Transparency is on the coronary heart of the whole lot we do at Bondora. We all know how essential it’s so that you can have easy accessibility to key statistics on borrowing, investing, and mortgage efficiency.

That’s why we’ve revamped our Statistics web page so it’s simpler to know, extra accessible, and constantly up to date with the information that issues most to you.

Constructed together with your suggestions

Our prospects and companions have shared that having clear, commonly up to date insights is essential to constructing belief. We all the time take your suggestions to coronary heart. Our new Statistics web page, which launched on 6 March 2025, is one other step in delivering the data you want if you want it.

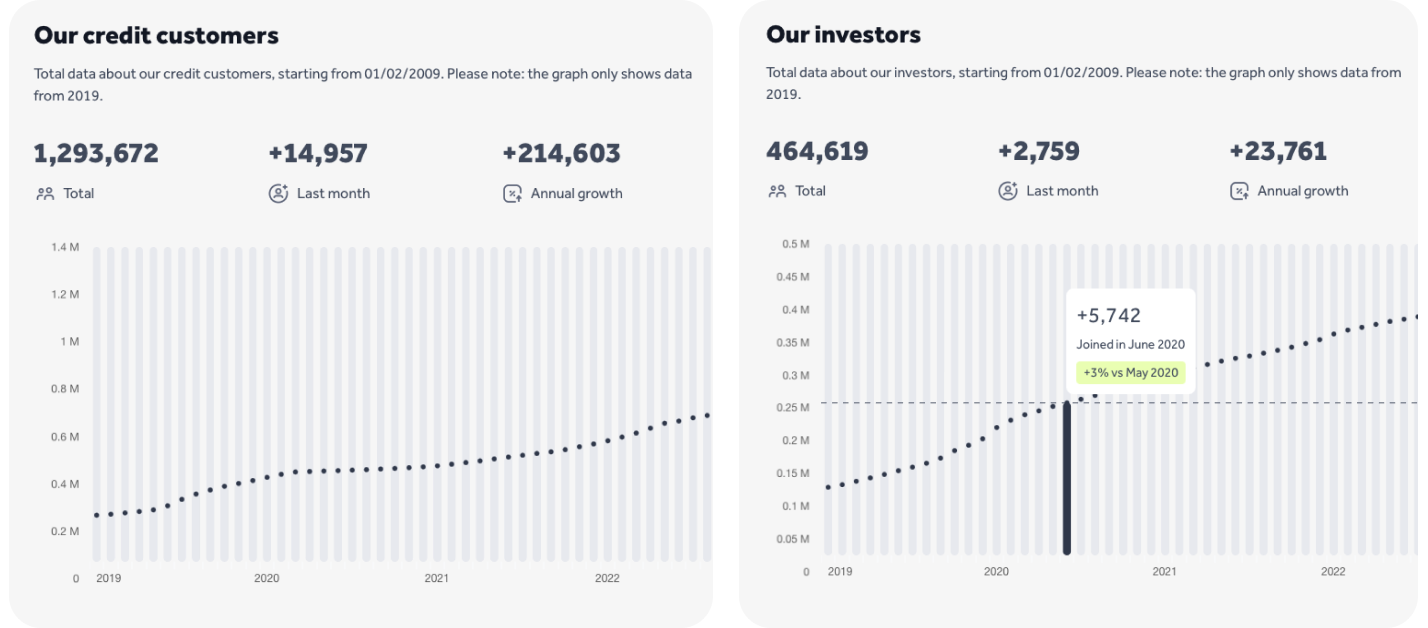

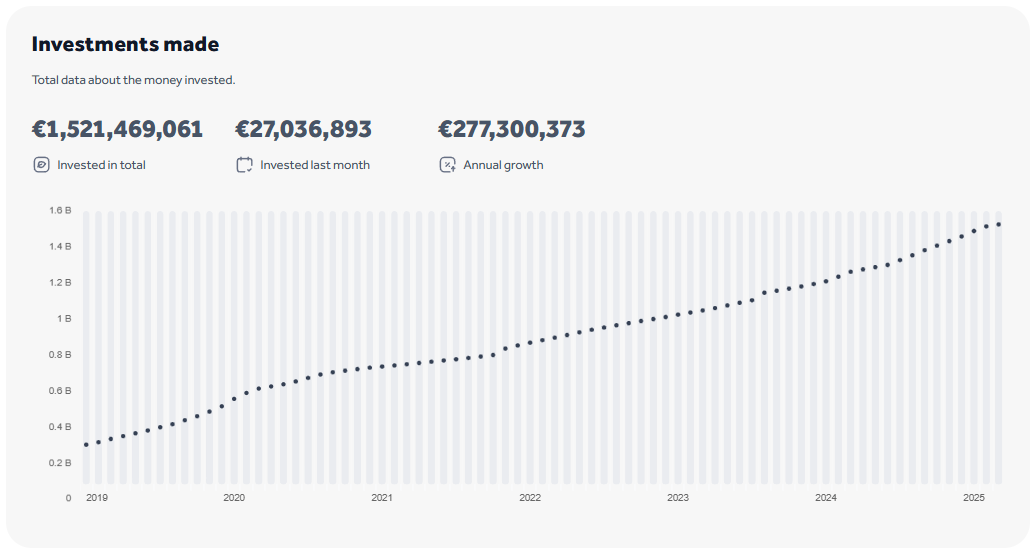

