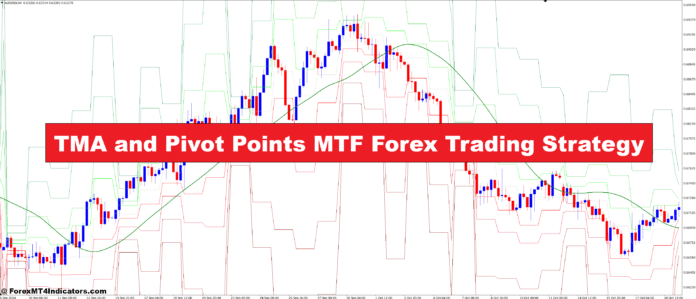

Are you misplaced on this planet of foreign currency trading? The TMA and Pivot Factors MTF technique might be your information. It makes use of Technical Transferring Common (TMA) bands, pivot factors, and multi-timeframe evaluation to clear the market noise. However, studying these instruments can really feel like a giant process.

Don’t fear! We’ll make this complicated technique easy. You’ll learn to use it to make higher buying and selling decisions. Prepare to enhance your foreign currency trading expertise with this highly effective technique.

Key Takeaways

- TMA bands provide a smoothed view of worth tendencies

- Pivot factors present key assist and resistance ranges

- Multi-timeframe evaluation boosts decision-making

- The technique combines technical indicators for deep market insights

- Merchants can set alerts for doable entry factors

- Understanding market dynamics is vital to success

Understanding TMA and Pivot Factors MTF Buying and selling System

The TMA and Pivot Factors MTF Buying and selling System is a robust device for foreign currency trading. It makes use of TMA buying and selling, pivot factors in foreign exchange, and multi-time body evaluation. This offers merchants a full view of the market.

What’s TMA Buying and selling?

TMA buying and selling makes use of Triangular Transferring Common bands to search out the perfect instances to purchase and promote. These bands are 2% above and under the primary line. They assist merchants know when to enter and exit the market. The TMA indicator is considered one of 91 out there for MT4 platforms.

Position of Pivot Factors in Foreign exchange

Pivot factors in foreign exchange are key for assist and resistance ranges. They assist predict when the market would possibly change route or get away. The TzPivots indicator lets merchants customise pivot level calculations for various time zones.

Multi-Timeframe Evaluation Defined

The multi-timeframe evaluation appears to be like at charts of various durations collectively. This offers a large view of the market, from short-term modifications to long-term tendencies. The BB Multi-Timeframe indicator helps many customizable timeframes. This helps merchants discover alternatives in varied time frames.

| Part | Operate | Key Characteristic |

|---|---|---|

| TMA Buying and selling | Establish purchase/promote zones | 2% band placement |

| Pivot Factors | Outline assist/resistance | Customizable time zones |

| Multi-Timeframe Evaluation | Present market overview | A number of timeframe assist |

By combining these components, merchants get a robust system for analyzing the market. This helps them make good buying and selling choices within the foreign exchange market.

Important Technical Indicators for the Technique

The TMA and Pivot Factors MTF Foreign exchange Buying and selling Technique makes use of three major technical indicators. These instruments give merchants a full view of the market and doable buying and selling probabilities.

TMA Bands Indicator

The TMA bands indicator is on the coronary heart of this technique. It units up dynamic assist and resistance ranges. This helps merchants discover the perfect instances to purchase and promote.

The indicator makes use of a 20-period setting and an ATR of 100 durations. When the value hits the higher band, it is perhaps time to promote. If the value touches the decrease band, it might be an excellent time to purchase.

Unique MTF RSI

The Multi-Timeframe (MTF) Relative Power Index (RSI) is vital for locating entry factors. This particular indicator appears to be like at market momentum throughout completely different timeframes. It provides a stronger sign than a typical RSI.

Merchants use it to examine if the TMA bands are proper. This makes their commerce entries extra correct.

Heiken Ashi Integration

The Heiken Ashi chart provides a particular view of worth motion. It smooths out worth modifications, making tendencies clearer. On this technique, merchants use Heiken Ashi to see tendencies and ensure indicators from the TMA bands and MTF RSI.

This combine helps to chop by market noise. It additionally makes timing trades higher.

| Indicator | Operate | Settings |

|---|---|---|

| TMA Bands | Establish purchase/promote zones | Interval: 20, ATR: 100 |

| MTF RSI | Decide entry factors | A number of timeframes |

| Heiken Ashi | Pattern visualization | Default settings |

Setting Up Your Buying and selling Platform

Establishing your foreign currency trading platform is vital for utilizing the TMA and Pivot Factors MTF technique. MetaTrader 4 is a best choice for a lot of merchants. It’s recognized for being simple to make use of and versatile. Let’s go over the foreign currency trading platform setup steps, specializing in including the fitting TMA technique indicators.

First, obtain and set up MetaTrader 4 from a trusted dealer. After putting in, you’ll want so as to add the wanted indicators. These embody TMA Bands, Unique MTF RSI, and Heiken Ashi charts. You’ll find these MetaTrader 4 indicators from dependable sources or your dealer’s library.

- Open MetaTrader 4

- Click on on “File” then “Open Information Folder”

- Navigate to the “MQL4” folder, then “Indicators”

- Copy your downloaded indicators into this folder

- Restart MetaTrader 4

After organising, customise your chart with the TMA Bands, Unique MTF RSI, and Heiken Ashi indicators. Regulate their settings to suit your buying and selling fashion and market circumstances. Bear in mind, organising these TMA technique indicators accurately is significant for achievement in foreign currency trading.

Methods to Commerce with TMA and Pivot Factors MTF Foreign exchange Buying and selling Technique

Purchase Entry

- The worth is above the TMA (indicating a bullish pattern).

- The worth is above the pivot level (indicating bullish market sentiment).

- Worth pulls again to the TMA (searching for a bounce from the TMA).

- Purchase when the value reveals indicators of assist on the TMA (e.g., a bullish candlestick sample, like a pin bar or engulfing sample) or shut above the TMA.

- RSI (Relative Power Index) is above 50 (indicating bullish momentum).

- MACD is exhibiting a bullish crossover (the MACD line crosses above the sign line).

- Enter a purchase place when the rice confirms assist on the TMA on the M15 or M5 chart.

Promote Entry

- The worth is under the TMA (indicating a bearish pattern).

- The worth is under the pivot level (indicating bearish market sentiment).

- Worth pulls again to the TMA (searching for a rejection or bounce under the TMA).

- Promote when the value reveals indicators of resistance on the TMA (e.g., a bearish candlestick sample, like a bearish engulfing or taking pictures star) or closes under the TMA.

- RSI is under 50 (indicating bearish momentum).

- MACD is exhibiting a bearish crossover (the MACD line crosses under the sign line).

- Enter a promote place when the value confirms resistance on the TMA on the M15 or M5 chart.

Multi-Timeframe Evaluation Implementation

Multi-timeframe foreign exchange evaluation mixes insights from completely different durations. It helps merchants see the massive image and make good decisions. Let’s dive into methods to use this methodology throughout varied timeframes.

30-Minute Timeframe Technique

The 30-minute technique is nice for fast merchants. It balances quick market modifications with strong pattern recognizing. Use TMA Bands and MTF RSI to search out good entry factors.

Search for worth breaks above or under the TMA Bands. Be sure that the MTF RSI agrees to enter a commerce.

60-Minute Timeframe Evaluation

The 60-minute evaluation provides a wider view of the market. It’s good for recognizing medium-term tendencies and key ranges. Combine Heiken Ashi candles with pivot factors to search out robust pattern modifications.

This timeframe is ideal for swing merchants wanting longer trades.

4-Hour Buying and selling Strategy

The 4-hour timeframe catches large market strikes. It filters out the noise and reveals vital tendencies. Use TMA Bands coloration to search out purchase and promote areas.

4-hour charts are nice for risky pairs like GBPUSD and USDJPY.

| Timeframe | Technique Focus | Advisable Indicators |

|---|---|---|

| 30-Minute | Brief-term trades | TMA Bands, MTF RSI |

| 60-Minute | Medium-term tendencies | Heiken Ashi, Pivot Factors |

| 4-Hour | Main pattern shifts | TMA Bands Coloration, ADR Weekly |

Consistency throughout timeframes is significant for achievement. All the time match your buying and selling together with your threat stage and account measurement.

Threat Administration and Place Sizing

Foreign exchange threat administration is vital to success with the TMA and Pivot Factors MTF technique. Merchants should hold their capital protected whereas aiming for earnings. It’s vital to set the fitting cease loss ranges, based mostly on the timeframe you’re buying and selling.

- Begin with a cease lack of 30-50 pips, adjusting to your timeframe

- Don’t threat greater than 1-2% of your account stability per commerce

- Use a place measurement calculator to determine lot sizes

- Set trailing stops to maintain earnings protected as trades transfer in your favor

Through the use of these threat administration ideas, you’ll enhance your buying and selling. Bear in mind, making a living constantly means managing losses properly, not simply profitable trades. The TMA technique with good threat management can assist you achieve the long term.

| Timeframe | Advised Cease Loss (pips) | Max Threat per Commerce (%) |

|---|---|---|

| 30-minute | 30-35 | 1% |

| 1-hour | 35-40 | 1.5% |

| 4-hour | 45-50 | 2% |

Regulate the following pointers to suit your buying and selling fashion and threat stage. Maintain checking and tweaking your place sizing to get the perfect out of your TMA technique.

Pivot Factors Integration Methods

Pivot level buying and selling boosts foreign exchange assist and resistance methods. This half talks about methods to use pivot factors properly in your buying and selling plan. We’ll have a look at Fibonacci’s pivot factors and their function find vital market ranges.

Fibonacci Pivot Factors

Fibonacci pivot factors are key instruments for foreign exchange merchants. They present vital assist and resistance areas. These pivot factors use Fibonacci ratios to search out market turning factors.

- Establish doable reversal zones

- Set actual entry and exit factors

- Decide stop-loss ranges

- Forecast worth targets

Help and Resistance Ranges

Foreign exchange assist and resistance ranges are the core of pivot level buying and selling. These ranges are the place worth motion typically stops or turns. By mixing Fibonacci pivot factors with conventional assist and resistance, merchants could make higher decisions.

| Pivot Level Degree | Calculation | Use in Buying and selling |

|---|---|---|

| Central Pivot Level (PP) | (Excessive + Low + Shut) / 3 | The primary reference for bullish/bearish bias |

| Help 1 (S1) | PP – (0.382 * (Excessive – Low)) | First assist stage |

| Resistance 1 (R1) | PP + (0.382 * (Excessive – Low)) | First resistance stage |

| Help 2 (S2) | PP – (0.618 * (Excessive – Low)) | Second assist stage |

| Resistance 2 (R2) | PP + (0.618 * (Excessive – Low)) | Second resistance stage |

Utilizing Fibonacci pivot factors with assist and resistance ranges makes a robust buying and selling framework. This methodology helps discover key worth zones for large market strikes.

Superior TMA and Pivot Factors MTF Foreign exchange Buying and selling Technique

The TMA and Pivot Factors MTF technique elevates foreign currency trading. It combines a number of indicators throughout completely different timeframes. This results in extra exact indicators and higher decision-making.

Superior foreign exchange methods typically use complicated TMA strategies. The TMA Centered Bands indicator has three bands on the chart. The center band modifications coloration to indicate the pattern route. Blue means the pattern is up, and crimson means it’s down.

Pivot level evaluation provides extra to this technique. Merchants discover three assist and resistance ranges from previous costs. This helps spot when the market would possibly change route or get away.

- Breakouts under the decrease TMA band sign shopping for alternatives

- Breakouts above the higher TMA band point out promoting probabilities

- RSI ranges above 50 counsel robust market circumstances

- Pivot factors present extra affirmation for entry and exit factors

This technique combines components for an in depth market evaluation. The TMA indicator is versatile for a lot of buying and selling types and markets. It’s helpful for each new and seasoned merchants.

Widespread Buying and selling Eventualities and Examples

Foreign currency trading examples assist merchants perceive market dynamics. Let’s discover bullish setups, bearish market buying and selling, and ranging market methods. We’ll use the TMA and Pivot Factors MTF method.

Bullish Buying and selling Setups

In bullish setups, search for worth closing above the higher TMA band. Enter when the Half Pattern purchase arrow seems and RSI crosses above 30. Set cease loss under the current low and goal the subsequent pivot level resistance.

Bearish Market Situations

For bearish market buying and selling, anticipate worth to shut under the decrease TMA band. Enter quick when the Half Pattern promote arrow kinds and RSI drops under 70. Place cease loss above the current excessive and goal for the closest pivot level assist.

Ranging Market Methods

In ranging market technique, give attention to pivot factors as key ranges. Purchase close to assist when the value bounces off the decrease TMA band. Promote close to resistance when worth rejects the higher TMA band. Use tighter cease losses and take earnings at opposing pivot factors.

Bear in mind, profitable buying and selling requires endurance and observe. All the time use correct threat administration, setting a 1:1.18 risk-reward ratio. Apply these methods on 4-hour charts for greatest outcomes throughout main forex pairs and commodities.

Optimization and Backtesting Strategies

Bettering buying and selling efficiency is vital. The TMA and Pivot Factors MTF technique will get higher with backtesting. This helps merchants regulate settings and guidelines to make the TMA technique efficiency higher.

Backtesting reveals nice outcomes for this technique. GBPUSD has the best acquire at 160 pips. EURJPY and EURUSD comply with with 104 and 100 pips, respectively. One of the best timeframes are 1-hour and 30-minute charts.

| Foreign money Pair | Common Month-to-month Pips |

|---|---|

| GBPUSD | 160 |

| EURJPY | 104 |

| EURUSD | 100 |

| GBPJPY | 95 |

| USDCHF | 85 |

Entry circumstances embody TDI crosses and Stochastic route. Adjusting SynergyInd settings may also assist. UseVolExpanding ought to be true.

Utilizing these optimization and backtesting strategies can result in higher buying and selling. The TMA and Pivot Factors MTF technique could be improved.

Conclusion

The TMA and Pivot Factors MTF Foreign exchange Buying and selling Technique is a robust device for merchants. It combines the TMA foreign exchange technique advantages with pivot factors buying and selling benefits. This offers merchants a full view of the forex markets.

Utilizing a number of indicators, just like the TMA Slope and the BBMACD_V2, helps quite a bit. These instruments present deep insights into market tendencies.

Pivot factors are very correct, with costs hitting them about 90% of the time. This makes them very dependable. The technique works properly on completely different timeframes, from quick 1-minute trades to longer 5-minute ones.

It’s good for making a living, with revenue targets of 5-10 pips. The MTF EMA 20 indicator can also be helpful. It reveals the place assist and resistance is perhaps.

With a profitable commerce charge of 69-79%, this technique could be very worthwhile. However, it’s vital to maintain practising and bettering. That is key to doing properly within the fast-changing foreign exchange market.

Advisable MT4 Dealer

XM Dealer

- Free $50 To Begin Buying and selling Immediately! (Withdraw-able Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Profitable Foreign exchange Dealer

- Further Unique Bonuses All through The 12 months

- Unique 50% Money Rebates for all Trades!

Already an XM consumer however lacking out on cashback? Open New Actual Account and Enter this Companion Code: 𝟕𝐖𝟑𝐉𝐐

Click on right here under to obtain: