Opinion from Dr. Andreas Freund. 21 August 2024

TL/DR

There are platform options for DeFi protocols to combine regulatory compliance with out compromising decentralization. Utilizing blockchain expertise and cryptographic protocols, DeFi protocols can guarantee safe and clear transactions that meet regulatory requirements whereas sustaining consumer privateness. Such protocols implement compliance guidelines on digital belongings and their holders. Due to this fact, they will present a strong and versatile system to assist DeFi protocols navigate the complicated regulatory panorama, contributing to a safer and extra dependable decentralized monetary ecosystem.

Introduction

Decentralized Finance (DeFi) has taken the monetary world by storm (not less than within the OpEd pages of Bloomberg and Fortune), providing a permissionless and clear different to conventional monetary establishments with a complete locked worth (TVL), as of this writing, of practically $100Bn. Nevertheless, this very decentralization creates a significant hurdle: compliance. Not like typical establishments with central management, DeFi protocols are sometimes ruled by self-executing code and lack a single entity liable for imposing rules. This raises a essential query: how can these revolutionary protocols combine compliance guidelines into their DNA with out compromising their core ideas of decentralization and autonomy? This problem lies on the coronary heart of DeFi’s future, as regulators grapple with discovering the best stability between fostering innovation and defending customers since practically all of the ~ $100Bn in TVL and billions of {dollars} every day trades on Decentralized Exchanges (DEXs) in response to DeFi Lama haven’t undergone any correct compliance checks. Sadly, and really lately, regulators have resorted to authorized motion in opposition to the likes of Uniswap, Twister Money, and different DeFi protocols.

After thumbing their noses at regulators for a few years, the organizations constructing DeFi protocols at the moment are realizing two issues:

- The phrases decentralization and No-Management don’t defend in opposition to costly authorized actions.

- DeFi mass adoption requires higher UX and compliance enforcement — each monetary and information privateness, and on the similar time.

Even when DeFi protocols needed to implement compliance checks instantly, it might not solely upset their finest shopper’s apple carts however would require protocol rewrites. In different phrases, utterly new variations of the protocol with older variations nonetheless working with none compliance checks. That isn’t a tenable scenario, since, very possible, the foundations or DAOs governing DeFi protocols would nonetheless be held to account for non-compliant variations of their protocol since “sensible contracts are perpetually” — sure, Marilyn Monroe pun quote meant.

Fortunately there’s a method ahead for these protocols. Leveraging blockchain-native compliance mechanisms – a mixture of sensible contracts, and blockchain-verifiable zero-knowledge proofs, representing assertions {that a} consumer and submitted asset transaction are compliant with the relevant legislation in a jurisdiction, yields a complete framework to make sure regulatory compliance, threat administration, and transaction reporting for any digital asset. The steered framework extends the work initially carried out by Azgad-Tromer et. al (2023) that mixes strong regulatory compliance actions with privateness safety, enabling, for instance, the creation of compliant variations of digital belongings that implement jurisdictional insurance policies whereas being privacy-preserving. The unique framework by Azgad-Tromer et al. preserves digital belongings’ financial worth and technological capabilities whereas making certain that delicate data is selectively seen solely to licensed legislation enforcement authorities – Fincen, SEC, OFAC, and so forth. This enhances the safety and integrity of digital asset transactions whereas sustaining privateness for respectable customers. Furthermore, the framework’s compatibility with several types of digital belongings resembling fungible and non-fungible digital belongings makes it a flexible resolution.

In brief, the framework augments blockchains with further details about actors’ identities and asset provenance in a privacy-preserving method and was first applied by Sealance. This revolutionary method allows the framework to handle the challenges posed by the decentralized nature of digital belongings. Attaching Compliance-Related Auxiliary Info (CRAI) to transactions involving digital belongings in encrypted kind ensures that essential compliance information, resembling consumer identities, credentials, transaction historical past, and fund provenance, stays safe and tamper-proof – see FinCen steerage on Anit-Cash-Laundering for example. The framework incorporates cryptographic protocols that may routinely implement compliance insurance policies assigned to digital belongings — what holders can and can’t do with such a digital asset — and digital asset holders — what belongings people can and can’t maintain and/or commerce. It will probably additionally replace CRAI in the course of the recording of transactions on the blockchain. This integration permits real-time compliance monitoring and reporting, enhancing transparency and accountability within the digital asset ecosystem.

Word, that earlier work on this space was carried out by Kaira et al. in 2021 for the case of a centrally managed Hedge Fund. Whereas complementary to this dialogue, it doesn’t contact on KYC/AML compliance, which is the central query we’re discussing on this paper.

The right way to make DeFi Protocols Regulatory Compliant

So how does such a framework function within the context of DeFi protocols, given that almost all belongings on these platforms usually are not natively regulatory compliant?

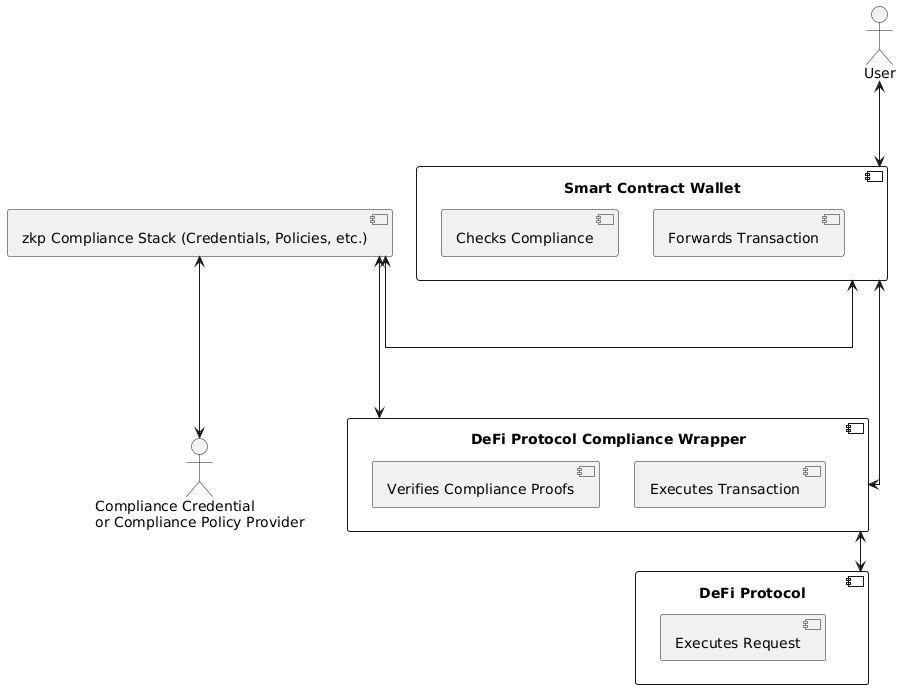

Fig. 1: Excessive-Stage DeFi (ZKP) Compliance Structure as an extension of Azgad-Tromer et al.

The important thing perception within the extension of the Azgad-Tromer et al. framework is {that a} sensible contract pockets used, for instance, in Account Abstraction (see EIP-4337) as a consultant of a number of Entity Owned Accounts (EOA) has considerably extra flexibility as a consequence of its programmability than an EOA. If a sensible contract pockets is mixed with different sensible contracts that implement compliance guidelines and work together with a DeFi protocol we’ve got all of the components we’d like. Consider a sensible contract pockets as functionally equal to a standard Dealer-Supplier, a regulated and registered entity, that locations trades for his or her purchasers, and a DeFi protocol with a number of compliance imposing sensible contracts as a registered inventory or commodity change with its buying and selling and compliance capabilities. Word {that a} Dealer-Supplier is a *registered entity* that may be a *authorized delegate* of a daily investor to position trades on the investor’s behalf and implement commerce compliance guidelines. The inventory change is one other *registered entity* – registered with regulatory authorities such because the SEC or Fincen – and its compliance and buying and selling capabilities are separate by design — separation of considerations is a major compliance rule.

With this analogy in thoughts, we will now assemble a regulatory-compliant DeFi protocol stack built-in with a compliance framework such because the one pioneered by Sealance by way of coverage supervisor contracts with related compliance insurance policies, and a compliance coverage and compliant account registry. Essentially the most easy implementation is thru “sensible contract hooks” in DeFi protocols as they permit customized compliance enforcement extensions to the protocol, for instance, Uniswap V4 or Seaport. Nevertheless, this doesn’t remedy the problem for DeFi protocols that don’t have such capabilities; presently nonetheless the bulk.

There’s a normal protected sample to work together with DeFi protocols that don’t have contract hooks for compliance checks when a consumer receives a yield-bearing instrument such because the Compound yield token (YT) e.g. cDai. In our description beneath, we implicitly assume that DeFi protocol contracts such because the Uniswap Router or Place Supervisor are registered contracts such that the compliance coverage enforcement mechanism embedded in “compliant” belongings can determine them as compliant and never require an extra zkp compliance assertion to be embedded with, for instance, a switch operate.

Fig. 2: Instance zkp-Compliance Stack software with Unsiwap and compliant sensible contract pockets

A compliance-safe DeFi interplay sample is described beneath utilizing the instance of including liquidity to a Uniswap Liquidity Pool for specificity:

- A consumer (EOA) calls a DeFi Protocol compliance (wrapper, also called a logical abstraction) contract instantly or by way of the consumer’s Sensible Contract Pockets in an account abstraction situation.

Word: the sensible contract pockets has already been given a Energy-Of-Lawyer certificates by way of an permitted KYC/AML supplier, resembling a financial institution or an change. This certificates is utilized in the identical method as a real-world Energy-Of-Lawyer works; it marks the sensible contract pockets as in a position to make use of the zero-knowledge proof (zkp) assertions of compliance that the zk-based compliance platform creates for a consumer’s asset transactions. - The DeFi (wrapper) contract verifies the submitted zkp compliance assertions utilizing the zk-based compliance stack – a sensible contract system see Fig 1 – routing compliance assertions within the type of zk-proofs to (compliance) coverage enforcement factors (PEP) – sensible contracts as a part of the zk compliance stack) the place proofs are verified and actions aka transactions are both allowed or denied. If the compliance checks are profitable, liquidity is added to a pool — both a pool of compliant or uncompliant belongings — on behalf of the consumer by the DeFi (wrapper) contract. Let’s assume for the next a compliant asset pool

- The DeFi compliance (wrapper) contract receives the YT and creates a compliant YT asset using one of many zkp assertions supplied by the consumer.

- The DeFi compliance (wrapper) contract then transfers the now compliant YT to the EOA or the sensible contract pockets — this additionally requires a zkp compliance assertion.

This prevents customers from buying and selling non-compliant YTs until the consumer manually unwraps the asset. Word that every one the yield now accumulates to the compliant YT. A variant of this method is utilizing DeFi compliance library contracts with the identical performance as a compliance wrapper contract whereas not requiring belief within the preliminary wrapper contract deployment.

For DeFi protocol transactions of compliant belongings (e.g. lending, swaps) or compliant belongings with non–compliant belongings (e.g. swaps), there’s an extra sample:

- A Consumer (EOA) can make the most of an authority delegation coverage expressed as a PEP for its sensible contract pockets such that the sensible contract pockets can work together with a compliant asset with out being required to supply a zkp compliance assertion. This may be achieved by the consumer making a delegating zkp compliance assertion (delegation to sensible contract pockets) and submitting it to the zk-based compliance stack to be validated after which registered with a particular Energy-Of-Lawyer coverage inside a PEP. Energy-of-attorney-type insurance policies can exist at a jurisdictional stage, by asset class, and even on the stage of particular person belongings.

Key Level: An authority delegation coverage to be utilized in a transaction is on the asset stage, not the extent of a payee, a payer, or an authorizer stage. This permits an asset to determine if a payer or payee is permitted to work together with it, with out being required to supply a zkp compliance assertion. - Recognized DeFi protocol sensible contracts e.g. Uniswap Router, or an Aave Lending Pool supervisor can, due to this fact, additionally make the most of a Proof Delegation coverage as described above. The first distinction is that on this context the entity creating the delegation zkp compliance assertion (regulatory whitelisting of a Defi protocol sensible contract), and the registration is finished by a certified coverage creator or registrar resembling a KYC supplier inside the zk-based compliance ecosystem.

Key Level: As within the case of an EOA, this registrar-proof-delegation coverage is on the stage of the asset, and may differentiate jurisdiction, asset class, and even particular person asset. Nevertheless, it’s of a distinct authority delegation coverage sort as a result of the requester has one other ecosystem function. Due to this fact, the compliant asset should have each sorts of authorization delegation insurance policies hooked up to it as a result of each a sensible contract pockets, a Defi protocol compliance wrapper, and a Defi Protocol sensible contract will work together with the compliant asset.

Conclusion

In abstract, to make sure the longevity and acceptance of DeFi protocols by mainstream customers, these protocols should transfer in direction of regulatory compliance. The described compliance platform, an extension of the framework proposed by Azgad-Tromer et al. and applied by Sealance, presents a sensible resolution permitting DeFi protocols to include compliance measures whereas sustaining decentralization. It makes use of blockchain expertise and superior cryptographic protocols for clear, safe transactions that meet regulatory necessities, all whereas preserving consumer privateness. It enforces compliance guidelines on digital belongings and their house owners, offering a stable and versatile system. The important thing advantages of the described compliance framework for DeFi protocols are:

- Regulatory Compliance: The framework allows DeFi protocols to stick to regulatory requirements with out compromising their decentralized nature (although KYC is essentially nonetheless carried out by centralized entities).

- Threat Administration: The framework allows mechanisms for efficient threat administration and transaction reporting for numerous digital belongings.

- Privateness Safety: The framework incorporates cryptographic privacy-preserving options resembling zkps making certain that delicate consumer data utilized in compliance credentials and in creating zkp compliance coverage assertions stays confidential, with private data saved and accessible solely by KYC/AML or different compliance credential suppliers resembling banks or exchanges

- Safety: Leveraging protected cryptographic protocols, the framework can improve the safety and integrity of digital asset transactions by imposing complicated enterprise guidelines.

- Versatility: It’s suitable with several types of digital belongings, together with fungible and non-fungible tokens, making it a flexible resolution for the DeFi ecosystem.

- Transparency and Accountability: The framework promotes transparency and accountability within the DeFi house by way of real-time compliance monitoring and reporting (by way of onchain submitted, totally encrypted studies).

Such a framework can help DeFi protocols in navigating the intricate regulatory atmosphere, contributing to a safer and extra reliable decentralized monetary ecosystem.

Dr Freund might be contacted through electronic mail at [email protected]

The submit Resolving the Dichotomy: DeFi Compliance underneath Zero-Information appeared first on Enterprise Ethereum Alliance.