Wolf Pack Fury EA

Introduction

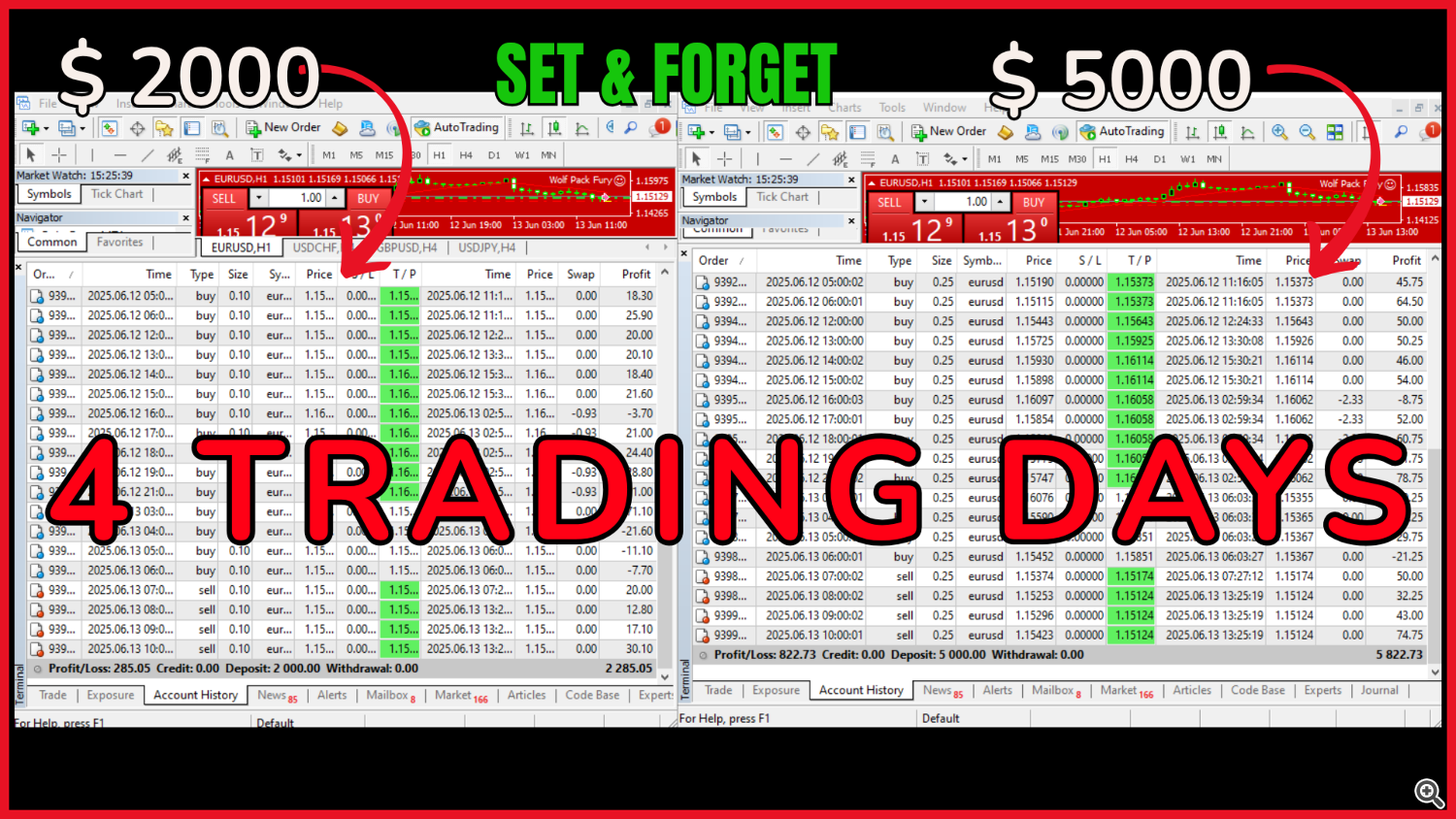

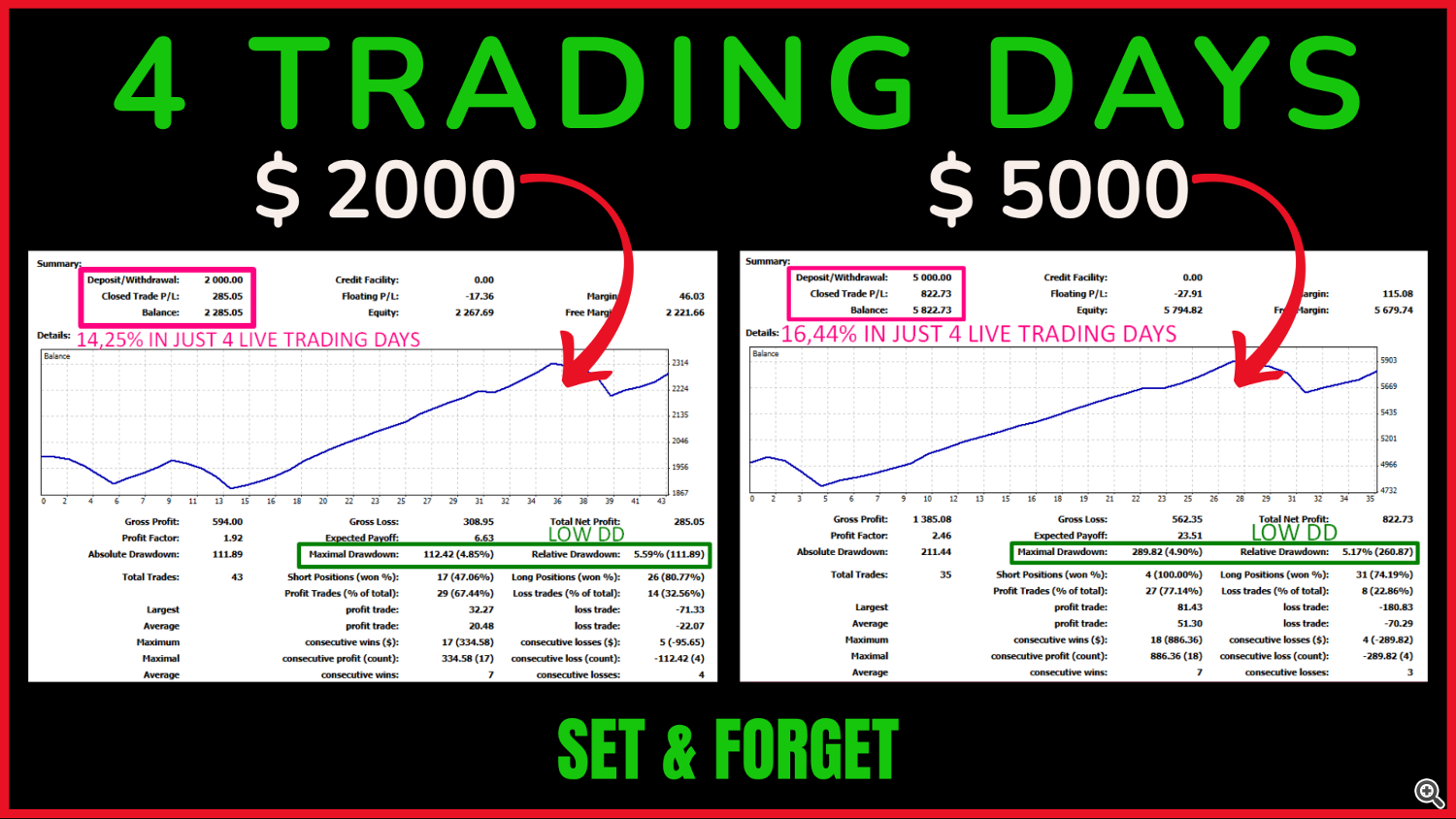

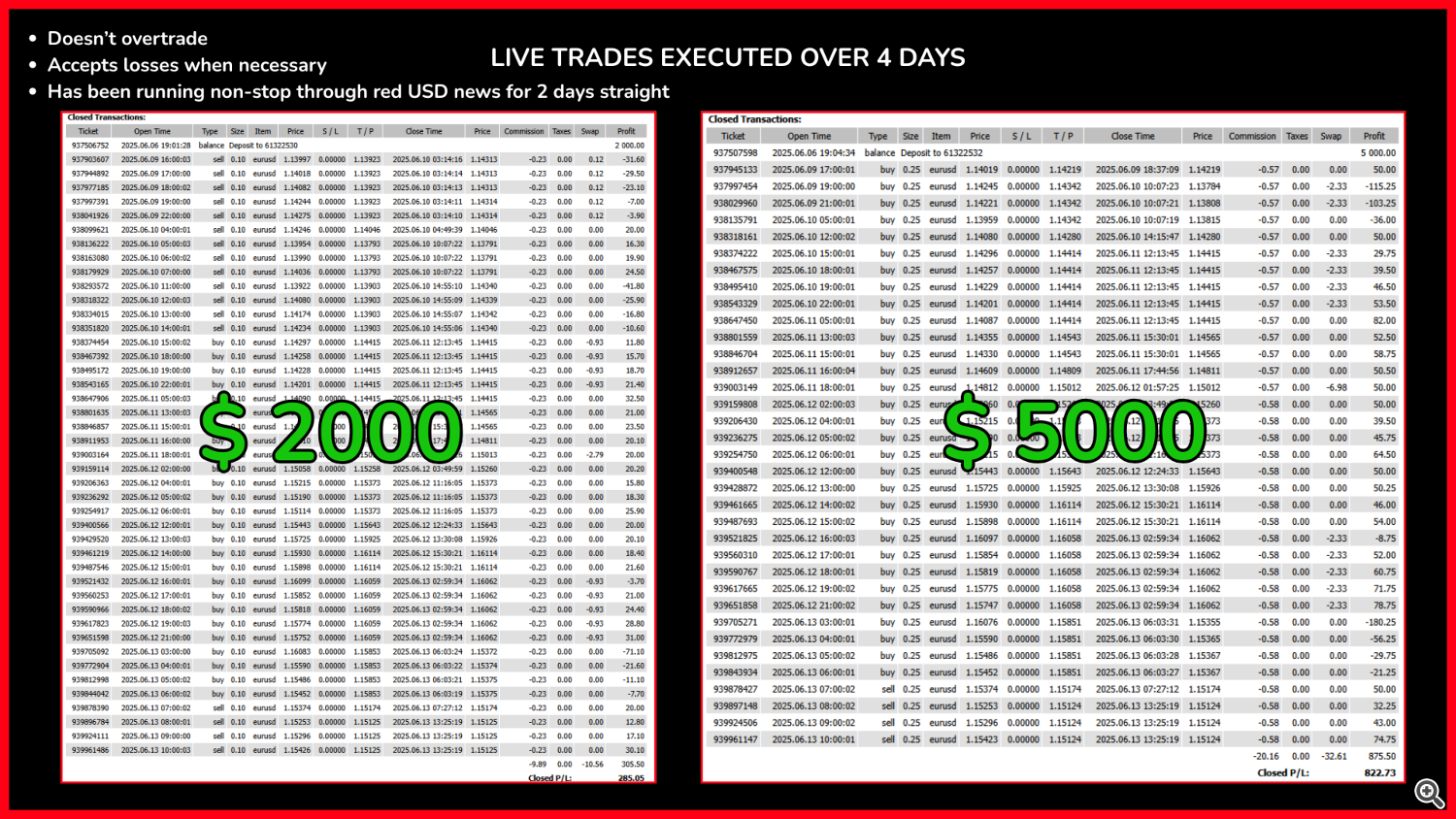

Wolf Pack Fury EA is designed for merchants who worth consistency and prudent capital administration. It doesn’t promise in a single day miracles; as a substitute, it goals to offer regular month-to-month returns whereas preserving full management over your account stability. The EA operates 24/5, utilizing volatility-based algorithms to adapt to various market environments.

Pricing

- Worth will increase by $100 every time 10 items are bought

- Buy value: $1,899

Core Options

- Optimized completely for the EURUSD pair on the H1 chart, enabling exact market entries with out overtrading

- Crafted for small accounts (from $200 to $5,000) but able to scaling to bigger balances

- Sturdy danger controls restrict the full publicity per commerce cycle, sustaining low drawdowns and account stability

- Clever entry spacing that may pause new orders throughout high-volatility candles (corresponding to information releases) to safeguard each commerce logic and capital

Advocate Lot Measurement Configuration

- Fastened lot-size mannequin primarily based in your account stability

- Solely parameter to set manually:

0.01 heaps per $200 of stability

Sensible examples:

- $200 → 0.01 heaps

- $400 → 0.02 heaps

- $600 → 0.03 heaps

- $800 → 0.04 heaps

- $1,000 → 0.05 heaps

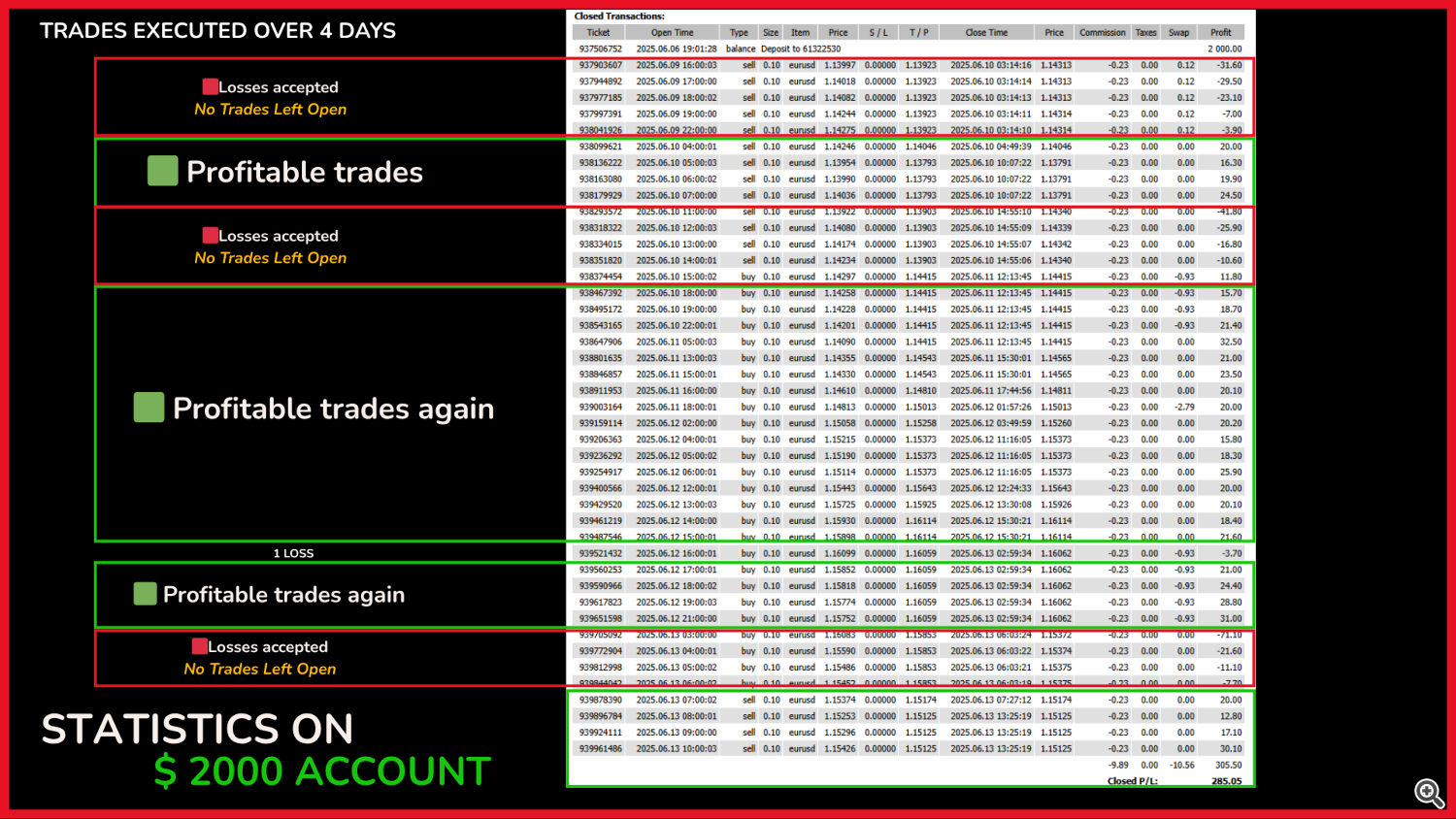

- $2,000 → 0.10 heaps

- $3,000 → 0.15 heaps

- $4,000 → 0.20 heaps

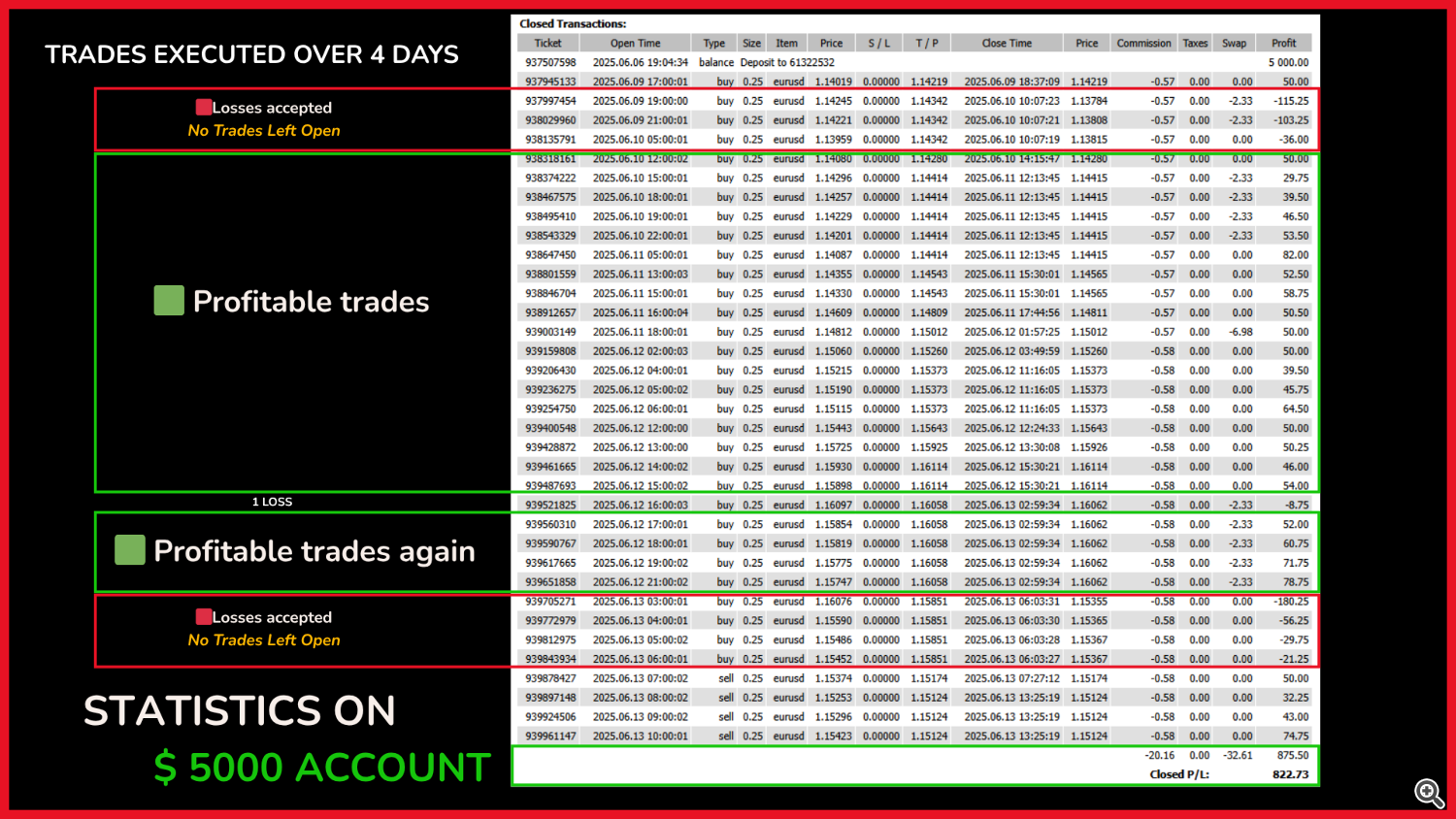

- $5,000 → 0.25 heaps

In the event you intend to make use of Wolf Pack Fury EA with greater than $5,000, please attain out and I’ll assist you configure it safely.

Take Revenue (TP)

- Default TP of 200 pips, chosen for H1 as a result of it:

- Secures a considerable variety of pips

- Is reasonable for H1 with out being extreme

- Permits environment friendly exits with out breaching danger parameters

- Every place carries its personal TP, however the EA employs an adaptive exit mechanism that constantly assesses whether or not to carry or regulate targets primarily based on present market context:

- Instance: When a number of positions are open with various lot sizes, the system might:

- Lock in beneficial properties first on bigger heaps

- Shut smaller heaps with a minor loss if it advantages the general account

- Instance: When a number of positions are open with various lot sizes, the system might:

- This mechanism integrates with the Multi parameter (staged lot development system)

- Modifying the TP just isn’t suggested, as its default setting is calibrated to take care of a balanced danger/reward ratio

Multi Parameter (Progressive Entry Multiplier)

- Employs a layered method—when value strikes towards the preliminary commerce, it provides new positions at successive ranges to common the entry value

- Multi determines how a lot the lot measurement will increase with every further place:

- Permits the EA to shut the mixed positions successfully as soon as value reverses, even when some didn’t hit full TP

- Repeatedly evaluates whether or not to maintain or adapt particular person TPs, probably:

- Closing bigger positions in revenue

- Exiting smaller positions at a small loss if it’s advantageous for the account

- That is a part of an adaptive volatility-based logic, not a set rule set

- Essential: Multi works along with NextTrades, Shifting, and EquityRisk; altering it could disrupt the staggered entry logic and compromise system stability

NextTrades (Max Variety of Trades per Cycle)

- Specifies the utmost variety of positions the EA can open in a single entry sequence

- Default is 10, offering flexibility for various market circumstances:

- In observe, EquityRisk management usually limits this to 4 or 5 positions earlier than reaching the danger threshold

- Solely in uncommon circumstances—corresponding to utilizing 0.01 heaps with a $20,000 stability—may it open all 10 positions

- Following the beneficial lot sizing ensures the variety of lively trades stays inside secure limits

Shifting (Distance Between Entry Ranges)

- Defines the minimal hole between staggered positions when value strikes unfavorably

- Whereas this hole is mounted, the EA’s volatility-based logic can briefly halt or delay the following place if circumstances aren’t appropriate:

- In visible mode, you’ll discover that in high-volume candles (e.g., information spikes), the EA might chorus from opening the following commerce even when the hole is met

- Relatively than performing mechanically, it waits for an optimum second to guard your capital

- Works hand in hand with Multi, NextTrades, and EquityRisk, forming the core of the EA’s intelligence

- Not beneficial to change, because it might upset the progressive entry logic and result in instability

EquityStop and EquityRisk (Capital Safety)

- EquityStop is enabled (TRUE) by default and robotically closes all open trades if a important fairness stage is breached, preserving account security—don’t disable this function

- EquityRisk units the utmost allowed danger per commerce cycle as a share of your account stability (default 5%), calculated primarily based on the EA’s win price, beneficial lot measurement, and Multi habits

- Embracing managed losses is a part of sound danger administration; these safeguards guarantee Wolf Pack Fury EA:

- Retains drawdown low

- Delivers regular month-to-month efficiency

- Preserves capital throughout extended antagonistic or high-volatility intervals

Open Hour / Shut Hour (Each day Buying and selling Window)

- Specifies the broker-time window throughout which the EA might open new trades:

- OpenHour marks the beginning of permitted buying and selling

- CloseHour marks the top

- Means that you can keep away from particular market hours or limit buying and selling to most well-liked periods, making certain exact management over EA exercise

Commerce on Friday / Friday Hour (Friday Buying and selling Management)

- TradeOnFriday enables you to allow or disable Friday buying and selling (TRUE by default), permitting regular operation till the desired hour

- FridayHour units the ultimate hour for Friday trades; as an example, setting FridayHour = 12 means the EA stops opening new orders at midday on Fridays (dealer time), although it trades usually Monday–Thursday till CloseHour

- Offers granular management over weekend publicity with out altering core logic

Use Each day Goal / Each day Goal (Each day Revenue Objective)

- UseDailyTarget enables you to activate a each day revenue restrict (FALSE by default)

- If turned on (TRUE), the EA stops opening new positions as soon as the goal is reached

- DailyTarget is denominated in your account foreign money (USD, EUR, and so forth.); reaching this determine pauses buying and selling till the following day

Essential

Wolf Pack Fury EA should run on a devoted account as a result of its danger controls rely upon the complete account stability. Letting one other EA function on the identical account can disrupt danger coherence and commerce logic. At all times use a devoted account with 100% of the capital managed by Wolf Pack Fury EA.

FAQ – Regularly Requested Questions

Can I exploit Wolf Pack Fury EA on any pair or timeframe?

It’s optimized for H1, chosen for its reliability and balanced danger/management profile. It could operate on different pairs or timeframes, however handbook testing and adjustment could be required. Really helpful use: H1 as supplied.

What sort of account ought to I exploit?

A low-spread, low-slippage account—ideally ECN. The kind of account is extra essential than the dealer itself.

Can I apply it to a typical account with low unfold?

Sure, however train warning—customary accounts usually incur hidden slippage (as much as 10 pips). With 2–3 pips of unfold added, efficiency might undergo. Check on a demo first if unsure.

Any beneficial dealer?

No particular brokers are endorsed—search an ECN account. Begin with a demo to judge efficiency, then change if wanted.

Does it work on small accounts?

Sure—it’s engineered for balances starting from $200 to $5,000, supplied you employ the beneficial lot measurement.

Can I run it on the identical account as different EAs?

No—it should run alone. Shared account utilization can disrupt danger logic and general stability.

Does it commerce on daily basis?

Sure—buying and selling is sort of steady, solely pausing if the market is exceptionally flat.

Do I would like a VPS?

Sure—like several EA, it should stay on-line 100% of the time. Utilizing a house PC dangers downtime; a VPS gives uninterrupted operation and peace of thoughts.

Which VPS ought to I exploit?

The dealer’s personal VPS is good—ask them immediately, because it usually affords ultra-low latency (2–10 ms). Generic VPS options might exhibit round 120 ms latency, whereas residence distant desktops can exceed 220 ms. Greater latency means slower EA reactions.

Can I contact you if I’ve questions or need assistance?

Completely—in case you want help with set up, VPS setup, or are not sure the place to start out, ship me a message. No query is just too fundamental; all of us begin someplace.