Is that this it? Are we again? Everybody within the startup and enterprise world has been ready for months for the re-opening of the IPO window. After a report breaking 2021 (1035 IPOs, beating the earlier report of 480 in 2020), 2022 noticed a dramatic decline (181 IPOs) and 2023 to date has not been a lot better.

Widespread knowledge available in the market over the previous few months has been that This autumn 2023 could be the time the IPO window would cautiously re-open for know-how corporations (latest non-tech IPOs like restaurant chain Cava being thought-about non-representative). And it might be essential that among the perfect corporations (the standard suspects being Stripe, Databricks and Instacart) would exit first, to pave the best way for a much bigger wave of high quality corporations proper behind them.

Effectively, this week has been an thrilling one – on Monday, ARM filed its F-1 (right here) and simply at the moment (Friday August 25), each Instacart (right here) and Klaviyo (right here) filed their S-1s. It’s going to be thrilling to see what occurs this Fall in IPO land.

New IPO filings additionally imply recent alternatives for the time-honored VC custom of S-1 breakdowns, though timing is unlucky given summer time trip schedule – right here and right here.

According to my normal investing deal with information and ML/AI, I’m going to choose Klaviyo for this primary breakdown of 2023, because it’s a closely data-driven enterprise. As I did up to now (see the S-1 fast teardowns for Snowflake, Palantir, Confluent, C3, nCino), that is meant as a QUICK breakdown – largely unedited notes and off-the-cuff ideas, in bullet level format.

Let’s dig in.

HIGH LEVEL THOUGHTS:

- The enterprise: information and ML/AI on the core. Klaviyo is a advertising automation platform, used primarily for e mail advertising and SMS advertising. It is usually, and maybe foremost, an information infrastructure enterprise with sturdy predictive analytics/ML/AI capabilities:

- Klaviyo really didn’t begin as an e mail automation play, however as a substitute as an e-Commerce targeted database to retailer disparate information sorts — occasions, paperwork and object information fashions.

- Because it developed into advertising automation, the entire premise of Klaviyo has been to empower e-commerce manufacturers to personal their buyer information, and create data-driven, customized expertise by way of owned channels (e mail and SMS). That is in distinction to promoting by way of giant retailers or marketplaces that don’t give manufacturers entry to the underlying shopper information and continuously change their algorithms.

- Leveraging one’s buyer information in an omni-channel, complicated world is just not getting any simpler: “Companies at the moment battle to ship impactful shopper experiences as a result of they can not successfully harness more and more complicated shopper information. […] As consumer monitoring guidelines change, third-party information has develop into unreliable, sophisticated, and costly to make use of. In the meantime, the proliferation of first-party information has made it tough for companies to combination, synthesize, and use these disparate information units.“

- From the start of the S-1, Klaviyo clearly defines itself as being closely pushed by information, ML and AI: “Our fashionable and intuitive SaaS platform combines our proprietary information and software layers into one vertically-integrated answer with superior machine studying and synthetic intelligence capabilities“.

- The time period “synthetic intelligence” is barely talked about 17 occasions within the S-1, a modest quantity given we’re at (or barely previous) the highest of the Generative AI hype cycle

- The Klaviyo platform has two core parts:

- Knowledge layer: Klaviyo has constructed from the bottom up a highly-scalable platform optimized for big volumes of information, sub-second-level accessibility, and excessive ranges of personalization and attribution. It could course of information from over 300 native integrations and open APIs and synchronize unaggregated, historic profile information with real-time occasion information in a single system-of-record.

- Utility layer: Klaviyo constructed an software layer on high of their information layer, which allows clients to create and handle focused advertising campaigns and flows, observe buyer conduct, and analyze marketing campaign efficiency – with out the necessity to rent in-house engineers, as Klaviyo has a powerful no-code element. The applying layer additionally provides built-in superior information science and predictive analytics capabilities to estimate shopper lifetime worth, predict a shopper’s subsequent order date, and calculate potential churn danger.

- Winner doesn’t take all?

- The final consensus is that any class in SaaS obeys a “winner take all”, energy regulation dynamic the place the market chief reaps all of the rewards, with maybe a #2 firm trailing behind, however everybody else struggling and in the end disappearing

- Nevertheless, apparently, the success of Klaviyo and its IPO appears to go in opposition to that consensus view. The ESP (e mail service supplier) market is extremely crowded, with a complete vary of massive gamers from MailChimp to Adobe to Salesforce, in addition to a bunch of newer startups (see this Gartner listing of e mail advertising corporations). Whereas the massive gamers don’t essentially break down the dimensions of their advertising automation companies of their public paperwork, we all know that not less than MailChimp was greater in revenues in 2021 (when it was acquired by Intuit) than Klaviyo is at the moment – about $1B for MailChimp then vs $585M for Klaviyo at the moment (not an ideal comparability, however directionally useful). But Klaviyo, whereas not being the 800 pound gorilla within the area, has nonetheless been performing impressively nicely (see metrics beneath). Possibly it has to do with the notably giant dimension of the ESP / advertising automation market; or the truth that Klaviyo has targeted deeply on one particular vertical (retail/eCommerce, notably Shopify retailers); or the truth that obstacles to entry and aggressive benefit could or could not final and compound within the SaaS world as a lot as incumbents would hope. In any case, the very fact stays that the ESP/advertising automation market has produced a number of very giant gamers, versus a single hyper-dominant chief.

- Shopify & Platform dependency: Klaviyo has been very a lot targeted on the Shopify ecosystem of small to medium-sized manufacturers, and it’s been an attention-grabbing dance to look at:

- Whereas it has constructed numerous partnerships over time (BigCommerce, Woo Commerce, Wix and many others), Klaviyo has *main* overlap with Shopify: 77.5% of its whole ARR in 2022 got here from clients who use the Shopify platform, so it’s majorly depending on how Shopify treats it.

- “Shopify” is talked about 198 occasions within the S-1.

- It clearly highlights Shopify as a danger issue within the S-1: “Our enterprise and success rely, partially, on our capacity to efficiently combine with third-party platforms, particularly with eCommerce platforms resembling Shopify, and our enterprise could be harmed because of any disruptions to those third-party platform integrations or {our relationships} with third-party platform suppliers“

- On the identical time, Shopify has a transparent curiosity within the continued success of Klaviyo:

- Shopify has been positioning itself for nicely over a decade as a platform on high of which different companies may thrive, and Klaviyo is without doubt one of the crown jewels of that effort

- Shopify can also be a significant investor in Klaviyo (see beneath), with a strategic partnership besides. The S-1 gives some particulars (p 108) concerning the partnership settlement they entered in July 2022 – it entails a income sharing settlement, widespread inventory warrant settlement, and a inventory buy settlement.

- Whereas it has constructed numerous partnerships over time (BigCommerce, Woo Commerce, Wix and many others), Klaviyo has *main* overlap with Shopify: 77.5% of its whole ARR in 2022 got here from clients who use the Shopify platform, so it’s majorly depending on how Shopify treats it.

- Bootstrapping origins. Whereas it has raised some huge cash ($454.8M in major), and was most valued at $9.5B, Klaviyo is just not your typical Silicon Valley story.

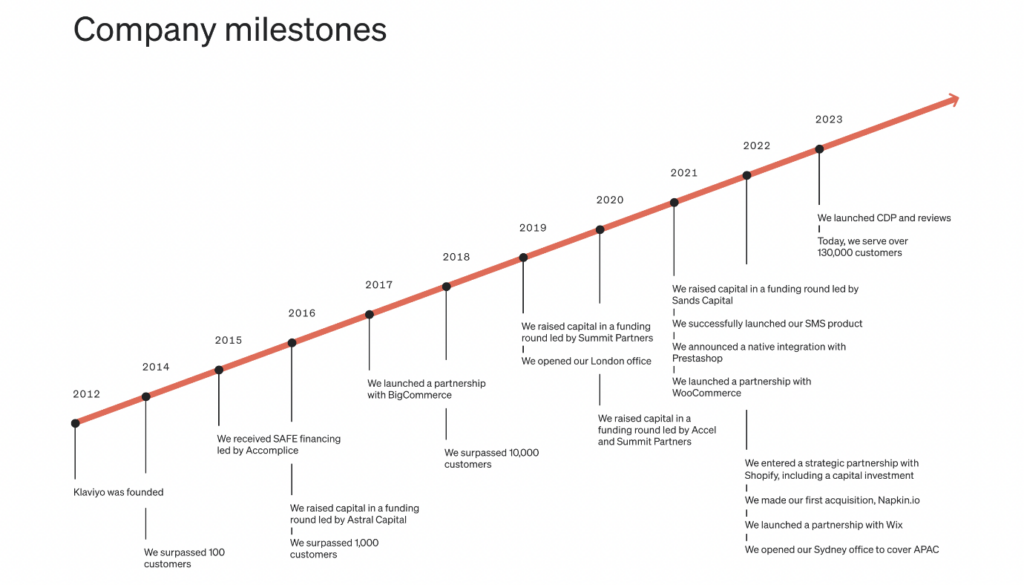

- Andrew Bialecki (who goes by “AB”) and Ed Hallen based Klaviyo in Boston in 2012 and bootstrapped the enterprise for 3 years as a worthwhile firm. Then for the following 3 years, they solely raised a complete of $8.5M ($1.5 in a seed in 2015 and $7M in a Sequence A in 2017), in line with Crunchbase. Klaviyo did find yourself elevating massive rounds of funding (beginning with a $150M Sequence B in 2019), however the enterprise was already thriving by then, commanding larger valuations and resulting in decrease dilution for the founders.

- Because of this, it largely bypassed the normal Silicon Valley ecosystem. Whereas it did increase from Boston VC agency Confederate (which owns 5.7% of the corporate earlier than the IPO) in early rounds, most of its funding got here from personal fairness agency Summit Companions (which owns 22.9% of the Class B shares earlier than the IPO) and strategic investor Shopify (which owns 11.2% earlier than the IPO).

- As a significant advantage of its bootstrapping origins, the biggest shareholder remains to be CEO Andrew Bialecki, who controls 38.1% of the Class B shares earlier than the IPO.

FINANCIALS & METRICS

Klaviyo has spectacular metrics throughout.

Financials

- Huge income quantity: Complete income was $585.1M, for the 12 months ended June 30, 2023

- Spectacular development (at this scale and given the harder setting): income grew at 56.5%, for the 12 months ended June 30, 2023

- Gross margin: 75%

- In contrast to most of its SaaS friends, Klaviyo is worthwhile: it had web earnings of $15M on income of $321M for the primary six months of the 12 months, in contrast with a lack of $25M on income of $208M for a similar interval final 12 months.

- Free Money Move margin: 8%

- Profitability appears to be a latest factor (not less than since its bootstrapping years), nonetheless: on an annual foundation, it had a $9.5M GAPP web loss for the 12 months ended June 30, 2023.

- Money: $439.8M on the stability sheet as of June. That is notably spectacular given $454.8M raised in major over the corporate’s historical past because it implies that, on a web foundation, the corporate solely burned $15M of capital, pointing to very excessive enterprise effectivity.

Metrics:

- Excessive web retention, notably given the variety of SMBs in its buyer base (see beneath): 119% NDR, as of June 30, 2023

- Land-and-expand technique is essentially targeted on product-led development

- Broaden in three major methods.

- As clients enhance their utilization, they transfer to larger subscription tiers.

- Klaviyo cross-sells extra communication channels, resembling SMS to clients who began with e mail providing, in addition to add-ons, resembling evaluations and their CDP providing.

- For bigger clients, Klaviyo sells its platform to their clients’ different manufacturers, enterprise items, and geographies.

- 130,000 clients at an ACV of about 5k

- 1,458 clients at greater than $50k ARR as of June 30, 2023, representing development of 94% year-over-year. That is the results of a gross sales push upmarket in the direction of bigger clients.

- CAC payback interval of solely 14 months for the quarter ended June 30, 2023.

- 42% of income on S&M over the past 12 months

- Glorious rule of 40 at 65%

- International workforce of 1,500+ staff (not that prime a quantity given income, a part of the effectivity constructed into the enterprise – $390k of income per worker?)

- Huge quantities of buyer information: “As of June 30, 2023, we assembled over 6.9 billion shopper profiles throughout our buyer base, and within the twelve month interval ended June 30, 2023, we processed over 695 billion occasions, that are information on how shoppers interact throughout channels, resembling opening an e mail, looking a web site, or inserting an order.“

CONCLUSION:

- High-quality firm with spectacular metrics

- Profitability and total effectivity of the enterprise very a lot aligned with present market temper and expectations

- Whereas (arguably) much less of a generational firm in comparison with a Stripe or Databricks (or Snowflake), it ought to have a really profitable IPO, assuming macro cooperates, and strongly contribute to re-opening the IPO window for others

- Does increase the bar fairly a bit for others doubtlessly following, given profitability and effectivity whereas rising strongly