From investor numbers to mortgage portfolio insights, the revamped Statistics web page offers you a clearer view of Bondora’s key knowledge. Whether or not you’re monitoring borrower exercise, complete investments, or returns, now you can entry this info in a format that’s simpler to navigate and up to date commonly.

Check out a few of the key knowledge factors accessible on the refreshed web page:

Whereas this primary model contains important insights, we’re dedicated to increasing it additional. Some mortgage portfolio efficiency knowledge isn’t automated but, however we’ll be rolling it out step-by-step. Within the meantime, yow will discover this knowledge beneath and anticipate common updates to maintain you knowledgeable.

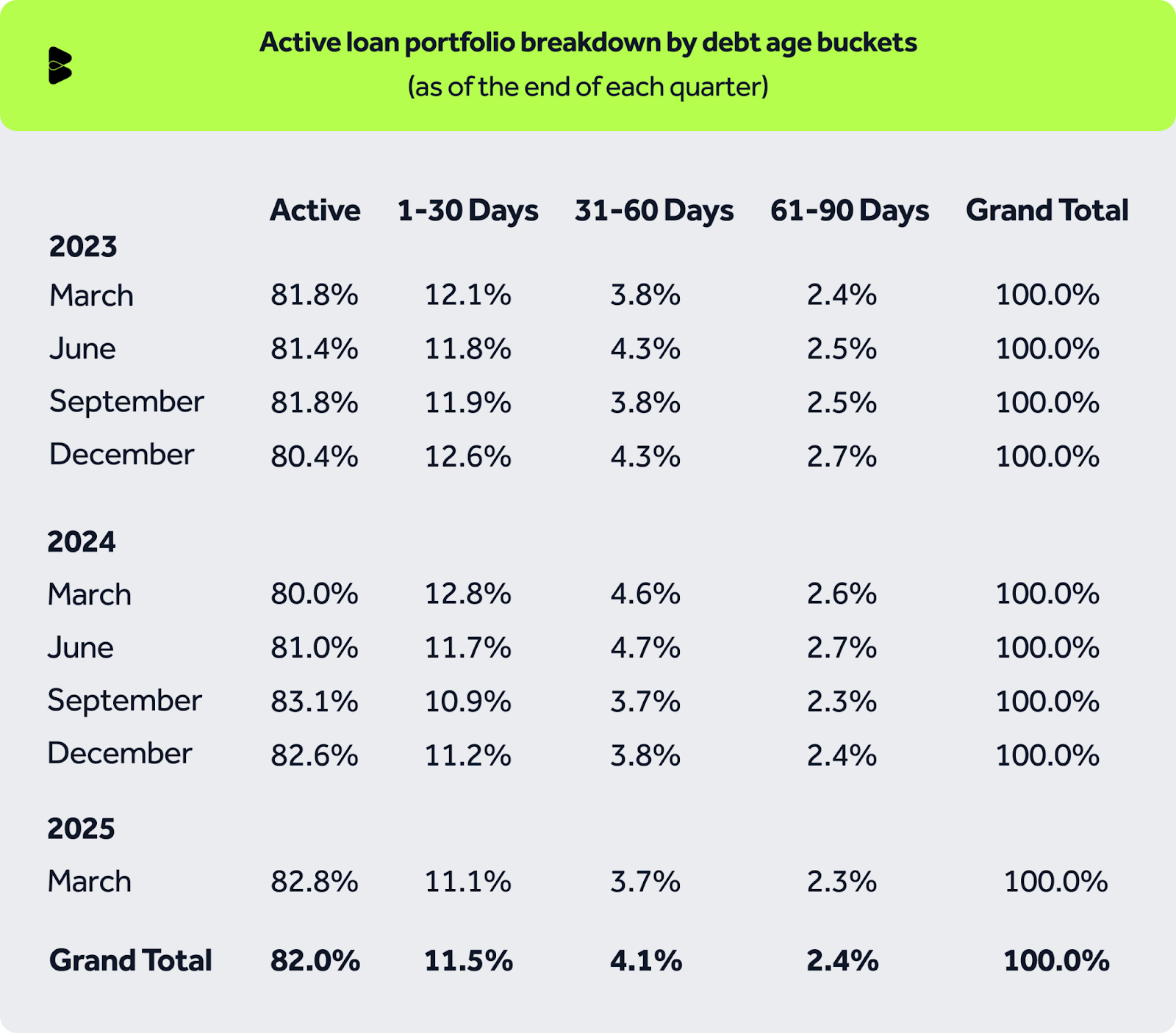

Mortgage portfolio particulars

Our lively mortgage portfolio has remained constantly secure, with over 80% of loans remaining lively throughout all durations. Delinquency ranges throughout totally different growing older buckets have proven solely minor variations, indicating robust portfolio well being.

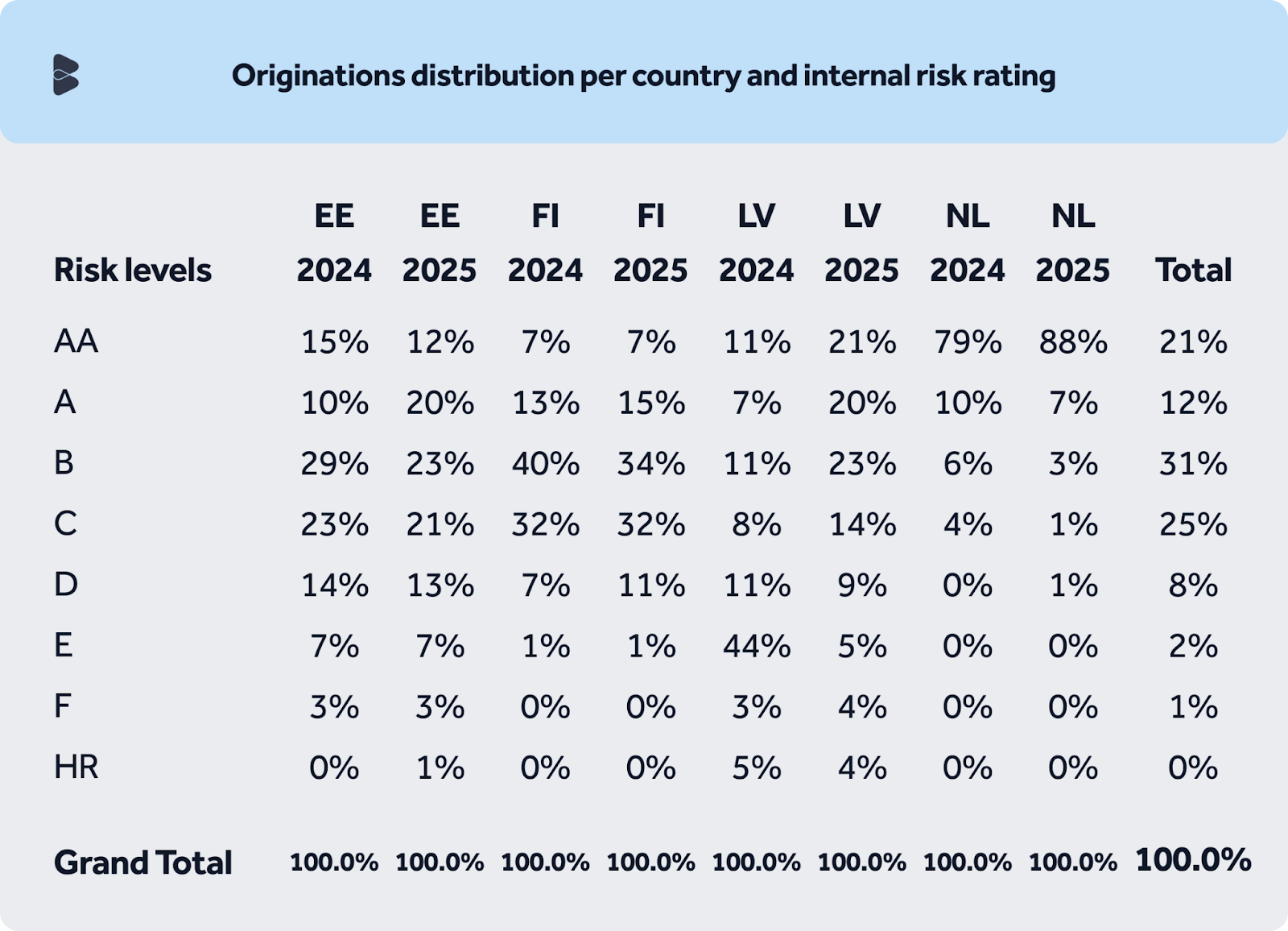

The vast majority of our originations fall inside low-risk ranges. We proceed to take a prudent method to danger administration by growing the proportion of loans within the AA-C danger classes throughout all markets.

