Are you having bother getting cash in Foreign currency trading? Many merchants discover it onerous to know when to purchase or promote. The quick modifications in forex markets could make it robust to determine.

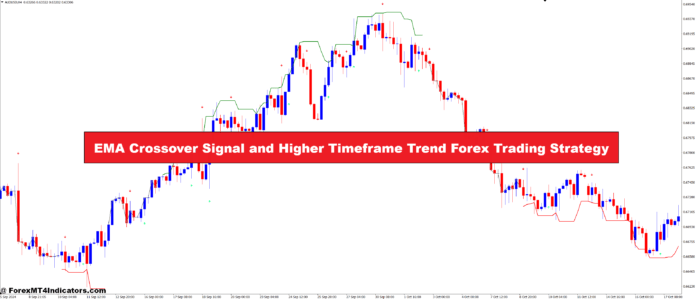

However, there’s a technique to make higher decisions. The EMA Crossover Sign and Larger Timeframe Development Foreign currency trading technique is right here. It makes use of Exponential Transferring Averages (EMAs) and appears at completely different timeframes. This technique may also help you time your trades higher and make more cash in Foreign exchange.

Key Takeaways

- EMA crossovers present clear entry and exit alerts

- Larger timeframe evaluation enhances pattern affirmation

- Combines short-term precision with long-term perspective

- Helps filter out market noise for higher decision-making

- Adaptable to varied forex pairs and market circumstances

- Integrates danger administration rules for safer buying and selling

Understanding Exponential Transferring Averages in Foreign exchange

Exponential Transferring Averages (EMAs) are key in foreign currency trading. They clean out value information and assist spot tendencies. Not like Easy Transferring Averages, EMAs focus extra on current costs, making them fast to react to market modifications.

What’s an Exponential Transferring Common

An Exponential Transferring Common is a shifting common that reacts quick to current value modifications. It offers extra weight to the newest information factors. This makes it a favourite amongst foreign exchange merchants who must sustain with quick market modifications.

EMA vs Easy Transferring Common

The principle distinction between EMA and Easy Transferring Common is their pace. The SMA treats all costs the identical, whereas the EMA focuses extra on current costs. This makes the EMA extra delicate to new data, which is nice for fast-moving foreign exchange markets.

| Function | EMA | SMA |

|---|---|---|

| Calculation | Weighted | Equal weight |

| Responsiveness | Quick | Gradual |

| Lag | Much less | Extra |

Why Foreign exchange Merchants Choose EMA

Foreign exchange merchants usually select EMAs for a number of causes. The short response of EMAs helps catch short-term value modifications, which is vital in foreign exchange. EMAs are nice for locating pattern course and when to enter or exit trades. Widespread EMA intervals in foreign exchange embrace the 20 EMA for short-term tendencies and the 200 EMA for long-term tendencies.

- 99.9% of merchants apply shifting averages to closing costs

- 50-day EMA is used as a short-term shifting common

- 200-day EMA is utilized as a long-term shifting common

The Fundamentals of Multi-Timeframe Evaluation

Multi-timeframe evaluation is a key device in foreign currency trading. It appears to be like at market tendencies from completely different time views. Merchants use it to know value actions, from quick 15-minute charts to lengthy each day charts.

Selecting the best timeframes is essential. Scalpers and day merchants like 1-5 minute charts for quick trades. Swing merchants use 15-minute or hourly charts for day swings. Place merchants take a look at 4-hour or each day charts for large market tendencies.

A typical combine for multi-timeframe evaluation is 30-minute, 15-minute, and 5-minute charts. This combine helps handle cash properly and makes earnings. One other setup is each day, 4-hour, and 1-hour charts, for fewer trades over longer occasions.

Key guidelines in multi-timeframe evaluation embrace:

- Keep away from buying and selling towards the worldwide pattern

- Enter trades when candles on all three timeframes have the identical colour

- Keep away from excessive volatility intervals

Merchants usually use exponential shifting averages (EMAs) with intervals of 21, 13, and eight throughout timeframes. A top-to-bottom EMA crossing means to promote, whereas bottom-to-top means to purchase. This technique doesn’t use cease orders however can use trailing stops properly.

EMA Crossover Sign and Larger Timeframe Development Foreign exchange Buying and selling Technique

The EMA Crossover Sign technique is a robust device for foreign exchange merchants. It makes use of short-term and long-term Exponential Transferring Averages (EMAs) to search out foreign exchange entry factors. This helps merchants spot tendencies and make sensible choices within the fast-moving foreign exchange market.

Core Technique Parts

The technique focuses on three key EMAs:

- Quick EMA: 9-period

- Gradual EMA: 50-period

- Larger Timeframe EMA: 100-period

These EMAs work collectively on a 15-minute chart. They create EMA crossover alerts and comply with increased timeframe tendencies.

Sign Era Guidelines

Merchants search for crossovers between the quick and gradual EMAs. A bullish sign is when the quick EMA goes above the gradual EMA. A bearish sign is when the quick EMA goes under the gradual EMA.

Place Administration Pointers

Good place administration is vital. The technique strikes the stop-loss to breakeven after a 25-pip transfer in favor of the commerce. This balances danger and reward, defending earnings and permitting for positive factors.

By utilizing EMA crossover alerts and better timeframe evaluation, merchants can construct a robust foreign currency trading technique. Keep in mind, constant observe and adapting to market modifications are important for fulfillment in foreign currency trading.

Widespread EMA Intervals and Their Significance

Exponential Transferring Averages (EMAs) are key in foreign currency trading. Merchants use completely different EMA intervals to review market tendencies. This helps them make sensible buying and selling decisions.

Quick-Time period EMA Choice

Quick-term EMAs are nice for day buying and selling and scalping. Merchants usually decide 5, 10, and 20-day EMAs. These EMAs rapidly comply with market modifications, serving to merchants discover one of the best occasions to purchase or promote.

Medium-Time period EMA Purposes

Medium-term EMAs, just like the 26 and 50-day EMAs, are liked by swing merchants. They filter out short-term noise however catch huge market tendencies. Merchants use them with short-term EMAs to verify pattern course and potential reversals.

Lengthy-Time period EMA Utilization

Lengthy-term EMAs, just like the 100 and 200-day EMAs, are standard with place merchants and buyers. They provide a large view of market tendencies. The 200-day EMA is vital for seeing the market’s total course.

| EMA Interval | Buying and selling Model | Utility |

|---|---|---|

| 5, 10, 20 | Day Buying and selling, Scalping | Fast market actions |

| 26, 50 | Swing Buying and selling | Medium-term pattern identification |

| 100, 200 | Place Buying and selling | Lengthy-term pattern evaluation |

Utilizing completely different EMA intervals can result in sturdy buying and selling methods. As an example, a short-term EMA crossing over a long-term EMA may imply it’s time to purchase. The other may imply it’s time to promote. Figuring out the way to use EMA intervals helps merchants construct higher buying and selling programs.

Technique Threat Administration Rules

Foreign exchange danger administration is vital to buying and selling success. The EMA Crossover and Larger Timeframe Development technique makes use of particular danger administration strategies. One essential rule is setting the precise stop-loss to regulate losses. Merchants normally set stop-loss ranges primarily based on market volatility and the way a lot danger they’ll take.

Place sizing can be crucial. Good merchants danger solely 1-2% of their capital per commerce. This retains their funds protected and lets them commerce extra. The technique additionally has take-profit ranges to lock in positive factors and transfer the stop-loss to breakeven after the primary acquire.

To higher handle danger, merchants can use extra methods reminiscent of:

- Utilizing trailing stops to safe earnings because the commerce goes their approach

- Setting a risk-reward ratio to ensure positive factors are greater than losses

- Altering place sizes primarily based on market circumstances and volatility

Following these danger administration guidelines helps defend capital and boosts buying and selling success. It’s essential to all the time use these strategies and verify how properly they work in several market conditions.

Buying and selling Session Optimization

Foreign currency trading classes are key to market ups and downs. The EMA Crossover technique could be tweaked for these modifications. Let’s see the way to make your buying and selling higher for every market session.

Greatest Buying and selling Hours

The foreign exchange market is open 24/7, however some hours are higher than others. The busiest occasions are when huge monetary facilities meet. For instance, the London-New York overlap (8:00 AM to 12:00 PM EST) could be very energetic.

Market Exercise Issues

Not all forex pairs are energetic on the identical time. For instance, EUR/USD is most energetic within the European and North American classes. Utilizing time-based buying and selling filters may also help you discover one of the best occasions to your pairs.

Time-Based mostly Filters

Time-based filters can enhance your EMA Crossover technique. They allow you to keep away from buying and selling when it’s quiet or throughout huge information. You may set your platform to commerce solely from 3:00 AM to 11:00 AM EST.

By choosing the proper buying and selling occasions, you possibly can enhance your EMA Crossover and keep away from dangers. Keep in mind, good foreign currency trading means figuring out the market and buying and selling when it’s most energetic.

Efficiency Metrics and Optimization

Foreign exchange technique backtesting is vital to checking if a buying and selling system works. It makes use of previous information to guess the way it may do sooner or later. Let’s take a look at the way to make it higher and essential buying and selling numbers.

Backtesting Outcomes

Backtests give us essential information about shifting common methods. Easy shifting averages (SMA) do properly briefly and long-term tendencies. Exponential shifting averages (EMA) are nice for brief and long-term tendencies too.

Technique Optimization Strategies

There are methods to make a method higher. Stroll-forward optimization and Monte Carlo simulations are two. For instance, tweaking the Transferring Common Convergence Divergence (MACD) made it extra worthwhile.

Efficiency Analysis Standards

Necessary buying and selling numbers embrace win charge, revenue issue, and most drawdown. It’s important to verify these in several markets and time frames. The Guppy A number of Transferring Common (GMMA) technique had a mean acquire of 9% per commerce in assessments.

| Technique | Effectiveness | Utility |

|---|---|---|

| Hull Transferring Common (HMA) | Worthwhile | Imply-reversion and trend-following |

| Linear-weighted Transferring Common (LWMA) | Worthwhile | Imply-reversion and trend-following |

| Adaptive Transferring Common (KAMA) | Worthwhile | Adapts to market volatility |

Widespread Technique Pitfalls and Options

Foreign currency trading could be robust, because of the EMA Crossover and Larger Timeframe Development technique. False alerts in ranging markets are an enormous drawback. This will trigger overtrading and losses. To repair this, including pattern affirmation indicators with the EMA crossover is a good suggestion.

Transferring averages could be gradual in fast-changing markets. This delay can imply lacking out on good trades. To get round this, utilizing shorter EMAs or including main indicators may also help.

Psychological points are additionally an enormous problem. The worry of lacking out or making an attempt to make again losses can result in unhealthy decisions. It’s essential to handle danger properly. This implies setting stop-loss ranges and sticking to position-sizing guidelines.

To do higher, merchants ought to change their technique primarily based in the marketplace. The EMA crossover works properly in trending markets. However in ranging markets, you may want a unique plan or cease buying and selling for a bit. By understanding these variations and adjusting, merchants can do higher and keep away from huge losses.

Superior Technique Variations

Superior foreign exchange methods let merchants tailor their strategies for higher outcomes. They’ll regulate to completely different market conditions. This will result in higher outcomes.

A number of Foreign money Pair Purposes

Utilizing the EMA Crossover technique with completely different forex pairs can unfold out danger. It additionally opens up extra possibilities. Merchants can apply it to huge pairs like EUR/USD, GBP/USD, and USD/JPY. They simply must tweak settings for every pair’s particular traits.

Further Technical Indicator Integration

Including extra indicators could make buying and selling programs stronger. For instance, mixing the Relative Energy Index (RSI) with EMA crossovers can provide clearer alerts. If the RSI is over 70 in an uptrend or underneath 30 in a downtrend, it could possibly make the EMA crossover sign stronger.

Customized Modifications

Customizing methods could make them extra exact. A technique is to alter EMA intervals primarily based on market exercise. For instance, use shorter EMA intervals (5 and 20) when markets are unstable. Use longer intervals (20 and 50) when markets are calm. This will make alerts extra correct.

One other technique to customise is by mixing indicators. Merchants may use the Transferring Common Convergence Divergence (MACD) with EMA crossovers. A purchase sign may occur when the MACD line goes above its sign line. This could match a bullish EMA crossover.

It’s key to check these superior methods and customized tweaks properly. Backtesting with previous information is essential. It reveals how the technique works in several market circumstances. This makes certain it’s dependable earlier than buying and selling stay.

Implementation Steps and Platform Setup

Organising Foreign currency trading platforms for the EMA Crossover and Larger Timeframe Development technique is essential. We’ll take a look at the primary steps.

Platform Choice

Select a platform that helps superior chart evaluation and automated buying and selling. MetaTrader 4, cTrader, and NinjaTrader are good choices. Every has particular options for technique use.

Chart Setup Pointers

Arrange your charts with EMAs: 21-period (quick) and 55-period (gradual). Add value motion indicators for higher evaluation. Use a number of timeframes to verify tendencies and entry factors.

Technique Automation Choices

Use automated buying and selling to comply with your technique properly. Many platforms have built-in scripting or third-party device integration. TradingView with PineConnector is a robust alternative for automation.

| Technique Element | Setting |

|---|---|

| Quick EMA Interval | 21 |

| Gradual EMA Interval | 55 |

| Preliminary Capital | $100,000 |

| Commerce Amount | 100% of fairness |

| Fee | 0.025% |

Backtest your technique from February 15, 2023, to February 21, 2024, with these settings. Set your cease loss to three occasions the 14-period ATR for good danger administration.

Find out how to Commerce with EMA Crossover Sign and Larger Timeframe Development Foreign exchange Buying and selling Technique

Purchase Entry

- Step 1: Larger Timeframe Development Affirmation

- Guarantee the upper timeframe (e.g., 4 hours or each day) is in an uptrend:

- Worth is above the 50 or 200 EMA on the upper timeframe chart.

- Step 2: EMA Crossover on the Decrease body

- On the decrease timeframe (e.g., 1 hour or half-hour), the quick EMA (9 or 12 intervals) crosses above the gradual EMA (50 intervals).

- Step 3: Affirm Purchase Setup

- The quick EMA should keep above the gradual EMA after the crossover, signaling the pattern continues to be bullish.

- Step 4: Entry

- Enter a purchase place as quickly because the quick EMA crosses above the gradual EMA, and the upper timeframe pattern is bullish.

Promote Entry

- Step 1: Larger Timeframe Development Affirmation

- Guarantee the upper timeframe (e.g., 4 hours or each day) is in a downtrend:

- Worth is under the 50 or 200 EMA on the upper timeframe chart.

- Step 2: EMA Crossover on the Decrease body

- On the decrease timeframe (e.g., 1 hour or half-hour), the quick EMA (9 or 12 intervals) crosses under the gradual EMA (50 intervals).

- Step 3: Affirm Promote Setup

- The quick EMA should keep under the gradual EMA after the crossover, signaling the pattern continues to be bearish.

- Step 4: Entry

- Enter a promote place as quickly because the quick EMA crosses under the gradual EMA, and the upper timeframe pattern is bearish.

Conclusion

The Multi-Timeframe Exponential Transferring Common Crossover Technique is a robust alternative for merchants. It helps catch tendencies and handle dangers properly. This technique makes use of EMAs, which rapidly reply to cost modifications.

It really works properly with completely different forex pairs and timeframes. This reveals its effectiveness.

Creating a great buying and selling plan is essential for this technique. Merchants ought to learn about EMA intervals like 5, 10, 20, 50, 100, and 200 days. They need to perceive how EMA crossovers sign pattern modifications.

A bullish sign occurs when a quick EMA goes above a gradual EMA. A bearish sign is when it goes under. The technique has proven success, like within the EUR/USD commerce making 65.5 pips and the USD/JPY commerce averaging 35 pips revenue.

Studying by no means stops with this technique. Merchants ought to attempt combining EMAs with RSI and Bollinger Bands for higher evaluation. They need to additionally be careful for false alerts in tight or huge buying and selling ranges.

As foreign exchange markets preserve altering with new tech, adopting this technique is vital. It’s essential for fulfillment within the fast-paced world of forex buying and selling.

Really helpful MT4 Dealer

XM Dealer

- Free $50 To Begin Buying and selling Immediately! (Withdraw-able Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Successful Foreign exchange Dealer

- Further Unique Bonuses All through The 12 months

- Unique 50% Money Rebates for all Trades!

Already an XM shopper however lacking out on cashback? Open New Actual Account and Enter this Associate Code: 𝟕𝐖𝟑𝐉𝐐

Click on right here under to obtain: