Ever questioned what occurs when a credit score buyer goes into default, doesn’t repay their mortgage, and what which means in your returns? Nicely, at the moment, that’s precisely the subject we’re diving into.

As a part of our investor neighborhood, you deserve clear, sincere insights into how your cash is performing, together with on the subject of the extra complicated subject of defaults.

Bondora Group is in its strongest place ever, with a transparent technique for continued progress. A key signal of that progress is the regular enchancment in our default charge. However what does “default” really imply? How can we measure it, and the way does it relate to the well being of our present portfolio and your funding?

Let’s have a look behind the numbers.

What’s a default?

A mortgage is taken into account in default when funds are greater than 90 days overdue, and the contract with the client is terminated as a result of the account is in arrears for an overdue interval.

However a default doesn’t imply cash misplaced. It’s the purpose the place our restoration efforts start, with the intention of recovering as a lot of the excellent quantity as doable. On common, in some international locations, we’re in a position to get better as much as 70% of the defaulted quantity, one thing we’ll discover extra in an upcoming weblog put up.

It’s important to acknowledge that our objective is to deal with each credit score buyer with respect and equity all through the restoration course of. We perceive that monetary challenges can occur, and our restoration technique balances accountable lending with compassionate debt administration.

To raised perceive the potential influence of defaults, we additionally study Loss Given Default (LGD), which displays the remaining loss after anticipated recoveries. This helps assess the portfolio’s long-term well being.

PD12: A key danger metric

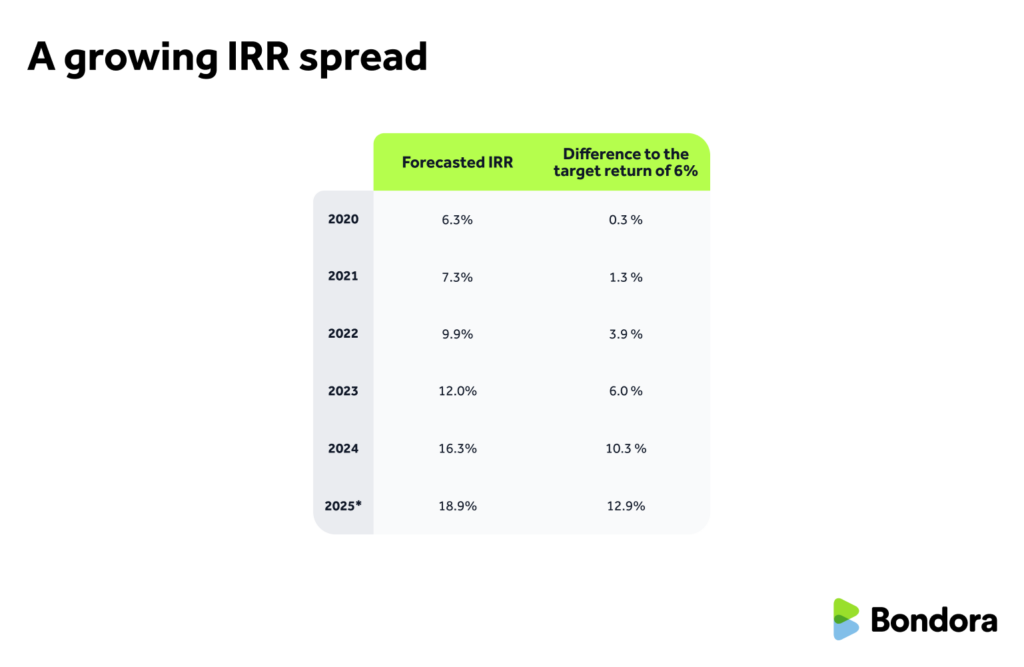

In a earlier article, we defined how we forecast our inside charge of return (IRR) and shared some key particulars. Now, we’d prefer to go additional by presenting our forecasted IRR over a extra prolonged interval and providing insights on PD12, a key metric utilized in IRR calculations.

PD12 measures the precise default charge inside 12 months of when a mortgage is issued. It acts as a number one indicator of credit score danger and is a key think about calculating our forecasted inside charge of return (IRR).

We’re inspired to see that our PD12 outcomes have steadily improved, reflecting higher danger fashions and extra considerate borrower analysis.

