Are you having bother discovering good buying and selling indicators within the foreign exchange market? The 3 EMA Crossover and Actual Cloud Foreign currency trading technique may also help. It makes use of technical indicators to search out high-probability setups simply. Through the use of Exponential Transferring Averages (EMAs) and the Actual Cloud indicator, you can also make higher buying and selling selections.

This technique is altering the sport within the foreign exchange world. It’s making a huge impact on merchants.

Key Takeaways

- Combines 3 EMAs (3, 13, 144) with Actual Cloud Indicator

- Relevant to all forex pairs on 15-minute timeframes or increased

- Gives clear entry and exit indicators for each lengthy and brief trades

- Presents a number of exit methods for various market situations

- Helps scale back market noise and establish robust tendencies

- Integrates danger administration by means of strategic stop-loss placement

Understanding the Energy of EMA Buying and selling Techniques

Exponential Transferring Common (EMA) buying and selling programs are widespread amongst foreign exchange merchants. They assist spot tendencies and when to enter or go away the market. Let’s see why they’re efficient and the way they’re completely different from different shifting averages.

What’s an Exponential Transferring Common (EMA)

An Exponential Transferring Common weighs current worth information extra. This makes EMAs faster to react to market adjustments than Easy Transferring Averages (SMAs). As an illustration, a 3-period EMA has a price of 51.25, displaying it’s quick to answer worth adjustments.

Advantages of Utilizing A number of EMAs

Merchants use a number of EMAs to see each brief and long-term tendencies. By mixing EMAs with completely different intervals, like 3, 13, and 144, they spot development shifts and ensure indicators. This methodology helps keep away from false indicators and provides a full view of market actions.

EMA vs SMA: Why Merchants Want EMAs

EMAs are most popular over SMAs for a number of causes. They react shortly to cost adjustments, excellent for short-term buying and selling. SMAs are higher for long-term evaluation, however EMAs catch quick market strikes. This fast response lets merchants make faster trades, probably boosting income in quick markets.

| Characteristic | EMA | SMA |

|---|---|---|

| Responsiveness | Excessive | Reasonable |

| Weight on current costs | Greater | Equal |

| Lag | Much less | Extra |

| Ideally suited for | Quick-term buying and selling | Lengthy-term evaluation |

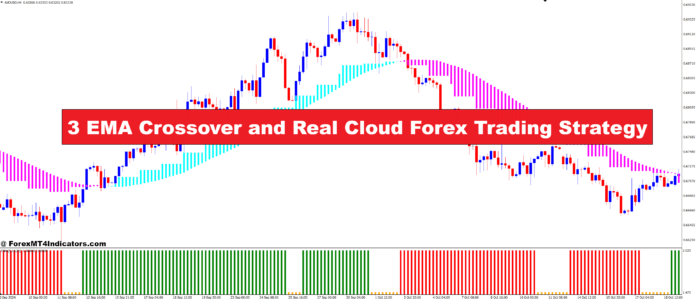

3 EMA Crossover and Actual Cloud Foreign exchange Buying and selling Technique

The 3 EMA Crossover and Actual Cloud indicators make a robust staff in Foreign exchange. They combine quick Exponential Transferring Averages with the Actual Cloud’s trend-following. Merchants use this combo on 1-hour charts and up, specializing in the Euro and US classes for greatest outcomes.

The 3 EMA Crossover makes use of three time intervals: 3, 13, and 144. These EMAs react quick to cost adjustments, giving faster indicators than easy shifting averages. The Actual Cloud indicator provides extra by displaying help and resistance ranges, making the technique higher.

Merchants normally purpose for a 100-pip take revenue with this technique. They use a risk-to-reward ratio of 1:1 for the primary lot and 1:2 for the second. This steadiness helps handle danger and goals for good positive aspects.

For lengthy positions, search for the worth above all three EMAs, with the shortest EMA crossing the longer ones. The Actual Cloud ought to present a bullish development, with costs above the cloud. This sign alignment boosts the prospect of profitable trades in trending markets.

- Use on 1-hour timeframes and above

- Deal with Euro and US buying and selling classes

- Intention for 100-pip take revenue

- Mix EMA crossovers with Actual Cloud tendencies

By mixing the three EMA Crossover with the Actual Cloud indicator, merchants get a full view of market tendencies and entry factors. This technique is exclusive amongst EMA-based strategies, mixing velocity, and development affirmation for Foreign exchange merchants.

Important Parts and Indicator Setup

Organising the three EMA Crossover and Actual Cloud technique wants cautious work. This half will present you learn how to arrange the EMA, Actual Cloud, and one of the best Foreign exchange time frames. This may enable you to commerce higher.

Setting Up the Three EMAs

The technique makes use of three Exponential Transferring Averages (EMAs) with intervals of three, 13, and 144. These EMAs shortly observe worth adjustments. They assist present each short-term actions and long-term tendencies. Right here’s learn how to set them up:

- Add EMA(3) for short-term worth actions

- Embody EMA(13) for medium-term tendencies

- Apply EMA(144) to establish long-term market course

Configuring the Actual Cloud Indicator

The Actual Cloud indicator helps with development evaluation. To set it up:

- Choose the Actual Cloud indicator out of your platform’s listing

- Regulate coloration settings for clear visible cues

- Set acceptable sensitivity ranges in your buying and selling type

Advisable Time Frames and Foreign money Pairs

For one of the best outcomes, use these time frames and pairs:

| Time Body | Foreign money Pairs |

|---|---|

| H1-H4 | EUR/USD, GBP/USD, USD/JPY |

| D1 | AUD/USD, USD/CAD, NZD/USD |

| W1 | EUR/GBP, USD/CHF, GBP/JPY |

Bear in mind, the EMA setup and Actual Cloud configuration work greatest together with your chosen Foreign exchange time frames. Strive completely different settings to search out one of the best match in your buying and selling technique.

Understanding the Actual Cloud Part

The Actual Cloud indicator is a key instrument for Foreign exchange merchants. It exhibits market dynamics, serving to discover good occasions to purchase or promote. By understanding the cloud, merchants could make higher selections.

Cloud Formation and Interpretation

The Actual Cloud indicator has 5 components that kind the cloud. These are the Tenkan-Sen, Kijun-Sen, Chikou Span, Senkou Span A, and Senkou Span B. Every half is essential for studying the cloud.

| Part | Calculation | Operate |

|---|---|---|

| Tenkan-Sen | (9-period excessive + 9-period low) / 2 | Quick-term development indicator |

| Kijun-Sen | (26-period excessive + 26-period low) / 2 | Medium-term development indicator |

| Senkou Span A | (Tenkan-Sen + Kijun-Sen) / 2 | Varieties one boundary of the cloud |

| Senkou Span B | (52-period excessive + 52-period low) / 2 | Varieties the opposite boundary of the cloud |

| Chikou Span | The present closing worth plotted 26 intervals again | Measures market sentiment |

Utilizing Cloud Boundaries for Commerce Choices

Cloud boundaries act as help and resistance. If the worth is above the cloud, it’s an excellent time to purchase. If it’s beneath, it’s time to promote. Merchants use these ranges to resolve when to commerce.

Cloud Shade Modifications and Their Significance

The Actual Cloud indicator’s coloration adjustments present market tendencies. A inexperienced cloud means the market goes up. A pink cloud means it’s taking place. These coloration adjustments assist merchants see when the market would possibly change.

Threat Administration and Place Sizing

Foreign exchange danger administration is essential to long-term buying and selling success. It helps defend your cash and retains your feelings balanced. Let’s have a look at learn how to handle danger with the three EMA Crossover and Actual Cloud technique.

Sensible merchants danger solely 1-2% of their account per commerce. This stops massive losses and retains feelings regular. For instance, with a $10,000 account, danger not more than $200 per commerce. Work out your place dimension primarily based in your cease loss and the way a lot danger you’ll be able to take.

Buying and selling psychology is essential for making choices. Keep disciplined and keep away from buying and selling an excessive amount of. Make guidelines for when to enter and exit trades, and the way a lot danger to take. Keep on with your plan, even if you’re shedding. This helps handle stress and improves your long-term outcomes.

| Account Dimension | Max Threat per Commerce (2%) | Cease Loss (pips) | Place Dimension (normal heaps) |

|---|---|---|---|

| $5,000 | $100 | 50 | 0.2 |

| $10,000 | $200 | 50 | 0.4 |

| $25,000 | $500 | 50 | 1.0 |

Use cease losses to restrict losses. Set stops primarily based on market construction, not simply pip values. Consider using trailing stops to guard income as trades transfer in your favor. This methodology is a part of systematic buying and selling, which reduces emotional choices.

Bear in mind, making constant income comes from good danger administration, not simply profitable trades. By specializing in place sizing and managing danger, you’ll be prepared for market adjustments. This may enable you to obtain long-term success in Foreign currency trading.

Superior Buying and selling Methods with EMA Technique

EMA technique variations give merchants highly effective instruments for market evaluation. By mixing the three EMA Crossover with different indicators, you’ll be able to unlock superior Foreign exchange methods. Let’s discover some methods to boost your buying and selling strategy.

One efficient methodology is to make use of the Ichimoku Cloud alongside EMAs. This combo provides a full view of market tendencies and doable reversals. When the worth crosses above each the cloud and the EMAs, it exhibits a robust bullish development.

One other superior method entails adapting the EMA technique for various time frames. Quick-term merchants would possibly use 5-minute charts, whereas long-term buyers would possibly use every day or weekly charts. This flexibility enables you to tailor your strategy to market evaluation.

Think about including volatility indicators just like the Common True Vary (ATR) to your technique. The ATR may also help set dynamic stop-loss ranges, enhancing danger administration in unstable markets.

| Superior Approach | Advantages | Concerns |

|---|---|---|

| Ichimoku Cloud + EMA | Complete development evaluation | Could improve complexity |

| Multi-timeframe evaluation | Broader market perspective | Requires extra effort and time |

| ATR for stop-loss | Dynamic danger administration | Wants common adjustment |

By mastering these superior Foreign exchange methods, you can also make your EMA technique higher. This might result in higher buying and selling outcomes. All the time take a look at new approaches earlier than utilizing them in stay buying and selling.

