Could introduced one other wave of progress throughout Bondora Group. We welcomed the very best variety of new traders in 2025 up to now, and Go & Develop reached a brand-new funding document.

With confidence constructing and investor engagement climbing, Could has really been a milestone month for the Bondora neighborhood. Let’s dive into the numbers!

New investor stats

In Could, a record-breaking 5,677 new traders joined Bondora to develop their wealth with ease. It’s the very best month-to-month determine for 2025 up to now. Welcome aboard!

Whereas our seventh Birthday Celebration with its €35,000 prize pool positively created some additional pleasure, we all know that individuals select Go & Develop for extra than simply prizes. It’s the simplicity, reliability, and easy expertise that retains them coming, and staying to develop their wealth.

Have you learnt anybody who may also profit from easy investing? Whenever you refer a pal and so they’ve accomplished the simple signup course of and began investing, you each can every earn a money bonus!

Refer them utilizing your distinctive code from your Dashboard right this moment.

Go & Develop investments in Could 2025

In Could, traders added €33,593,458 to their Go & Develop accounts, setting a brand new month-to-month document! That’s an 11.7% improve from April’s already-strong whole of €30,082,562.

Despite the fact that the birthday celebration has wrapped, it’s clear that our neighborhood’s belief in Go & Develop stays sturdy. Individuals throughout Europe proceed to decide on Go & Develop for its easy, steady, and hassle-free investing expertise.

Returns earned in Could

Traders earned €2,786,812 in returns throughout their Go & Develop accounts in Could. That’s a constant and stable efficiency, sustaining our reliable momentum, and serving to our traders attain their monetary objectives.

Mortgage origination stats – Could 2025

Mortgage originations surged in Could, with Bondora AS issuing €28,700,018 in loans. The majority of originations got here from Finland and the Netherlands.

Right here’s a breakdown by nation:

🇫🇮 Finland led with €20,601,736 in originations, up 57.6% from April.

🇳🇱 The Netherlands adopted with €4,176,120, a 38.3% improve from the earlier month.

🇪🇪 Estonia issued €3,233,511 in loans, up 16.5%.

🇱🇻 Latvia rose to €493,506, a 67.1% improve.

🇩🇰 Denmark noticed a wholesome rebound with €195,145 in originations, its strongest month since launching not too long ago.

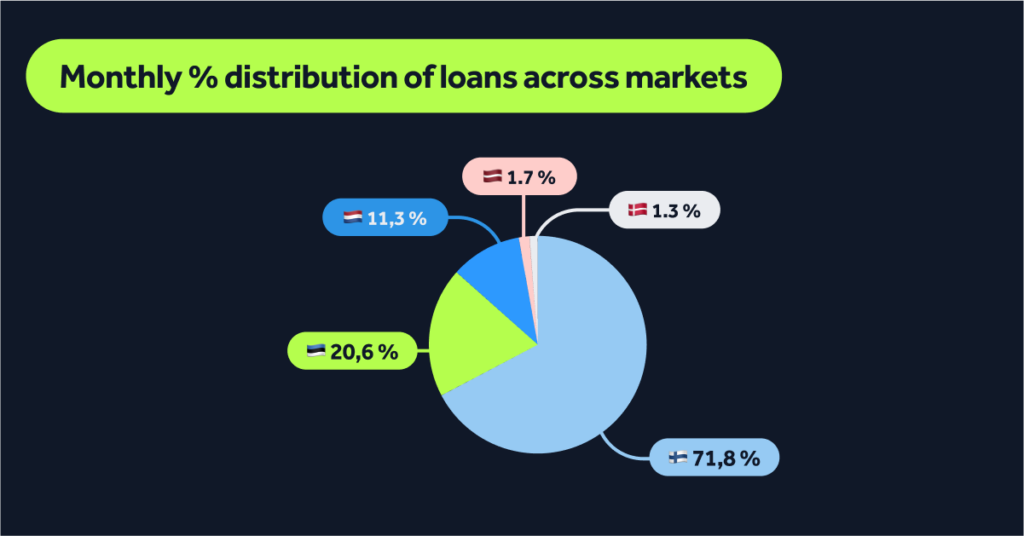

Could’s mortgage origination shares:

- Finland: 71.8%

- Netherlands: 20.6%

- Estonia: 11.3%

- Latvia: 1.7%

- Denmark: 1.3%

Need to perceive extra about mortgage defaults?

Ever marvel what it means when a mortgage is “in default” and the way Bondora handles it? We not too long ago printed an article explaining all of it. Click on the hyperlink under to learn the complete weblog submit. It’s clear, clear, and straightforward to know.

Social media communities

Not following us on Instagram, Fb, or LinkedIn but? Be part of us there for extra updates, useful and enjoyable content material, in addition to a peek into life at Bondora!