Many merchants battle to identify tendencies within the foreign exchange market. On daily basis, over $5 trillion is traded globally, making it a fast-moving area. This weblog will clarify instruments and methods to determine tendencies with ease.

Hold studying—it’s less complicated than you suppose!

Key Takeaways

- Foreign exchange tendencies present worth motion over time, akin to uptrends, downtrends, or sideways tendencies. Figuring out them helps merchants make higher choices and scale back dangers.

- Instruments like transferring averages, RSI, Bollinger Bands, and MACD assist spot tendencies and predict modifications in foreign money costs successfully.

- Highs and lows on charts reveal pattern energy. Decrease highs/lows sign bearish actions whereas shorter gaps between retests trace at weaker demand or reversals.

- Widespread patterns embrace uptrend (increased highs), downtrend (decrease lows), and sideways pattern (flat motion). These information merchants on entry or exit factors for trades.

- Recognizing early tendencies permits merchants to behave quick in a $7 trillion each day foreign exchange market utilizing easy instruments for smarter methods.

How To Spot Traits In Foreign exchange Market Worth Actions

Foreign exchange tendencies present how foreign money costs transfer over time. Recognizing these tendencies helps merchants make higher choices and discover probabilities to commerce.

Understanding the Idea of Traits within the Foreign exchange Market

Traits within the foreign exchange market present how a foreign money pair’s worth strikes over time. Costs could rise (uptrend), fall (downtrend), or keep flat (sideways pattern). These tendencies usually repeat as a result of patterns like provide and demand or market sentiment.

Figuring out these actions helps merchants spot buying and selling alternatives.

Many elements form tendencies, akin to rates of interest, inflation, and financial tendencies progress. For instance, increased rates of interest usually strengthen a foreign money, creating an upward pattern. Merchants analyze worth knowledge and use technical evaluation instruments to find out the route of the pattern successfully.

The Significance of Figuring out Traits for Profitable Buying and selling

Figuring out tendencies helps merchants make smarter choices. Use tendencies to point out the place the market is heading, serving to merchants predict future worth actions. As an example, a robust uptrend with increased highs and better lows usually alerts probabilities to purchase.

Recognizing a pattern early will increase earnings in foreign currency trading with the pattern. It permits merchants to comply with the prevailing pattern as a substitute of going towards it, decreasing dangers. Pattern modifications sign reversals, akin to a foreign money shifting from an upward to a downward motion.

Instruments for Figuring out Foreign exchange Traits

Merchants use instruments to identify and comply with tendencies in foreign exchange markets. These instruments assist make sense of worth modifications, exhibiting clear alerts for motion.

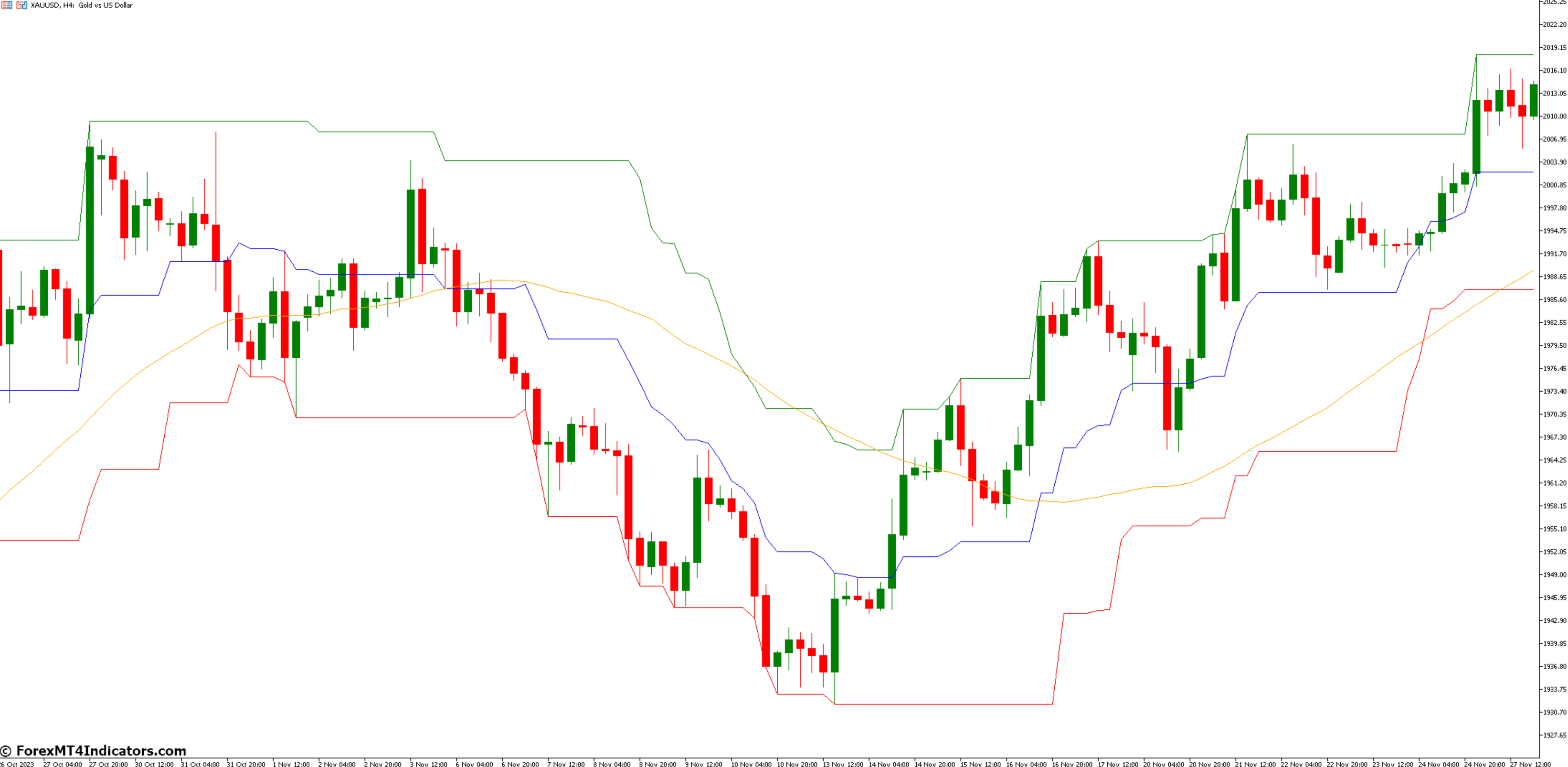

Shifting Averages

Shifting averages present the typical worth patterns over a set time. A 20-day transferring common recalculates each day utilizing the final 20 days. They clean out worth motion, making tendencies clearer.

If the present worth stays above the transferring common, it alerts an uptrend. If it falls under, this implies a downtrend would possibly exist. This software helps foreign exchange merchants make knowledgeable buying and selling choices based mostly on market pattern indicators.

Relative Power Index (RSI)

RSI works nicely with transferring averages to determine a pattern in foreign exchange. It measures the velocity and dimension of worth actions over 14 days. Merchants use this software to verify if a foreign money pair is overbought or oversold.

Values go from 0–100. A rating above 70 alerts overbought situations, which means a downward pattern could begin quickly. Under 30 suggests oversold ranges, pointing to an upward pattern buying and selling reversal.

This helps merchants spot modifications early and plan trades higher.

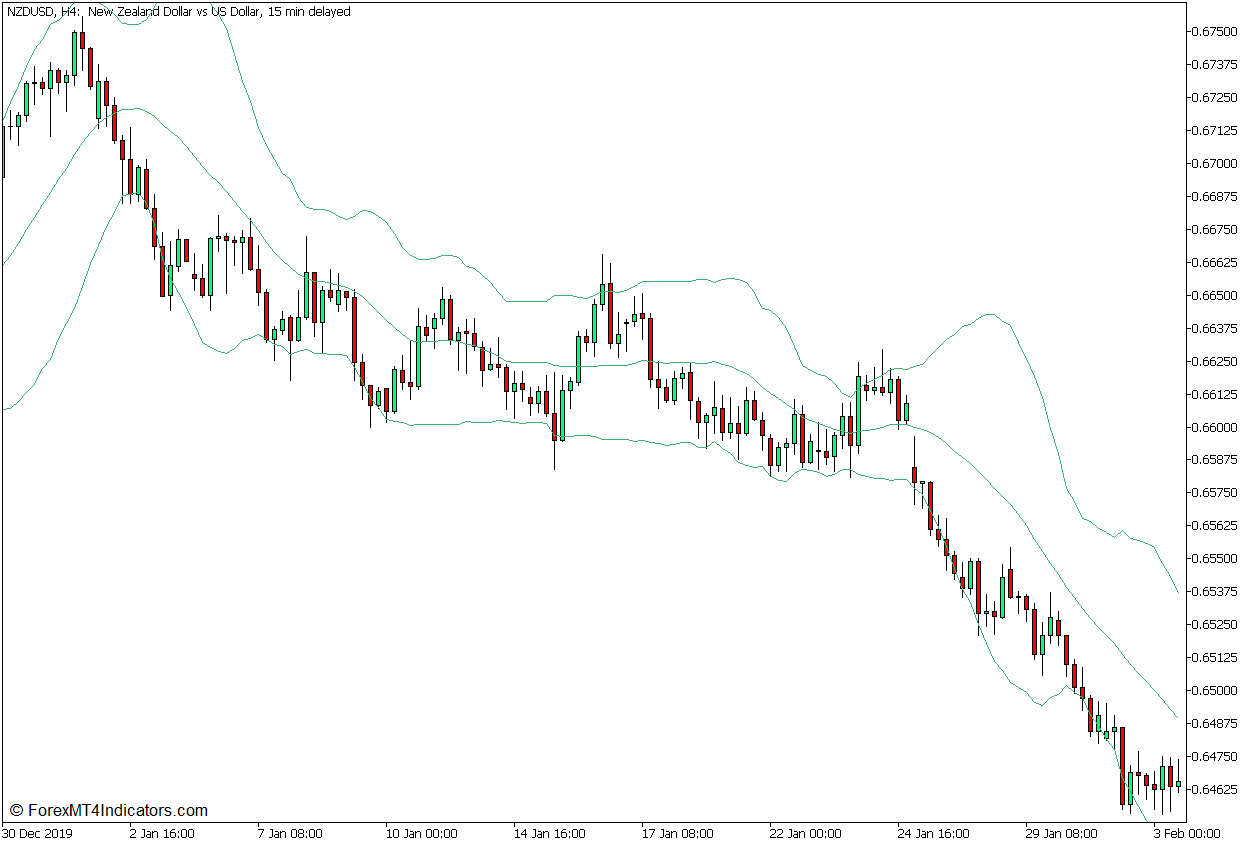

Bollinger Bands

Bollinger Bands measures worth volatility. They create three strains—an higher band, a decrease band, and a center line, which is normally a 20-day transferring common. Costs nearing the higher band present an uptrend or bullish strain.

If costs drop close to the decrease band, it alerts a downtrend or bearish motion.

Merchants depend on these bands to determine tendencies and potential reversals in foreign exchange market exercise. A powerful pattern usually pushes costs outdoors these bands briefly earlier than pulling them again inside them.

This software helps merchants assess momentum and predict modifications in worth route successfully with out relying solely on closing worth knowledge.

Shifting Common Convergence Divergence (MACD)

MACD makes use of two transferring averages to point out pattern modifications. A brief-term common crossing above a long-term one alerts an uptrend. Crossing under it exhibits a downtrend as a substitute.

Merchants use MACD to determine the route of tendencies in foreign currency trading methods. It really works nicely for figuring out weak and powerful tendencies in foreign money pairs just like the Euro or Japanese Yen.

This indicator helps traders act early on worth motion evaluation.

Strategies to Decide Pattern Power

Recognizing pattern energy helps merchants see if a worth transfer will final or fade. Study easy methods to verify the ability of tendencies—this step can enhance your buying and selling sport!

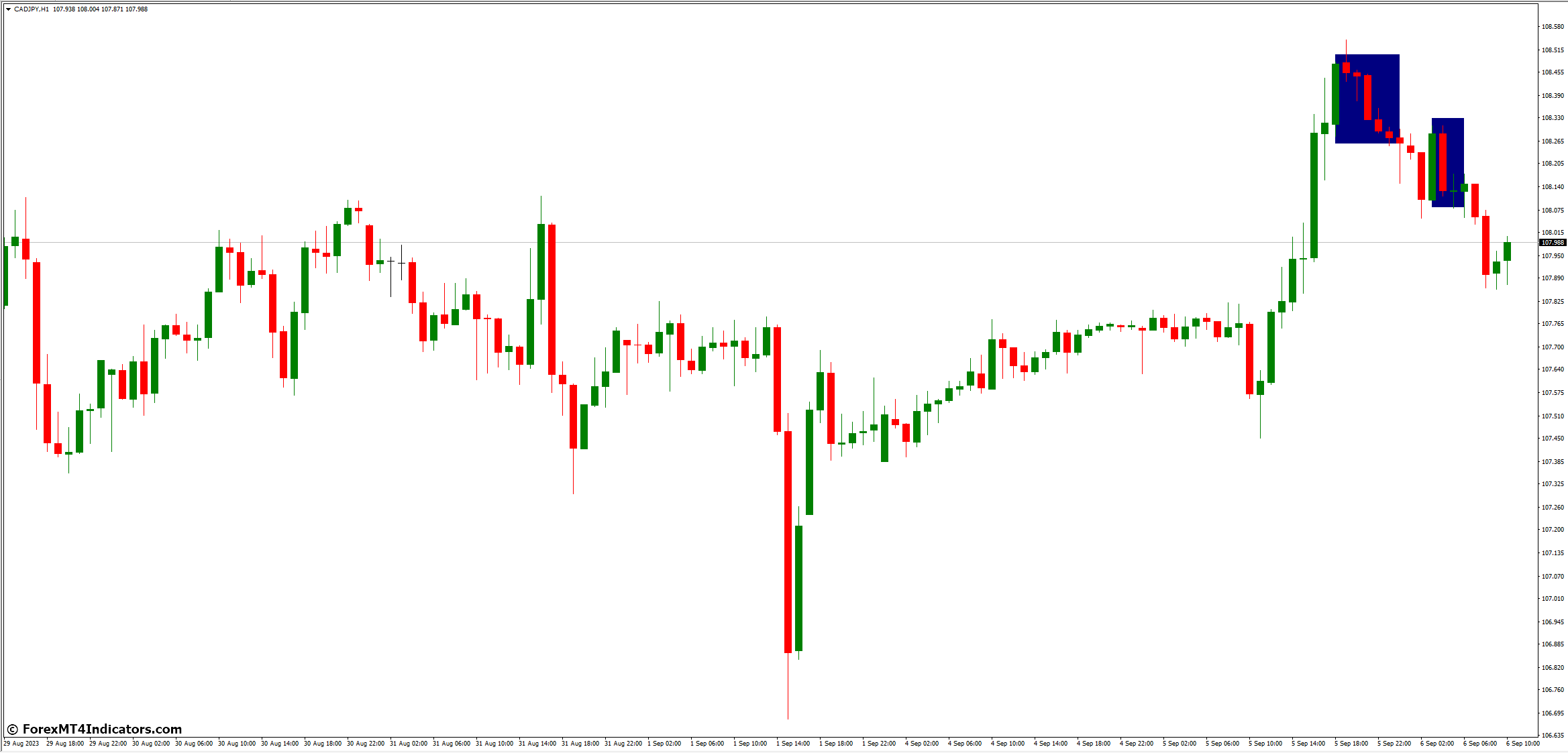

Analyzing Highs and Lows

Decrease highs and decrease lows sign a bearish pattern. For instance, a GBP/USD each day chart with a rounding prime sample usually exhibits these alerts earlier than reversing. Merchants monitor swing highs/lows to verify the energy of this pattern.

Highs clustering close to resistance trace at weak upward momentum. However, decrease lows reaching new ranges present stronger downtrends. Observing these patterns lets merchants determine tendencies and decide modifications early on in worth actions.

Measuring the Distance Between Worth Retests

Shorter gaps between worth retests counsel weaker demand. If the gap shrinks, it might sign a possible breakdown. For instance, within the foreign exchange market, EUR/USD examined assist over 256 days.

Afterward, it dropped an enormous 3,300 pips in simply 44 weeks.

Merchants ought to watch how briskly the value strikes again to key ranges like helps or resistances. A tightening sample usually predicts decrease momentum and pattern reversal. Utilizing technical evaluation instruments akin to Shifting Averages will help monitor these shifts successfully inside numerous foreign money pairs’ actions.

Utilizing Clustering Worth Motion

Heavy worth motion close to necessary ranges could sign a market reversal. As an example, AUD/USD dropped by 680 pips in 30 days after breaking down from such a stage. Clustering seems the place many candles type shut collectively on charts, exhibiting hesitation or doable change in pattern route.

Merchants ought to deal with these clusters at assist and resistance zones to determine tendencies within the foreign exchange market. By studying worth motion inside these areas, they will decide if the present pattern will proceed or reverse.

This technique helps forecast future actions with out relying solely on indicators.

Widespread Pattern Patterns in Foreign exchange

Merchants usually observe patterns that present if costs transfer up, down, or keep flat. Recognizing these tendencies helps merchants determine one of the best time to enter or exit trades based mostly on worth motion.

Uptrend and Downtrend

An uptrend exhibits costs transferring increased over time. It types increased highs and better lows on a chart. Merchants use lengthy trades throughout sturdy tendencies with rising alternate charges, aiming to revenue as the value climbs.

A downtrend occurs when costs drop constantly. It creates decrease lows and decrease highs. Weak tendencies could present steep pullbacks, making it dangerous to carry positions for too lengthy. Figuring out these patterns helps merchants determine commerce foreign exchange successfully in a trending market.

Sideways Pattern

A sideways pattern exhibits horizontal worth motion. It lacks a robust uptrend or downtrend. The foreign money pair worth is transferring inside a decent vary, reflecting indecision available in the market.

This sample can final for hours, days, and even weeks.

Merchants use instruments like Bollinger Bands to verify this pattern. Figuring out it helps them put together for doable breakouts. Sideways tendencies usually happen earlier than huge strikes within the foreign exchange market, making them essential for strategic buying and selling choices.

Conclusion

Recognizing tendencies within the foreign exchange market is essential for good buying and selling. Instruments like transferring averages and RSI assist merchants learn worth modifications. Watching highs, lows, and patterns boosts confidence in choices.

Traits information methods for each day buying and selling and investments. Use these strategies to commerce the foreign exchange properly each time!