Purpose to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade consultants and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

In a putting forecast, two tutorial researchers, Murray Rudd and Dennis Porter, have predicted that Bitcoin (BTC) may soar to an astonishing $4.3 million by 2036 if institutional shopping for developments proceed.

This prediction was highlighted by market knowledgeable Giovanni Incasa, who emphasised the importance of making use of rigorous supply-demand theories to Bitcoin’s distinctive financial construction.

Provide Shock Warning

Rudd and Porter have employed pure mathematical modeling to research Bitcoin’s market dynamics, warning that the upcoming provide shock may result in worth fluctuations ten occasions extra extreme than something seen so far.

Their findings recommend that the consequences of this provide shock will end in everlasting wealth redistribution, basically altering the panorama of digital belongings.

Associated Studying

Based on their conservative estimates, the Bitcoin worth may attain $2.2 million per coin by 2036, a projection rooted in what they describe as “financial physics.”

The researchers be aware that the present liquid provide of Bitcoin stands at solely 11.2 million cash, with an estimated 4 million Bitcoin misplaced ceaselessly resulting from misplaced keys and Satoshi Nakamoto’s unspent stash.

Their evaluation reveals that solely half of BTC’s complete provide is actively liquid, which means that even modest institutional purchases may result in vital provide shortages.

Proof of this pattern will be seen within the every day shopping for habits of US exchange-traded funds (ETFs), which have averaged 285 Bitcoin per day since their launch, and the actions of Bitcoin treasury corporations which can be eradicating hundreds of cash from circulation by debt financing.

Senator Cynthia Lummis has additionally proposed a strategic reserve of 1 million Bitcoin, which might contain an acquisition of roughly 550 cash per day over 5 years.

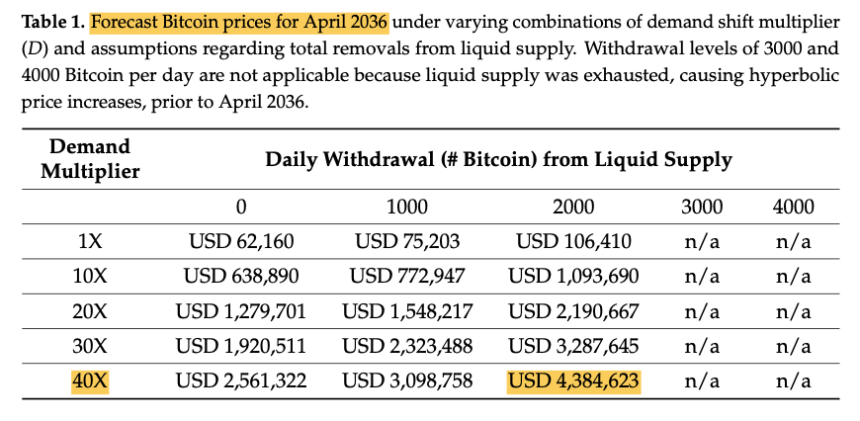

The researchers calculate that if 2,000 Bitcoin are faraway from circulation every day, the worth may attain $106,000—a determine that’s already near immediately’s buying and selling worth of $104,800, suggesting that their mathematical framework is holding true.

The crux of the researchers’ findings is that conventional provide curves should not relevant to BTC. Its completely inelastic provide creates vital bottlenecks as demand rises, resulting in dramatic worth will increase. They emphasize that establishments that delay their investments danger turning into completely priced out of the market.

Three Situations For Bitcoin

Rudd and Porter define three potential situations for Bitcoin’s future. In a conservative state of affairs, with a 20-fold enhance in demand and continued institutional adoption resulting in 2,000 every day Bitcoin withdrawals, costs may attain $2.2 million by 2036.

Their bullish state of affairs posits a 30-fold demand progress, the place Bitcoin may hit $5 million by early 2031. Essentially the most excessive, hyperbolic state of affairs anticipates a 40-fold demand enhance, with every day withdrawals escalating to 4,000 Bitcoin, doubtlessly driving costs to $4.3 million by 2036 and valuing Bitcoin at six occasions the present market cap of gold.

Associated Studying

The implications of Rudd and Porter’s analysis prolong past mere hypothesis. It highlights a transformative interval for BTC and the broader monetary panorama, the place strategic positioning and early adoption may imply the distinction between thriving and merely surviving within the digital financial system.

Featured picture from DALL-E, chart from TradingView.com