Frequent Errors to Keep away from

Foreign currency trading errors can value you a large number. It’s key to know and keep away from these traps for fulfillment with the three EMA Crossover and Actual Cloud technique. Let’s have a look at some widespread errors and learn how to keep away from them.

False Sign Recognition

False indicators are a giant drawback in Foreign currency trading. They occur when the market is quiet or shifting in small steps. To keep away from these, test indicators on completely different timeframes. Look forward to a transparent development earlier than you commerce.

Overtrading Pitfalls

Overtrading is a typical mistake for brand new merchants. Scalping can imply 20-100 trades a day. However, it’s essential to remain disciplined. Observe your buying and selling plan and don’t commerce each doable setup. High quality is extra essential than amount in Foreign exchange.

Threat Administration Errors

Poor danger administration can empty your buying and selling account quick. All the time danger solely 1-2% of your capital per commerce. Use stop-loss orders slightly below Senkou Span B for lengthy trades or above it for brief trades. Intention for a risk-reward ratio of 1:2 or extra for long-term success.

- Misinterpreting financial indicators like PMI

- Neglecting to backtest methods earlier than stay buying and selling

- Utilizing extreme leverage (follow regulated limits)

- Ignoring market situations and buying and selling throughout low liquidity

By avoiding these widespread Foreign currency trading errors, you’ll do higher with the three EMA Crossover and Actual Cloud technique. Keep disciplined, handle your danger, and continue to learn to get higher at buying and selling.

Backtesting and Technique Optimization

Foreign exchange backtesting is essential to checking the three EMA Crossover and Actual Cloud technique. It appears at previous information to see how properly the technique works. This implies making an attempt out trades previously to see how they might do.

To make the technique higher, we examined it in three completely different market occasions:

- Bull market: 14/02/2011 to 25/04/2011

- Bear market: 18/08/2014 to 19/01/2015

- Flat market: 15/08/2016 to 03/10/2016

We examined 50 trades for every market sort within the coaching set. Then, we examined 20 trades for every sort within the ahead take a look at. This deep have a look at previous information exhibits what works and what doesn’t.

We checked out essential numbers like most drawdown and win charge. The primary algorithm made $31,758.96, lower than the $33,115.64 from simply shopping for and holding. We then made the principles higher:

- Quick-term EMA: 10 days (from 15)

- Lengthy-term EMA: 35 days (from 50)

- Alpha: 0.92 (from 1)

- Threshold: 0.02 (from 0.05)

These adjustments made the technique higher, incomes $41,372.98. This beat the buy-and-hold methodology. However, bear in mind, previous outcomes don’t at all times imply future success as a result of markets change.

The way to Commerce with 3 EMA Crossover and Actual Cloud Foreign exchange Buying and selling Technique

Purchase Entry

- The 9-period EMA crosses above the 21-period EMA (bullish crossover).

- The 21-period EMA crosses above the 55-period EMA.

- The value is above the Ichimoku Cloud.

- The general development ought to be bullish (the cloud shall be above the worth, and the worth ought to be in an uptrend).

- Search for the cloud to be inexperienced, which implies the market is in an uptrend.

- The 9 EMA ought to be above the 21 EMA and the 21 EMA above the 55 EMA.

Promote Entry

- The 9-period EMA crosses beneath the 21-period EMA (bearish crossover).

- The 21-period EMA crosses beneath the 55-period EMA.

- The value is beneath the Ichimoku Cloud.

- The general development ought to be bearish (the cloud shall be beneath the worth, and the worth ought to be in a downtrend).

- The cloud ought to be pink, indicating a bearish development.

- The 9 EMA ought to be beneath the 21 EMA and the 21 EMA beneath the 55 EMA.

Conclusion

The three EMA Crossover and Actual Cloud Foreign exchange Buying and selling Technique is a robust instrument for Foreign exchange technique mastery. It makes use of Exponential Transferring Averages and the Actual Cloud indicator. This helps merchants see market tendencies and when to enter the market.

To make use of this technique properly, you should know its components. The 9-period EMA is quick and good for short-term buying and selling. The 50-day and 200-day EMAs present long-term tendencies and essential cross factors. The Actual Cloud provides extra evaluation, serving to affirm commerce selections.

Studying by no means stops for merchants. They need to hold testing and enhancing their methods. That is key to success. Even with good danger administration, merchants should keep alert and keep away from errors.

As merchants get higher, they’ll see this technique is simply the beginning. Mixing technical evaluation with elementary data and ongoing studying boosts expertise. This results in being profitable within the fast-changing Foreign exchange market.

Advisable MT4 Dealer

XM Dealer

- Free $50 To Begin Buying and selling Immediately! (Withdraw-able Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Profitable Foreign exchange Dealer

- Further Unique Bonuses All through The Yr

- Unique 50% Money Rebates for all Trades!

Already an XM shopper however lacking out on cashback? Open New Actual Account and Enter this Associate Code: 𝟕𝐖𝟑𝐉𝐐

Click on right here beneath to obtain: