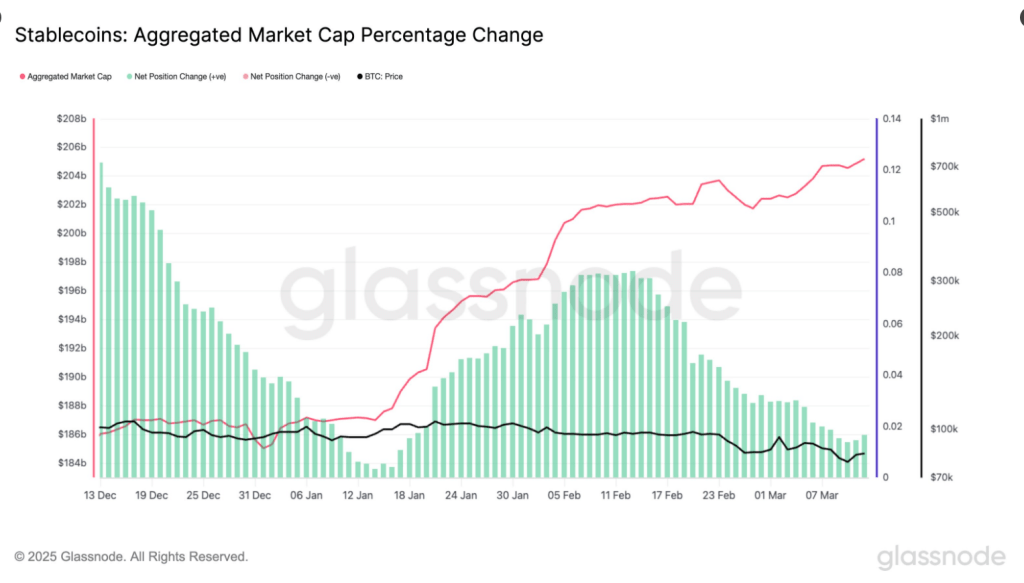

Early in 2025, there was a big surge within the stablecoin market, with a $20 billion enhance in complete provide. With a ten% enhance from January, the full provide now stands at nearly $205 billion. The spike, in accordance with information from Glassnode, comes after a dip in late 2024, when the availability of stablecoins fell from $187 billion to $185 billion.

Associated Studying

Stablecoins See A Robust Rebound

For buying and selling cryptocurrencies, stablecoins—like USDT and USDC—typically act as a reserve for buyers anticipating the best time to purchase belongings like Bitcoin. The newest rise exhibits that investor curiosity has surged, particularly in view of final yr’s decelerate.

Since Jan 1, the mixture #stablecoin provide has elevated by $20.17B (+10.9%), now reaching greater than $205B.

For comparability, the December peak clocked in at $187B however the provide truly contracted within the final two weeks of 2024 and dropped to $185B by January 2025. pic.twitter.com/gQbdMEDisb

— glassnode (@glassnode) March 13, 2025

Given the earlier fall, this comeback is particularly notable. For many of 2024 the market has been shedding stablecoins; however, this pattern has currently reversed. Though previous patterns recommend that Bitcoin’s worth could also be impacted, it’s unknown whether or not this enhance will result in an increase in purchases of cryptocurrencies.

Bitcoin Traders Watching Carefully

A rising stablecoin provide is commonly seen as a bullish signal for Bitcoin. Traditionally, the value of Bitcoin has risen according to the stablecoin depend. The reasoning is straightforward: extra stablecoins imply extra potential capital simply ready to be entered into the market.

Some analysts consider this recent injection may push Bitcoin larger. Nonetheless, not all stablecoins are used for buying and selling. Many are held for remittances, funds, or as a hedge in opposition to inflation, particularly in nations the place native currencies are unstable.

As of at this time, the market cap of cryptocurrencies stood at $2.65 trillion. Chart: TradingView

Stablecoin Alternate Holdings Drop 21%

Whereas the full provide is rising, solely 21% of stablecoins are at the moment sitting on exchanges. This can be a vital drop from 2021, when over 50% of the availability was out there for instant buying and selling, Glassnode disclosed. This shift means that whereas new cash are being issued, they aren’t all being deployed into crypto markets instantly.

Associated Studying

This might level to one in all two potentialities: both stablecoins are getting used extra typically outdoors of exchanges or buyers are nonetheless ready for the acceptable second. Ought to the latter show proper, the affect on Bitcoin could possibly be much less notable than anticipated.

What This Means For Bitcoin’s Future

The stablecoin market is at the moment experiencing a resurgence, which is mostly a good growth for the cryptocurrency sector. Nonetheless, it’s unsure whether or not this can end in a short-term enhance within the worth of Bitcoin. Stablecoin utilization has fluctuated, and extra financial variables will contribute to this growth.

On the time of writing, Bitcoin was buying and selling at 82,264, down 1.1% and 6.9% within the each day and weekly frames.

Featured picture from Warwick Enterprise College, chart from TradingView