A rising IRR unfold

Even when accounting for defaults and recoveries, our forecasted IRR continues to point out a wholesome unfold above the 6% Go & Develop goal return.Right here’s how that forecasted IRR has developed over the previous 5 years:

*Forecast based mostly on present mortgage efficiency and assumptions of the partial yr’s knowledge.

This unfold has been steadily rising, reflecting enhancements in credit score danger management and the general power of the portfolio. These elements reinforce Bondora’s capability to ship two stuff you worth enormously: steady, sustainable long-term returns and near-instant liquidity.

The consolidation of Go & Develop, our flagship product, and the distinctive challenges of the COVID years formed our present portfolio method. Regardless of headwinds, like Finland’s restrictive curiosity ceiling, we strengthened our underwriting fashions and refined our portfolio methods.

Bondora’s evolution is a narrative of progress by studying. Challenges from earlier years have led to raised techniques, smarter danger fashions, and stronger efficiency. Decrease default charges and a strong danger framework now outline our operations.

As our Chief Credit score Officer Juris Rieksts-Riekstiņš explains:

“Since Q3 2023, we’ve achieved our widest-ever unfold between mortgage defaults and curiosity charged throughout all our markets, a transparent win for credit score danger management.”

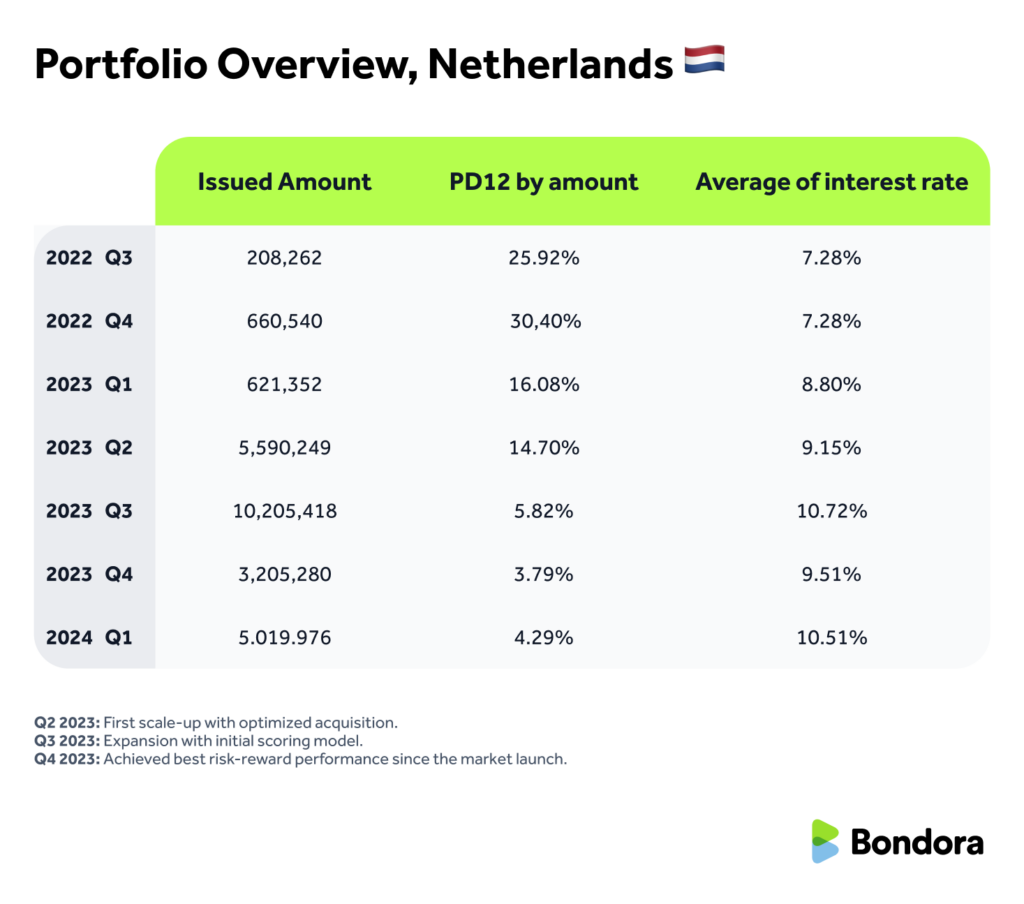

A shining instance of this adaptability is the Netherlands, the place we reached high-performance danger metrics inside just some quarters. Extra on that under.

Market-specific efficiency developments

Right here’s a snapshot of how our efficiency is evolving throughout key markets.

Observe: Q2 2024 stats shall be out there after Q2 2025, because of the required 12-month remark interval to categorise defaults precisely.:

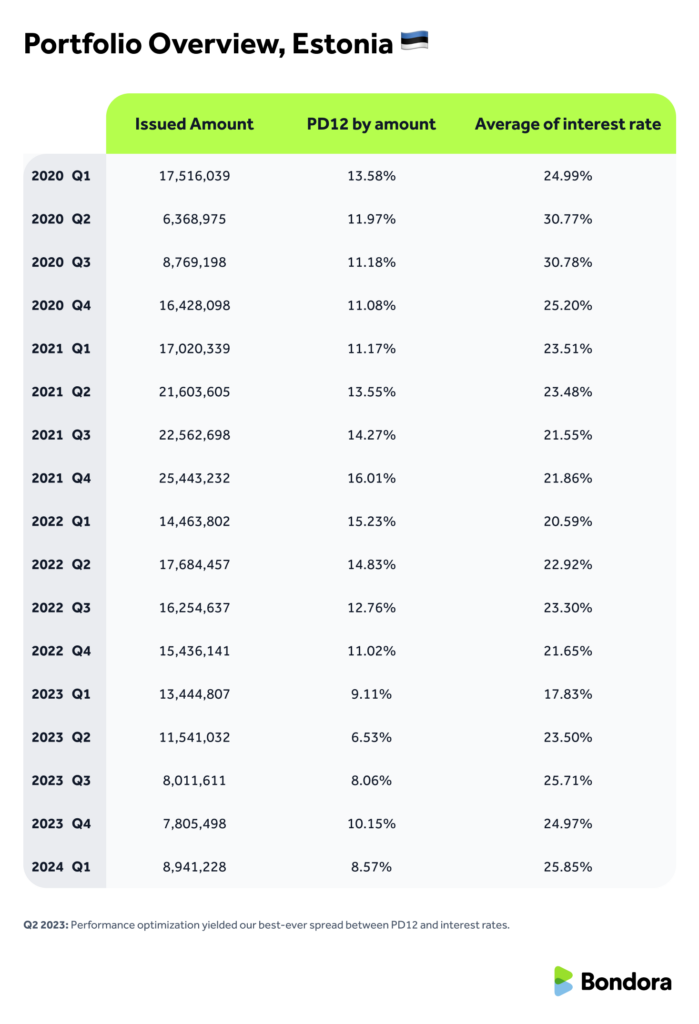

🇪🇪 Estonia

- Q2 2023: Efficiency optimization led to our best-ever unfold between PD12 and rates of interest.

- Right this moment’s Estonian portfolio is extra steady and predictable than in earlier years.

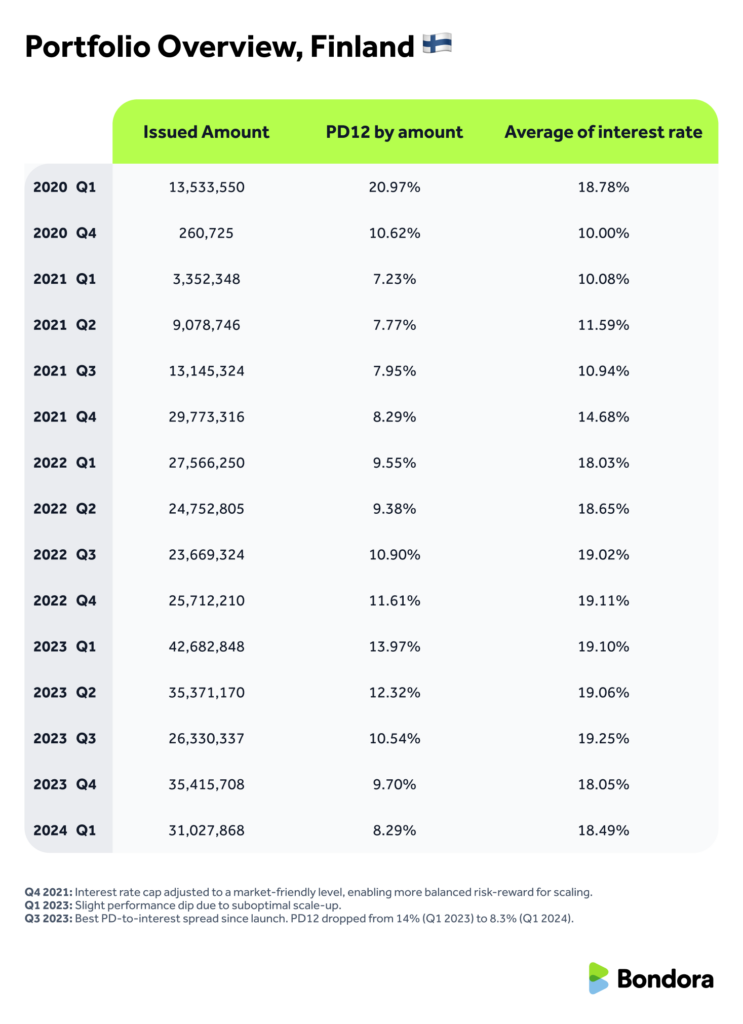

🇫🇮 Finland

- This fall 2021: Rate of interest cap adjusted, making a more healthy risk-reward stability for scaling.

- Q1 2023: A slight momentary dip as we scaled operations.

- Q3 2023–Q1 2024: Vital enchancment when PD12 fell from 14% to eight.3%, the very best unfold since market launch.

- Finland now constantly represents practically 70% of our whole portfolio, making these enhancements particularly significant.

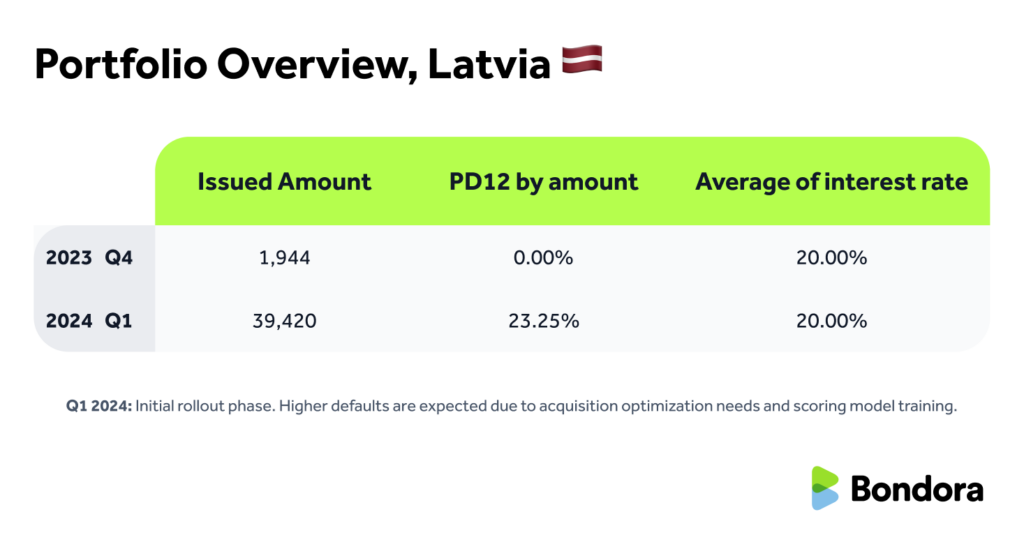

🇱🇻 Latvia

- Q1 2024: Early-stage market. Increased default charges are anticipated on this part as we optimize acquisition and enhance scoring accuracy.

🇳🇱 Netherlands

- Q2 2023: First scale-up with optimized acquisition.

- Q3 2023: Growth with preliminary scoring mannequin.

- This fall 2023: Achieved greatest risk-reward efficiency for the reason that market launch.

Throughout all markets, our portfolio continues to enhance, with the share of defaulted loans steadily lowering. This pattern displays the influence of our ongoing efforts to boost portfolio well being by higher danger administration.

Wanting again to maneuver ahead

Reflecting on previous outcomes and analyzing historic knowledge permits us to be taught from actual expertise and make the mandatory changes for a fair higher future.

On the core of our knowledge sharing lies our dedication to transparency. We’ll proceed to share key insights with you in our common month-to-month stats weblog posts, real-time updates on our revamped Statistics web page, and in additional in-depth articles like this one, which breaks down the numbers even additional.

In a future weblog put up, we’ll discover how we handle the restoration course of, from respectful communication with debtors to the techniques we use to get better funds pretty and responsibly.

📣 Have a query about defaults or our statistics?

Share your ideas by way of the suggestions type and assist form what we share subsequent.