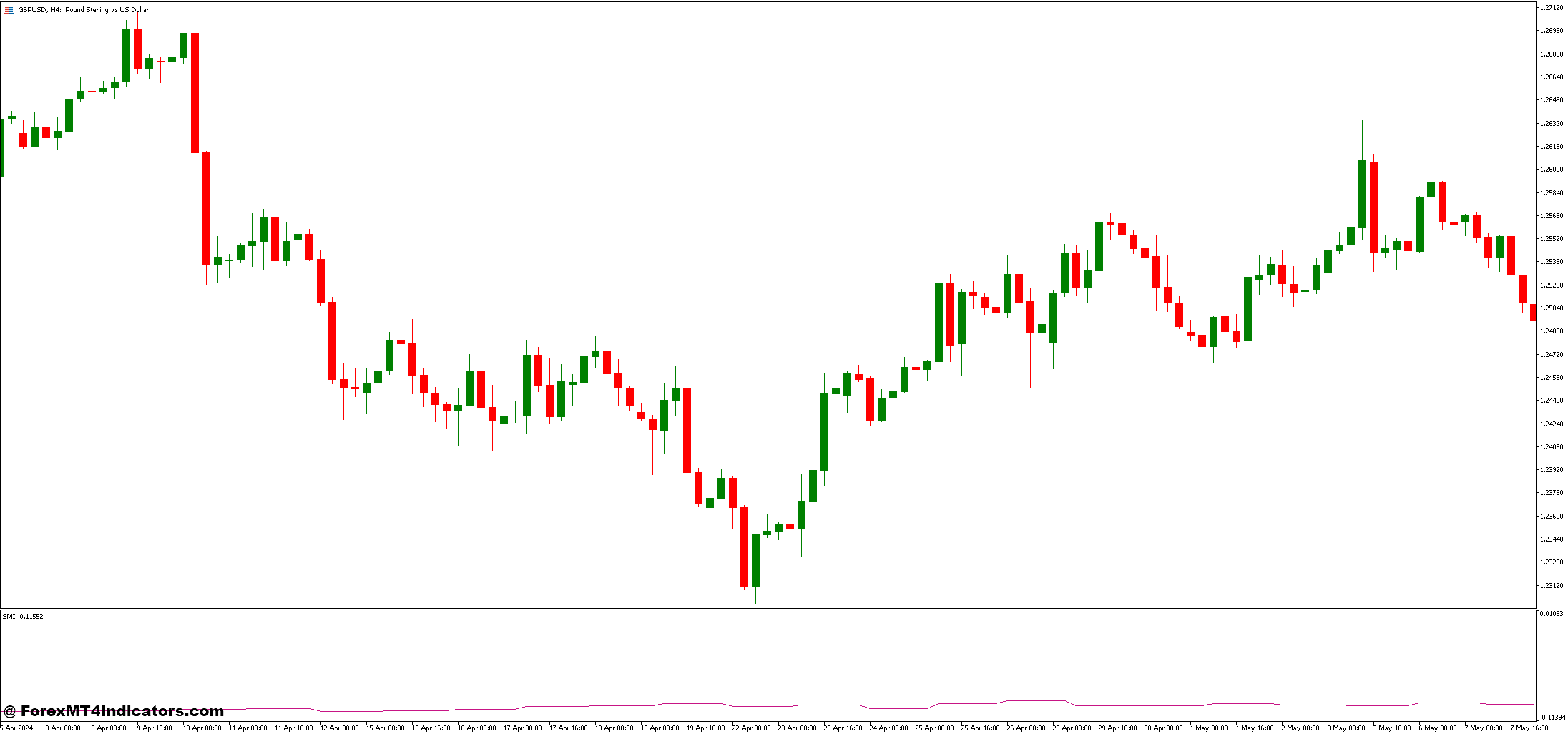

The Repulse SMI and Breakout Foreign exchange Buying and selling Technique combines two highly effective methods to boost the chance of profitable trades: the Repulse Smoothed Momentum Indicator (SMI) and breakout patterns. This technique is designed to determine high-probability buying and selling alternatives by recognizing sturdy momentum shifts and breakout indicators. Merchants utilizing this technique can successfully seize value actions that happen when the market breaks key help or resistance ranges, whereas additionally guaranteeing that momentum is aligned with the breakout route.

What’s the Repulse SMI?

The Repulse SMI is a variation of the standard Smoothed Momentum Indicator, which is broadly used to measure market momentum. Not like common momentum indicators that may be noisy, the Repulse SMI smooths the info to remove random fluctuations and spotlight the true market developments. The indicator helps merchants spot overbought and oversold circumstances and confirms when momentum is shifting, making it perfect for breakout methods.

When mixed with the breakout method, the Repulse SMI may give clear indicators in regards to the energy of a pattern. A key function of the Repulse SMI is its potential to determine when momentum is constructing in a sure route, making it a precious instrument for merchants trying to enter trades originally of sturdy value strikes.

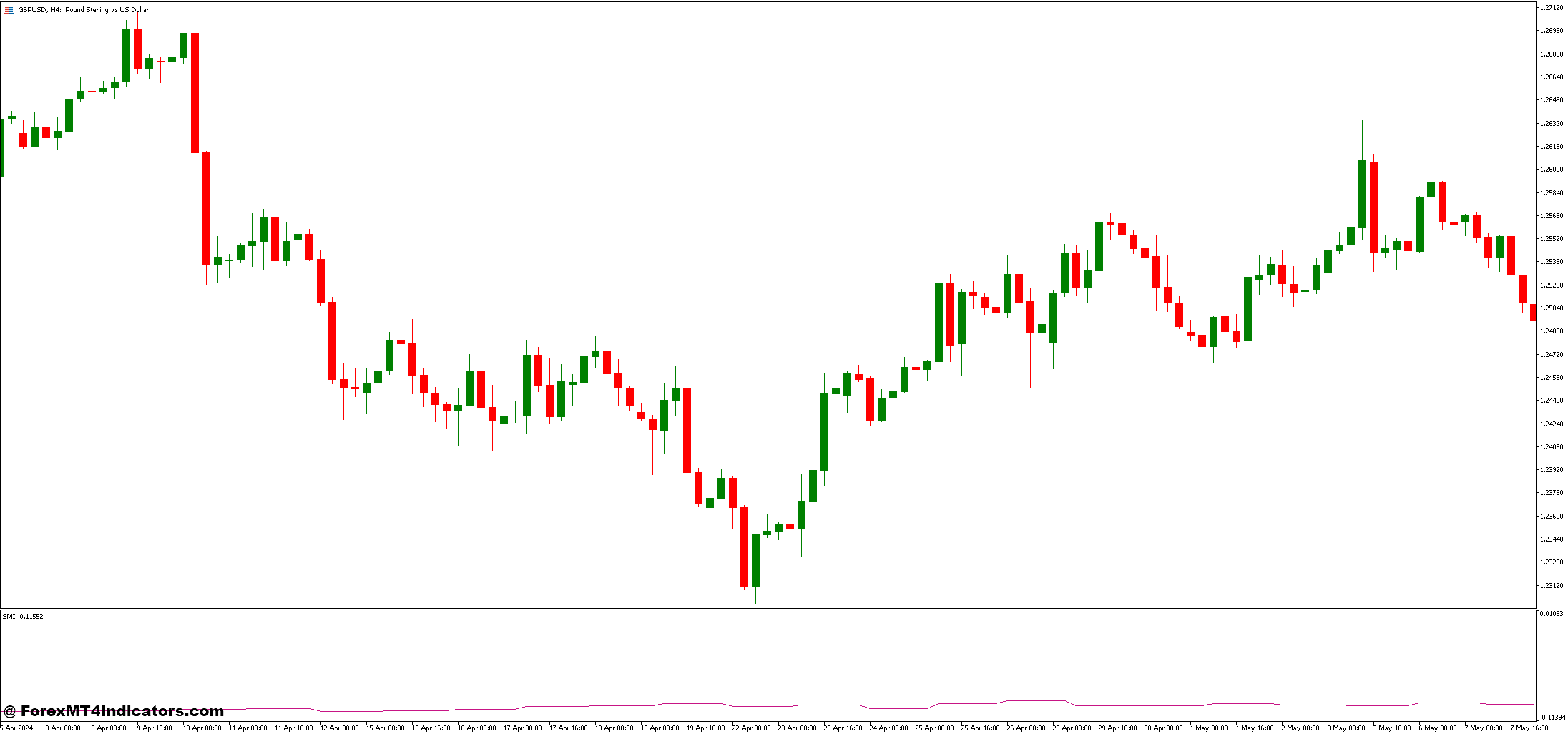

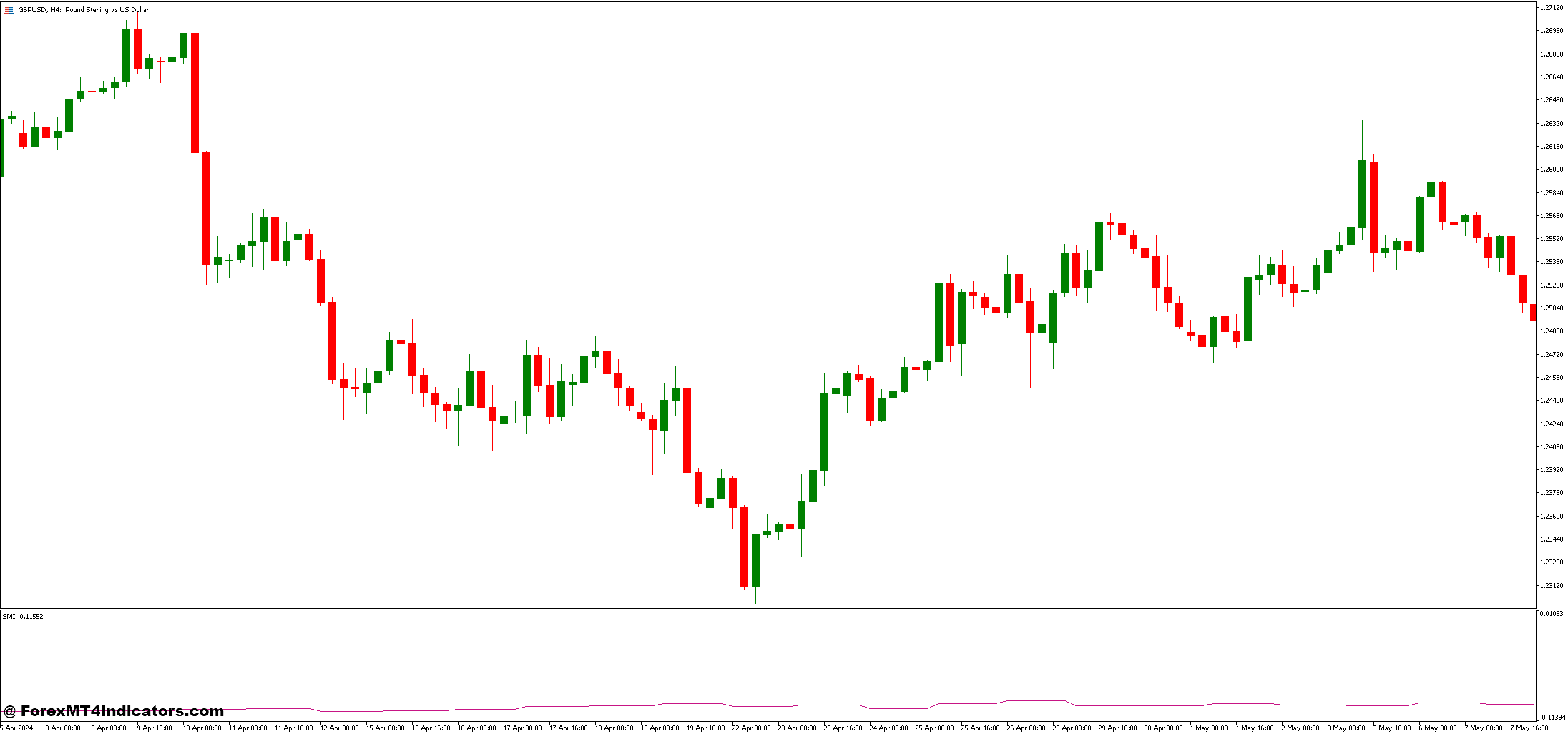

Repulse SMI Indicator

The Repulse SMI Indicator is a variation of the standard Smoothed Momentum Indicator (SMI), designed to supply a clearer and extra refined view of market momentum. The first benefit of the Repulse SMI over different momentum indicators is its potential to clean out market noise and filter out insignificant fluctuations, permitting merchants to higher concentrate on the real market developments.

Key Options of the Repulse SMI Indicator

- Smoothed Knowledge: The Repulse SMI is designed to remove the “noise” in market information, making it simpler for merchants to identify the precise pattern route. By smoothing value motion, it reduces the impression of short-term volatility, giving a extra dependable image of momentum.

- Momentum Evaluation: This indicator helps measure the energy and route of the market by evaluating the present value with a shifting common over a specified interval. Sturdy momentum signifies that the market is shifting in a transparent route, whereas weak momentum suggests consolidation or indecision.

- Overbought and Oversold Circumstances: Like many momentum indicators, the Repulse SMI is able to figuring out overbought and oversold circumstances. A market that’s in an overbought situation might quickly expertise a reversal, whereas an oversold situation might point out the potential for a bounce or upward value motion.

- Divergence Indicators: The Repulse SMI may also present precious divergence indicators, the place the worth makes new highs or lows, however the indicator fails to substantiate the transfer. This generally is a warning signal of a possible reversal or a weakening pattern.

Breakout Indicator

The Breakout Indicator is a buying and selling instrument used to determine potential breakout factors available in the market. A breakout happens when the worth strikes past a major help or resistance degree, typically accompanied by a rise in quantity or volatility. Breakout methods intention to seize massive value actions that comply with these breakouts, which usually mark the start of a brand new pattern.

Key Options of the Breakout Indicator

- Help and Resistance Ranges: The core precept of breakout buying and selling revolves round figuring out key help and resistance ranges. These are the worth ranges the place the market has traditionally reversed or consolidated. When the worth breaks by means of these ranges, it suggests that there’s sufficient momentum to proceed within the route of the breakout.

- Volatility and Quantity: Breakout indicators typically depend on elevated volatility and quantity to substantiate the validity of the breakout. A breakout accompanied by a major surge in quantity signifies that the breakout is prone to be sustained. Conversely, a breakout with low quantity might recommend that the transfer lacks energy and will reverse shortly.

- Sorts of Breakouts: Breakout indicators could be utilized to numerous market circumstances. Frequent kinds of breakouts embody:

- Worth Breakouts: When the worth strikes above resistance or beneath help.

- Chart Sample Breakouts: These happen when the worth breaks out from chart patterns like triangles, flags, or channels, signaling a continuation or reversal of the pattern.

- Vary Breakouts: Breakouts from tight buying and selling ranges the place the worth has been consolidating, signaling a possible shift in momentum.

- False Breakouts: One problem of breakout buying and selling is the prevalence of false breakouts, the place the worth breaks a key degree solely to reverse shortly afterward. Breakout indicators typically embody affirmation options reminiscent of quantity spikes or momentum indicators to cut back the chance of false breakouts.

Learn how to Commerce with Repulse SMI and Breakout Foreign exchange Buying and selling Technique

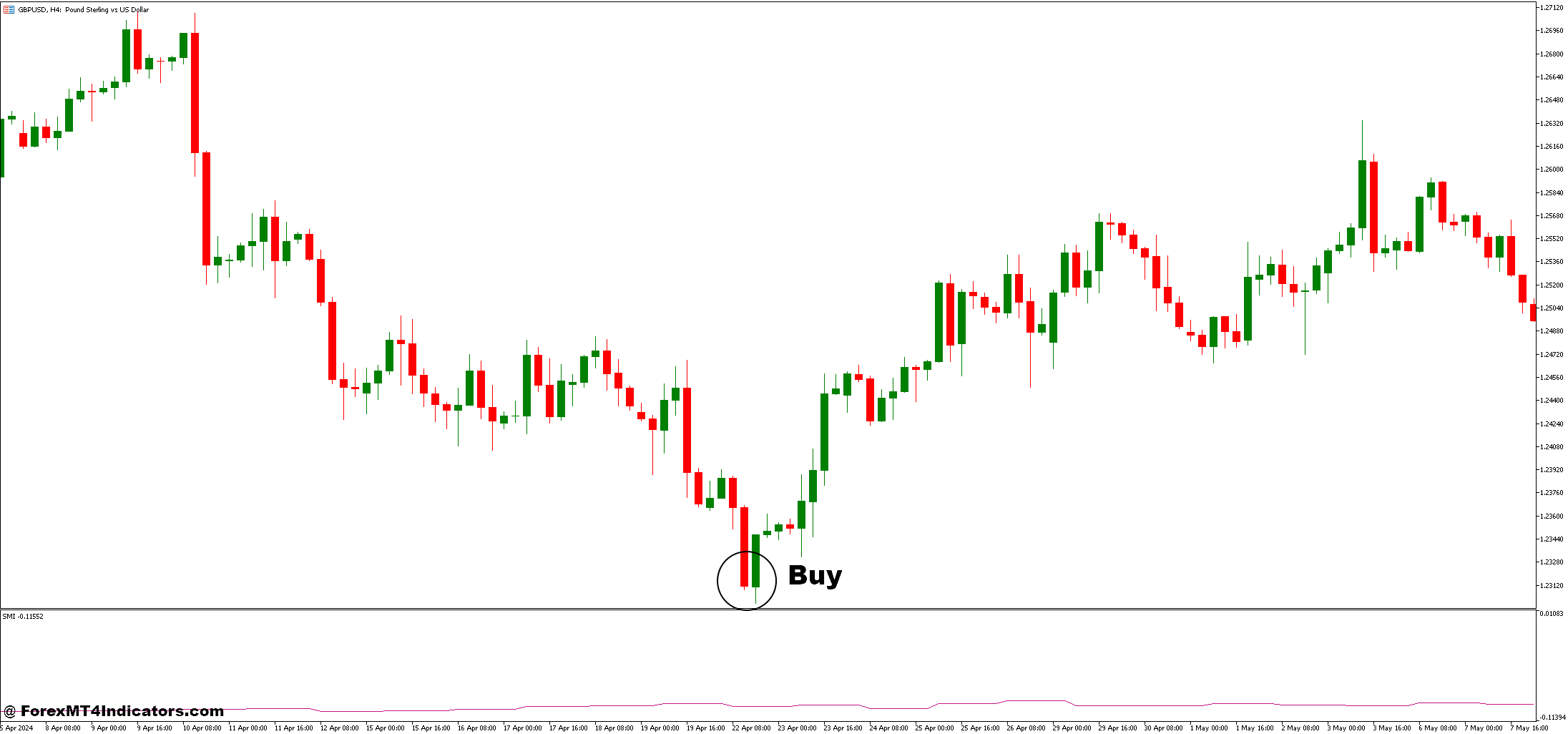

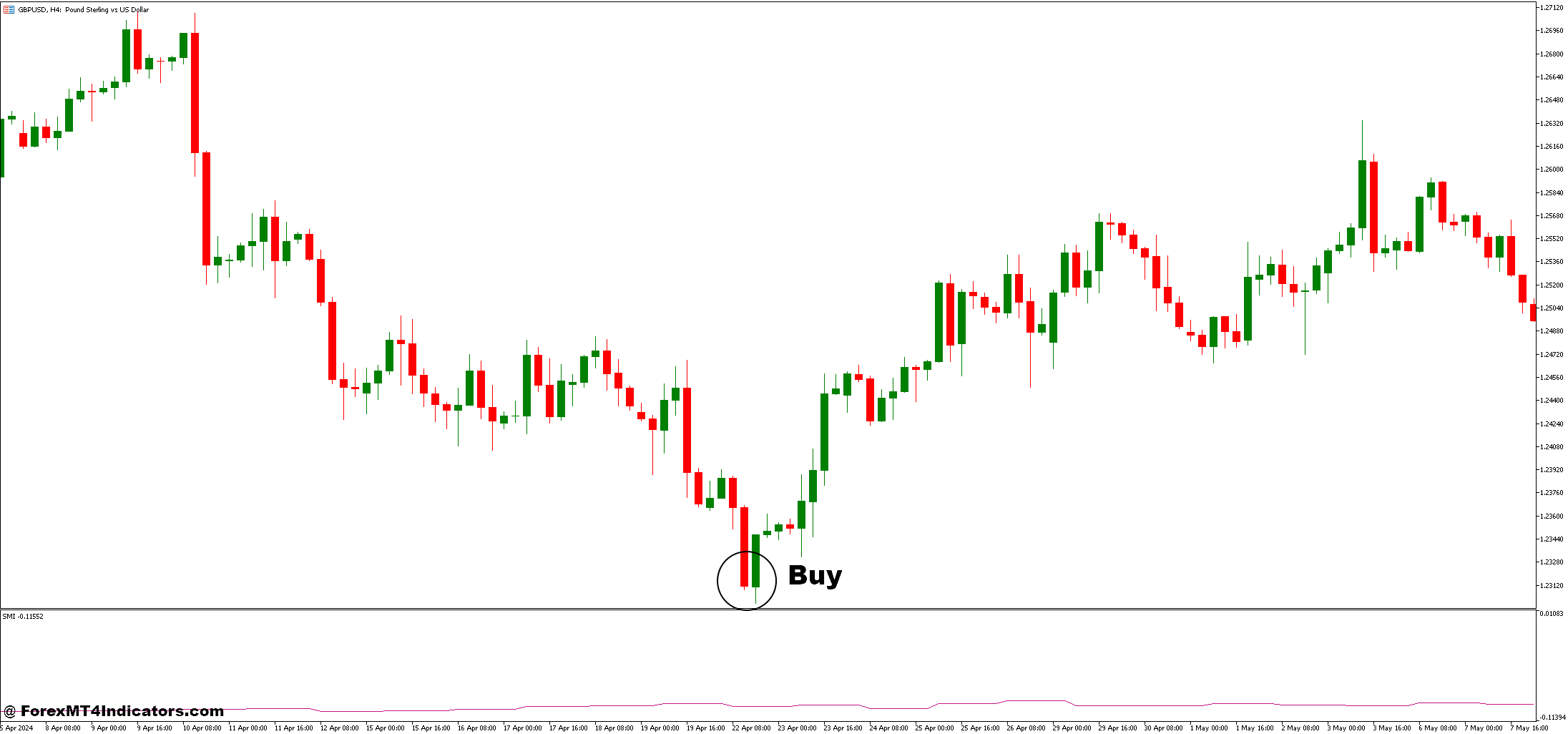

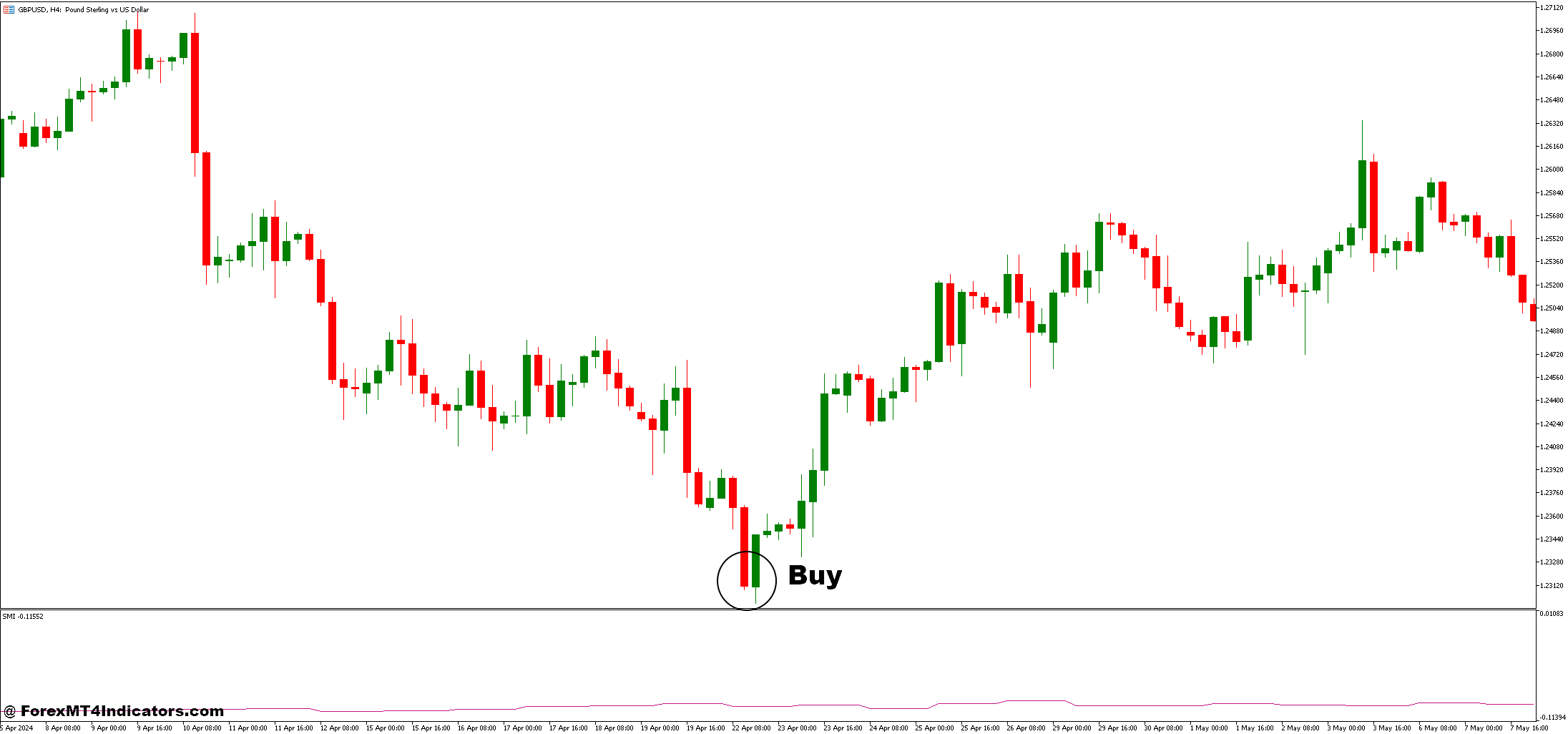

Purchase Entry

- Determine Key Resistance Stage: Find a major resistance degree on the chart.

- Look ahead to Breakout: Monitor the worth motion because it breaks above the recognized resistance degree.

- Verify with Repulse SMI: Make sure the Repulse SMI is above the zero line, confirming sturdy bullish momentum.

- Enter the Commerce: Enter a purchase place as soon as the worth has damaged above resistance and the Repulse SMI confirms constructive momentum.

- Set Cease Loss: Place a stop-loss slightly below the breakout degree or beneath the earlier swing low.

- Set Take Revenue: Place a take-profit degree based mostly on the subsequent key resistance or utilizing a good reward-to-risk ratio.

- Monitor Momentum: Constantly monitor the Repulse SMI for any indicators of momentum weakening. If the Repulse SMI begins to weaken or cross again into impartial, contemplate exiting the place.

