What’s the very first thing new merchants often be taught when beginning buying and selling?

Maybe… Transferring averages?

Chart patterns?

Help & Resistance, perhaps?

How about Candlesticks Patterns?

Technical evaluation has probably the most enticing subjects in any case, proper!

Nonetheless, whereas these ideas might help you enter and handle a commerce…

…they received’t maintain you within the recreation in the long term.

To offer your self an opportunity at holding your portfolio intact, you want a necessary lesson in…

Danger administration!

And that, my pal, is what I’ve ready for you at the moment.

Particularly, you’ll be taught…

- The best and quickest threat administration technique to use in shares

- A exact threat administration technique that means that you can be versatile along with your threat on the inventory market

- Accessible place sizing calculators that you should utilize anytime with out registering or downloading something

- Superior recommendations on the way to management your threat relying available on the market situation and your buying and selling technique

Now, this coaching information is greater than only a Wikipedia entry on threat varieties.

I’ll present you precisely the way to apply these strategies and which instruments you might want to get began at the moment.

Sound good?

Then let’s start!

The right way to apply threat administration in shares: Portfolio allocation technique

On this part, I’ll train you the precise calculations for a way place sizing works.

…so that you simply perceive precisely the way to recreate them your self!

Now, this place sizing technique is finest used:

- For diversifying your portfolio

- For each buying and selling and investing

- For any type of buying and selling or investing when not coping with leverage

The portfolio allocation technique works by setting a “fastened proportion” restrict when shopping for a inventory.

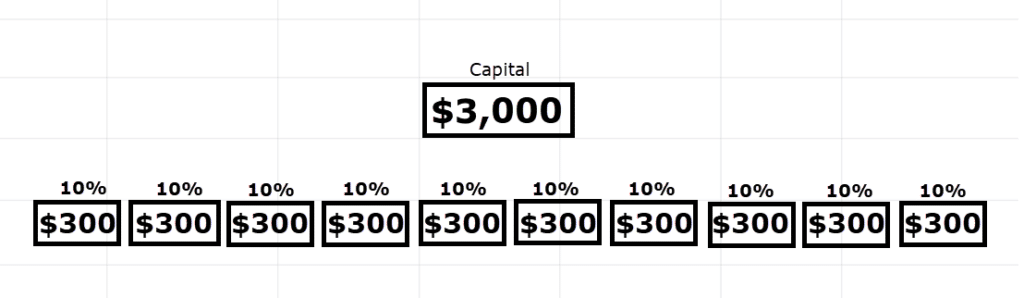

For instance, say you have got a $3,000 buying and selling account.

And let’s say that you simply need to have a most allocation of 10% per commerce.

Which means that for those who’re fascinated by shopping for a inventory, you don’t need to purchase shares price greater than $300…

And by now…

You need to see that having a ten% allocation offers you a most open commerce of 10…

Make sense?

However you may be questioning…

“Okay, however how does this work in the actual world?”

“How precisely do I calculate what number of shares to purchase when the inventory’s value is $1.92?”

