Purpose to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade consultants and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Ethereum is buying and selling slightly below the $2,500 mark, struggling to reclaim larger floor as bearish momentum picks up throughout the broader crypto market. After repeated failed makes an attempt to interrupt previous resistance, ETH now sits below heavy promoting stress, elevating issues a couple of deeper correction. Bulls look like shedding management as total market sentiment weakens amid international financial uncertainty and the persistent weight of rising US Treasury yields. Some market members at the moment are bracing for a big downturn if Ethereum fails to carry above key demand zones.

Associated Studying

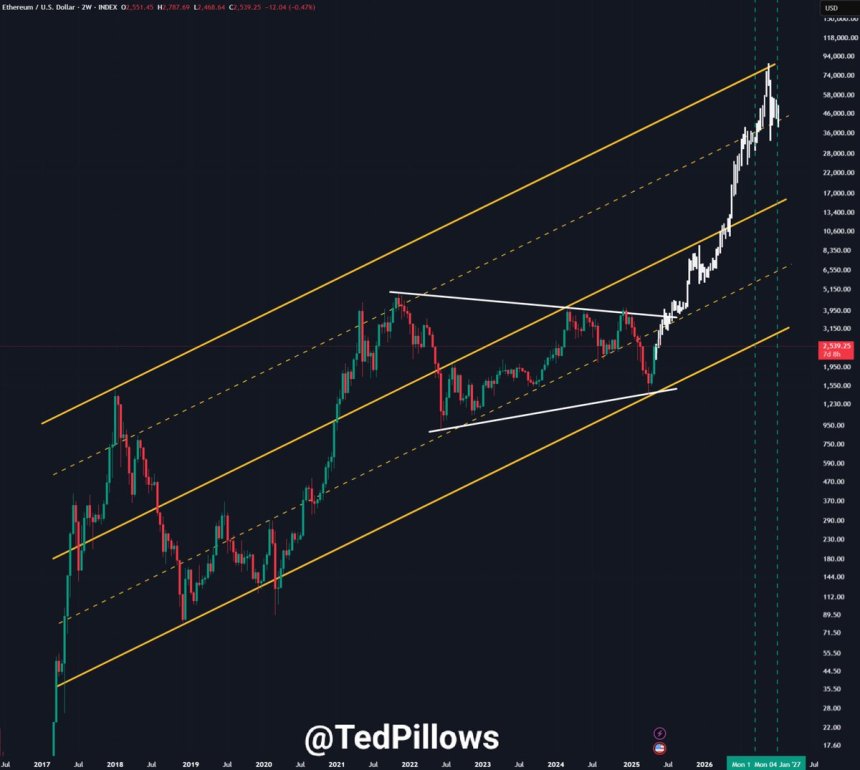

Nonetheless, not everybody is popping bearish. Some outstanding analysts preserve a extremely bullish long-term view, arguing that Ethereum nonetheless has vital upside this cycle. In line with Ted Pillows, Ethereum might attain $10,000 earlier than the cycle ends. From his perspective, present value motion represents a brief dip reasonably than a development reversal, and accumulating throughout weak point is the smarter transfer for long-term traders.

Whereas short-term uncertainty dominates headlines, long-term conviction stays robust amongst Ethereum supporters who level to rising institutional curiosity, declining change provide, and the general maturing of the Ethereum ecosystem as causes to remain optimistic. For now, ETH’s place just below $2,500 units the stage for a essential check within the days forward.

Ethereum Analysts Eye Breakout Potential

Ethereum is at the moment testing an important help degree at $2,500 after repeatedly reaching the $2,700 resistance over the previous few weeks. This zone has confirmed troublesome to interrupt, however bulls are nonetheless holding the road. If ETH manages to reclaim the higher vary and shut above it, analysts consider it might ignite the altseason the market has been ready for.

Regardless of Ethereum’s underperformance over the previous 12 months, marked by an absence of sustained momentum and vital promoting stress, the latest value motion suggests a shift. Over the previous few weeks, ETH has entered a extra bullish section, supported by growing on-chain exercise and stronger demand.

Some analysts stay firmly bullish. Ted Pillows, for instance, has projected that Ethereum is headed above $10,000 this cycle. Whereas short-term volatility could trigger concern, long-term conviction stays robust. For a lot of traders, the message is obvious: embrace the dips, accumulate strategically, and keep away from panic promoting.

Technical sentiment throughout the board is popping cautiously optimistic. Market watchers level to Ethereum’s resilience on the $2,500 degree as an indication of constructing power. If this help holds and bulls step in with quantity, the breakout above $2,700 might be swift and aggressive.

Associated Studying

ETH Assessments Key Help As Bulls Defend $2,500

Ethereum is at the moment buying and selling round $2,488 after a 2% day by day drop, exhibiting continued weak point under the essential $2,700 resistance zone. The chart highlights a transparent consolidation vary forming since early Could, with ETH repeatedly failing to shut above the 200-day SMA, at the moment round $2,680. This long-term shifting common is performing as a big barrier, stopping any breakout momentum from gaining traction.

Help stays on the decrease boundary of the vary close to $2,470–$2,500, the place consumers have constantly stepped in to soak up promoting stress. This space coincides with the 34-day EMA at $2,386 and the 100-day SMA slightly below present ranges, forming a dense cluster of technical help.

Nonetheless, quantity has been declining, suggesting that neither bulls nor bears have clear management. If Ethereum loses the $2,470 degree decisively, the subsequent key space to look at lies close to $2,300, the place the 50-day SMA might act as a cushion.

Associated Studying

Conversely, reclaiming $2,700 with power might sign the start of a bigger transfer to the upside. Till then, ETH stays caught in a variety, and merchants will probably be watching intently for a decisive break—up or right down to outline Ethereum’s subsequent main development.

Featured picture from Dall-E, chart from TradingView