Bitcoin continues to indicate indicators of restoration as its value rebounds from a short correction final week. On the time of writing, the crypto is buying and selling at $109,693, reflecting a 0.4% enhance over the previous 24 hours. Regardless of this upward motion, the present value stays roughly 2% under its all-time excessive of over $111,000, recorded final month.

This ongoing power in value efficiency has been accompanied by notable on-chain indicators, notably from giant holders. CryptoQuant contributor Crypto Dan lately analyzed the present market construction and conduct of Bitcoin whales.

Bitcoin Whale Habits Suggests Additional Upside

In his newest evaluation, Dan noticed that regardless of Bitcoin hovering close to file ranges, there may be little proof of the profit-taking conduct usually noticed throughout earlier market tops. In line with him, whales are usually not participating in mass selloffs, suggesting that these buyers anticipate the rally to proceed.

Dan emphasised that these giant holders are possible ready for extra pronounced market euphoria and better valuations earlier than initiating substantial promote exercise, a sample usually seen close to the ultimate levels of a bull market.

Bitcoin – Close to All-Time Highs however No Revenue-Taking

“Whales present no intention of taking earnings at this value degree and are prone to look ahead to increased costs, the place important market overheating and a bubble type, earlier than making their strikes.” – By @DanCoinInvestor pic.twitter.com/W5PtrHo0Q5

— CryptoQuant.com (@cryptoquant_com) June 11, 2025

Whale Change Exercise Signifies Comparable Transfer

Additional reinforcing the present sentiment, one other CryptoQuant analyst, Darkfost, highlighted a major development in Binance whale conduct.

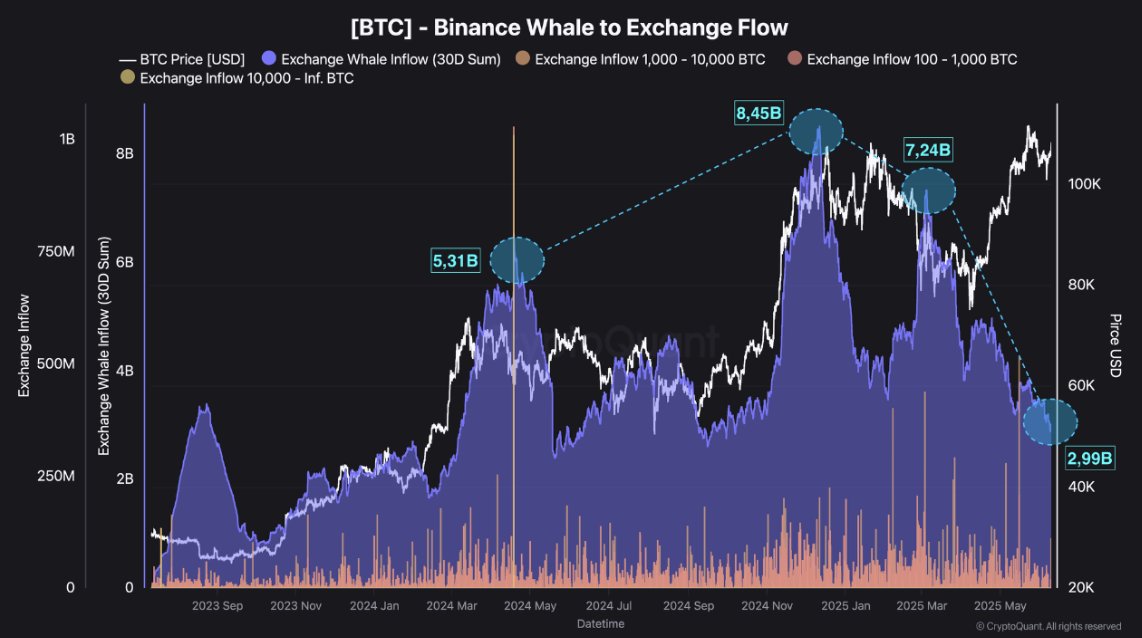

In line with Darkfost, historic information reveals that when Bitcoin approaches or breaches its all-time excessive, there may be usually a pointy rise in alternate inflows, pushed by whales in search of to take earnings.

This sample was seen throughout earlier cycle peaks, the place inflows reached $5.3 billion in early 2024, and even increased ranges of $8.45 billion and $7.24 billion in earlier cycles.

A powerful bullish sign from Binance whales!

“At present, nonetheless, inflows are simply round $3 billion and are persevering with to say no, suggesting that these whales want to maintain holding.” – By @Darkfost_Coc

Full evaluation

https://t.co/T1FlLnM4nK pic.twitter.com/O3XrqhAyEc

— CryptoQuant.com (@cryptoquant_com) June 11, 2025

In distinction, latest inflows to Binance stay considerably decrease. Darkfost experiences present inflows hovering round $3 billion, and extra importantly, on a declining trajectory. This divergence from historic patterns means that whales are refraining from promoting at present ranges.

Their lowered exercise implies an expectation that increased costs could lie forward, and that they’re positioning for doubtlessly larger returns later within the cycle. This restraint from giant holders is seen as an necessary sign, particularly given the affect whale actions can have on market liquidity and value motion.

Featured picture created with DALL-E, Chart from TradingView