Let me present you…

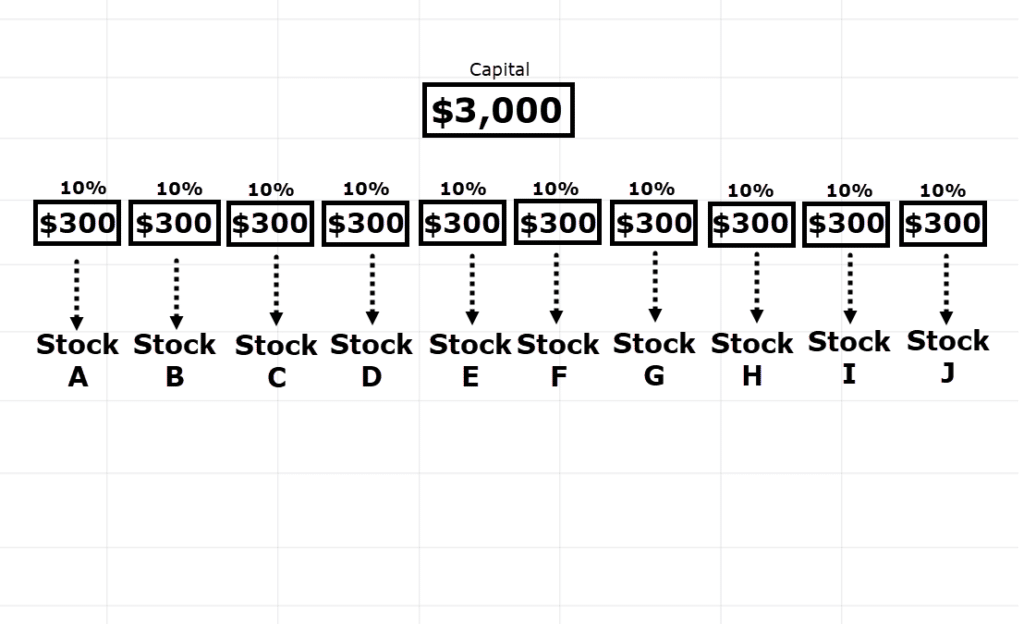

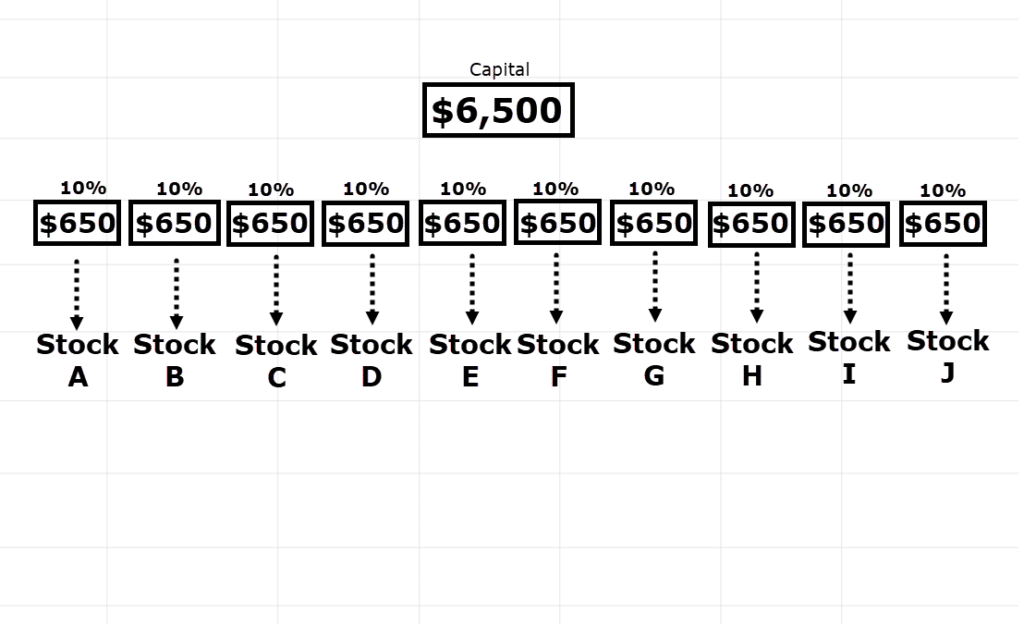

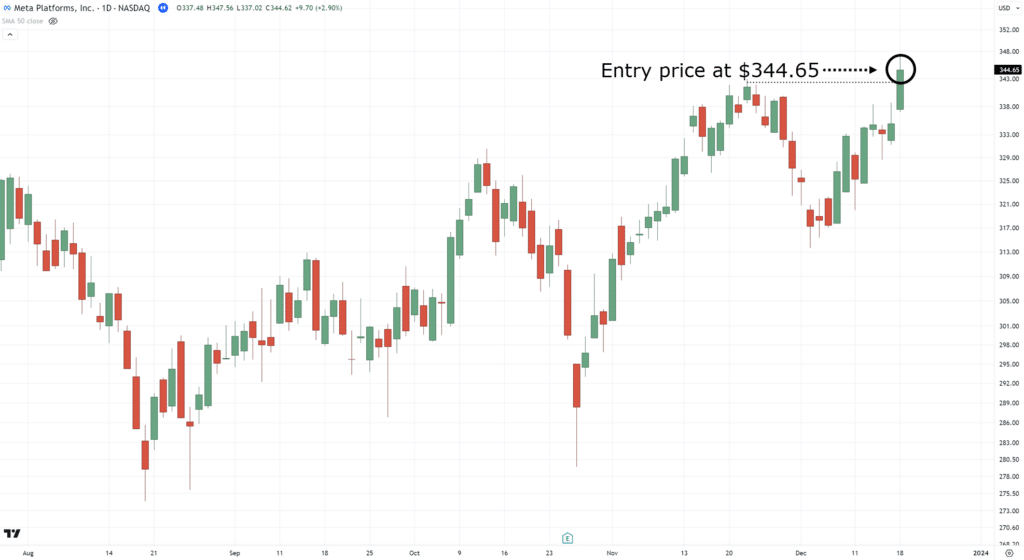

This time, let’s say that you’ve a $6,500 buying and selling account.

And {that a} 10% allocation signifies that you’ll purchase shares price as much as $650.

This provides you a most open commerce of 10…

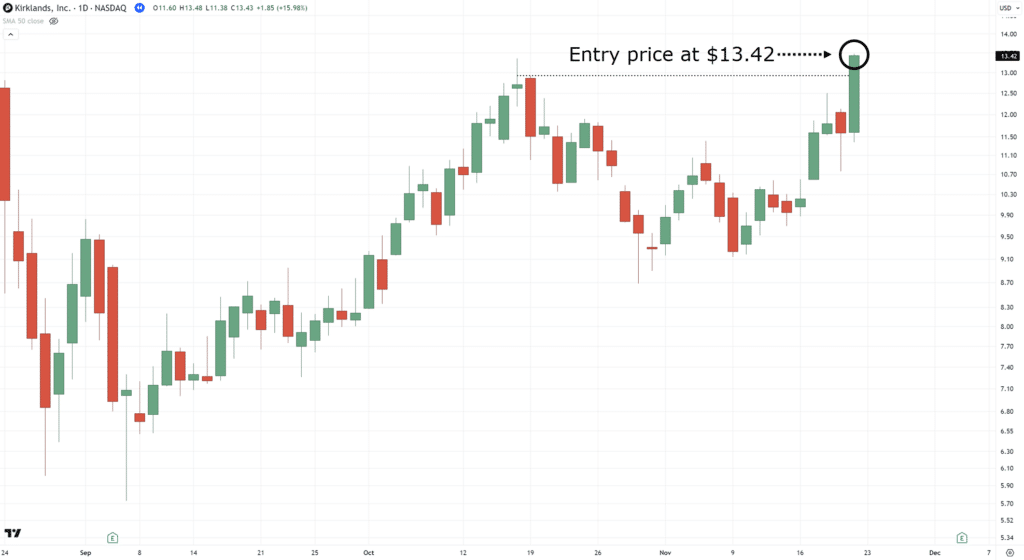

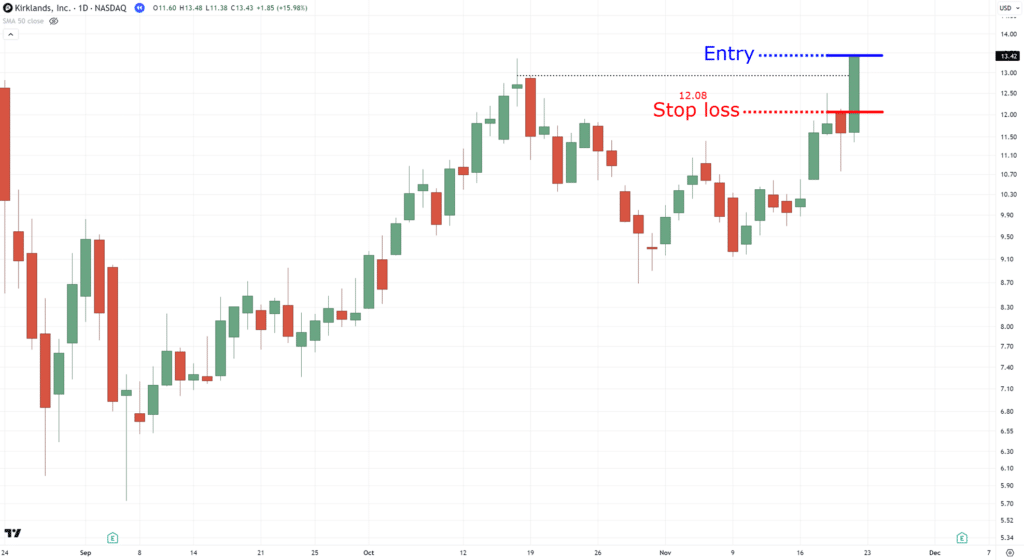

Now, you discover three shares you want (as a result of they’re at present on a breakout!)…

The query now could be…

What number of shares can I purchase?

First, take their closing costs:

- KIRK – $13.42

- CRWD – $176.25

- META – $344.65

The following factor you do is divide these closing costs by your 10% allocation quantity, $650…

And voila, now you understand precisely what number of shares to purchase!

(And sure, you’ll need to “spherical down” the calculation as you don’t need to allocate greater than 10%)

Now, you may be questioning…

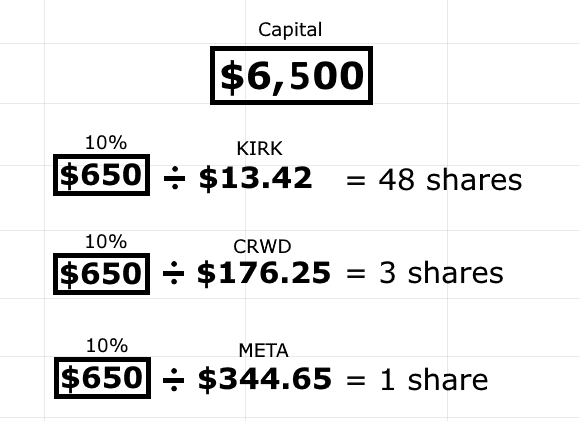

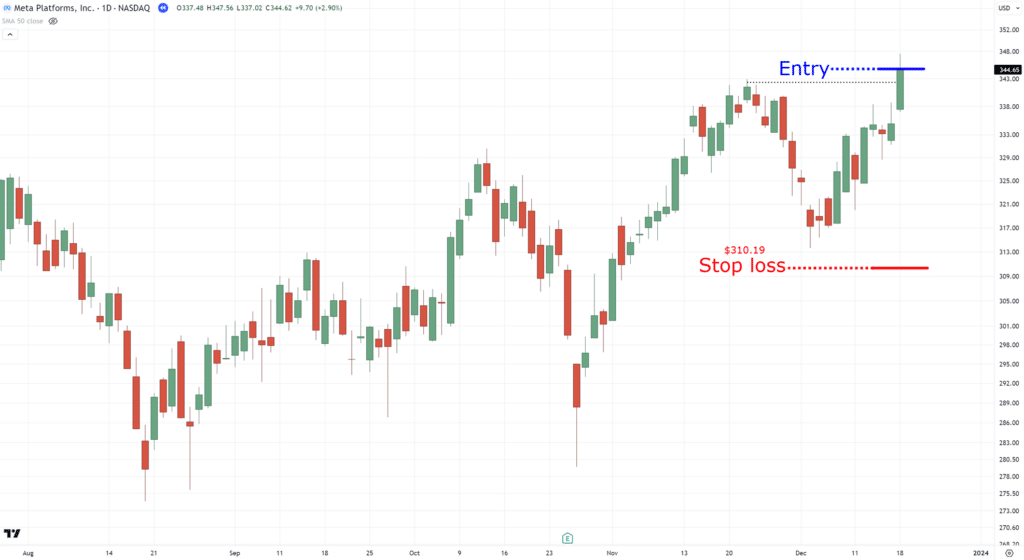

“The place do I place my cease loss?”

And that may be a superb query!

Merely talking, calculate it by subtracting 10% of the final closing value…

By doing so, it signifies that in case your cease loss is hit…

…you’ll lose not more than $65.

I’ll clarify extra about this idea shortly, however understanding the fixed-percentage cease loss goes hand-in-hand with the portfolio allocation technique.

Bought it?

So, let’s transfer on to the subsequent place sizing technique…

The right way to apply threat administration in shares: Share technique

So, for those who’re buying and selling with shares with none leverage, then utilizing portfolio allocation place sizing is smart.

Nonetheless, if you’re buying and selling with leverage, then understanding this proportion place sizing is essential.

Within the earlier threat administration technique, the formulation was easy:

Shares to purchase = (Portfolio stability x 10% allocation) / Inventory value

…however this time, you might want to ramp issues up just a bit!

Now, earlier than I share with you some formulation right here, I need you to know the precept of this threat administration technique:

In case your cease loss is hit, you place dimension in a method that you simply solely lose 1% of your account stability

So, for instance…

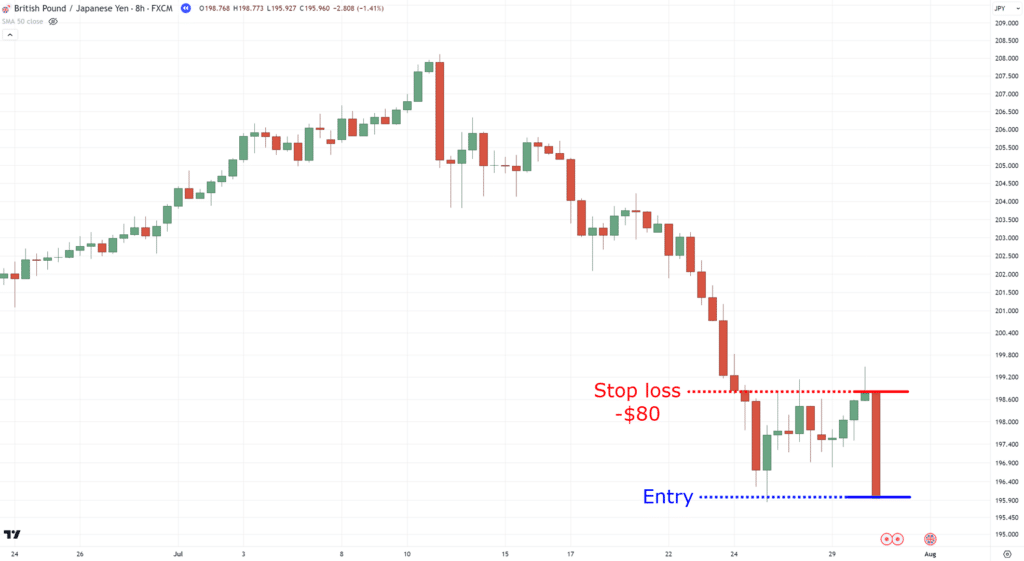

You’ve an $8,000 account, 1% of that capital is $80.

Which means that if my cease loss is hit, I need to guarantee that I don’t lose greater than $80 on my total portfolio.

Once more, this so-called “1%” differs from the allocation, because it refers back to the cease loss.

However you may ask:

“What makes this place sizing technique good?”

Effectively, the fantastic thing about it’s you could be versatile in the place you place your cease loss.

You possibly can place a decent cease loss, and nonetheless just remember to solely lose 1% when your cease loss is hit…

You possibly can have a large cease loss, and nonetheless just remember to solely lose 1% when your cease loss is hit…

See what I imply?

This provides you flexibility on the place you need to place your cease loss, as your potential loss will stay static.

So, again to the query:

How do you apply this?

For shares, go by this equation…

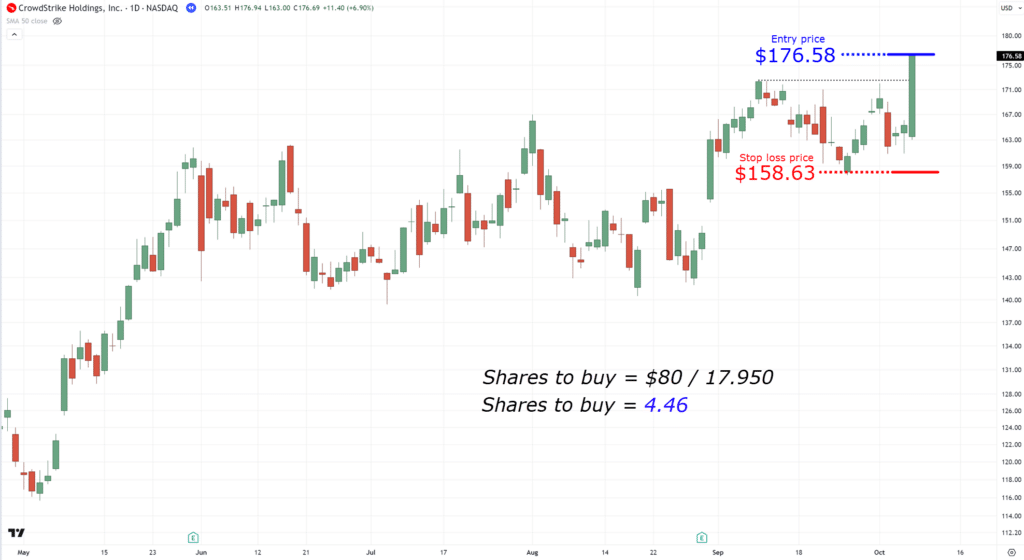

Shares to purchase = Danger quantity / (entry value – cease loss value)

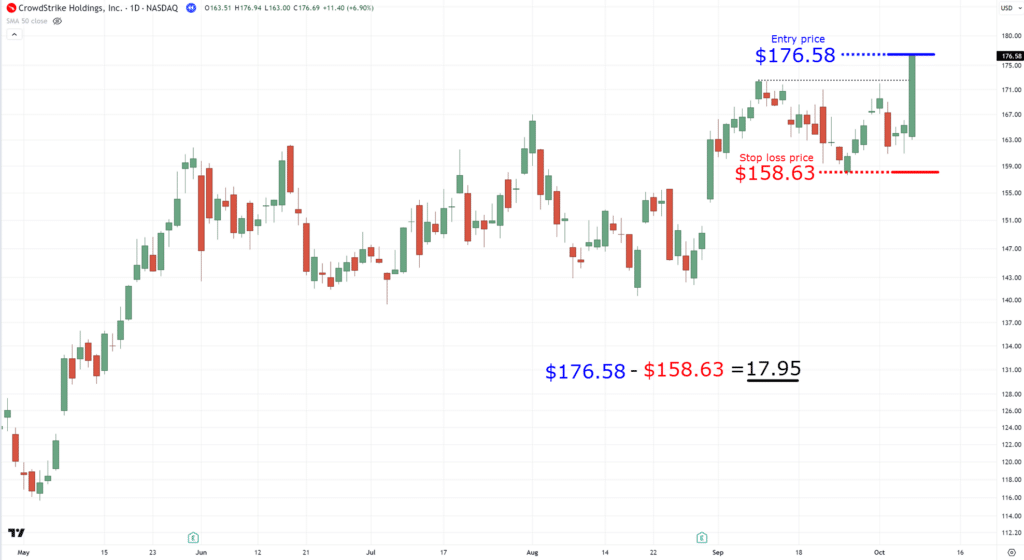

Let’s take the earlier instance for instance.

I first must subtract the entry value and the cease loss value…

Lastly, I simply divide it by 1% of my $8,000 account, which is $80!

After doing these calculations, you may work out what number of shares to purchase…

On this case, for those who purchase 4 shares at that entry value, even when your cease loss is hit, you’ll not lose greater than $80.

Nonetheless with me?

Nice!

As a result of from right here on, issues get a complete lot simpler…

Subsequent, I’ll share with you totally different instruments on how one can apply threat administration to shares.

The right way to apply threat administration in shares: What instruments must you use?

The aim of this part is to automate your threat administration.

Alright, I do know what you’re considering proper now:

“Why didn’t you begin with this within the first place?”

Effectively, nothing feels higher than proudly owning the information you discovered – and it makes extra sense than blindly following another person’s calculation, proper?

So, listed below are some primary standards I’ll lay down for what sort of threat administration instruments you’ll use:

- The chance administration software have to be free (no registration required)

- The chance administration software have to be straightforward to make use of and perceive

- The chance administration software should require no set up or obtain

Sound superior?

Effectively, I meant it after I mentioned you could apply every little thing you discovered as quickly as you end this buying and selling information!

So, what’s the software that meets these standards?

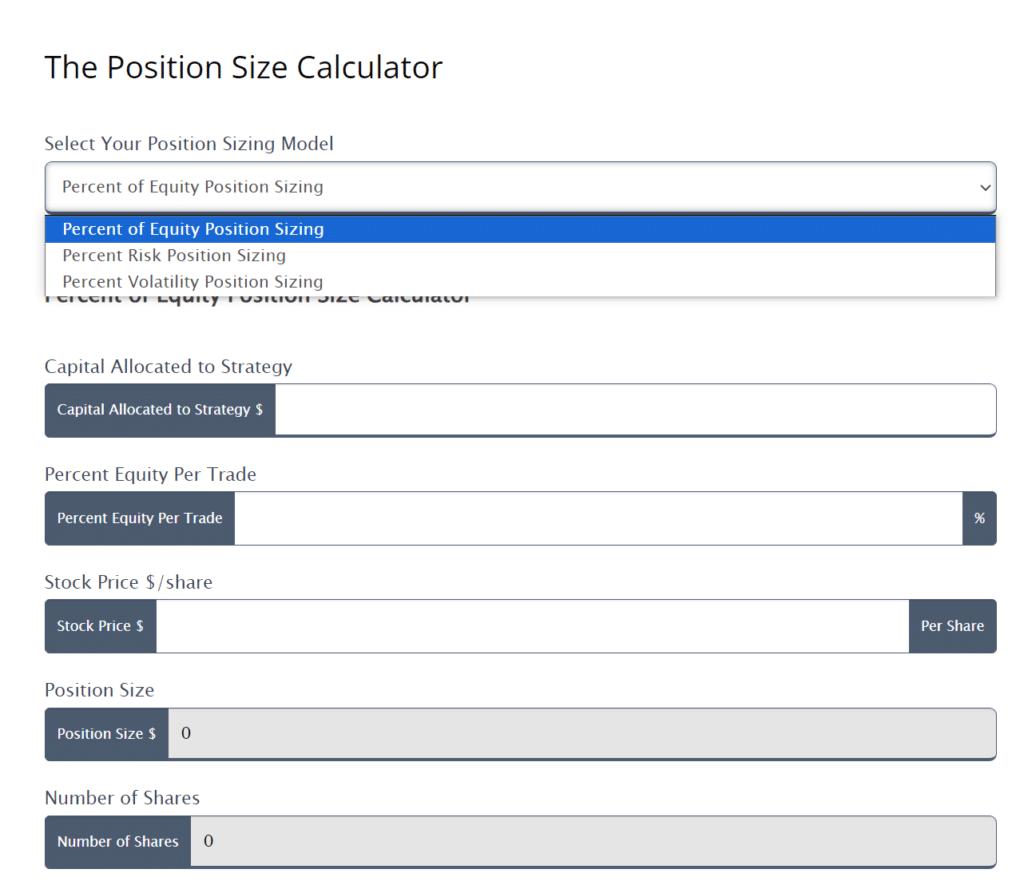

The most effective position-sizing software for shares

Fortuitously, this software was launched very just lately – whereas I used to be penning this information for you, actually!

So, to present correct credit score… it’s the place sizing software of Adrian Reid:

Enlightened Inventory Buying and selling’s Place Measurement Calculator

What I really like about this software is that it’s an all-in-one resolution, providing you with every little thing you might want to find out about the way to apply threat administration on shares.

Think about automating every little thing you’ve discovered on this information to this point… multi function place!

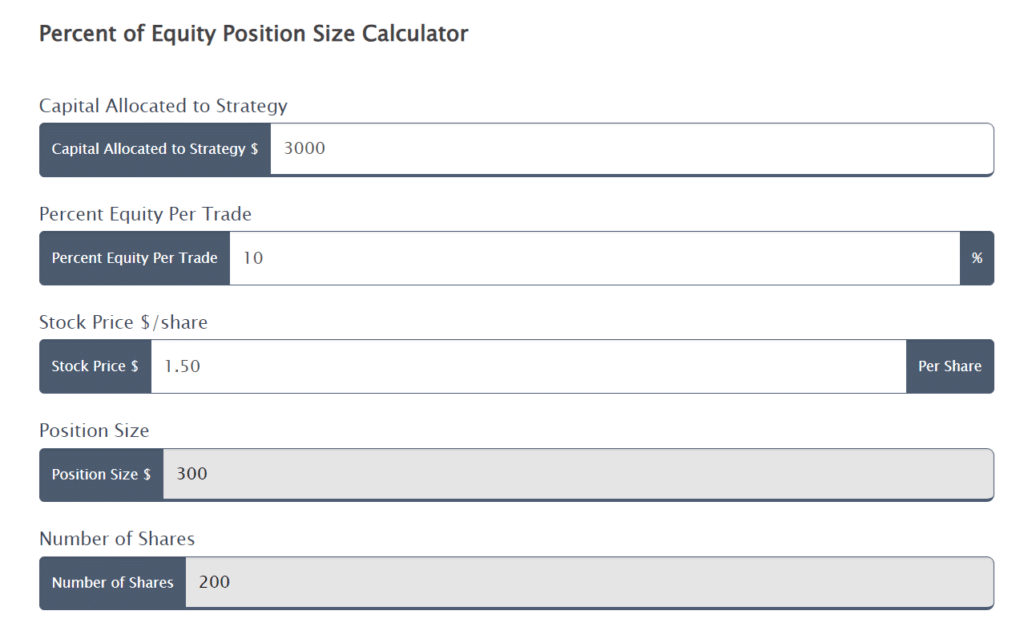

For instance, let’s say you have got a capital of $3,000, and also you’re allocating 10% of your capital per inventory.

And let’s say the inventory’s value on entry is $1.50 per share.

What number of shares do you purchase?

Effectively, simply plug within the numbers…

then bam!… you get 200 shares to purchase!

Straightforward-peasy!

However how in regards to the different place sizing technique I shared with you?

Sure, the web site has that, too…

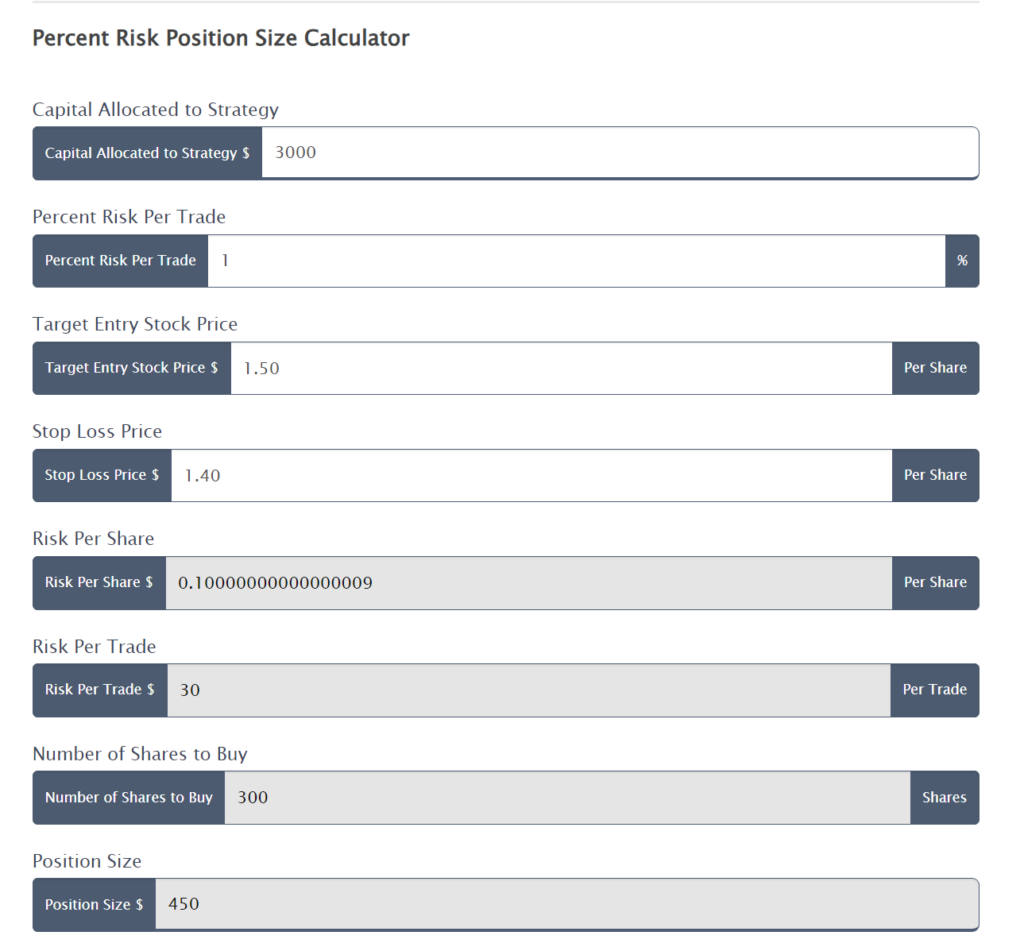

Within the instance above, I positioned the identical capital quantity.

However this time, I entered that I’d be risking 1% per commerce, that the inventory’s entry value is $1.50, and I wished the cease loss at $1.40.

And what are you aware – I should buy 300 shares primarily based on the calculation!

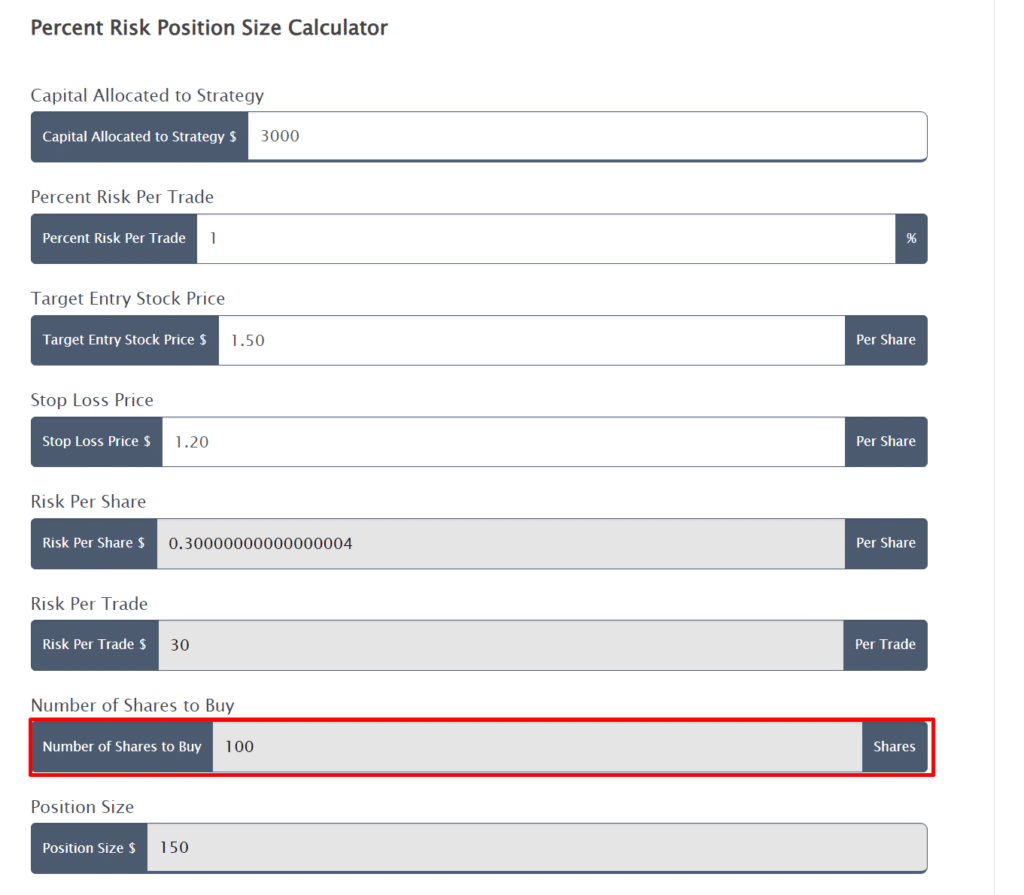

OK, however what for those who felt that the cease loss distance was too tight and wished to position it out additional?

Effectively, that’s the fantastic thing about this explicit threat administration technique, my pal!

You may be versatile about the place you need to place your cease loss however nonetheless preserve threat.

So, in case your cease loss now could be decrease, at $1.20…

The calculator reveals that I’d need to enter this commerce with 100 shares.

It’s a wider cease loss, however nonetheless the identical threat, at not more than 1% per commerce.

Fairly neat, proper?

And though I’m positive there are much more calculators on the market that absolutely automate this course of…

…or buying and selling platforms that have already got built-in threat administration calculators in them, too…

On this case, I need to do my finest to share probably the most accessible calculators on the market with you.

I actually didn’t need to spend half of your studying time on the way to register with sure brokers or set up particular indicators in your platform!

Now, within the subsequent part, I’m going to construct on what you’ve discovered on this information to this point.

Possibly you observed I all the time ask you to threat 1% of your account per commerce or allocate 10% of your account per commerce?

However…. when can you alter these numbers?

When must you threat 0.5% per commerce?

How about 2% per commerce?

And what about allocation?

When do you allocate 20% of your capital per commerce on a single inventory?

How do you go about it?

Learn on to seek out out!

The right way to apply threat administration in shares: The key to altering the parameters

So, the way you modify your threat relies upon available on the market situation and what sort of buying and selling type you have got.

That’s why, on this remaining part, I’ll share with you the way to apply:

- Danger administration for bull markets within the inventory markets

- Danger administration for bear markets within the inventory markets

- Danger administration for intraday buying and selling in shares

Let’s take a more in-depth look…

Danger administration for bull markets within the inventory markets

There’s a standard saying:

“When it’s a bull market, every little thing you contact turns into gold…

…however every little thing you contact turns to shit in a bear market!”

It’s exactly why it’s best to capitalize on a bull market when it comes however be defensive throughout a bear market.

As you understand, the frequent proportion for portfolio allocation is 10%, which supplies you a most of 10 open trades.

However contemplate being extra aggressive in your portfolio allocation at any time when a bull market happens.

That is completed, for instance, by allocating 12.5% per inventory, providing you with 8 most open trades.

It concentrates your portfolio a bit extra, which means you can face better losses but in addition make better returns.

And for those who want to go for probably the most aggressive portfolio allocation proportion, you may allocate 20% per inventory, providing you with a most open commerce of simply 5.

So, by utilizing this idea, you achieve extra flexibility to interact along with your account, attempting to capitalize on the tide of a bull market.

Danger administration for bear markets within the inventory markets

Admittedly, in a bear market, it doesn’t must be the case that every little thing you contact turns to shit.

It simply signifies that discovering an “outlier” trending inventory throughout a sea of blood is way tougher!

So, you have got two choices.

First, you may keep in money.

Second, you allocate much less, comparable to a most of 5% per inventory, providing you with a most open commerce of 20.

After all, you all the time need to enter trades with a sound buying and selling technique, too.

However one other essential query is:

“Why are you doing it like this, with so many open trades?”

The reply, my pal, is with the intention to improve your odds with a bigger pattern dimension of open trades.

Chances are high, plenty of these shares you’re holding throughout a bear market will most probably fail.

Nonetheless…

As soon as you notice a golden egg in your basket in the midst of a bear market, it’s time to promote your laggards and scale them into your winners!

Principally, the idea is that on a bull market, you’d need to be extra aggressive.

However on the bear market, you’d need to be extra defensive.

Make sense?

Good, since you’ve simply completed an entire information on the way to apply threat administration in shares!

With that mentioned, let’s go over a abstract on what you’ve discovered at the moment.

Conclusion

Right here’s the reality:

Realizing the way to apply threat administration in shares should come first (and definitely not final!)

Taking your time over it ensures you don’t blow by means of your account, regardless of what number of occasions you mess up!

And within the worst-case situation?

Your portfolio bleeds, providing you with sufficient time to be taught out of your errors and seal the wound.

So, right here’s a fast recap of what you’ve discovered at the moment…

- A portfolio allocation place sizing technique is among the most dependable methods to commerce markets with none leverage.

- Having a risk-based proportion place sizing is a little more sophisticated to use, however offers you each the pliability of inserting your cease loss wherever whereas additionally managing

- There are free and accessible place sizing calculators prepared so that you can entry, comparable to calculators from Enlightened Inventory Buying and selling.

- On a bull market, contemplate allocating extra shares per inventory, however on a bear market, you have to be defensive by allocating much less.

So, there’s your full information, from newbie to superior, on how one can surgically management the danger parameters of your portfolio!

However truly, I need to hear what you assume.

What are another threat administration strategies you understand of?

And for those who commerce crypto or foreign exchange, how do you apply threat administration there?

Let me know within the feedback under!