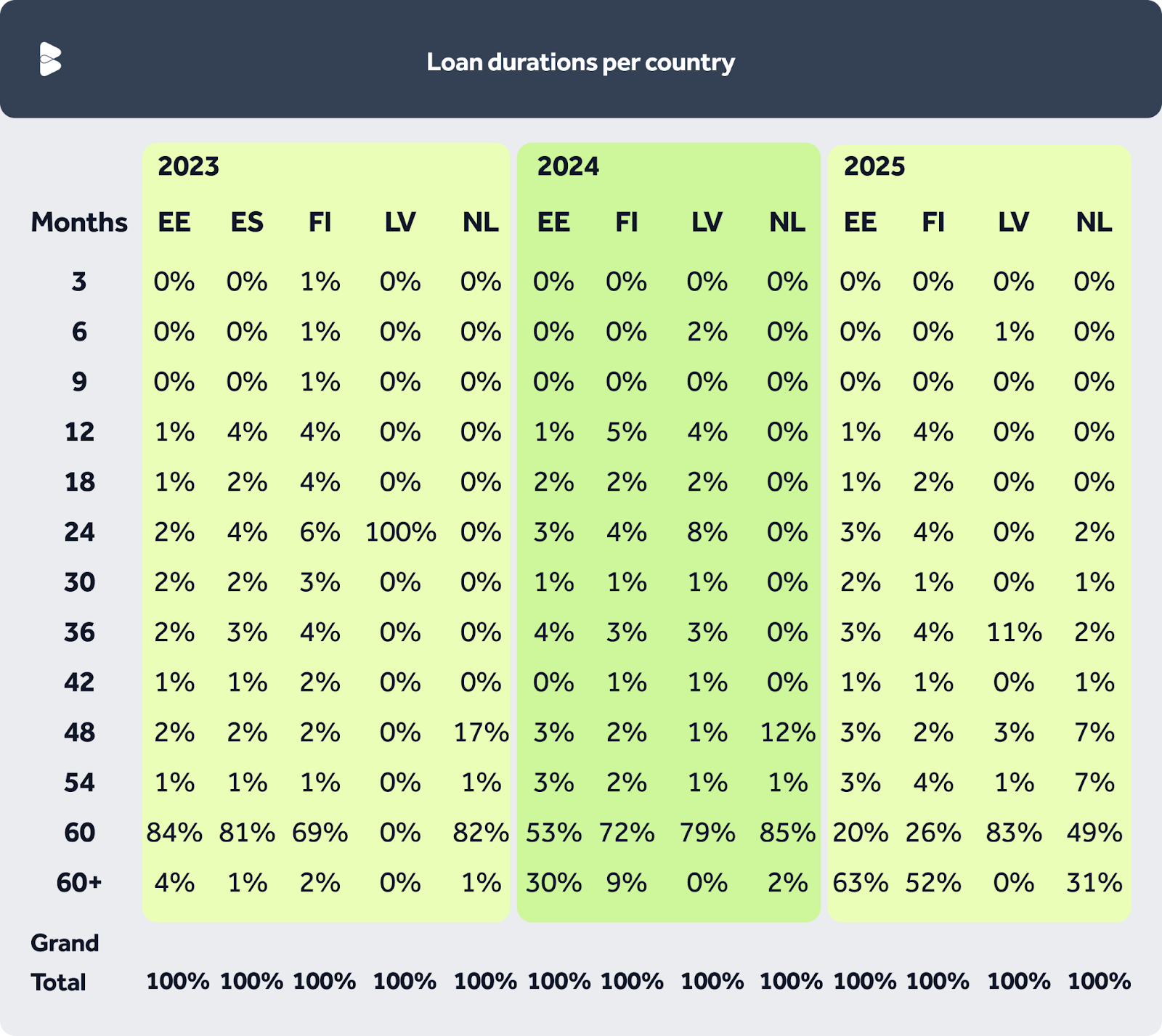

Our mortgage prospects usually favor longer mortgage durations, as they lead to extra manageable month-to-month funds. Providing prolonged phrases permits for extra mortgage issuance at decrease danger ranges whereas sustaining the next proportion of on-time repayments.

We’ll proceed to give you detailed insights in future updates as we improve and develop the information we share.

Assist form the subsequent replace

This web page was constructed for you—so inform us what you’d wish to see subsequent! On the backside of the Statistics web page, you’ll discover a survey the place you possibly can share your suggestions and tell us what extra knowledge can be most respected to you! Your enter will assist us construct future updates.

Extra monetary insights coming quickly

This weblog submit centered on our revamped lending and funding statistics, however there’s extra knowledge on the best way. Our audited annual monetary report might be revealed quickly, supplying you with a broader have a look at Bondora’s monetary efficiency in 2024. Keep tuned!

📊 Discover the revamped Statistics web page and share your ideas.