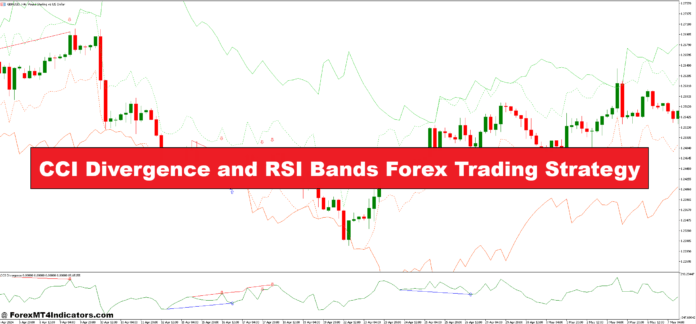

The CCI Divergence and RSI Bands Foreign exchange Buying and selling Technique is a strong mixture of two confirmed technical indicators that provide merchants a dynamic strategy to figuring out market reversals and potential worth traits. Within the extremely unstable world of foreign currency trading, counting on a single indicator can usually result in inconsistent outcomes. By integrating the Commodity Channel Index (CCI) and Relative Energy Index (RSI) Bands, this technique creates a strong system that helps merchants filter out market noise, enhance entry timing, and optimize exit factors. The synergy between these two indicators makes this technique significantly efficient for short-term and swing merchants searching for precision and reliability of their trades.

The CCI Divergence performs a vital function in recognizing early indicators of worth reversals. Divergence happens when the worth of a forex pair strikes in a single course whereas the CCI indicator strikes in the wrong way. This discrepancy alerts weakening momentum and the potential of a development reversal, providing merchants invaluable insights into upcoming market actions. Alternatively, RSI Bands are designed to establish overbought and oversold circumstances with a larger degree of flexibility than the normal RSI. By increasing and contracting based mostly on volatility, RSI Bands present merchants with clearer zones for high-probability commerce entries and exits. Collectively, these indicators complement one another, enhancing the technique’s accuracy in figuring out reversals and development continuations.

What units this technique aside is its means to adapt to completely different market circumstances, providing merchants an edge whether or not the market is trending or consolidating. By combining the predictive nature of CCI Divergence with the dynamic construction of RSI Bands, merchants achieve a complete view of market momentum, permitting them to make knowledgeable choices with confidence. Whether or not you’re a novice exploring new methods or an skilled dealer seeking to refine your edge, the CCI Divergence and RSI Bands Foreign exchange Buying and selling Technique provides a dependable framework to navigate the complexities of the foreign exchange market successfully.

CCI Divergence Indicator

The Commodity Channel Index (CCI) Divergence Indicator is a flexible software designed to establish shifts in momentum and potential reversals within the foreign exchange market. The CCI measures the deviation of a forex pair’s worth from its common worth over a selected interval, indicating whether or not the market is overbought or oversold. When the CCI begins to diverge from the precise worth motion, it alerts that the present development is shedding momentum, and a reversal could possibly be imminent. As an illustration, if the worth is making increased highs whereas the CCI is making decrease highs, it creates bearish divergence, suggesting that purchasing strain is weakening. Equally, bullish divergence happens when the worth makes decrease lows whereas the CCI types increased lows, indicating potential shopping for alternatives as sellers lose power.

One of many main benefits of the CCI Divergence Indicator is its means to identify reversals earlier than they happen, giving merchants an edge in coming into trades early. In contrast to lagging indicators that observe worth actions, divergence highlights delicate discrepancies between worth motion and market momentum. This permits merchants to anticipate shifts in course and capitalize on rising traits. To maximise its effectiveness, the CCI Divergence Indicator is usually used along with different instruments like help and resistance ranges or candlestick patterns to verify the alerts and scale back false positives. By incorporating CCI Divergence into their technique, merchants achieve a deeper understanding of market dynamics and might higher handle threat when positioning their trades.

RSI Bands Indicator

The RSI Bands Indicator is a modified model of the basic Relative Energy Index (RSI) that adapts to market volatility through the use of dynamic bands as an alternative of fastened overbought and oversold ranges. Whereas the normal RSI operates inside a spread of 0 to 100, with the 70 and 30 ranges indicating overbought and oversold circumstances respectively, the RSI Bands create higher and decrease bands that increase and contract based mostly on volatility. This dynamic adjustment permits merchants to establish high-probability commerce setups extra successfully, because the bands mirror altering market circumstances somewhat than inflexible thresholds. When worth motion reaches the outer RSI Bands, it usually alerts a possible reversal or exhaustion within the prevailing development, offering merchants with alternatives for entries or exits.

What makes the RSI Bands significantly helpful is their means to filter out market noise and supply clearer alerts in periods of excessive volatility. In trending markets, the RSI Bands might help merchants experience traits confidently by figuring out pullbacks or corrections inside the development. In ranging markets, the bands function dependable boundaries, highlighting areas the place worth is prone to reverse. By combining the RSI Bands with different indicators, such because the CCI Divergence, merchants can verify alerts and improve their decision-making course of. This adaptability makes the RSI Bands Indicator a invaluable software for merchants searching for precision and consistency in each trending and uneven market circumstances.

Collectively, the CCI Divergence and RSI Bands indicators kind a synergistic technique, offering merchants with the instruments wanted to navigate advanced worth actions with confidence.

Find out how to Commerce with CCI Divergence and RSI Bands Foreign exchange Buying and selling Technique

Purchase Entry

- Determine Bullish Divergence:

- Value makes decrease lows.

- CCI types increased lows (divergence sign).

- RSI Bands Affirmation:

- Value approaches or bounces from the decrease RSI Band.

- Look ahead to a bullish reversal candlestick (e.g., hammer, bullish engulfing).

- Enter the Commerce:

- Enter on the shut of the confirming bullish candlestick.

Promote Entry

- Determine Bearish Divergence:

- Value makes increased highs.

- CCI types decrease highs (divergence sign).

- RSI Bands Affirmation:

- Value reaches or rejects the higher RSI Band.

- Look ahead to a bearish reversal candlestick (e.g., taking pictures star, bearish engulfing).

- Enter the Commerce:

- Enter on the shut of the confirming bearish candlestick.

Conclusion

The CCI Divergence and RSI Bands Foreign exchange Buying and selling Technique is a extremely efficient strategy for figuring out potential market reversals and bettering commerce accuracy. By combining the predictive energy of the CCI Divergence with the dynamic flexibility of the RSI Bands, merchants can anticipate modifications in momentum and make well-informed buying and selling choices. This technique works seamlessly in each trending and ranging markets, permitting merchants to identify high-probability commerce setups whereas filtering out market noise.

Advisable MT4 Dealer

XM Dealer

- Free $50 To Begin Buying and selling Immediately! (Withdraw-able Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Successful Foreign exchange Dealer

- Further Unique Bonuses All through The Yr

- Unique 50% Money Rebates for all Trades!

Already an XM consumer however lacking out on cashback? Open New Actual Account and Enter this Associate Code: 𝟕𝐖𝟑𝐉𝐐

Click on right here beneath to obtain: