By Aimee Raleigh, Principal at Atlas Enterprise, as a part of the From The Trenches characteristic of LifeSciVC

“It was the most effective of instances, it was the worst of instances…”

One other JPM is behind us, and whereas a lot of the small discuss was centered on the gorgeous climate, spectacular sea of pink in help of the Biotech CEO Sisterhood, and Monday’s offers (congratulations to ITCI, Scorpion, and IDRx groups!), general sentiment was bifurcated. Whereas many early-stage personal VCs (and particularly these taking part in latest M&A) are feeling good going into 2025, public buyers lamented the poor efficiency of public portfolios and indices. Equally on the corporate facet, a number of megaround darlings have captured a big share of the capital prior to now 12 months (almost 100 raises >$100M). In distinction, the temper is extra apprehensive for these corporations with knowledge or timing setbacks, particularly on high of one of many highest charges of RIFs in 2024. The previous 12 months has been a blended bag, particularly when factoring in tenuous macro headwinds comparable to uncertainty concerning the brand new administration, debate on drug pricing, and persistently excessive rates of interest. You’ll hear from different retailers that JPM sentiment ranged from poor to cautiously optimistic – whereas I received’t add extra adjectives to the pile, beneath are a few of my key takeaways as we begin the brand new 12 months.

Earlier than we dive in, I might be remiss if I didn’t name out the truth that a lot of final 12 months’s themes proceed to be entrance and heart, together with M&A and investor {dollars} targeted on “sizzling” areas. With out additional ado – my key themes from this 12 months’s JPM as we look ahead to one other productive 12 months in biotech…

Courageous New World: China Property are Right here to Keep

Regardless of grandstanding from Washington, China out-licenses to U.S. and EU-based biotech and Pharma have by no means been extra considerable than prior to now 12 months (Fig. 1). Whereas our trade will proceed to debate whether or not the fast timelines and considerable applications out there in China are a increase or a bust for our biotech financial system, there isn’t a denying the panorama for therapeutic improvement is shifting (and particularly for “validated” targets for “best-in-class” performs). Pharma specifically elevated China-sourced deal quantity considerably final 12 months, a vote of confidence for the sturdy discovery and improvement expertise there in addition to extra environment friendly timelines to scientific proof-of-concept. Stifel not too long ago reported that ~1/3 of Pharma licensing offers in 2024 had been sourced from China, an unimaginable statistic and one which factors to the shifting panorama for asset-centric offers.

A number of questions are high of thoughts for buyers when excited about China-sourced belongings:

- How lengthy will these offers stay aggressive, particularly within the context of quickly growing economics (upfront, complete milestones, royalties, fairness)?

- How can we mannequin evolution of this market – will we proceed to see largely “me-too” or “me-better” performs? Or will the China ecosystem evolve to ship first-in-class applications targeted on riskier biology or difficult druggability?

- Associated to the above, what number of impartial applications in opposition to the identical goal can the market fairly help? In some unspecified time in the future we are going to attain a saturation level in belongings, past which there aren’t sufficient consumers to credibly carry a program by means of late-stage improvement and commercialization.

The longer term right here isn’t all or none – it’s extremely unlikely China will utterly change Western international locations in drug discovery and improvement, and it’s also unlikely that future laws will utterly block collaboration. It’s to our profit as an trade to work in direction of a brand new paradigm that leverages cross-geography collaboration, whereas additionally guaranteeing the U.S. and Europe stay aggressive in executing on improvement for first-in-class performs.

There and Again Once more: Traders Tiring of “Me-Too” Performs

Relatedly, investor pleasure for asset-centric performs has performed a task within the rush to supply (largely clinical-stage) belongings from China. As my colleague Bruce wrote in a latest submit (right here), the sentiment in 2024 was overwhelmingly “assets-in, platforms-out.” Corporations elevating cash for first-in-class biology or earlier platforms tended to have a harder fundraising journey final 12 months, with few standout exceptions. Nevertheless, the pendulum will inevitably shift, and the query is whether or not we as an trade can foresee that shift early and modify or whether or not we’ve got already oversaturated sure indications and targets. Given the motion in direction of huge indications of the previous 18 months (weight problems, broader cardiovascular, excessive incidence oncology, and enormous I&I indications), it’s necessary to recollect the big price, experience, and time dedication required to run a number of Section 3 trials and commercialize in these aggressive areas. It’s unlikely that many corporations past Pharma and large-cap biotech can pull it off. Thus, if you end up evaluating the 7th antibody program in opposition to Goal X, think about whether or not the client pool is saturated and what incremental alternative is obtainable by any differentiated options. I’ve little question many extra of those applications will “work” clinically than will be feasibly commercialized.

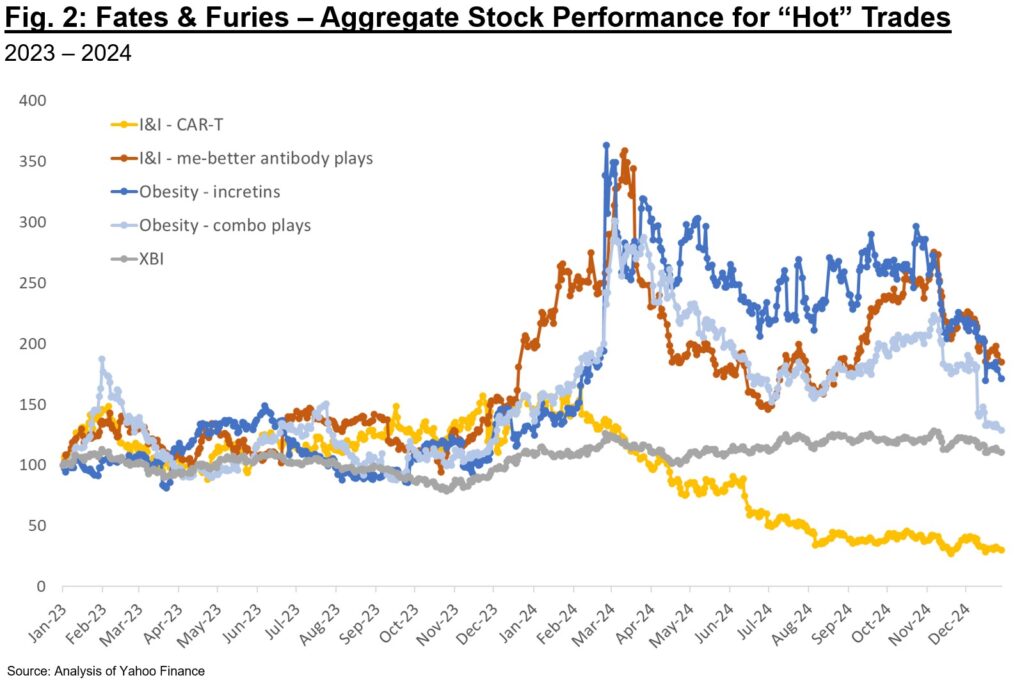

For example, we are able to think about a few of the “sizzling” areas in 2024 and the combination inventory efficiency for consultant public corporations (Fig. 2). Whereas each I&I and weight problems performs are controversial sturdy performers, it’s worthwhile to notice that some classes clearly turned overhyped final 12 months and subsequently offered off. At instances the sell-off was as a result of knowledge that, whereas good, fell in need of the perfection priced in. At different instances, it was associated to aggressive performs rising on the personal facet. In a market the place there are zero-sum components, an “apparent” play is simply valued as long as it’s perceived as best-in-class and aggressive in late-stage improvement.

Maybe within the near-future buyers will once more recognize riskier however probably higher-reward biology and offers – we might already be beginning to see that in 2025 with a few of the giant follow-on financings for next-gen modalities. A typical chorus this previous JPM was that of public buyers lamenting lack of “originality” within the personal offers they had been evaluating. There’s an uncanny Catch-22 at play – platform or first-in-class asset performs require appreciable funding and conviction, however firm creation VCs can’t proceed to put money into these areas if later-stage buyers (crossover and publics) don’t take part in financings earlier than these are de-risked in Section 2. If we proceed to pay attention bets in “validated” performs, I frankly fear in regards to the novelty of our collective pipelines 5 years from now.

New Alternatives & Headwinds in Scientific Improvement

So the place does an investor or entrepreneur look when some indications really feel saturated? One space of focus could be indications the place trial landscapes are evolving such that chance of success is larger at present than beforehand. For example, think about bronchial asthma – up till the early 2010s bronchial asthma trials didn’t use eosinophil ranges as an inclusion standards or stratifier, however moderately some taste of Th2 marker (e.g., periostin). A number of mechanisms that many agree ought to work (e.g., anti-IL13 lebrikizumab) failed beneath this trial design – is {that a} learn on the mechanistic relevance itself, or moderately the setting wherein it was trialed? Altering improvement paradigms supply a path ahead for brand spanking new or beforehand discarded mechanisms – a number of of my favorites from the previous ~12 months are beneath:

- COPD: a pure extension of the eos excessive vs. low paradigm in bronchial asthma is the appliance of this affected person stratification strategy in COPD. The Dupixent approval for sufferers with an eosinophilic phenotype final September factors to the success of this strategy. Will anti-IL33s have the identical success stratifying by smoking standing? We’ll quickly discover out, as plenty of these readouts are anticipated this 12 months.

- HFpEF: coronary heart failure is an space the place incretins are radically altering the paradigm, together with the idea that weight reduction can really be helpful in sufferers (in comparison with the “weight problems paradox” notion, i.e., weight problems correlates with higher survival charges, implying losing a few pounds may very well be detrimental to CV outcomes). Novo and LLY have trialed semaglutide and tirzepatide in each T2D and non-diabetic overweight populations with coronary heart failure and proven beautiful efficacy on CV outcomes, high quality of life, and performance. Nearly as necessary because the incretin mechanism, these trials established a brand new paradigm for overweight HFpEF when it comes to affected person choice, approvable endpoints, and remedy length. Hopefully this altering trial panorama for HFpEF, and probably broader segments of HF, alleviates a few of the danger for biotechs growing new remedies for these sufferers.

- Urticaria: the exceptional efficacy of KIT inhibitors in CSU has confirmed the function of mast cells in driving pathology, and has additionally ushered within the idea of Xolair naïve vs. refractory as a affected person stratification strategy. Whereas Xolair is an okay early-line agent for sufferers, potent KIT inhibitors like CLDX’s barzolvolimab have proven to be equally efficacious throughout each Xolair-naïve and refractory sufferers, suggesting that best-in-class efficacy is feasible throughout affected person segments when disabling mast cells. Different applications focusing on Th2 biology (e.g., dupilumab) have proven mediocre efficacy and solely within the Xolair-naïve inhabitants, implying restricted influence of the mechanism past present standard-of-care.

- Strong tumors: latest FDA steerage on use of ctDNA as an endpoint for remedies with healing intent for stable tumors could also be an early biomarker for a shift within the surrogate endpoint panorama. Whereas extra work is required to harmonize assays and interpretation throughout therapies and trial settings, it’s a promising improvement to expedite sign in search of in these trials.

Whereas these altering paradigms can assist drive additional improvement, there are additionally loads of indications the place the trial panorama is in dire want of latest insights on affected person stratification, endpoint choice, and remedy length. Atopic Dermatitis specifically stands out – whereas the pipeline of energetic brokers is growing, so too is the collective uncertainty re: constraining placebo response. Likewise for ALS, we proceed to see failed mechanisms throughout trials (the previous 12 months alone it was ATXN2, eIF2B, RIPK1, 15-Lipoxygenase, and others) and it’s unclear whether or not we’re seeing trial design noise or true adverse reads on the biology. At this level it’s unclear whether or not NfL as a surrogate will probably be related throughout a number of subtypes of ALS (genetic and in any other case) and what timeframe is cheap to see illness modification. That stated, with a number of high-conviction applications near the clinic (together with from Hint and others), hopefully 2025 brings extra readability on tips on how to finest consider therapies for this devastating situation.

Herculean Scientific Influence: What Can’t Incretins Do?!

Whereas some buyers are rising exhausted with the sheer quantity of weight problems newcos, it’s clear T2D and weight problems are solely the tip of the iceberg for indication relevance of this class. The “winners” have potential to command great market share given the enduring metabolic profit established prior to now few years for this class. In 2024 we witnessed stellar readouts in HFpEF, MASH, Obstructive Sleep Apnea, Knee Osteoarthritis, Power Kidney Illness, and T2D prevention. Whereas these datasets are being generated by LLY and NOVO, there’s now a strong clinical-stage pipeline of incretins in quick pursuit.

There’s great alternative for any Pharma with a present or future metabolic illness franchise to construct quickly right here – the market is so giant that no 2 gamers can feasibly nook all market share. Many indications exist the place growing stage of weight reduction (and corresponding enhancements in lipid profiles, glucose management, and so forth.) is prone to drive better scientific profit. Tirzepatide (Zepbound / Mounjaro) is clearly market-leading for these advantages, however there’s nonetheless substantial therapeutic potential for an agent that achieves larger weight reduction (approaching ~25% bar set by bariatric surgical procedure at 1 12 months). Whereas a few of these potential rivals (e.g., CagriSema, MariTide) have disenchanted when it comes to differentiation vs. tirzepatide, others in late-stage improvement (VKTX, Kailera, choose others) might very nicely obtain the excessive bar required for differentiation.

Along with the broad spectrum of metabolic ailments the place incretins at the moment are a related first line remedy, there are a number of high-risk however high-reward readouts forward in 2025. Topline readouts from Novo’s research of semaglutide in early Alzheimer’s Illness (EVOKE and EVOKE PLUS) are anticipated by the top of this 12 months. One other trial by Novo will learn out on the efficacy of semaglutide and cagrilintide (amylin) in alcohol-related liver illness – importantly this trial has excessive potential to indicate profit on alcohol consumption, probably paving the way in which for broader improvement in substance use problems. Lastly, we’re beginning to see trials for incretins together with anti-inflammatory brokers for I&I circumstances with a comorbid weight problems inhabitants (e.g., Lilly’s Section 3 trial for tirzepatide together with anti-IL17A ixekizumab in psoriasis).

Finally there are rising “tiers” of mechanistic rationale for incretins in indications past weight problems and T2D:

- Group 1: most “apparent” enlargement of mechanism and associated to influence of weight reduction on physique mechanics. Examples embrace Knee Osteoarthritis and Obstructive Sleep Apnea.

- Group 2: much less apparent however probably associated to each discount in fats mass & irritation. HFpEF and MASH fall into this class, and whereas not 100% correlated, improved weight reduction profit (a surrogate for therapeutic efficiency) tends to enhance outcomes for these indications.

- Group 3: indications the place incretin efficiency is prone to influence efficacy however the place knowledge remains to be rising. These indications embrace habit / cravings, cognition / dementia, and long-term CV outcomes.

Whereas the urge for food for brand spanking new incretin-based corporations is waning, it’s largely a results of the compelling late-stage applications (e.g., from VKTX, Kailera, and others) already in line to compete with LLY and NOVO. It’s additionally clear that incretins as a category have extra to show when it comes to mechanistic relevance and influence on human well being – this might very nicely be the largest therapeutic breakthrough of our lifetimes.

Inside Neuro, Epilepsy Continues to be a Darling for Traders

2024 noticed many features within the neuro area, together with repurposing anti-amyloid antibodies with TfR1 shuttles for improved mind penetration, the primary approval in Schizophrenia in over 30 years in Cobenfy, and optimistic mHTT and NfL readouts in Huntington’s. Final 12 months was additionally marked by quite a few compelling datasets for epilepsy. Specifically, knowledge in pediatric developmental and epileptic encephalopathies (DEE) and grownup focal epilepsy suggests a paradigm shift to best-in-class exercise with safer profiles. A few of the compelling readouts prior to now 12 months, and people on faucet for 2025, are beneath:

- Novel therapies for DEEs might obtain illness modification and thus have a profound impact on infants and kids with refractory epilepsy.

- STOK not too long ago acquired Section 3 design alignment from the FDA, EMA, and PMDA (Japan) for the EMPEROR trial of zorevunersen, an progressive oligonucleotide to extend SCN1A transcript ranges and thus immediately tackle the haploinsufficiency driving illness. Compelling seizure discount (>85%) is annotated for these sufferers on high of standard-of-care (albeit in an open-label setting). As well as, Section 2 knowledge displaying profit on cognitive and developmental scales in addition to inclusion of the Vineland-3 endpoint in Section 3 suggests potential for actual illness modification in these refractory sufferers

- Final 12 months Lundbeck acquired Longboard Prescribed drugs largely for its 5-HT2c superagonist small molecule remedy Bexicaserin after studying out compelling Section 1/2 earlier within the 12 months in DEEs. Given >30% seizure discount (placebo-corrected) throughout DEE sufferers, 2025 will probably be an necessary execution 12 months for the Section 3 trial for the mechanism

- Praxis additionally learn out a compelling Section 2 dataset for DEEs final 12 months – relutrigine is a sodium channel inhibitor being trialed in SCN2A and SCN8A DEE sufferers. Topline knowledge confirmed almost 50% seizure discount (placebo-corrected) at 16 weeks in a really extreme inhabitants and 1/3 of sufferers achieved seizure freedom

- Whereas early, Xenon not too long ago printed preclinical knowledge for its Nav1.1 sodium channel openers, which have blockbuster potential for Dravet Syndrome.

- The previous 12 months has additionally seen great advances in therapies for adults with focal epilepsy.

- 2/7.3 potassium channel openers have quickly emerged as one of many highest-potential remedies for focal epilepsy, particularly these with selectivity (and thus security) to allow power remedy. XENE leads the pack with azetukalner, attaining ~35% seizure discount (placebo-corrected) in a latest Section 2b readout. BHVN’s Kv7 activator BHVN-7000 isn’t too far behind, and these applications might usher in a flood of rivals

- RAPP’s RAP-219, whereas earlier-stage, has potential in focal epilepsy as a extra selective AMPA receptor NAM – Section 2a readouts are anticipated this 12 months, and apparently will present a learn on lengthy episodes (through implanted intracranial EEG) as a possible PD marker

The mechanisms governing hyperexcitability in seizure era may play a task in different neuro circumstances, and it’s no shock a few of these applications are additionally being developed for psych, motion problems, and associated circumstances. Even with all of the success of this area, it’s value noting that 2024 wasn’t uniformly optimistic in epilepsy – Ovid and Takeda noticed the Section 3 failure of small molecule inhibitor of ldl cholesterol 24-hydroxylase (CH24H) soticlestat in refractory Dravet syndrome and Lennox-Gastaut syndrome. Whereas not all knowledge has been rosy, the longer term has by no means regarded so brilliant for epilepsy remedies and 2025 might usher in an actual paradigm shift for brand spanking new (and probably disease-modifying) medicines.

Closing Ideas – Exits Will Proceed to Dictate Sentiment

Finally buyers are judged on their exits, so M&A and public portfolio efficiency will proceed to play an outsized function in sentiment for 2025. On the previous, Pharma patent cliffs proceed to loom giant and thus will probably drive sustained acquisitions for scientific or near-clinical performs. On the latter, we’re nonetheless seeing sturdy knowledge being rewarded (e.g., BMPC, DNLI, others final week). Even when shares aren’t at their all-time highs, there’s alternative to choose winners and do nicely on this market, particularly contemplating a few of the undervalued names.

There’s a bimodal distribution in investor and firm sentiment and it’s unlikely to vary within the very near-term. As an alternative of specializing in what’s out of our management (geopolitical agita, pricing strain, cussed inflation), let’s put power into what we are able to management: doing every thing in our collective energy to convey medicines to sufferers. Cheers to a productive 2025 for our trade.

P.S. For these of you following alongside, sure the callbacks to literature had been intentional and there are 5 in complete!