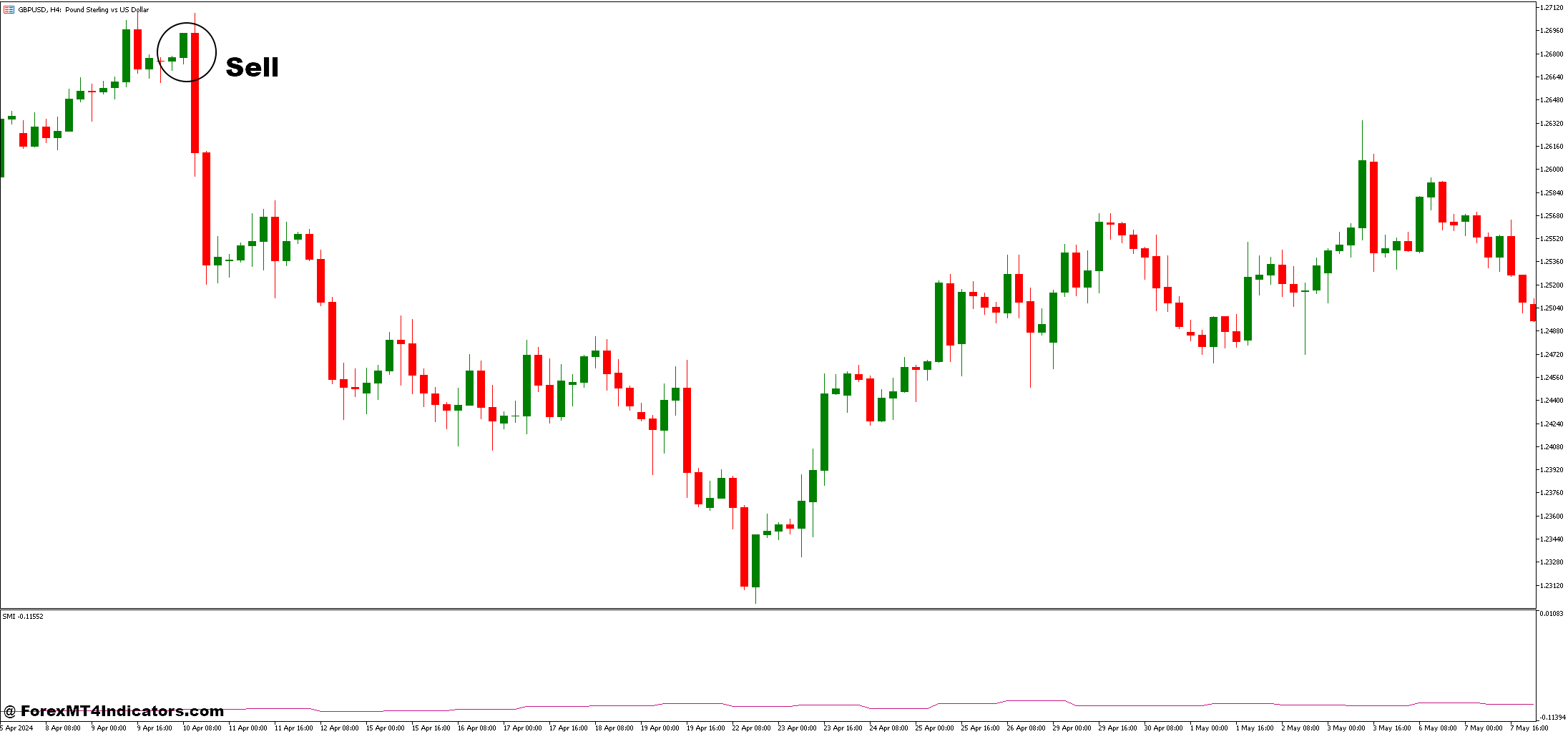

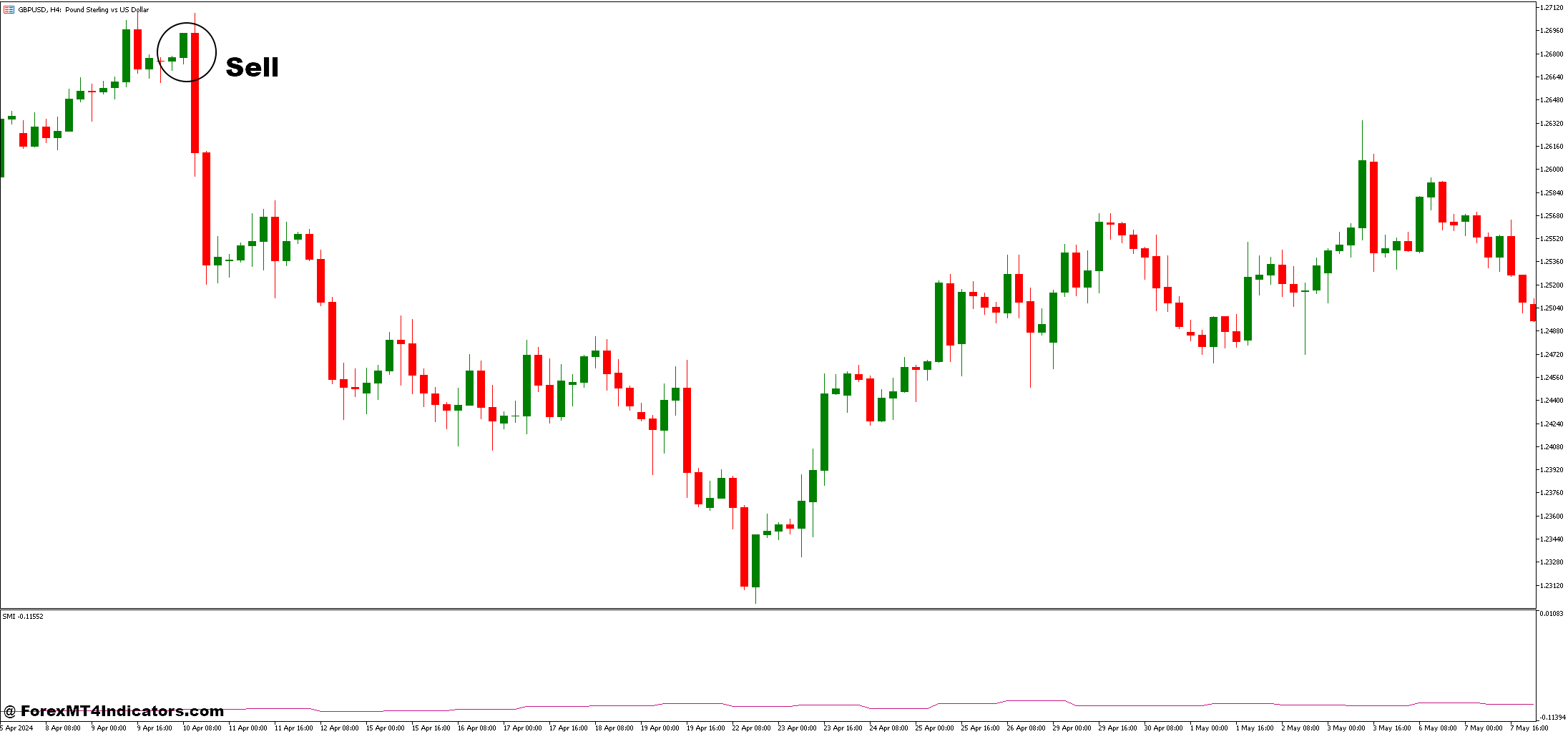

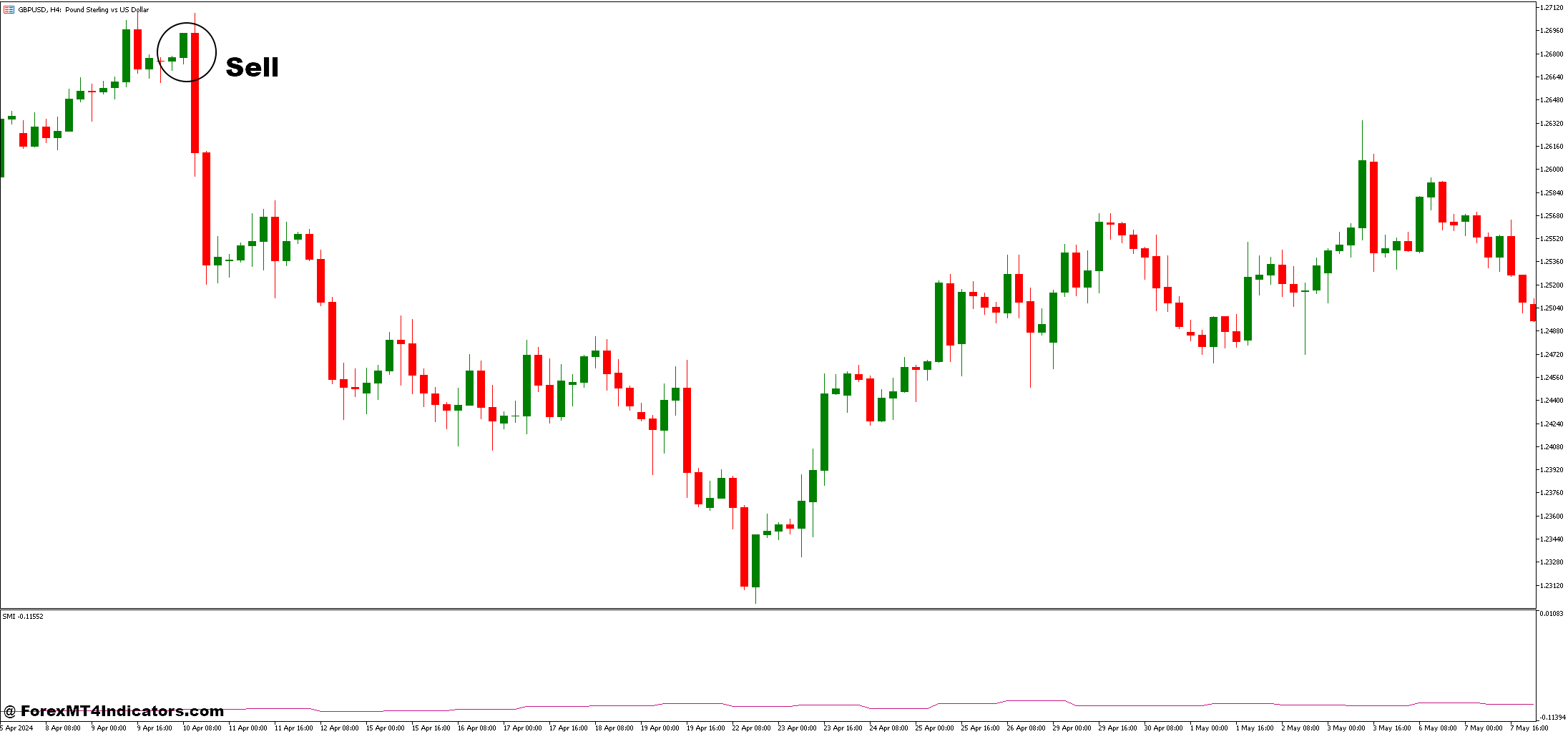

Promote Entry

- Determine Key Help Stage: Find a major help degree on the chart.

- Look ahead to Breakout: Look ahead to the worth to interrupt beneath the recognized help degree.

- Verify with Repulse SMI: Make sure the Repulse SMI is beneath the zero line, indicating bearish momentum.

- Enter the Commerce: Enter a promote place as soon as the worth has damaged beneath help and the Repulse SMI confirms adverse momentum.

- Set Cease Loss: Place a stop-loss simply above the breakout degree or above the earlier swing excessive.

- Set Take Revenue: Place a take-profit degree based mostly on the subsequent key help or utilizing a good reward-to-risk ratio.

- Monitor Momentum: Regulate the Repulse SMI. If it begins to indicate indicators of weakening or strikes into impartial territory, contemplate closing the commerce early.

Conclusion

The Repulse SMI and Breakout Foreign exchange Buying and selling Technique is a extremely efficient method for merchants trying to seize worthwhile developments with strong affirmation. By combining the facility of breakout methods, which determine key help and resistance ranges, with the momentum affirmation supplied by the Repulse SMI, this technique enhances your potential to enter trades with excessive chance and robust directional motion.

Really useful MT4 Dealer

XM Dealer

- Free $50 To Begin Buying and selling Immediately! (Withdraw-able Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Successful Foreign exchange Dealer

- Further Unique Bonuses All through The Yr

- Unique 50% Money Rebates for all Trades!

>> Signal Up for XM Dealer Account right here with Unique 50% Money Rebates For All Future Trades [Use This Special Invitation Link]

Already an XM shopper however lacking out on cashback? Open New Actual Account and Enter this Associate Code: 𝟕𝐖𝟑𝐉𝐐

Click on right here beneath to obtain:

Save

Save

Get Obtain Entry